Go Back

Last Updated :

Last Updated :

Jan 15, 2026

Jan 15, 2026

Form 8858: Reporting Foreign Disregarded Entities & Compliance Essentials

As a founder steering a US startup, agency, or e-commerce company, understanding your tax obligations is essential to keep your business compliant and optimized for growth. One critical but often overlooked form in the international tax landscape is Form 8858. This IRS form plays a vital role in reporting foreign disregarded entities (FDEs), a common structure for startups expanding globally or managing offshore entities.

In this guide, we’ll dive into what Form 8858 is, why it matters for founders like you, and practical steps to handle your foreign disregarded entities’ reporting requirements with confidence. Along the way, we’ll point you to helpful resources that can streamline your US bookkeeping and tax processes.

What Is Form 8858 and Who Needs to File It?

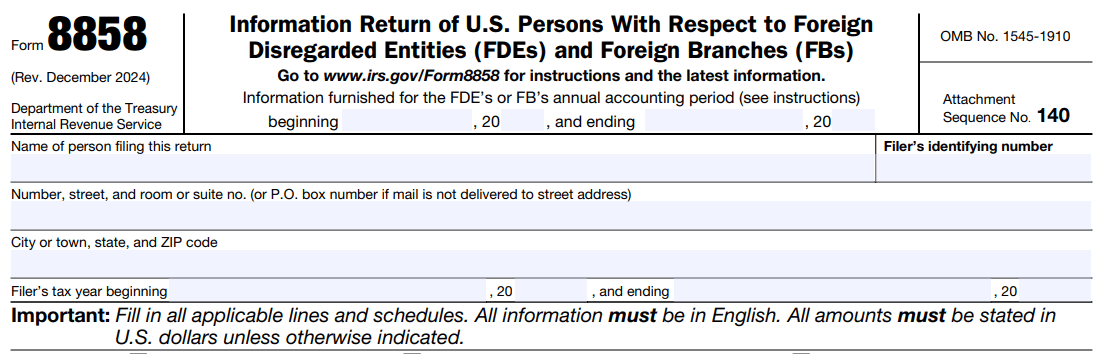

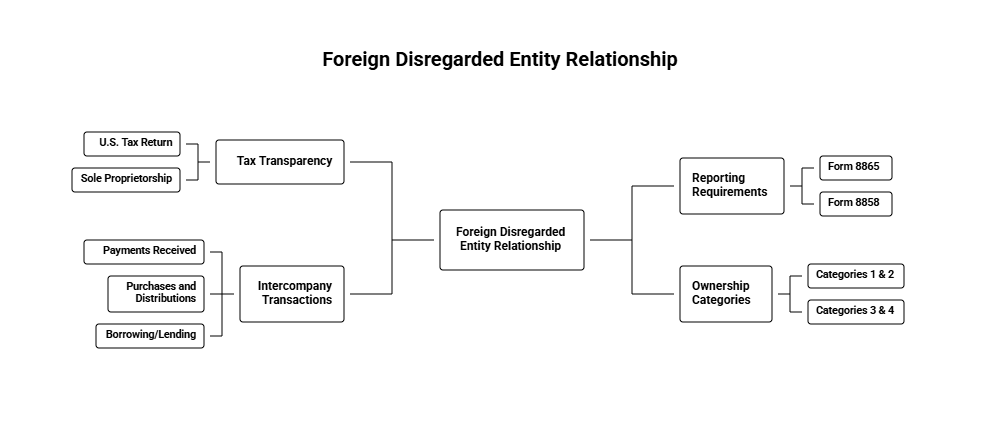

Form 8858 is officially titled the “Information Return of U.S. Persons With Respect To Foreign Disregarded Entities.” It is used by U.S. persons who own a foreign disregarded entity to report certain financial details about those entities to the IRS.

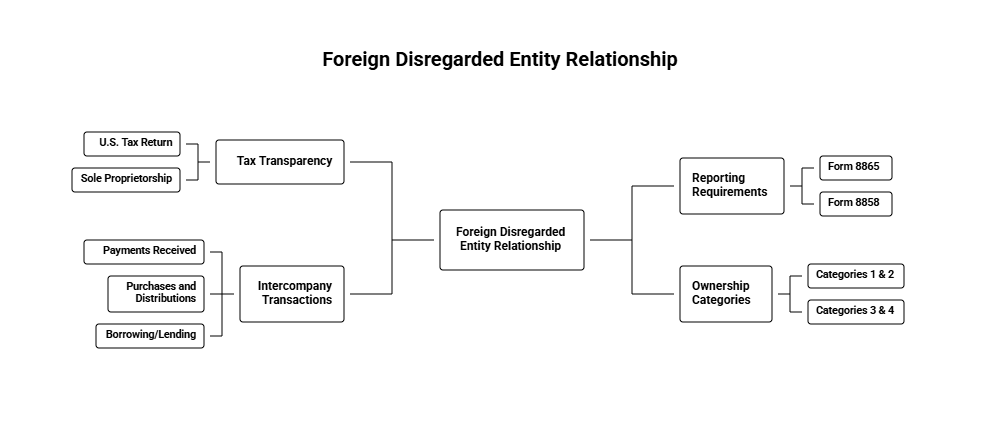

An FDE is a business entity considered separate from its owner under foreign law but “disregarded” as separate for U.S. tax purposes. The IRS treats these structures as pass-throughs, meaning their income, losses, and other financial activity are attributed directly to their U.S. owners.

Who Must File Form 8858?

U.S. individuals, partnerships, and corporations with direct or indirect ownership in a foreign disregarded entity.

Examples include founders who wholly own an offshore single-member LLC or U.S. startups with international branch operations classified as FDEs.

Even indirect ownership—such as owning a U.S. company that owns a foreign disregarded entity through a holding company—can trigger reporting.

Why It Matters to Founders

Foreign disregarded entities are often used by startups for:

Overseas hiring or subsidiary launches

International logistics or supply chain setups

Holding foreign intellectual property

Participating in accelerator or venture programs outside the U.S.

If you use these setups without proper reporting, the IRS can issue penalties of $10,000 or more per missed or late Form 8858, potentially jeopardizing your company’s compliance status.

For an overview of how international business activity impacts your federal reporting obligations, check out Haven’s Business Tax Services.

How to File Form 8858: A Step-by-Step Overview

While the official instructions may appear daunting, filing Form 8858 becomes manageable when approached in clear, logical steps:

Step | Task | Details / Tips |

1 | Determine Filing Requirement | Confirm whether you meet criteria for direct or indirect ownership of an FDE. |

2 | Collect Entity Data | Gather legal name, local address, jurisdiction, and tax identification numbers. |

3 | Compile Financials | Prepare income statements and balance sheets, converted to USD using approved exchange rates. |

4 | Complete Form Sections A–C | Report FDE details, P&L, assets, liabilities, and intercompany transactions. |

5 | Attach to Tax Return | File Form 8858 with Form 1040, 1065, or 1120. |

6 | Consult a Cross-border Tax Expert | Avoid audit exposure by working with international tax specialists. |

Need a deeper dive across common IRS forms? Our Tax Guide for Founders breaks down everything you should know.

Common Pitfalls Founders Should Avoid

Misunderstanding Entity Classifications

An offshore entity may be treated differently by U.S. tax rules than by its local jurisdiction.

Incorrect Currency Conversions

Use IRS-approved annual average exchange rates and document sources.

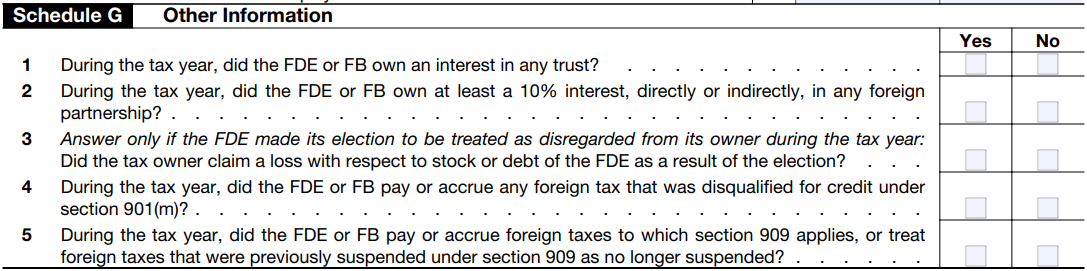

Ignoring Intercompany Transactions

Loans, services, and IP transfers must be disclosed.

Missing Filing Deadlines

Avoid escalating IRS penalties by submitting Form 8858 on time.

How Modern Bookkeeping Eases Form 8858 Compliance

International tax filings are heavy lifts without a system that can:

Track multi-entity ownership

Sync multi-currency transactions

Identify intercompany flows

Feed clean data into annual filings

At Haven, we help startups:

Stay IRS-compliant with automated data aggregation

Identify risk areas related to Form 8858

Access scalable tax support

Explore our Reporting Solutions built to simplify international operations and keep your startup audit-ready.

Master Form 8858 Filing to Unlock Global Growth

As a founder, staying ahead of reporting obligations like Form 8858 is a small but powerful step toward building investor trust, avoiding IRS penalties, and optimizing your tax strategy for global success. Proactively managing foreign disregarded entities sends a strong signal that your financial operations are well structured.

With tools that support multi-entity compliance and expert guidance tailored for founders, you can scale internationally with confidence.

As a founder steering a US startup, agency, or e-commerce company, understanding your tax obligations is essential to keep your business compliant and optimized for growth. One critical but often overlooked form in the international tax landscape is Form 8858. This IRS form plays a vital role in reporting foreign disregarded entities (FDEs), a common structure for startups expanding globally or managing offshore entities.

In this guide, we’ll dive into what Form 8858 is, why it matters for founders like you, and practical steps to handle your foreign disregarded entities’ reporting requirements with confidence. Along the way, we’ll point you to helpful resources that can streamline your US bookkeeping and tax processes.

What Is Form 8858 and Who Needs to File It?

Form 8858 is officially titled the “Information Return of U.S. Persons With Respect To Foreign Disregarded Entities.” It is used by U.S. persons who own a foreign disregarded entity to report certain financial details about those entities to the IRS.

An FDE is a business entity considered separate from its owner under foreign law but “disregarded” as separate for U.S. tax purposes. The IRS treats these structures as pass-throughs, meaning their income, losses, and other financial activity are attributed directly to their U.S. owners.

Who Must File Form 8858?

U.S. individuals, partnerships, and corporations with direct or indirect ownership in a foreign disregarded entity.

Examples include founders who wholly own an offshore single-member LLC or U.S. startups with international branch operations classified as FDEs.

Even indirect ownership—such as owning a U.S. company that owns a foreign disregarded entity through a holding company—can trigger reporting.

Why It Matters to Founders

Foreign disregarded entities are often used by startups for:

Overseas hiring or subsidiary launches

International logistics or supply chain setups

Holding foreign intellectual property

Participating in accelerator or venture programs outside the U.S.

If you use these setups without proper reporting, the IRS can issue penalties of $10,000 or more per missed or late Form 8858, potentially jeopardizing your company’s compliance status.

For an overview of how international business activity impacts your federal reporting obligations, check out Haven’s Business Tax Services.

How to File Form 8858: A Step-by-Step Overview

While the official instructions may appear daunting, filing Form 8858 becomes manageable when approached in clear, logical steps:

Step | Task | Details / Tips |

1 | Determine Filing Requirement | Confirm whether you meet criteria for direct or indirect ownership of an FDE. |

2 | Collect Entity Data | Gather legal name, local address, jurisdiction, and tax identification numbers. |

3 | Compile Financials | Prepare income statements and balance sheets, converted to USD using approved exchange rates. |

4 | Complete Form Sections A–C | Report FDE details, P&L, assets, liabilities, and intercompany transactions. |

5 | Attach to Tax Return | File Form 8858 with Form 1040, 1065, or 1120. |

6 | Consult a Cross-border Tax Expert | Avoid audit exposure by working with international tax specialists. |

Need a deeper dive across common IRS forms? Our Tax Guide for Founders breaks down everything you should know.

Common Pitfalls Founders Should Avoid

Misunderstanding Entity Classifications

An offshore entity may be treated differently by U.S. tax rules than by its local jurisdiction.

Incorrect Currency Conversions

Use IRS-approved annual average exchange rates and document sources.

Ignoring Intercompany Transactions

Loans, services, and IP transfers must be disclosed.

Missing Filing Deadlines

Avoid escalating IRS penalties by submitting Form 8858 on time.

How Modern Bookkeeping Eases Form 8858 Compliance

International tax filings are heavy lifts without a system that can:

Track multi-entity ownership

Sync multi-currency transactions

Identify intercompany flows

Feed clean data into annual filings

At Haven, we help startups:

Stay IRS-compliant with automated data aggregation

Identify risk areas related to Form 8858

Access scalable tax support

Explore our Reporting Solutions built to simplify international operations and keep your startup audit-ready.

Master Form 8858 Filing to Unlock Global Growth

As a founder, staying ahead of reporting obligations like Form 8858 is a small but powerful step toward building investor trust, avoiding IRS penalties, and optimizing your tax strategy for global success. Proactively managing foreign disregarded entities sends a strong signal that your financial operations are well structured.

With tools that support multi-entity compliance and expert guidance tailored for founders, you can scale internationally with confidence.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026