Go Back

Last Updated :

Last Updated :

Jan 26, 2026

Jan 26, 2026

Form 8868: How to Get an Extension for Exempt Organizations

For founders leading exempt organizations such as nonprofits or certain government entities, managing IRS deadlines efficiently is crucial to avoid penalties and keep operations smooth. One key document to understand from day one is Form 8868, the IRS form that allows your organization to request an extension for filing certain tax returns. This practical guide is tailored to help founders, COOs, and heads of finance at startups, agencies, and e-commerce businesses navigate this process confidently and with minimal risk.

Whether you’re new to exempt organization compliance or looking to streamline your tax management processes, this article covers everything you need—from understanding eligibility and deadlines to step-by-step instructions for filing an extension with Form 8868.

What Is Form 8868 and Why Does It Matter for Exempt Organizations?

Form 8868 is the IRS Application for Automatic Extension of Time to File an Exempt Organization Return. It’s designed primarily for organizations exempt from federal income tax that need more time (up to six months) to file forms like:

Form 990, 990-EZ, or 990-PF (annual information returns for nonprofits)

Form 4720 (excise tax returns)

Other related exempt organization returns

The form grants an automatic extension to file—not to pay taxes or excise fees owed. This distinction is important: your organization still owes any taxes by the original due date to avoid interest and penalties.

Why founders need to care: Filing for an extension using Form 8868 can safeguard your organization from late-filing penalties, which can add up quickly. It also buys crucial time when finalizing complex documents, assembling fundraising or grant reports, or completing audits.

For startups and agencies with exempt entities that might lack in-house tax experts, leveraging Form 8868 appropriately is a practical, risk-reducing move.

Who Can File Form 8868 and When?

Eligibility Criteria

Generally, the following entities can file Form 8868:

Tax-exempt organizations under IRS 501(c) status

Governmental units filing exempt returns

Certain trusts and other exempt entities

If your organization is obliged to file any exempt-income tax or information return mentioned by the IRS (including Form 990 and its variants), you may request an extension using Form 8868.

Deadlines to Keep in Mind

Key Rule: The extension request must be filed by the original due date of the return. For example, if your Form 990 is normally due on May 15th, your Form 8868 must be submitted on or before May 15th.

If you miss this deadline, you forfeit the extension and may face penalties.

The IRS grants a 6-month automatic extension to file the return but not to pay any taxes or excise fees.

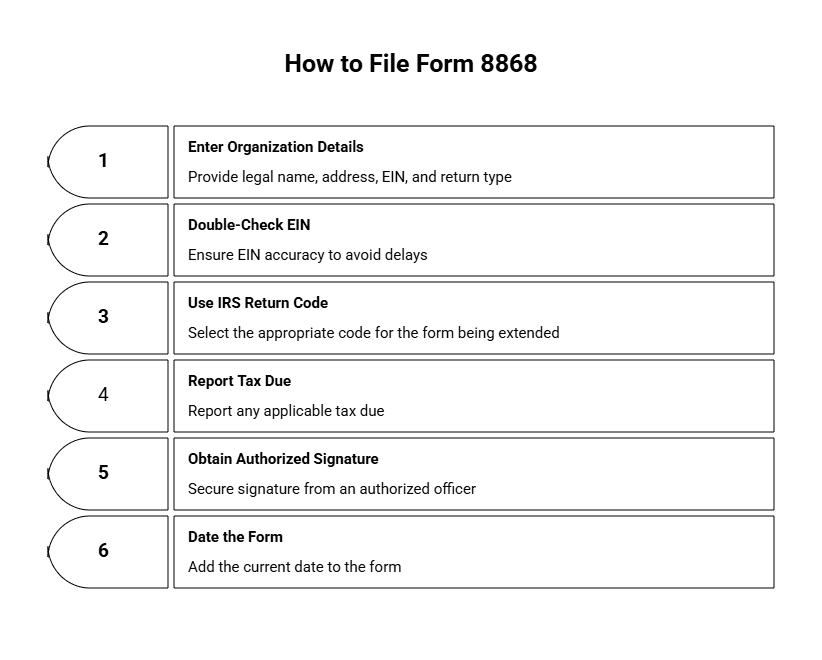

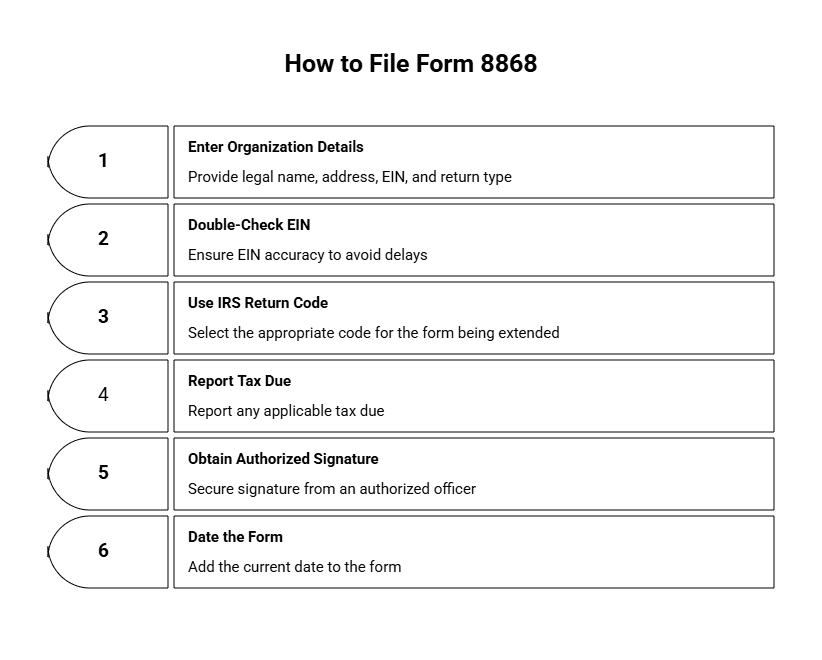

How to File Form 8868: Step-by-Step Guide

Knowing how to properly fill and submit Form 8868 is vital for clean and compliant filings. Here’s a breakdown of the form’s parts and what each requires.

Part | Description | Founder-Focused Tips |

Part I: Identification | Enter your organization's legal name, address, EIN, and return type (e.g., Form 990). | Double-check EIN accuracy to avoid processing delays. Keep your info consistent across filings. |

Part II: Return Code and Tax Information | Use an IRS return code for the form you are extending (codes listed in Form 8868 instructions) and report any tax due (if applicable). | While most exempt orgs owe no tax, some like 990-PF filers may have excise tax—ensure accurate reporting. |

Part III: Signature | An authorized officer must sign (e.g., CEO, CFO, or Executive Director) and date the form. | As a founder or COO, ensure that the signer is authorized under your bylaws. An unsigned form is considered invalid. |

Filing Methods: Electronic vs. Paper Filing

Today, there are two ways to file Form 8868:

Filing Method | Pros for Startups & Agencies | Cons |

Electronic Filing (E-file) | Fast processing (often same day), fewer errors, confirmation received, no mailing hassle | Requires IRS e-file credentials and access to software or IRS e-file providers |

Paper Filing | No need for e-file credentials; accessible for organizations without tech infrastructure | Slow processing (can take weeks), risk of mail delays, no immediate confirmation |

For modern startups or agencies with tech-savvy finance teams, electronic filing is the recommended method for speed and accuracy. However, paper filing remains an option for smaller organizations or those new to IRS systems.

You can find detailed IRS addresses for paper submission in the IRS instructions for Form 8868 (PDF).

Common Issues and How to Avoid Them

Founders aiming to get extension filings right should watch out for:

Missing or late submission: Form 8868 must be filed by the original due date.

Incorrect return codes: Using the wrong code can cause processing errors. Refer to the IRS instructions carefully.

Failure to sign: An unsigned form is invalid and will not grant an extension.

Confusing extension with payment: Filing Form 8868 does not extend the payment deadline. Taxes must still be paid on time.

Not tracking confirmation: If e-filing, save confirmation receipts; if mailing, consider certified mail to confirm receipt.

How Form 8868 Fits Into Your Larger Tax Strategy

As a founder or head of finance, extending filing deadlines isn’t about avoiding responsibility—it’s a strategic move to:

Buy time for complex accounting or fundraising reports

Await critical financial info, such as large donations or grants

Coordinate with outsourced tax advisors or bookkeepers for high-quality data

Since exempt organizations often have complicated compliance needs—especially when intertwined with R&D tax credits or multi-state operations—aligning Form 8868 with your broader tax and accounting workflow is smart.

To learn how other tax extensions work for entities like C-Corps, which may impact funding or payroll, explore this guide to filing business tax extensions for C-Corps.

What About Payments, Penalties, and Interest?

Remember that Form 8868 only extends the filing deadline, not payment deadlines. If your organization owes:

Excise tax (Form 4720-related)

Other payments associated with your exempt return

You must pay those by the original due date to avoid:

Penalties for late payment

Interest on unpaid balances

For official, detailed guidance, consult IRS.gov’s Tax Information for Exempt Organizations to stay compliant.

Why Getting Form 8868 Right Matters

Form 8868 is a powerful tool that founders of exempt organizations can leverage to manage IRS deadlines efficiently and minimize risk. It gives you the flexibility needed to gather all critical financial data in a busy fiscal period and mitigate penalties for late filings.

By understanding the filing requirements, timely submission, and the distinction between extensions to file versus extensions to pay, you keep your startup or agency exempt organization compliant and thriving.

When used properly, Form 8868 supports your organization’s scaling and compliance goals—making it an essential part of your financial playbook.

For founders leading exempt organizations such as nonprofits or certain government entities, managing IRS deadlines efficiently is crucial to avoid penalties and keep operations smooth. One key document to understand from day one is Form 8868, the IRS form that allows your organization to request an extension for filing certain tax returns. This practical guide is tailored to help founders, COOs, and heads of finance at startups, agencies, and e-commerce businesses navigate this process confidently and with minimal risk.

Whether you’re new to exempt organization compliance or looking to streamline your tax management processes, this article covers everything you need—from understanding eligibility and deadlines to step-by-step instructions for filing an extension with Form 8868.

What Is Form 8868 and Why Does It Matter for Exempt Organizations?

Form 8868 is the IRS Application for Automatic Extension of Time to File an Exempt Organization Return. It’s designed primarily for organizations exempt from federal income tax that need more time (up to six months) to file forms like:

Form 990, 990-EZ, or 990-PF (annual information returns for nonprofits)

Form 4720 (excise tax returns)

Other related exempt organization returns

The form grants an automatic extension to file—not to pay taxes or excise fees owed. This distinction is important: your organization still owes any taxes by the original due date to avoid interest and penalties.

Why founders need to care: Filing for an extension using Form 8868 can safeguard your organization from late-filing penalties, which can add up quickly. It also buys crucial time when finalizing complex documents, assembling fundraising or grant reports, or completing audits.

For startups and agencies with exempt entities that might lack in-house tax experts, leveraging Form 8868 appropriately is a practical, risk-reducing move.

Who Can File Form 8868 and When?

Eligibility Criteria

Generally, the following entities can file Form 8868:

Tax-exempt organizations under IRS 501(c) status

Governmental units filing exempt returns

Certain trusts and other exempt entities

If your organization is obliged to file any exempt-income tax or information return mentioned by the IRS (including Form 990 and its variants), you may request an extension using Form 8868.

Deadlines to Keep in Mind

Key Rule: The extension request must be filed by the original due date of the return. For example, if your Form 990 is normally due on May 15th, your Form 8868 must be submitted on or before May 15th.

If you miss this deadline, you forfeit the extension and may face penalties.

The IRS grants a 6-month automatic extension to file the return but not to pay any taxes or excise fees.

How to File Form 8868: Step-by-Step Guide

Knowing how to properly fill and submit Form 8868 is vital for clean and compliant filings. Here’s a breakdown of the form’s parts and what each requires.

Part | Description | Founder-Focused Tips |

Part I: Identification | Enter your organization's legal name, address, EIN, and return type (e.g., Form 990). | Double-check EIN accuracy to avoid processing delays. Keep your info consistent across filings. |

Part II: Return Code and Tax Information | Use an IRS return code for the form you are extending (codes listed in Form 8868 instructions) and report any tax due (if applicable). | While most exempt orgs owe no tax, some like 990-PF filers may have excise tax—ensure accurate reporting. |

Part III: Signature | An authorized officer must sign (e.g., CEO, CFO, or Executive Director) and date the form. | As a founder or COO, ensure that the signer is authorized under your bylaws. An unsigned form is considered invalid. |

Filing Methods: Electronic vs. Paper Filing

Today, there are two ways to file Form 8868:

Filing Method | Pros for Startups & Agencies | Cons |

Electronic Filing (E-file) | Fast processing (often same day), fewer errors, confirmation received, no mailing hassle | Requires IRS e-file credentials and access to software or IRS e-file providers |

Paper Filing | No need for e-file credentials; accessible for organizations without tech infrastructure | Slow processing (can take weeks), risk of mail delays, no immediate confirmation |

For modern startups or agencies with tech-savvy finance teams, electronic filing is the recommended method for speed and accuracy. However, paper filing remains an option for smaller organizations or those new to IRS systems.

You can find detailed IRS addresses for paper submission in the IRS instructions for Form 8868 (PDF).

Common Issues and How to Avoid Them

Founders aiming to get extension filings right should watch out for:

Missing or late submission: Form 8868 must be filed by the original due date.

Incorrect return codes: Using the wrong code can cause processing errors. Refer to the IRS instructions carefully.

Failure to sign: An unsigned form is invalid and will not grant an extension.

Confusing extension with payment: Filing Form 8868 does not extend the payment deadline. Taxes must still be paid on time.

Not tracking confirmation: If e-filing, save confirmation receipts; if mailing, consider certified mail to confirm receipt.

How Form 8868 Fits Into Your Larger Tax Strategy

As a founder or head of finance, extending filing deadlines isn’t about avoiding responsibility—it’s a strategic move to:

Buy time for complex accounting or fundraising reports

Await critical financial info, such as large donations or grants

Coordinate with outsourced tax advisors or bookkeepers for high-quality data

Since exempt organizations often have complicated compliance needs—especially when intertwined with R&D tax credits or multi-state operations—aligning Form 8868 with your broader tax and accounting workflow is smart.

To learn how other tax extensions work for entities like C-Corps, which may impact funding or payroll, explore this guide to filing business tax extensions for C-Corps.

What About Payments, Penalties, and Interest?

Remember that Form 8868 only extends the filing deadline, not payment deadlines. If your organization owes:

Excise tax (Form 4720-related)

Other payments associated with your exempt return

You must pay those by the original due date to avoid:

Penalties for late payment

Interest on unpaid balances

For official, detailed guidance, consult IRS.gov’s Tax Information for Exempt Organizations to stay compliant.

Why Getting Form 8868 Right Matters

Form 8868 is a powerful tool that founders of exempt organizations can leverage to manage IRS deadlines efficiently and minimize risk. It gives you the flexibility needed to gather all critical financial data in a busy fiscal period and mitigate penalties for late filings.

By understanding the filing requirements, timely submission, and the distinction between extensions to file versus extensions to pay, you keep your startup or agency exempt organization compliant and thriving.

When used properly, Form 8868 supports your organization’s scaling and compliance goals—making it an essential part of your financial playbook.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026