Go Back

Last Updated :

Last Updated :

Jan 5, 2026

Jan 5, 2026

Form 8863 Filing Guide: American Opportunity and Lifetime Learning Credits

For founders steering startups, agencies, or e-commerce ventures, managing finances efficiently is a strategic lever for growth. Understanding education tax credits is more than a compliance checkbox—it’s a way to reduce your personal tax burden and reinvest those savings into your business. IRS Form 8863 is the primary tool used to claim these credits.

What is Form 8863?

Form 8863, Education Credits, is used to calculate and claim two specific tax credits for qualified higher education expense:

American Opportunity Credit (AOC): A credit of up to $2,500 per student for the first four years of postsecondary education. Up to 40% of this credit is refundable, meaning you can receive it even if you owe no tax.

Lifetime Learning Credit (LLC): A nonrefundable credit of up to $2,000 per tax return for any level of postsecondary education, including graduate school and courses to acquire or improve job skills.

Who Needs to File?

You should file Form 8863 if you, your spouse, or a dependent paid "qualified education expenses" to an eligible educational institution in 2025.

Founder Upksilling: If you are taking professional development courses to improve your leadership or technical skills, you may qualify for the LLC.

Income Limits: These credits are subject to "phase-outs." For 2025, the credit begins to reduce if your Modified Adjusted Gross Income (MAGI) exceeds $80,000 ($160,000 for joint filers).

Step-by-Step: How to Fill Out Form 8863

Step 1: Complete Part III for Each Student

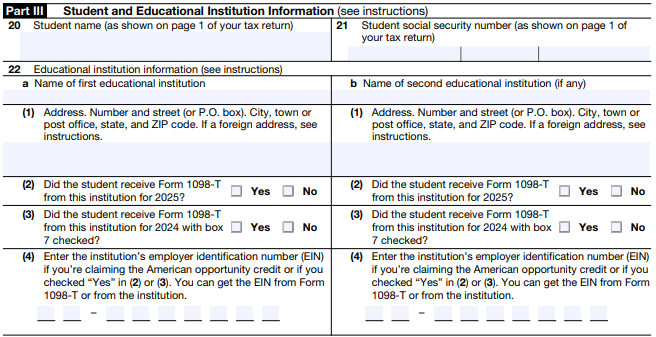

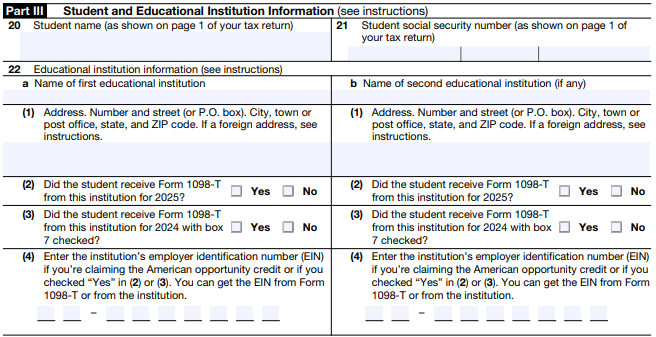

Important: You must complete a separate Part III (Page 2) for every student you are claiming a credit for before filling out the summary sections on Page 1.

Lines 20–21: Enter the student's name and SSN exactly as they appear on your tax return.

Line 22: Enter the school's name, address, and Employer Identification Number (EIN). You can find this on Form 1098-T provided by the school.

Eligibility Check (Lines 23–26): Answer these questions to see if the student qualifies for the AOC. If they have a felony drug conviction or have already claimed the AOC for four years, they are only eligible for the LLC.

Step 2: Calculate the Credits (Lines 27–31)

For AOC (Lines 27–30): Enter adjusted qualified expenses (tuition, fees, and required course materials) up to $4,000.

For LLC (Line 31): Enter adjusted qualified expenses for the LLC.

Step 3: Summarize on Page 1

Part I (AOC): Combine the amounts from all Part III forms to find your total AOC. Line 8 will show your refundable portion (40%), which goes on Form 1040, Line 29.

Part II (LLC): Combine the amounts for the LLC. This is nonrefundable and will be limited by the tax you actually owe.

Common Pitfalls for Founders

Double Dipping: You cannot claim both the AOC and the LLC for the same student in the same year.

Age 24 Rule: If you are a founder under age 24, specific residency and support conditions must be met to claim the refundable portion of the AOC.

Qualified Expenses: Room and board, insurance, and student health fees generally do not count as qualified expenses.

When is Form 8863 Due?

Form 8863 must be attached to your individual tax return (Form 1040 or 1040-SR). It is due by the tax filing deadline (usually April 15).

Maximize Your Savings with Haven

Strategic tax planning is a growth engine, not just a compliance task. Haven’t specialized tax services for startups and agencies ensure you never leave money on the table.

Integrated Filings: We help founders reconcile personal education credits with business deductions to maximize total tax alpha.

Audit-Ready Documentation: Our platform helps you organize 1098-Ts and receipts so you're always prepared.

For founders steering startups, agencies, or e-commerce ventures, managing finances efficiently is a strategic lever for growth. Understanding education tax credits is more than a compliance checkbox—it’s a way to reduce your personal tax burden and reinvest those savings into your business. IRS Form 8863 is the primary tool used to claim these credits.

What is Form 8863?

Form 8863, Education Credits, is used to calculate and claim two specific tax credits for qualified higher education expense:

American Opportunity Credit (AOC): A credit of up to $2,500 per student for the first four years of postsecondary education. Up to 40% of this credit is refundable, meaning you can receive it even if you owe no tax.

Lifetime Learning Credit (LLC): A nonrefundable credit of up to $2,000 per tax return for any level of postsecondary education, including graduate school and courses to acquire or improve job skills.

Who Needs to File?

You should file Form 8863 if you, your spouse, or a dependent paid "qualified education expenses" to an eligible educational institution in 2025.

Founder Upksilling: If you are taking professional development courses to improve your leadership or technical skills, you may qualify for the LLC.

Income Limits: These credits are subject to "phase-outs." For 2025, the credit begins to reduce if your Modified Adjusted Gross Income (MAGI) exceeds $80,000 ($160,000 for joint filers).

Step-by-Step: How to Fill Out Form 8863

Step 1: Complete Part III for Each Student

Important: You must complete a separate Part III (Page 2) for every student you are claiming a credit for before filling out the summary sections on Page 1.

Lines 20–21: Enter the student's name and SSN exactly as they appear on your tax return.

Line 22: Enter the school's name, address, and Employer Identification Number (EIN). You can find this on Form 1098-T provided by the school.

Eligibility Check (Lines 23–26): Answer these questions to see if the student qualifies for the AOC. If they have a felony drug conviction or have already claimed the AOC for four years, they are only eligible for the LLC.

Step 2: Calculate the Credits (Lines 27–31)

For AOC (Lines 27–30): Enter adjusted qualified expenses (tuition, fees, and required course materials) up to $4,000.

For LLC (Line 31): Enter adjusted qualified expenses for the LLC.

Step 3: Summarize on Page 1

Part I (AOC): Combine the amounts from all Part III forms to find your total AOC. Line 8 will show your refundable portion (40%), which goes on Form 1040, Line 29.

Part II (LLC): Combine the amounts for the LLC. This is nonrefundable and will be limited by the tax you actually owe.

Common Pitfalls for Founders

Double Dipping: You cannot claim both the AOC and the LLC for the same student in the same year.

Age 24 Rule: If you are a founder under age 24, specific residency and support conditions must be met to claim the refundable portion of the AOC.

Qualified Expenses: Room and board, insurance, and student health fees generally do not count as qualified expenses.

When is Form 8863 Due?

Form 8863 must be attached to your individual tax return (Form 1040 or 1040-SR). It is due by the tax filing deadline (usually April 15).

Maximize Your Savings with Haven

Strategic tax planning is a growth engine, not just a compliance task. Haven’t specialized tax services for startups and agencies ensure you never leave money on the table.

Integrated Filings: We help founders reconcile personal education credits with business deductions to maximize total tax alpha.

Audit-Ready Documentation: Our platform helps you organize 1098-Ts and receipts so you're always prepared.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026