Go Back

Last Updated :

Last Updated :

Dec 22, 2025

Dec 22, 2025

Form 8938 Filing Guide: Reporting Foreign Financial Assets (Non-Table Format)

Form 8938 Filing Guide: Reporting Foreign Financial Assets (Non-Table Format)

For founders and finance leaders steering US startups, agencies, and e-commerce companies, understanding tax compliance can feel like navigating a maze – especially when it involves foreign financial assets. One critical form to master is Form 8938, a necessary document under the Foreign Account Tax Compliance Act (FATCA) that many business founders and controllers overlook or misunderstand.

This guide unpacks what Form 8938 entails, who must file it, and how to stay compliant, all while tying it to key business outcomes like minimizing tax liabilities and avoiding costly penalties.

What is Form 8938 and Why Does It Matter for Founders?

Form 8938, formally known as the Statement of Specified Foreign Financial Assets, is required by the IRS for certain U.S. persons who hold an interest in specified foreign financial assets. It supplements traditional financial disclosures and helps the government combat offshore tax evasion.

Key Compliance Distinction: Form 8938 vs. FBAR

It is crucial to understand that filing Form 8938 does not relieve you of the obligation to file FinCEN Form 114 (FBAR), and vice-versa. You may be required to file both.

Form 8938 (FATCA Disclosure):

Scope: Reports a broad range of specified foreign financial assets, including foreign bank accounts and non-account assets like foreign stock, partnership interests, and certain life insurance.

Filing: Filed with your annual federal income tax return (Form 1040).

Threshold: High, based on residency and filing status (e.g., $50,000 for a single person living in the U.S.).

FinCEN Form 114 (FBAR):

Scope: Reports foreign financial accounts (like bank and brokerage accounts).

Filing: Filed separately with the Financial Crimes Enforcement Network (FinCEN).

Threshold: Low ($10,000 aggregate value) at any point during the calendar year.

Why Should Startup Founders and Finance Leaders Care?

Even if your startup doesn't operate internationally in a traditional sense, founders with any kind of foreign financial involvement should take note. This might include:

Foreign bank accounts holding business or personal funds.

Foreign stocks, securities, or ownership in foreign corporations/partnerships.

Interests in foreign entities or businesses.

Foreign-issued life insurance or annuity contracts.

Failing to properly file Form 8938 when required can lead to significant penalties, strengthening your credibility with investors and financial institutions.

Who Must File Form 8938? Key Thresholds and Tests

You must file Form 8938 if you are a "Specified Person" (which includes most U.S. citizens, residents, and certain domestic entities) and the total value of your "Specified Foreign Financial Assets" exceeds the applicable dollar threshold.

The filing threshold is based on two factors: your filing status and your location of residence (U.S. vs. foreign). The minimum threshold that triggers the filing requirement is based on either the value on the last day of the tax year or the maximum value at any point during the year.

Key Filing Thresholds (Aggregate Maximum Value)

Unmarried, living in the U.S.:

$50,000 on the last day of the tax year, or

$75,000 at any time during the year.

Married filing jointly, living in the U.S.:

$100,000 on the last day of the tax year, or

$150,000 at any time during the year.

Unmarried, living abroad:

$200,000 on the last day of the tax year, or

$300,000 at any time during the year.

Married filing jointly, living abroad:

$400,000 on the last day of the tax year, or

$600,000 at any time during the year.

Founders’ Practical Tip:

Thresholds are cumulative: The values of all specified foreign assets held across all accounts and types must be added up to determine if you meet the threshold.

Valuation: Values must be reported in U.S. Dollars. Convert foreign currencies using the exchange rate on the date of valuation (typically the year-end rate from the Treasury Department's Bureau of the Fiscal Service).

When is Form 8938 Due?

Form 8938 is due with your annual income tax return (e.g., Form 1040). The deadline is the same as your tax return (typically April 15). If you receive an extension to file your income tax return (e.g., to October 15), your Form 8938 is automatically extended to that date as well.

Step-by-Step Guide to Filing Form 8938 for Your Startup

Filing Form 8938 requires careful preparation. Follow these guidance-oriented steps:

Step 1: Identify and Inventory All Foreign Financial Assets

Your first step is gathering comprehensive information. You must account for holdings that qualify as "Specified Foreign Financial Assets," including:

Bank account statements.

Foreign investment portfolios.

Ownership details of foreign corporations or partnerships.

Documents related to foreign pensions or insurance products.

Step 2: Determine Maximum Value and Reporting Obligation

Calculate the maximum fair market value (FMV) of all assets (in USD) at any point during the year. If this aggregate amount exceeds the threshold for your filing status and location (see section above), you must file.

Step 3: Fill Out Form 8938 Carefully and Accurately

The form requires you to provide specific details on each asset.

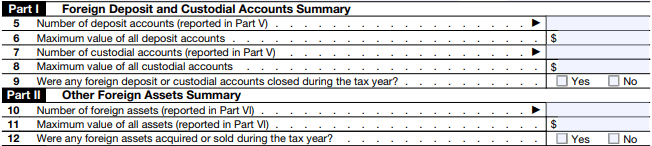

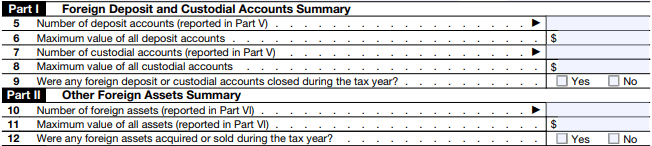

Part I & II: Foreign Assets Summary (Page 1)

You will summarize the maximum total value and the number of accounts you hold.

Action: Enter your Taxpayer Identification Number (TIN) and check the box that corresponds to your filer type (Line 3). Founders filing personally will check 3a Specified individual.

Action: Complete Lines 5-8 to report the total number of deposit and custodial accounts and the maximum aggregate value of those accounts during the tax year.

Part V & VI: Detailed Asset Reporting (Pages 3-6)

These sections require asset-by-asset reporting.

Action for Accounts (Part V): For each foreign deposit or custodial account, report the name of the financial institution, the address, and the maximum value of the account during the year.

Action for Other Assets (Part VI): For assets like foreign stock or partnership interests, you must identify the issuer or counterparty and report the asset’s maximum value.

Action for Income (Part IV): You must report the amount of income, if any, that was generated from each specified foreign asset and indicate where that income was reported on your primary tax return (e.g., Form 1040, Schedule B). This ensures transparency between your income and asset reporting.

Step 4: Attach Form 8938 to Your Federal Tax Return

Form 8938 must be filed with your annual Form 1040, 1120, or other tax return. Do not file it separately. For founders managing multiple responsibilities, integrate this filing into your main tax preparation checklist.

Step 5: Keep Supporting Documentation

Retain records substantiating your asset values and holdings for at least three tax years after filing, as the IRS can request this information during an audit.

Common Mistakes Founders Should Avoid

Improving scannability by bolding key mistakes and providing clear, actionable steps to prevent them.

Confusing Form 8938 and FBAR: This is the most common error. Remember: FBAR is filed electronically with FinCEN; Form 8938 is attached to your IRS income tax return. You usually need to file both if you meet the respective thresholds.

Ignoring the "Maximum Value" Threshold: Filing is triggered if the value exceeded the threshold at any point during the year, not just on December 31st. Track foreign asset values throughout the year to avoid this surprise.

Incorrect Valuation: All assets must be reported in U.S. Dollars. Failing to use the correct official exchange rate for foreign currency assets can lead to reporting errors.

Excluding Non-Account Assets: Form 8938 is broad. Do not only report bank accounts; include foreign-issued stocks, securities, and interests in foreign entities unless they are excepted.

Failing to Check the Overlap Box: If an asset (like a foreign corporation interest) is reported on another form, such as Form 5471 or Form 8865, you must check the relevant box on Form 8938 (Part II, Line 13) to avoid duplicative reporting.

Penalties and FAQs

Penalties for Non-Compliance

Accurate and timely filing is essential to avoid costly fines that can accumulate quickly.

Initial Penalty: The initial penalty for failure to file is $10,000.

Continued Failure: If you fail to file after IRS notification, an additional penalty of $10,000 can be assessed for each 30-day period of non-compliance, up to a maximum additional penalty of $50,000.

Accuracy-Related Penalties: If an underpayment of tax is related to an undisclosed foreign financial asset, the accuracy-related penalty can be doubled from 20% to 40% of the underpayment.

Q: If I don't have to file a tax return, do I still file Form 8938?

A: No. You are only required to file Form 8938 if you are required to file an income tax return (e.g., Form 1040, 1120, or 1065).

Q: Do I need to report foreign real estate?

A: Directly held foreign real estate (such as a vacation home or rental property) is not a specified foreign financial asset and is not reported on Form 8938. However, if the real estate is held through a foreign entity (like a foreign corporation or partnership), your interest in that entity is a specified foreign financial asset and must be reported.

Q: Does filing Form 8938 mean I will be taxed on those assets?

A: Form 8938 is purely an informational form. It reports the existence and value of assets. Whether you are taxed depends on the type of asset and the income it generates, which is reported on other parts of your tax return.

Official IRS Guidance on Foreign Asset Reporting

Since compliance requirements evolve continually, staying updated via official sources is key. For detailed criteria, filing instructions, and updates, consult the official IRS FATCA resource page and the Form 8938 Instructions.

Mastering Form 8938 is Essential for Startup Founders Managing Foreign Financial Assets.

Form 8938 Filing Guide: Reporting Foreign Financial Assets (Non-Table Format)

For founders and finance leaders steering US startups, agencies, and e-commerce companies, understanding tax compliance can feel like navigating a maze – especially when it involves foreign financial assets. One critical form to master is Form 8938, a necessary document under the Foreign Account Tax Compliance Act (FATCA) that many business founders and controllers overlook or misunderstand.

This guide unpacks what Form 8938 entails, who must file it, and how to stay compliant, all while tying it to key business outcomes like minimizing tax liabilities and avoiding costly penalties.

What is Form 8938 and Why Does It Matter for Founders?

Form 8938, formally known as the Statement of Specified Foreign Financial Assets, is required by the IRS for certain U.S. persons who hold an interest in specified foreign financial assets. It supplements traditional financial disclosures and helps the government combat offshore tax evasion.

Key Compliance Distinction: Form 8938 vs. FBAR

It is crucial to understand that filing Form 8938 does not relieve you of the obligation to file FinCEN Form 114 (FBAR), and vice-versa. You may be required to file both.

Form 8938 (FATCA Disclosure):

Scope: Reports a broad range of specified foreign financial assets, including foreign bank accounts and non-account assets like foreign stock, partnership interests, and certain life insurance.

Filing: Filed with your annual federal income tax return (Form 1040).

Threshold: High, based on residency and filing status (e.g., $50,000 for a single person living in the U.S.).

FinCEN Form 114 (FBAR):

Scope: Reports foreign financial accounts (like bank and brokerage accounts).

Filing: Filed separately with the Financial Crimes Enforcement Network (FinCEN).

Threshold: Low ($10,000 aggregate value) at any point during the calendar year.

Why Should Startup Founders and Finance Leaders Care?

Even if your startup doesn't operate internationally in a traditional sense, founders with any kind of foreign financial involvement should take note. This might include:

Foreign bank accounts holding business or personal funds.

Foreign stocks, securities, or ownership in foreign corporations/partnerships.

Interests in foreign entities or businesses.

Foreign-issued life insurance or annuity contracts.

Failing to properly file Form 8938 when required can lead to significant penalties, strengthening your credibility with investors and financial institutions.

Who Must File Form 8938? Key Thresholds and Tests

You must file Form 8938 if you are a "Specified Person" (which includes most U.S. citizens, residents, and certain domestic entities) and the total value of your "Specified Foreign Financial Assets" exceeds the applicable dollar threshold.

The filing threshold is based on two factors: your filing status and your location of residence (U.S. vs. foreign). The minimum threshold that triggers the filing requirement is based on either the value on the last day of the tax year or the maximum value at any point during the year.

Key Filing Thresholds (Aggregate Maximum Value)

Unmarried, living in the U.S.:

$50,000 on the last day of the tax year, or

$75,000 at any time during the year.

Married filing jointly, living in the U.S.:

$100,000 on the last day of the tax year, or

$150,000 at any time during the year.

Unmarried, living abroad:

$200,000 on the last day of the tax year, or

$300,000 at any time during the year.

Married filing jointly, living abroad:

$400,000 on the last day of the tax year, or

$600,000 at any time during the year.

Founders’ Practical Tip:

Thresholds are cumulative: The values of all specified foreign assets held across all accounts and types must be added up to determine if you meet the threshold.

Valuation: Values must be reported in U.S. Dollars. Convert foreign currencies using the exchange rate on the date of valuation (typically the year-end rate from the Treasury Department's Bureau of the Fiscal Service).

When is Form 8938 Due?

Form 8938 is due with your annual income tax return (e.g., Form 1040). The deadline is the same as your tax return (typically April 15). If you receive an extension to file your income tax return (e.g., to October 15), your Form 8938 is automatically extended to that date as well.

Step-by-Step Guide to Filing Form 8938 for Your Startup

Filing Form 8938 requires careful preparation. Follow these guidance-oriented steps:

Step 1: Identify and Inventory All Foreign Financial Assets

Your first step is gathering comprehensive information. You must account for holdings that qualify as "Specified Foreign Financial Assets," including:

Bank account statements.

Foreign investment portfolios.

Ownership details of foreign corporations or partnerships.

Documents related to foreign pensions or insurance products.

Step 2: Determine Maximum Value and Reporting Obligation

Calculate the maximum fair market value (FMV) of all assets (in USD) at any point during the year. If this aggregate amount exceeds the threshold for your filing status and location (see section above), you must file.

Step 3: Fill Out Form 8938 Carefully and Accurately

The form requires you to provide specific details on each asset.

Part I & II: Foreign Assets Summary (Page 1)

You will summarize the maximum total value and the number of accounts you hold.

Action: Enter your Taxpayer Identification Number (TIN) and check the box that corresponds to your filer type (Line 3). Founders filing personally will check 3a Specified individual.

Action: Complete Lines 5-8 to report the total number of deposit and custodial accounts and the maximum aggregate value of those accounts during the tax year.

Part V & VI: Detailed Asset Reporting (Pages 3-6)

These sections require asset-by-asset reporting.

Action for Accounts (Part V): For each foreign deposit or custodial account, report the name of the financial institution, the address, and the maximum value of the account during the year.

Action for Other Assets (Part VI): For assets like foreign stock or partnership interests, you must identify the issuer or counterparty and report the asset’s maximum value.

Action for Income (Part IV): You must report the amount of income, if any, that was generated from each specified foreign asset and indicate where that income was reported on your primary tax return (e.g., Form 1040, Schedule B). This ensures transparency between your income and asset reporting.

Step 4: Attach Form 8938 to Your Federal Tax Return

Form 8938 must be filed with your annual Form 1040, 1120, or other tax return. Do not file it separately. For founders managing multiple responsibilities, integrate this filing into your main tax preparation checklist.

Step 5: Keep Supporting Documentation

Retain records substantiating your asset values and holdings for at least three tax years after filing, as the IRS can request this information during an audit.

Common Mistakes Founders Should Avoid

Improving scannability by bolding key mistakes and providing clear, actionable steps to prevent them.

Confusing Form 8938 and FBAR: This is the most common error. Remember: FBAR is filed electronically with FinCEN; Form 8938 is attached to your IRS income tax return. You usually need to file both if you meet the respective thresholds.

Ignoring the "Maximum Value" Threshold: Filing is triggered if the value exceeded the threshold at any point during the year, not just on December 31st. Track foreign asset values throughout the year to avoid this surprise.

Incorrect Valuation: All assets must be reported in U.S. Dollars. Failing to use the correct official exchange rate for foreign currency assets can lead to reporting errors.

Excluding Non-Account Assets: Form 8938 is broad. Do not only report bank accounts; include foreign-issued stocks, securities, and interests in foreign entities unless they are excepted.

Failing to Check the Overlap Box: If an asset (like a foreign corporation interest) is reported on another form, such as Form 5471 or Form 8865, you must check the relevant box on Form 8938 (Part II, Line 13) to avoid duplicative reporting.

Penalties and FAQs

Penalties for Non-Compliance

Accurate and timely filing is essential to avoid costly fines that can accumulate quickly.

Initial Penalty: The initial penalty for failure to file is $10,000.

Continued Failure: If you fail to file after IRS notification, an additional penalty of $10,000 can be assessed for each 30-day period of non-compliance, up to a maximum additional penalty of $50,000.

Accuracy-Related Penalties: If an underpayment of tax is related to an undisclosed foreign financial asset, the accuracy-related penalty can be doubled from 20% to 40% of the underpayment.

Q: If I don't have to file a tax return, do I still file Form 8938?

A: No. You are only required to file Form 8938 if you are required to file an income tax return (e.g., Form 1040, 1120, or 1065).

Q: Do I need to report foreign real estate?

A: Directly held foreign real estate (such as a vacation home or rental property) is not a specified foreign financial asset and is not reported on Form 8938. However, if the real estate is held through a foreign entity (like a foreign corporation or partnership), your interest in that entity is a specified foreign financial asset and must be reported.

Q: Does filing Form 8938 mean I will be taxed on those assets?

A: Form 8938 is purely an informational form. It reports the existence and value of assets. Whether you are taxed depends on the type of asset and the income it generates, which is reported on other parts of your tax return.

Official IRS Guidance on Foreign Asset Reporting

Since compliance requirements evolve continually, staying updated via official sources is key. For detailed criteria, filing instructions, and updates, consult the official IRS FATCA resource page and the Form 8938 Instructions.

Mastering Form 8938 is Essential for Startup Founders Managing Foreign Financial Assets.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026