Go Back

Last Updated :

Last Updated :

Jan 15, 2026

Jan 15, 2026

How to Get U.S. Residency Certification: A Practical Guide to Form 8802

When you’re a founder, understanding how to manage your tax residency status efficiently can unlock significant tax savings and compliance peace of mind. One key tool in this process is Form 8802, the application for a U.S. residency certification. This certification supports your claim to tax treaty benefits with foreign jurisdictions and helps avoid double taxation — a crucial advantage when your business operates internationally or engages in cross-border transactions.

In this guide, we’ll unpack what Form 8802 is, why it matters for startup founders, and walk you through the application process with practical tips tailored to your business growth needs. We'll also weave in relevant tax forms and IRS guidelines to help you navigate the complexities confidently.

What Is Form 8802 and Why Founders Should Care

Form 8802, officially titled the “Application for United States Residency Certification,” is a document submitted to the IRS to request a Certification of U.S. Residency. This certification confirms that your company—or you as an individual—are considered a resident of the U.S. for tax purposes under applicable tax treaties.

Why is this important for founders?

Access to tax treaty benefits: Many countries have tax treaties with the U.S. that reduce withholding taxes on dividends, interest, royalties, and other payments. Without proof of U.S. residency, foreign tax authorities may apply withholding at higher rates.

Avoid double taxation: Tax residency certification supports your claim for relief from being taxed both in the U.S. and abroad on the same income.

Facilitates international business expansion: If your startup is scaling globally or partnering with foreign entities, certification expedites withholding tax relief.

Supports R&D tax credit strategies: Especially relevant if you’re leveraging tax benefits associated with R&D expenditures abroad.

For founders navigating this landscape, Form 8802 becomes a practical tool—not just a bureaucratic formality—helping you control your tax costs and compliance risks.

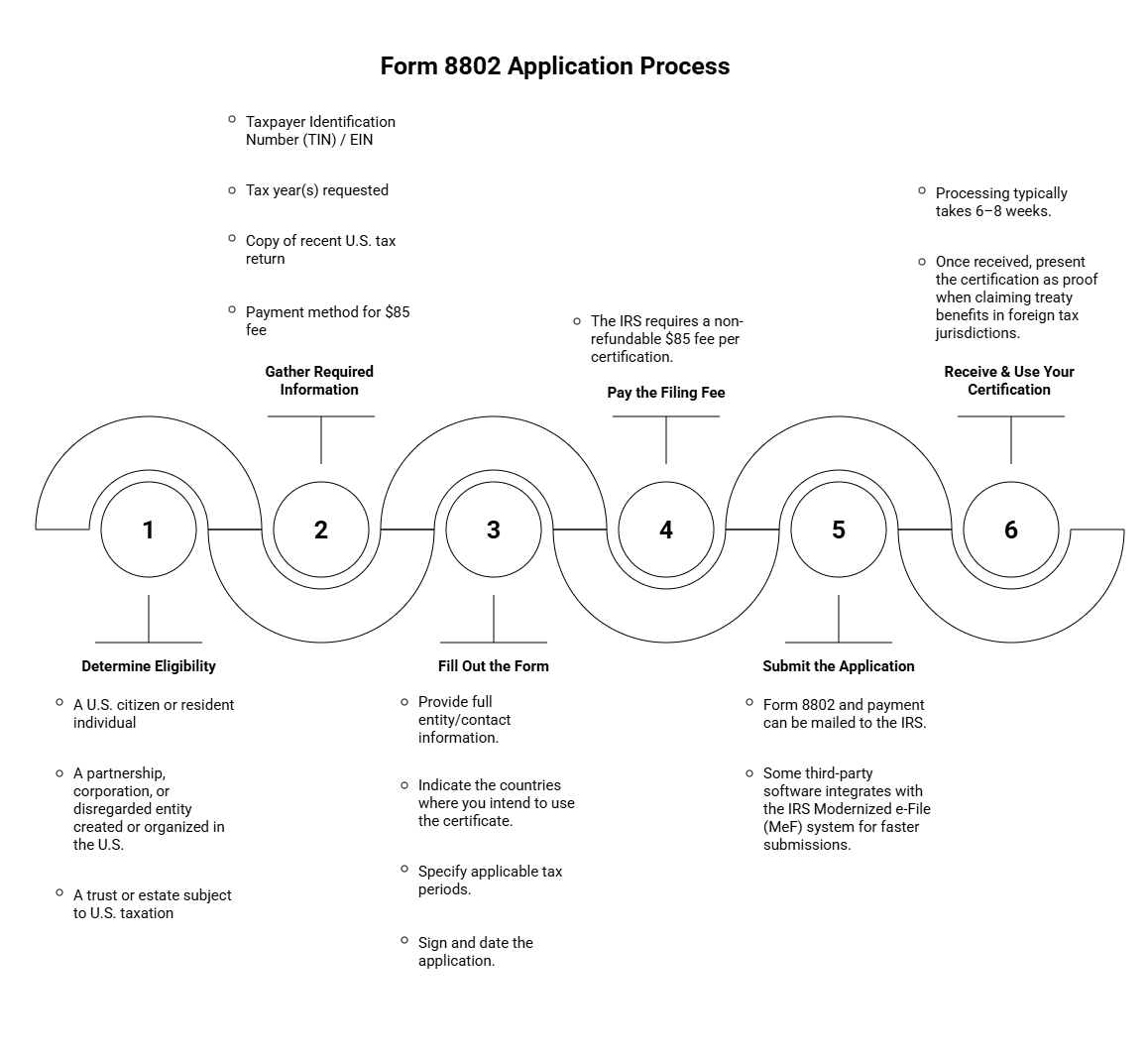

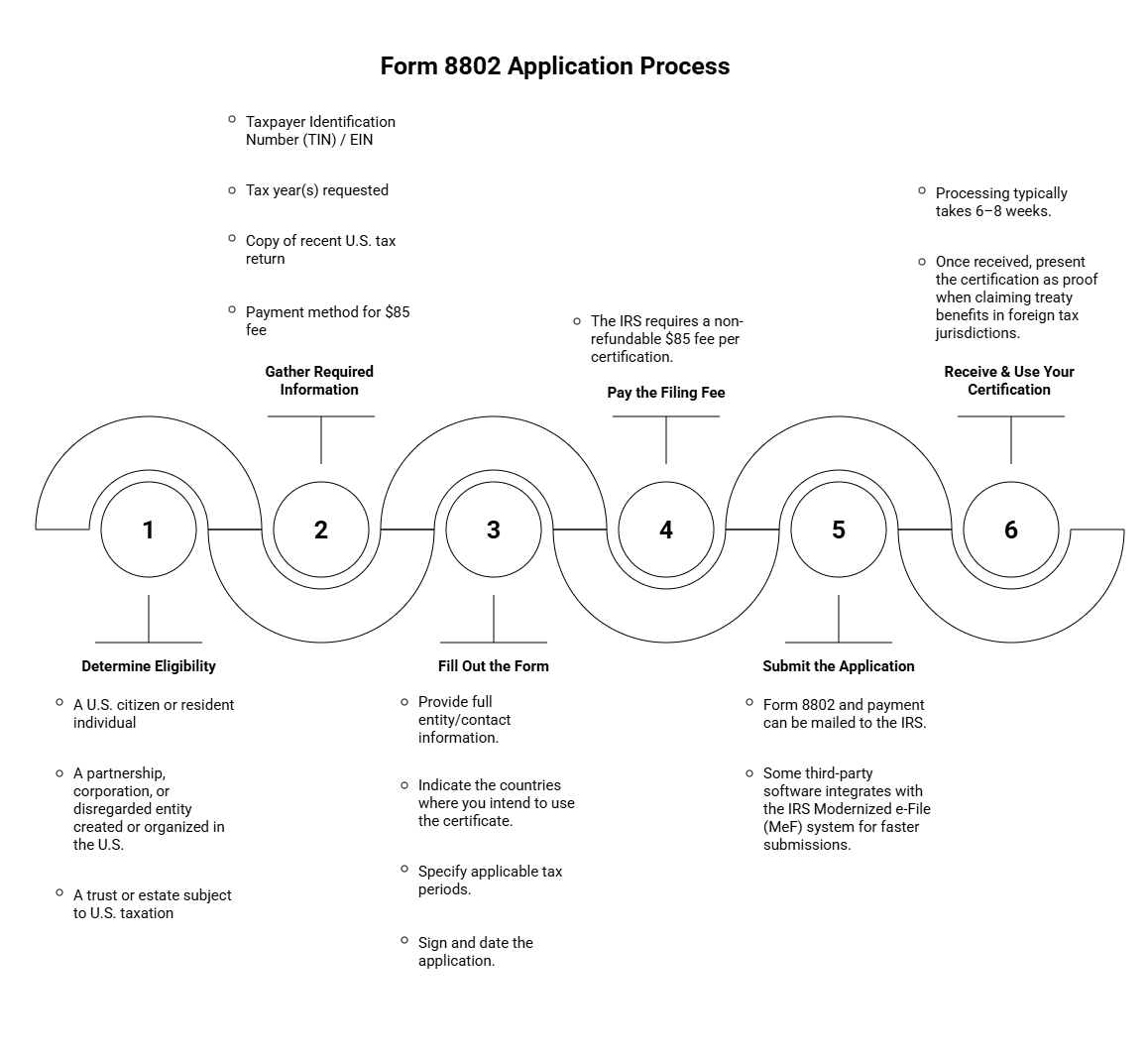

How to Apply for Form 8802: A Step-by-Step Guide for Founders

Filing Form 8802 accurately and timely can save headaches, denials, and delays. Here's a clear, pragmatic approach:

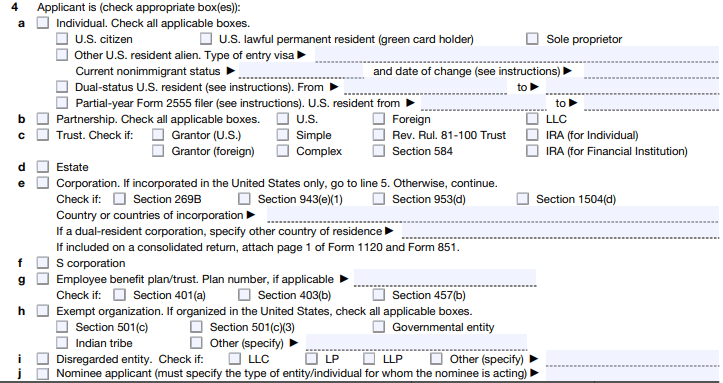

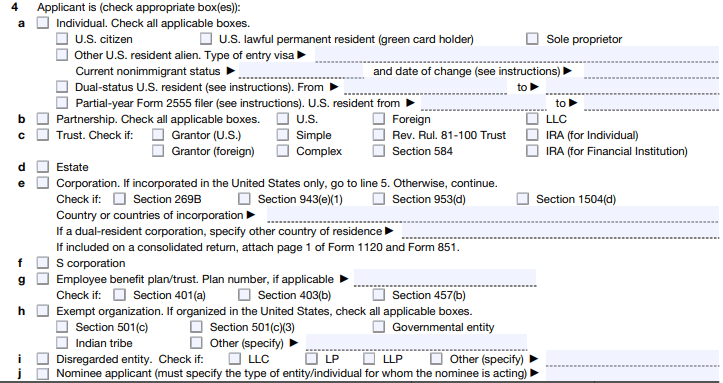

Step 1: Determine Eligibility

You can file Form 8802 if you are:

A U.S. citizen or resident individual

A partnership, corporation, or disregarded entity created or organized in the U.S.

A trust or estate subject to U.S. taxation

Step 2: Gather Required Information

Before beginning the application, have these details ready:

Information Required | Why It Matters |

Taxpayer Identification Number (TIN) / EIN | Identifies your business or personal status to the IRS |

Tax year(s) requested | Certification is valid per year and may require renewal |

Copy of recent U.S. tax return | Proof of filing ensures accurate residency determination |

Payment method for $85 fee | Required for processing |

Step 3: Fill Out the Form

Provide full entity/contact information.

Indicate the countries where you intend to use the certificate.

Specify applicable tax periods.

Sign and date the application.

Refer to the official IRS instructions to avoid common errors.

Step 4: Pay the Filing Fee

The IRS requires a non-refundable $85 fee per certification.

Step 5: Submit the Application

Form 8802 and payment can be mailed to the IRS. Some third-party software integrates with the IRS Modernized e-File (MeF) system for faster submissions.

Step 6: Receive & Use Your Certification

Processing typically takes 6–8 weeks. Once received, present the certification as proof when claiming treaty benefits in foreign tax jurisdictions.

Key Considerations for Startup Founders Using Form 8802

Timing Is Everything

Submit Form 8802 well before any anticipated foreign tax deadlines or income events. Late applications can result in default foreign withholding rates.

Stay Compliant with U.S. Tax Filings

The IRS checks your tax return history when reviewing residency requests. Founders should stay current on filings—especially Form 1120.

Consider Representative Authorization

If a CPA prepares and submits Form 8802 on your behalf, you’ll also need to complete Form 2848 to formally grant representative authorization. To understand when this is required and how it simplifies communication with the IRS, review our guide on authorizing an IRS representative and make sure everything is set up correctly before filing.

Align With Broader Tax Responsibilities

Residency certification interacts with other reporting such as:

Payroll and employment filings (e.g., Form 940)

R&D tax filings

State-level compliance

Avoid These Pitfalls When Filing Form 8802

Filing Form 8802 can be straightforward, but small mistakes often lead to delays or added tax exposure. The table below highlights the most common pitfalls and how to avoid them.

Common Mistake | How to Prevent It | Impact |

Submitting too late | Build calendar reminders | Higher foreign withholding |

Errors in EIN or tax year | Cross-check records | Delays or denial |

Incorrect payment | Match amount and method | Application returned |

Missing documentation | Save copies of everything | Needed for audits |

Ignoring state tax effects | Consult a CPA | Conflicts with federal treatment |

How to Integrate Form 8802 Into Your Startup’s Financial Workflows

Automate Filing Reminders

Add Form 8802 deadlines to your operations calendar or accounting software.

Coordinate With R&D Tax Strategy

Residency certification may affect eligibility or presentation of foreign R&D expenses.

Leverage Expert Support

A tax professional can minimize errors and manage multi-country filings.

Form 8802 Is a Strategic Lever for Founders Managing U.S. Tax Residency

Navigating international tax treaties can be daunting, but Form 8802 is a straightforward, impactful tool that founders can use to unlock treaty benefits, avoid double taxation, and simplify global operations. By understanding the application process and integrating it into your startup’s financial workflows, you gain a practical advantage in minimizing tax burdens and maximizing compliance agility.

If your business engages in cross-border commerce or investments, securing your U.S. residency certification early and accurately is critical. Haven’s team specializes in helping startups with integrated bookkeeping, tax filings, and R&D credits.

When you’re a founder, understanding how to manage your tax residency status efficiently can unlock significant tax savings and compliance peace of mind. One key tool in this process is Form 8802, the application for a U.S. residency certification. This certification supports your claim to tax treaty benefits with foreign jurisdictions and helps avoid double taxation — a crucial advantage when your business operates internationally or engages in cross-border transactions.

In this guide, we’ll unpack what Form 8802 is, why it matters for startup founders, and walk you through the application process with practical tips tailored to your business growth needs. We'll also weave in relevant tax forms and IRS guidelines to help you navigate the complexities confidently.

What Is Form 8802 and Why Founders Should Care

Form 8802, officially titled the “Application for United States Residency Certification,” is a document submitted to the IRS to request a Certification of U.S. Residency. This certification confirms that your company—or you as an individual—are considered a resident of the U.S. for tax purposes under applicable tax treaties.

Why is this important for founders?

Access to tax treaty benefits: Many countries have tax treaties with the U.S. that reduce withholding taxes on dividends, interest, royalties, and other payments. Without proof of U.S. residency, foreign tax authorities may apply withholding at higher rates.

Avoid double taxation: Tax residency certification supports your claim for relief from being taxed both in the U.S. and abroad on the same income.

Facilitates international business expansion: If your startup is scaling globally or partnering with foreign entities, certification expedites withholding tax relief.

Supports R&D tax credit strategies: Especially relevant if you’re leveraging tax benefits associated with R&D expenditures abroad.

For founders navigating this landscape, Form 8802 becomes a practical tool—not just a bureaucratic formality—helping you control your tax costs and compliance risks.

How to Apply for Form 8802: A Step-by-Step Guide for Founders

Filing Form 8802 accurately and timely can save headaches, denials, and delays. Here's a clear, pragmatic approach:

Step 1: Determine Eligibility

You can file Form 8802 if you are:

A U.S. citizen or resident individual

A partnership, corporation, or disregarded entity created or organized in the U.S.

A trust or estate subject to U.S. taxation

Step 2: Gather Required Information

Before beginning the application, have these details ready:

Information Required | Why It Matters |

Taxpayer Identification Number (TIN) / EIN | Identifies your business or personal status to the IRS |

Tax year(s) requested | Certification is valid per year and may require renewal |

Copy of recent U.S. tax return | Proof of filing ensures accurate residency determination |

Payment method for $85 fee | Required for processing |

Step 3: Fill Out the Form

Provide full entity/contact information.

Indicate the countries where you intend to use the certificate.

Specify applicable tax periods.

Sign and date the application.

Refer to the official IRS instructions to avoid common errors.

Step 4: Pay the Filing Fee

The IRS requires a non-refundable $85 fee per certification.

Step 5: Submit the Application

Form 8802 and payment can be mailed to the IRS. Some third-party software integrates with the IRS Modernized e-File (MeF) system for faster submissions.

Step 6: Receive & Use Your Certification

Processing typically takes 6–8 weeks. Once received, present the certification as proof when claiming treaty benefits in foreign tax jurisdictions.

Key Considerations for Startup Founders Using Form 8802

Timing Is Everything

Submit Form 8802 well before any anticipated foreign tax deadlines or income events. Late applications can result in default foreign withholding rates.

Stay Compliant with U.S. Tax Filings

The IRS checks your tax return history when reviewing residency requests. Founders should stay current on filings—especially Form 1120.

Consider Representative Authorization

If a CPA prepares and submits Form 8802 on your behalf, you’ll also need to complete Form 2848 to formally grant representative authorization. To understand when this is required and how it simplifies communication with the IRS, review our guide on authorizing an IRS representative and make sure everything is set up correctly before filing.

Align With Broader Tax Responsibilities

Residency certification interacts with other reporting such as:

Payroll and employment filings (e.g., Form 940)

R&D tax filings

State-level compliance

Avoid These Pitfalls When Filing Form 8802

Filing Form 8802 can be straightforward, but small mistakes often lead to delays or added tax exposure. The table below highlights the most common pitfalls and how to avoid them.

Common Mistake | How to Prevent It | Impact |

Submitting too late | Build calendar reminders | Higher foreign withholding |

Errors in EIN or tax year | Cross-check records | Delays or denial |

Incorrect payment | Match amount and method | Application returned |

Missing documentation | Save copies of everything | Needed for audits |

Ignoring state tax effects | Consult a CPA | Conflicts with federal treatment |

How to Integrate Form 8802 Into Your Startup’s Financial Workflows

Automate Filing Reminders

Add Form 8802 deadlines to your operations calendar or accounting software.

Coordinate With R&D Tax Strategy

Residency certification may affect eligibility or presentation of foreign R&D expenses.

Leverage Expert Support

A tax professional can minimize errors and manage multi-country filings.

Form 8802 Is a Strategic Lever for Founders Managing U.S. Tax Residency

Navigating international tax treaties can be daunting, but Form 8802 is a straightforward, impactful tool that founders can use to unlock treaty benefits, avoid double taxation, and simplify global operations. By understanding the application process and integrating it into your startup’s financial workflows, you gain a practical advantage in minimizing tax burdens and maximizing compliance agility.

If your business engages in cross-border commerce or investments, securing your U.S. residency certification early and accurately is critical. Haven’s team specializes in helping startups with integrated bookkeeping, tax filings, and R&D credits.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026