Go Back

Last Updated :

Last Updated :

Dec 22, 2025

Dec 22, 2025

Form 8862 Guide: How to Claim Disallowed Tax Credits

For founders steering startups, agencies, and e-commerce ventures in the U.S., managing personal tax compliance—especially securing valuable refundable tax credits—is essential for optimizing household cash flow and reinvestment opportunities. One common hurdle is navigating the IRS Form 8862, a crucial document that allows taxpayers to reclaim certain tax credits previously disallowed or reduced.

This guide demystifies Form 8862, offering practical, guidance-oriented steps tailored to founders and finance leaders keen to take control of their tax credits with confidence.

What Is Form 8862 and Who Must File It?

Form 8862, officially titled the "Information To Claim Certain Credits After Disallowance," is a mandatory form used to re-establish your eligibility for specific tax credits that the IRS previously denied or reduced.

The Credits It Covers

Form 8862 is specifically required for claiming the following personal tax credits:

EIC: Earned Income Credit

CTC/RCTC/ACTC/ODC: Child Tax Credit (and related credits like the Additional Child Tax Credit and Credit for Other Dependents)

AOTC: American Opportunity Tax Credit (for educational expenses)

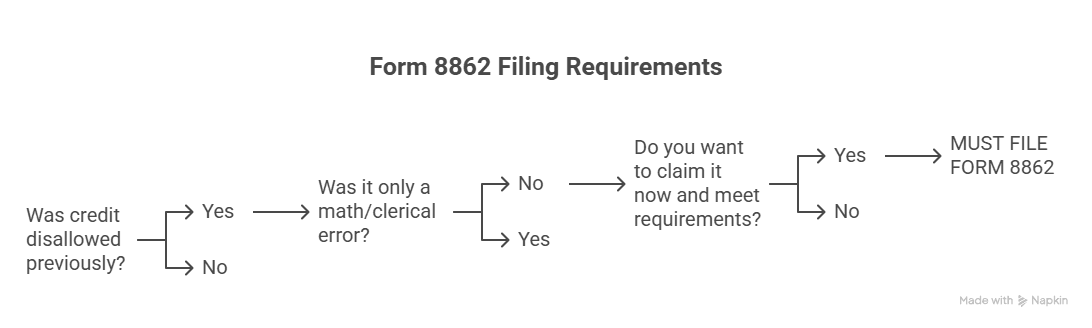

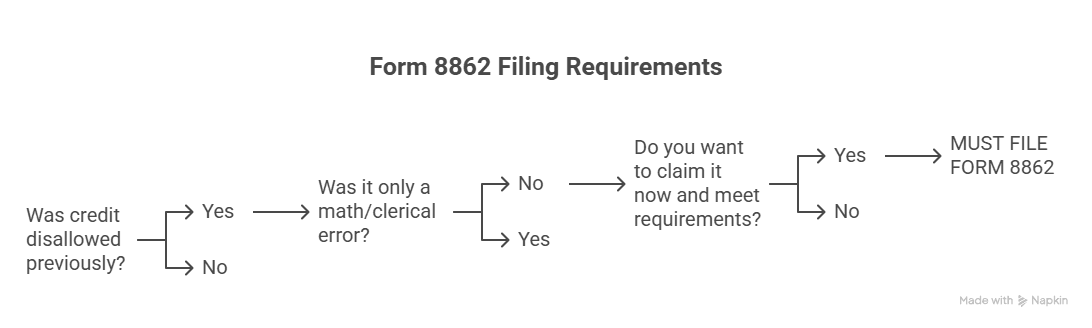

Who Needs to File Form 8862?

You must complete and attach Form 8862 to your tax return if both of the following conditions apply:

Your claim for the EIC, CTC/RCTC/ACTC/ODC, or AOTC was previously reduced or disallowed for any reason other than a math or clerical error.

You now want to claim the credit that was previously disallowed and you meet all the requirements for the credit in the current tax year.

When Form 8862 Is Due

Form 8862 is not filed on its own. It is an Attachment to your federal income tax return (e.g., Form 1040).

GUIDANCE: The due date for Form 8862 is the same as the due date for your tax return (usually April 15, or the extended due date). You must file Form 8862 with the return on which you are claiming the previously disallowed credit.

How to Fill Out Form 8862 (Step-by-Step Guidance)

Filing Form 8862 requires you to clearly demonstrate to the IRS that you meet all eligibility requirements for the credit in the current tax year, despite the prior disallowance.

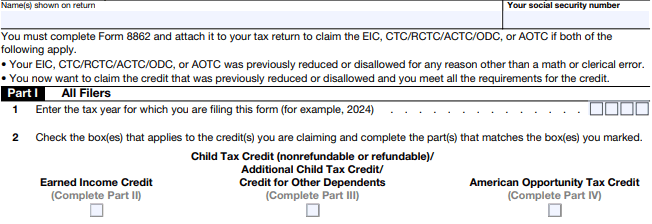

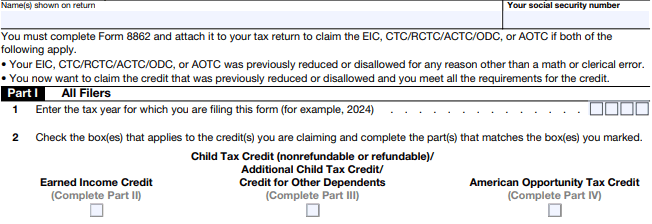

Step 1: Complete Part I - General Information (Lines 1 & 2)

Action: Provide basic identifying information and specify which credit(s) you are attempting to reclaim.

Enter the Tax Year (Line 1): Write the four-digit year for which you are filing this form (e.g., 2024).

Select the Credit(s) (Line 2): Check the box(es) corresponding to the credit(s) you are claiming. This tells the IRS which specific subsequent Part (II, III, or IV) you must complete.

Step 2: Complete the Relevant Credit Part(s) (Part II, III, or IV)

You only need to complete the section(s) that match the box(es) you checked on Line 2.

A. If Claiming the Earned Income Credit (EIC) - Complete Part II

Part II requires you to confirm basic eligibility and provide details about your qualifying children, if applicable.

Line 3 (Simple Correction): If the only reason your EIC was disallowed was due to an incorrect report of earned income or investment income, check "Yes". If you check "Yes," you skip the rest of Part II.

Line 4 (Qualifying Child status): Answer whether you (or your spouse) could be claimed as a qualifying child of another taxpayer. If "Yes," you cannot claim the EIC.

Section A (With Children): You must list the name of each qualifying child and confirm they lived with you in the U.S. for more than half the year (183 days, or 184 days if a leap year).

GUIDANCE: If a child did not meet the 183-day residency test, you cannot claim the EIC for that child.

B. If Claiming Child Tax Credit/ODC (CTC/ACTC/ODC) - Complete Part III

Part III asks you to list all qualifying children and other dependents for whom you are claiming the credit(s).

Lines 12 & 13 (Names): List the name(s) of each child (Line 12) or other dependent (Line 13).

Lines 14-17 (Eligibility Tests): You must answer "Yes" to a series of questions for each person listed, confirming:

Residency Test (Line 14): Did the child live with you for more than half the year?

Qualifying Child Test (Line 15): Did the child meet the requirements to be a qualifying child for the CTC/RCTC/ACTC?

Dependency Test (Line 16): Is the person your dependent?

Citizenship Test (Line 17): Is the person a citizen, national, or resident of the United States?

CAUTION: If you answer "No" to any question (14, 15, 16, or 17) for a person, you cannot claim the credit for that person.

C. If Claiming American Opportunity Tax Credit (AOTC) - Complete Part IV

Line 18 (Student Names): Enter the name(s) of the student(s) for whom you are claiming the AOTC.

Line 19a (Eligible Student Test): Did the student meet the requirements to be an eligible student for the AOTC?

Line 19b (Four-Year Limit Test): Has the Hope Scholarship Credit or AOTC been claimed for the student for any four tax years before the current year?

CAUTION: If you answer "No" to 19a or "Yes" to 19b, you cannot claim the credit for that student.

Step 3: Attach and File

Action: Ensure Form 8862 is fully completed and included with your Form 1040 (or other appropriate tax return).

Common Mistakes to Avoid

Pitfall | Explanation | Founder-Friendly Fix |

Filing Separately | Sending Form 8862 by itself. The form is an attachment to your tax return and must be filed with it. | Ensure your tax software or preparer includes Form 8862 with your main return (Form 1040). |

Failing Residency Test | Claiming a child for EIC (Part II, Line 7) or CTC (Part III, Line 14) when they did not live with you for the required 183 days. | Maintain documentation (school records, medical records) proving the child's residency for the majority of the year. |

Ignoring Prior Disallowance | Not filing Form 8862 when required. If your credit was previously disallowed, you must file this form to reclaim it. | Review all prior IRS notices. If a notice mentioned disallowance (not just clerical error), plan to file Form 8862. |

Dependency Confusion | Failing the dependency test (Part III, Line 16) where the qualifying person is claimed as a dependent by another taxpayer. | Confirm with all involved parties (e.g., former spouse) who is claiming the dependency for the current tax year. |

Frequently Asked Questions (FAQs)

What is the difference between a disallowance and a math error?

A math or clerical error is a simple calculation mistake that the IRS corrects automatically, and you do not need to file Form 8862. A disallowance means the IRS questioned your eligibility for the credit (e.g., residency, relationship, income threshold). In the latter case, Form 8862 is required to re-establish eligibility.

If I file Form 8862, am I guaranteed to get the credit back?

No. Form 8862 is the mandatory application to reclaim the credit. You must still meet all of the credit's eligibility requirements for the current tax year, and the IRS must approve your documentation.

Can I use Form 8862 for business tax credits like the R&D Credit?

No. Form 8862 is strictly for re-claiming the personal tax credits listed on the form (EIC, CTC/ODC, AOTC). Business credits, such as the R&D tax credit (Form 6765), have their own rules for claiming and dealing with disallowance.

For founders steering startups, agencies, and e-commerce ventures in the U.S., managing personal tax compliance—especially securing valuable refundable tax credits—is essential for optimizing household cash flow and reinvestment opportunities. One common hurdle is navigating the IRS Form 8862, a crucial document that allows taxpayers to reclaim certain tax credits previously disallowed or reduced.

This guide demystifies Form 8862, offering practical, guidance-oriented steps tailored to founders and finance leaders keen to take control of their tax credits with confidence.

What Is Form 8862 and Who Must File It?

Form 8862, officially titled the "Information To Claim Certain Credits After Disallowance," is a mandatory form used to re-establish your eligibility for specific tax credits that the IRS previously denied or reduced.

The Credits It Covers

Form 8862 is specifically required for claiming the following personal tax credits:

EIC: Earned Income Credit

CTC/RCTC/ACTC/ODC: Child Tax Credit (and related credits like the Additional Child Tax Credit and Credit for Other Dependents)

AOTC: American Opportunity Tax Credit (for educational expenses)

Who Needs to File Form 8862?

You must complete and attach Form 8862 to your tax return if both of the following conditions apply:

Your claim for the EIC, CTC/RCTC/ACTC/ODC, or AOTC was previously reduced or disallowed for any reason other than a math or clerical error.

You now want to claim the credit that was previously disallowed and you meet all the requirements for the credit in the current tax year.

When Form 8862 Is Due

Form 8862 is not filed on its own. It is an Attachment to your federal income tax return (e.g., Form 1040).

GUIDANCE: The due date for Form 8862 is the same as the due date for your tax return (usually April 15, or the extended due date). You must file Form 8862 with the return on which you are claiming the previously disallowed credit.

How to Fill Out Form 8862 (Step-by-Step Guidance)

Filing Form 8862 requires you to clearly demonstrate to the IRS that you meet all eligibility requirements for the credit in the current tax year, despite the prior disallowance.

Step 1: Complete Part I - General Information (Lines 1 & 2)

Action: Provide basic identifying information and specify which credit(s) you are attempting to reclaim.

Enter the Tax Year (Line 1): Write the four-digit year for which you are filing this form (e.g., 2024).

Select the Credit(s) (Line 2): Check the box(es) corresponding to the credit(s) you are claiming. This tells the IRS which specific subsequent Part (II, III, or IV) you must complete.

Step 2: Complete the Relevant Credit Part(s) (Part II, III, or IV)

You only need to complete the section(s) that match the box(es) you checked on Line 2.

A. If Claiming the Earned Income Credit (EIC) - Complete Part II

Part II requires you to confirm basic eligibility and provide details about your qualifying children, if applicable.

Line 3 (Simple Correction): If the only reason your EIC was disallowed was due to an incorrect report of earned income or investment income, check "Yes". If you check "Yes," you skip the rest of Part II.

Line 4 (Qualifying Child status): Answer whether you (or your spouse) could be claimed as a qualifying child of another taxpayer. If "Yes," you cannot claim the EIC.

Section A (With Children): You must list the name of each qualifying child and confirm they lived with you in the U.S. for more than half the year (183 days, or 184 days if a leap year).

GUIDANCE: If a child did not meet the 183-day residency test, you cannot claim the EIC for that child.

B. If Claiming Child Tax Credit/ODC (CTC/ACTC/ODC) - Complete Part III

Part III asks you to list all qualifying children and other dependents for whom you are claiming the credit(s).

Lines 12 & 13 (Names): List the name(s) of each child (Line 12) or other dependent (Line 13).

Lines 14-17 (Eligibility Tests): You must answer "Yes" to a series of questions for each person listed, confirming:

Residency Test (Line 14): Did the child live with you for more than half the year?

Qualifying Child Test (Line 15): Did the child meet the requirements to be a qualifying child for the CTC/RCTC/ACTC?

Dependency Test (Line 16): Is the person your dependent?

Citizenship Test (Line 17): Is the person a citizen, national, or resident of the United States?

CAUTION: If you answer "No" to any question (14, 15, 16, or 17) for a person, you cannot claim the credit for that person.

C. If Claiming American Opportunity Tax Credit (AOTC) - Complete Part IV

Line 18 (Student Names): Enter the name(s) of the student(s) for whom you are claiming the AOTC.

Line 19a (Eligible Student Test): Did the student meet the requirements to be an eligible student for the AOTC?

Line 19b (Four-Year Limit Test): Has the Hope Scholarship Credit or AOTC been claimed for the student for any four tax years before the current year?

CAUTION: If you answer "No" to 19a or "Yes" to 19b, you cannot claim the credit for that student.

Step 3: Attach and File

Action: Ensure Form 8862 is fully completed and included with your Form 1040 (or other appropriate tax return).

Common Mistakes to Avoid

Pitfall | Explanation | Founder-Friendly Fix |

Filing Separately | Sending Form 8862 by itself. The form is an attachment to your tax return and must be filed with it. | Ensure your tax software or preparer includes Form 8862 with your main return (Form 1040). |

Failing Residency Test | Claiming a child for EIC (Part II, Line 7) or CTC (Part III, Line 14) when they did not live with you for the required 183 days. | Maintain documentation (school records, medical records) proving the child's residency for the majority of the year. |

Ignoring Prior Disallowance | Not filing Form 8862 when required. If your credit was previously disallowed, you must file this form to reclaim it. | Review all prior IRS notices. If a notice mentioned disallowance (not just clerical error), plan to file Form 8862. |

Dependency Confusion | Failing the dependency test (Part III, Line 16) where the qualifying person is claimed as a dependent by another taxpayer. | Confirm with all involved parties (e.g., former spouse) who is claiming the dependency for the current tax year. |

Frequently Asked Questions (FAQs)

What is the difference between a disallowance and a math error?

A math or clerical error is a simple calculation mistake that the IRS corrects automatically, and you do not need to file Form 8862. A disallowance means the IRS questioned your eligibility for the credit (e.g., residency, relationship, income threshold). In the latter case, Form 8862 is required to re-establish eligibility.

If I file Form 8862, am I guaranteed to get the credit back?

No. Form 8862 is the mandatory application to reclaim the credit. You must still meet all of the credit's eligibility requirements for the current tax year, and the IRS must approve your documentation.

Can I use Form 8862 for business tax credits like the R&D Credit?

No. Form 8862 is strictly for re-claiming the personal tax credits listed on the form (EIC, CTC/ODC, AOTC). Business credits, such as the R&D tax credit (Form 6765), have their own rules for claiming and dealing with disallowance.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026