Go Back

Last Updated :

Last Updated :

Dec 11, 2025

Dec 11, 2025

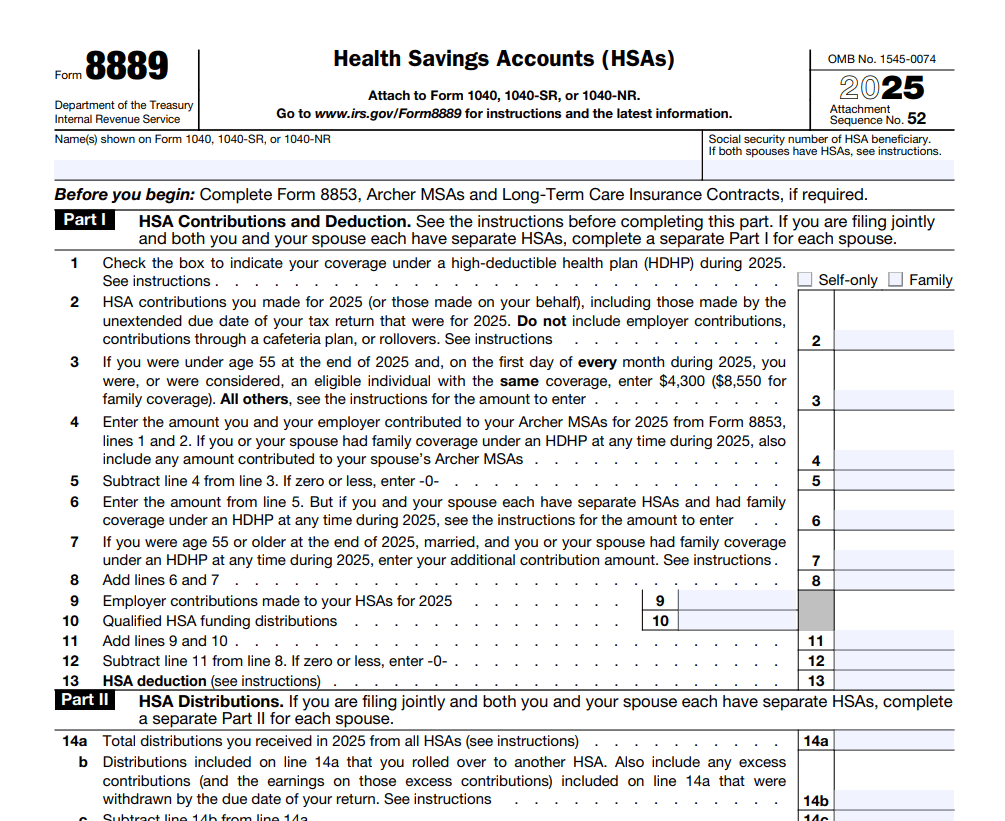

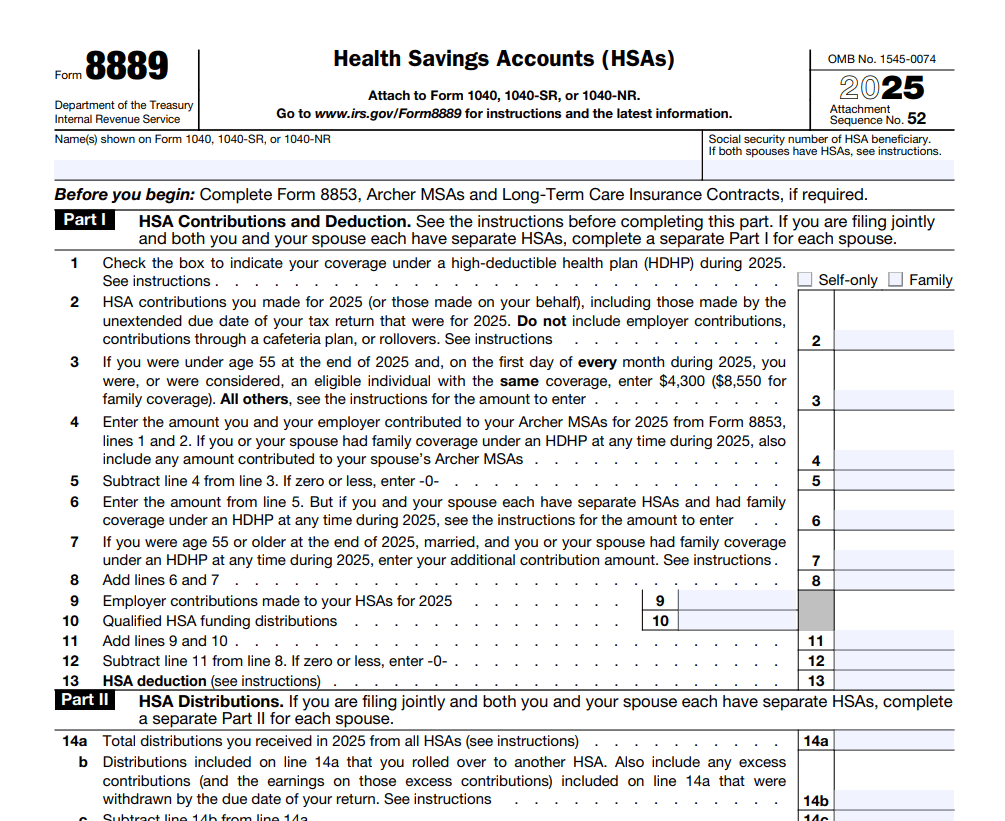

Form 8889 Guide: How to Report HSA Contributions, Withdrawals, and Deductions

Health Savings Accounts (HSAs) have become an increasingly valuable tool for US startups, agencies, and e-commerce companies looking to manage health care expenses while gaining tax advantages.

For founders and finance leaders, understanding Form 8889 is essential to accurately reporting HSA contributions, withdrawals, and deductions on your business or personal tax returns. This guide distills practical insights and step-by-step instructions so you can harness HSAs effectively without getting bogged down by tax form complexities.

What Is Form 8889 and Why Does It Matter to Founders?

Form 8889 is the IRS document used to report contributions to and distributions from an HSA. Since many startups offer HSAs as part of employee benefit packages, founders and finance heads need to accurately complete this form for themselves and employees. Here’s why:

Tax Savings: Contributions to HSAs reduce taxable income if made pre-tax or deductible if self-funded post-tax.

Compliance: Incorrect reporting can trigger IRS audits and penalties.

Cash Flow Planning: Knowing allowable contribution limits helps align benefits with startup cash flow constraints.

Employee Engagement: Transparent HSA management enhances your benefits' perceived value.

For startups, where financial resources and timing matter greatly, the efficient use of HSAs can mean tangible savings year-round.

How to Report HSA Contributions on Form 8889

Step 1: Understand Your Contribution Type and Limits

Before filling out Form 8889, it’s important to know which type of HSA contributions you’re reporting and whether they fall within the annual IRS limits. HSAs allow two main contribution sources, and each one affects how the form is completed:

Employer contributions: These are made directly by your startup or agency. They are typically pre-tax and excluded from Social Security and Medicare taxes. Employer contributions must be included when calculating your total annual HSA funding.

Employee contributions: These include amounts individuals contribute through payroll deductions or by paying the HSA custodian directly. Payroll contributions are usually pre-tax; direct contributions may be deducted on the individual’s tax return if made post-tax.

Understanding which category applies helps ensure the amounts reported on Form 8889 match payroll records and HSA statements.

Reference: Annual HSA Contribution Limits (Form 8889 Inputs)

Each year, the IRS sets maximum contribution limits that determine whether individuals must report excess contributions or adjust their totals on Form 8889. Here are the limits for 2024:

Coverage Type | Maximum Contribution |

Self-only | $4,150 |

Family coverage | $8,300 |

Catch-up (age 55+) | Additional $1,000 |

Contribution limits reset annually. If someone changes coverage mid-year—from self-only to family, for example—prorated limits may apply.

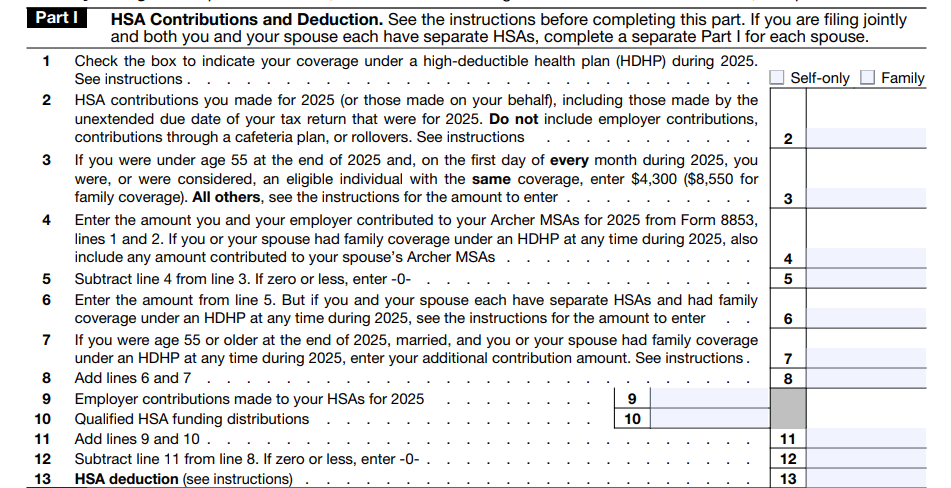

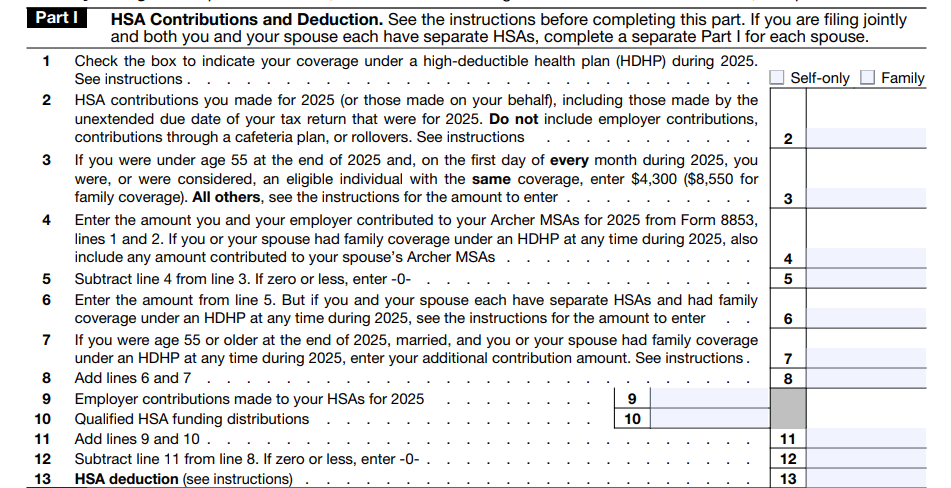

Step 2: Complete Part I of Form 8889

Part I focuses on contributions and deductions:

Line 1: Enter total HSA contributions made by both employer and employee.

Line 2: Record employer contributions (excluding those via cafeteria plans).

Lines 3–8: Calculate excess contributions, partial-year adjustments, or special cases.

Startup tip: If you offer HSAs through a cafeteria plan, track these contributions separately—they impact tax reporting.

Internal Resource: Review Haven’s Business Tax Services to better integrate HSA management within your broader tax strategy.

Reporting HSA Distributions and Withdrawals on Form 8889

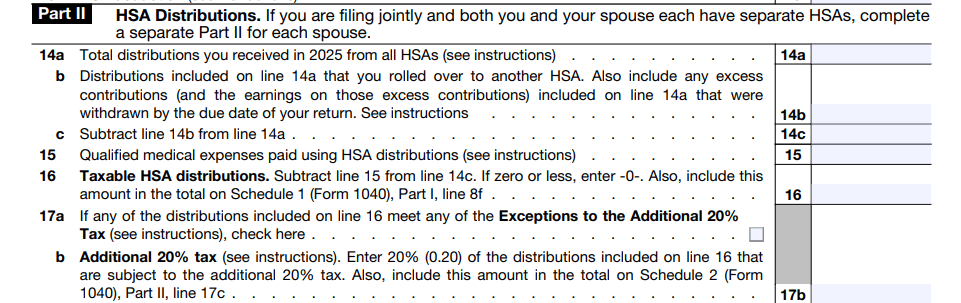

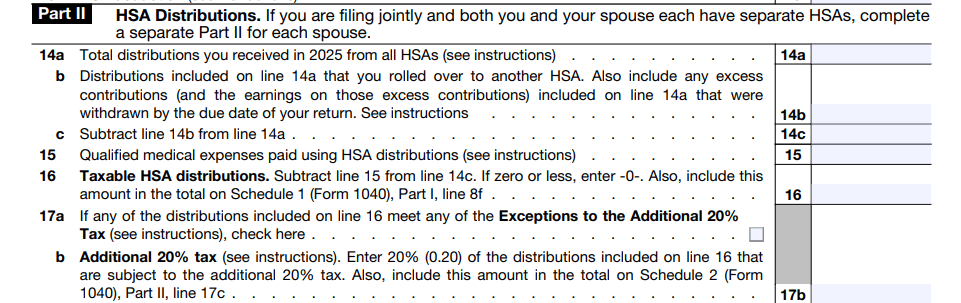

Step 3: Part II — Reporting Distributions

Distributions must be reported to show whether funds were used for qualified medical expenses.

Line 9: Total distributions taken

Lines 10–13: Qualified expenses vs. taxable amounts

Qualified expenses include:

Doctor visits, hospital care, prescriptions

Dental & vision care

Some OTC medications (with a prescription)

Accurate tracking prevents misreporting and preserves tax advantages.

Calculating Deductions and Dealing with Excess Contributions

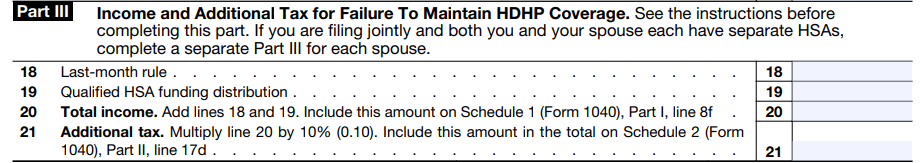

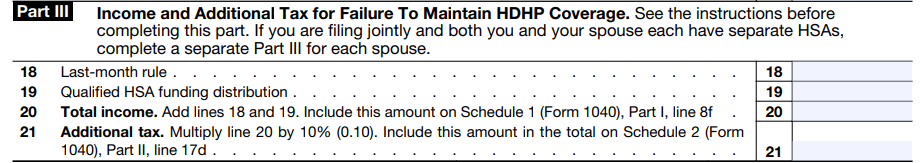

Step 4: Part III — Deductions and Excess Contributions

Key areas for founders:

How to calculate deductions for personally funded contributions

How to correct excess contributions before penalties apply

If not addressed before the tax deadline, excess contributions may incur a 6% excise tax per year.

Line 14: Deduction for contributions

Lines 15–16: Excess contribution calculations

Founder Tip: Avoid penalties by setting clear payroll rules and educating employees early.

Explore Haven’s Small Business Tax Planning guide for deeper integration.

Common Challenges Startups Face with Form 8889 — and How to Overcome Them

Even with the tax advantages HSAs offer, many startups run into operational and compliance challenges when completing Form 8889 for themselves or their teams.

These issues often stem from unclear payroll reporting, mid-year insurance changes, or gaps in understanding IRS distribution rules. The table below highlights the most common hurdles founders face—and practical steps to resolve them before they affect tax filings or employee benefits.

Challenge | Solution |

Tracking eligible contributions | Use payroll systems that clearly separate HSA deductions |

Understanding distribution rules | Train finance/HR teams using IRS guidance |

Supporting multiple employees’ HSAs | Adopt cloud bookkeeping systems with scalable employee tracking |

Mid-year coverage changes | Follow IRS prorating worksheets in the Form 8889 instructions |

Why Responsive, Startup-Native Bookkeeping Matters for HSAs

Form 8889 intersects with:

Payroll

Benefits administration

Corporate + personal tax filing

This complexity means startups benefit from:

Real-time, startup-native bookkeeping

Hands-on guidance for HSA reporting

Integrated R&D tax credit planning

Founder-friendly tax workflows

Syncing HSA records with your accounting system ensures clean year-end reporting.

Where to Learn More About HSA Tax Filing

The IRS provides full guidance in Publication 969 — a must-read for compliance.

Make Form 8889 Work for Your Startup’s Health Savings Goals

Mastering Form 8889 empowers founders, COOs, and finance leaders to maximize available tax benefits while building a more resilient employee benefits strategy. When you understand how contributions, distributions, and annual limits work, HSAs become more than a compliance requirement—they become a tool for financial clarity, smarter planning, and long-term savings for both your team and your business.

With Haven’s startup-focused bookkeeping and tax support, you can streamline HSA reporting, reduce administrative friction, and keep your operations aligned with IRS requirements as you scale.

Health Savings Accounts (HSAs) have become an increasingly valuable tool for US startups, agencies, and e-commerce companies looking to manage health care expenses while gaining tax advantages.

For founders and finance leaders, understanding Form 8889 is essential to accurately reporting HSA contributions, withdrawals, and deductions on your business or personal tax returns. This guide distills practical insights and step-by-step instructions so you can harness HSAs effectively without getting bogged down by tax form complexities.

What Is Form 8889 and Why Does It Matter to Founders?

Form 8889 is the IRS document used to report contributions to and distributions from an HSA. Since many startups offer HSAs as part of employee benefit packages, founders and finance heads need to accurately complete this form for themselves and employees. Here’s why:

Tax Savings: Contributions to HSAs reduce taxable income if made pre-tax or deductible if self-funded post-tax.

Compliance: Incorrect reporting can trigger IRS audits and penalties.

Cash Flow Planning: Knowing allowable contribution limits helps align benefits with startup cash flow constraints.

Employee Engagement: Transparent HSA management enhances your benefits' perceived value.

For startups, where financial resources and timing matter greatly, the efficient use of HSAs can mean tangible savings year-round.

How to Report HSA Contributions on Form 8889

Step 1: Understand Your Contribution Type and Limits

Before filling out Form 8889, it’s important to know which type of HSA contributions you’re reporting and whether they fall within the annual IRS limits. HSAs allow two main contribution sources, and each one affects how the form is completed:

Employer contributions: These are made directly by your startup or agency. They are typically pre-tax and excluded from Social Security and Medicare taxes. Employer contributions must be included when calculating your total annual HSA funding.

Employee contributions: These include amounts individuals contribute through payroll deductions or by paying the HSA custodian directly. Payroll contributions are usually pre-tax; direct contributions may be deducted on the individual’s tax return if made post-tax.

Understanding which category applies helps ensure the amounts reported on Form 8889 match payroll records and HSA statements.

Reference: Annual HSA Contribution Limits (Form 8889 Inputs)

Each year, the IRS sets maximum contribution limits that determine whether individuals must report excess contributions or adjust their totals on Form 8889. Here are the limits for 2024:

Coverage Type | Maximum Contribution |

Self-only | $4,150 |

Family coverage | $8,300 |

Catch-up (age 55+) | Additional $1,000 |

Contribution limits reset annually. If someone changes coverage mid-year—from self-only to family, for example—prorated limits may apply.

Step 2: Complete Part I of Form 8889

Part I focuses on contributions and deductions:

Line 1: Enter total HSA contributions made by both employer and employee.

Line 2: Record employer contributions (excluding those via cafeteria plans).

Lines 3–8: Calculate excess contributions, partial-year adjustments, or special cases.

Startup tip: If you offer HSAs through a cafeteria plan, track these contributions separately—they impact tax reporting.

Internal Resource: Review Haven’s Business Tax Services to better integrate HSA management within your broader tax strategy.

Reporting HSA Distributions and Withdrawals on Form 8889

Step 3: Part II — Reporting Distributions

Distributions must be reported to show whether funds were used for qualified medical expenses.

Line 9: Total distributions taken

Lines 10–13: Qualified expenses vs. taxable amounts

Qualified expenses include:

Doctor visits, hospital care, prescriptions

Dental & vision care

Some OTC medications (with a prescription)

Accurate tracking prevents misreporting and preserves tax advantages.

Calculating Deductions and Dealing with Excess Contributions

Step 4: Part III — Deductions and Excess Contributions

Key areas for founders:

How to calculate deductions for personally funded contributions

How to correct excess contributions before penalties apply

If not addressed before the tax deadline, excess contributions may incur a 6% excise tax per year.

Line 14: Deduction for contributions

Lines 15–16: Excess contribution calculations

Founder Tip: Avoid penalties by setting clear payroll rules and educating employees early.

Explore Haven’s Small Business Tax Planning guide for deeper integration.

Common Challenges Startups Face with Form 8889 — and How to Overcome Them

Even with the tax advantages HSAs offer, many startups run into operational and compliance challenges when completing Form 8889 for themselves or their teams.

These issues often stem from unclear payroll reporting, mid-year insurance changes, or gaps in understanding IRS distribution rules. The table below highlights the most common hurdles founders face—and practical steps to resolve them before they affect tax filings or employee benefits.

Challenge | Solution |

Tracking eligible contributions | Use payroll systems that clearly separate HSA deductions |

Understanding distribution rules | Train finance/HR teams using IRS guidance |

Supporting multiple employees’ HSAs | Adopt cloud bookkeeping systems with scalable employee tracking |

Mid-year coverage changes | Follow IRS prorating worksheets in the Form 8889 instructions |

Why Responsive, Startup-Native Bookkeeping Matters for HSAs

Form 8889 intersects with:

Payroll

Benefits administration

Corporate + personal tax filing

This complexity means startups benefit from:

Real-time, startup-native bookkeeping

Hands-on guidance for HSA reporting

Integrated R&D tax credit planning

Founder-friendly tax workflows

Syncing HSA records with your accounting system ensures clean year-end reporting.

Where to Learn More About HSA Tax Filing

The IRS provides full guidance in Publication 969 — a must-read for compliance.

Make Form 8889 Work for Your Startup’s Health Savings Goals

Mastering Form 8889 empowers founders, COOs, and finance leaders to maximize available tax benefits while building a more resilient employee benefits strategy. When you understand how contributions, distributions, and annual limits work, HSAs become more than a compliance requirement—they become a tool for financial clarity, smarter planning, and long-term savings for both your team and your business.

With Haven’s startup-focused bookkeeping and tax support, you can streamline HSA reporting, reduce administrative friction, and keep your operations aligned with IRS requirements as you scale.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026