Go Back

Last Updated :

Last Updated :

Jan 15, 2026

Jan 15, 2026

Form 8594 Guide: Asset Acquisition Statements & Allocation Rules

Acquiring another business is a pivotal milestone for any founder. Beyond the strategic vision it takes to grow through acquisition, financial accuracy is essential to maximize tax benefits and remain compliant with IRS regulations. One critical document you'll encounter during this process is Form 8594, the Asset Acquisition Statement under Section 1060.

Mastering the nuances of Form 8594 empowers founders and their finance leads to properly allocate purchase prices, validate tax positions, and plan ahead confidently post-acquisition. This founder-focused guide explains key sections of the form, highlights common pitfalls, and shares best practices to streamline the filing process while prioritizing your startup's financial strategy.

What Is Form 8594 and Why Founders Need to Care

IRS Form 8594 is used when a business is bought or sold via an asset acquisition and helps both parties report how the total purchase price is allocated among the various asset categories. Officially titled the "Asset Acquisition Statement Under Section 1060," the form is a requirement when:

A trade or business is sold in an asset transaction (not merely a stock sale);

Multiple asset types—like IP, goodwill, and tangible property—are part of the sale;

The buyer and seller must agree on how to allocate the total purchase price across different asset classes.

Why Does Form 8594 Matter for Startup Acquisitions?

Proper allocation enables founders to take advantage of tax benefits sooner.

Tax Consistency: Both buyer and seller must submit Form 8594 with matching purchase price allocations or risk red flags from the IRS.

Depreciation & Amortization: Misallocation impacts your ability to deduct asset costs accurately over time.

Audit Defense: Clean records and accurate forms help reduce exposure to IRS scrutiny.

Cash Flow Optimization: Proper allocation enables founders to take advantage of tax benefits sooner.

If your startup acquires another company’s brand, customer lists, and IP—along with assets like computers and office leases—Form 8594 establishes how much value is assigned to each category for tax purposes.

When Are Founders Required to File IRS Form 8594?

You must file Form 8594 if your company:

Is buying or selling the assets (not stock) of another trade or business;

Is party to a transaction that includes at least one transfer of a significant asset class such as equipment, buildings, licenses, customer contracts, or goodwill;

Needs to allocate total acquisition consideration between classes of assets.

This form is generally attached to your annual federal income tax return for the year the acquisition occurs. Both buyers and sellers must file it independently with matching information.

Understanding the Asset Classes on Form 8594

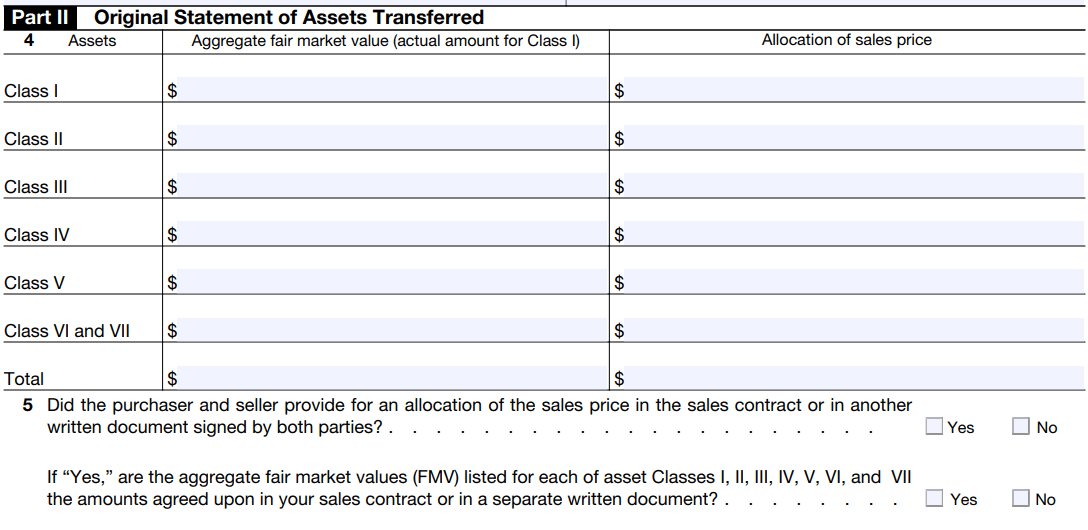

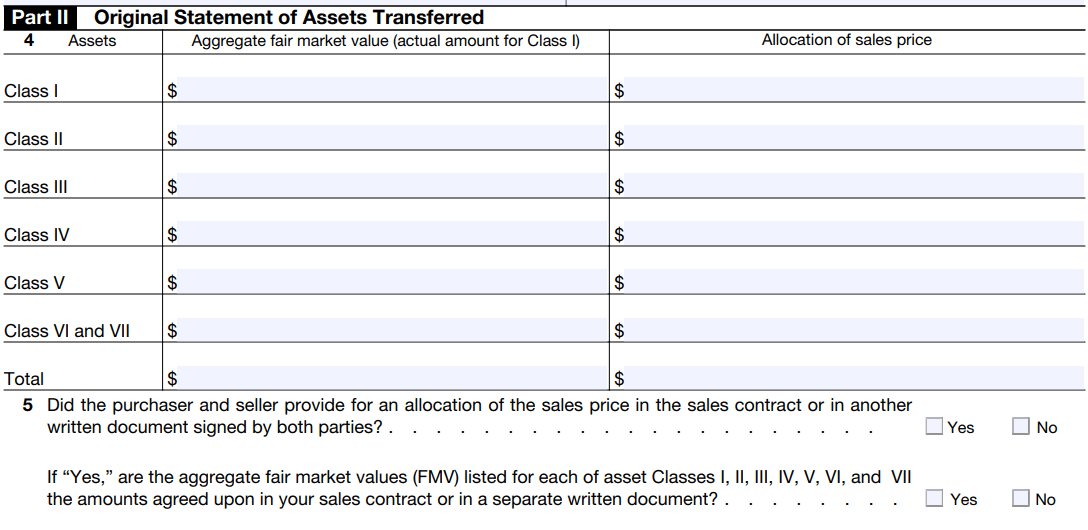

Form 8594 breaks down the transaction into seven categories (Classes I through VII) to standardize how asset values are reported.

Asset Class | Description | Examples |

Class I | Cash and general deposit accounts | Cash, checking account balances |

Class II | Certificates of deposit and government securities | Treasury bills, time deposits |

Class III | Accounts receivable | Customer balances, unpaid invoices |

Class IV | Inventory | Goods held for resale, raw materials |

Class V | Tangible personal property | Computers, equipment, vehicles |

Class VI | Intangible assets (excluding goodwill) | Patents, trademarks, software licenses |

Class VII | Goodwill and going concern value | Residual value after allocations |

For startup M&A, Classes VI (IP) and VII (Goodwill) often carry most of the purchase price. Ensure valuations are well documented and defensible.

Key Allocation Rules

Total purchase price must equal the FMV allocated across all classes.

Buyer and seller must submit consistent allocations.

Asset class impacts deductions: depreciation vs. amortization vs. capital gain treatment.

How Founders Should Prepare and File Form 8594

1. Determine the Total Consideration

Add up all forms of payment—cash, stock, earn-outs, and liabilities assumed—to calculate the total purchase price.

2. Allocate FMVs to Each Asset Class

Work with finance experts or valuation professionals. Use:

Appraisals

Comparable deals

Historical data adjusted for asset condition

3. Complete Buyer & Seller Parts of IRS Form 8594

Enter legal names and EINs

Include date of sale and allocation table

Attach the completed form to each party’s tax return

4. Maintain Your Records

Keep copies of:

Purchase agreements

Valuation documents

Completed Form 8594 submissions

Pro Tip: Reflect these allocations in your accounting system immediately to ensure correct depreciation and amortization schedules.

Tax and Financial Implications of Form 8594 for Startups

Tax Deductions & Amortization

Tangible Assets (Class V): Depreciated over 3–7 years.

Intangible Assets (Class VI): Amortized over 15 years.

Goodwill (Class VII): Amortized over 15 years unless impaired.

Capital Gains Management

Form 8594 determines how sellers recognize gain by asset category—some as ordinary income, others as capital gains.

Deal Structuring Impacts

Founders can improve outcomes by:

Allocating more value to depreciable/amortizable assets

Understanding how post-acquisition income and expenses shift

For guidance on broader tax filings, review Haven’s business tax services.

Best Practices and Resources for Founders

Review IRS Guidelines: See the official IRS Form 8594 instructions.

Engage Advisors Early: CPAs and tax counsel should be involved pre-LOI.

Ensure Consistency: Buyer and seller filings must match.

Update Your Books: Enter assets with correct FMVs immediately.

Model Ahead: Incorporate depreciation and amortization into forecasts.

How Haven Helps Founders Navigate IRS Form 8594

As a startup founder, you don’t need to go it alone. Haven specializes in founder-friendly accounting and tax services that simplify IRS forms like Form 8594 and integrate them into broader growth strategies. We help you:

Allocate assets accurately and draft compliant filings;

Prepare depreciation and amortization schedules;

File all relevant documents, including Form 8594 and Form 1120 (we also have a guide on how to fill out this form);

Optimize tax impacts while reducing administrative overhead.

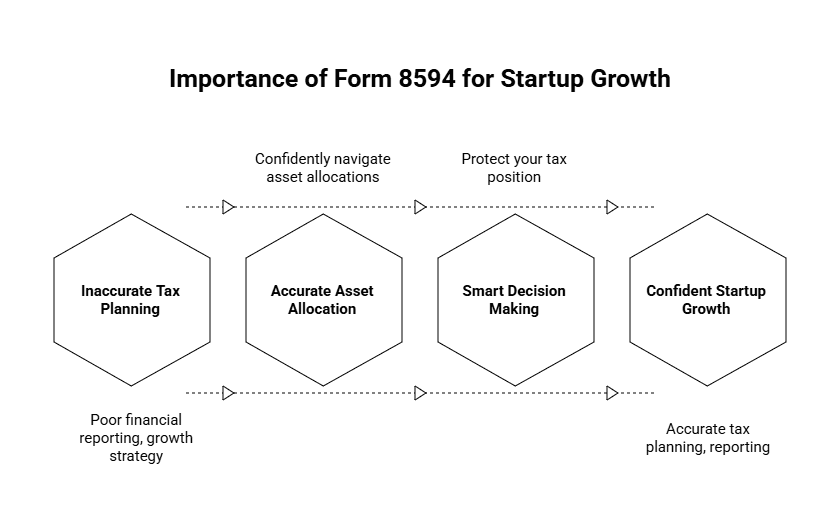

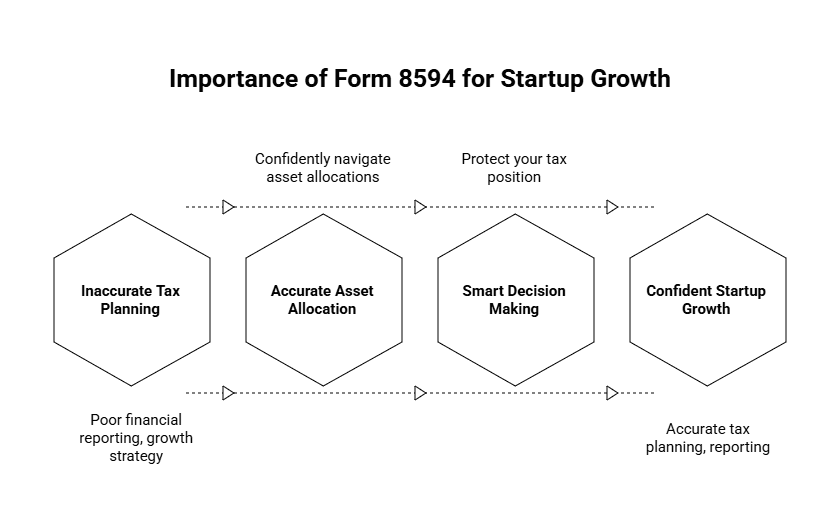

Why Form 8594 Matters Now

In the journey of startup growth through acquisitions, Form 8594 is more than paperwork—it’s a foundation for accurate tax planning, financial reporting, and long-term growth strategy. Whether you're acquiring another business or preparing for a future exit, understanding this form empowers founders to make smarter decisions and protect their tax position.

With the right partners and processes, founders can navigate asset allocations confidently and compliantly.

Acquiring another business is a pivotal milestone for any founder. Beyond the strategic vision it takes to grow through acquisition, financial accuracy is essential to maximize tax benefits and remain compliant with IRS regulations. One critical document you'll encounter during this process is Form 8594, the Asset Acquisition Statement under Section 1060.

Mastering the nuances of Form 8594 empowers founders and their finance leads to properly allocate purchase prices, validate tax positions, and plan ahead confidently post-acquisition. This founder-focused guide explains key sections of the form, highlights common pitfalls, and shares best practices to streamline the filing process while prioritizing your startup's financial strategy.

What Is Form 8594 and Why Founders Need to Care

IRS Form 8594 is used when a business is bought or sold via an asset acquisition and helps both parties report how the total purchase price is allocated among the various asset categories. Officially titled the "Asset Acquisition Statement Under Section 1060," the form is a requirement when:

A trade or business is sold in an asset transaction (not merely a stock sale);

Multiple asset types—like IP, goodwill, and tangible property—are part of the sale;

The buyer and seller must agree on how to allocate the total purchase price across different asset classes.

Why Does Form 8594 Matter for Startup Acquisitions?

Proper allocation enables founders to take advantage of tax benefits sooner.

Tax Consistency: Both buyer and seller must submit Form 8594 with matching purchase price allocations or risk red flags from the IRS.

Depreciation & Amortization: Misallocation impacts your ability to deduct asset costs accurately over time.

Audit Defense: Clean records and accurate forms help reduce exposure to IRS scrutiny.

Cash Flow Optimization: Proper allocation enables founders to take advantage of tax benefits sooner.

If your startup acquires another company’s brand, customer lists, and IP—along with assets like computers and office leases—Form 8594 establishes how much value is assigned to each category for tax purposes.

When Are Founders Required to File IRS Form 8594?

You must file Form 8594 if your company:

Is buying or selling the assets (not stock) of another trade or business;

Is party to a transaction that includes at least one transfer of a significant asset class such as equipment, buildings, licenses, customer contracts, or goodwill;

Needs to allocate total acquisition consideration between classes of assets.

This form is generally attached to your annual federal income tax return for the year the acquisition occurs. Both buyers and sellers must file it independently with matching information.

Understanding the Asset Classes on Form 8594

Form 8594 breaks down the transaction into seven categories (Classes I through VII) to standardize how asset values are reported.

Asset Class | Description | Examples |

Class I | Cash and general deposit accounts | Cash, checking account balances |

Class II | Certificates of deposit and government securities | Treasury bills, time deposits |

Class III | Accounts receivable | Customer balances, unpaid invoices |

Class IV | Inventory | Goods held for resale, raw materials |

Class V | Tangible personal property | Computers, equipment, vehicles |

Class VI | Intangible assets (excluding goodwill) | Patents, trademarks, software licenses |

Class VII | Goodwill and going concern value | Residual value after allocations |

For startup M&A, Classes VI (IP) and VII (Goodwill) often carry most of the purchase price. Ensure valuations are well documented and defensible.

Key Allocation Rules

Total purchase price must equal the FMV allocated across all classes.

Buyer and seller must submit consistent allocations.

Asset class impacts deductions: depreciation vs. amortization vs. capital gain treatment.

How Founders Should Prepare and File Form 8594

1. Determine the Total Consideration

Add up all forms of payment—cash, stock, earn-outs, and liabilities assumed—to calculate the total purchase price.

2. Allocate FMVs to Each Asset Class

Work with finance experts or valuation professionals. Use:

Appraisals

Comparable deals

Historical data adjusted for asset condition

3. Complete Buyer & Seller Parts of IRS Form 8594

Enter legal names and EINs

Include date of sale and allocation table

Attach the completed form to each party’s tax return

4. Maintain Your Records

Keep copies of:

Purchase agreements

Valuation documents

Completed Form 8594 submissions

Pro Tip: Reflect these allocations in your accounting system immediately to ensure correct depreciation and amortization schedules.

Tax and Financial Implications of Form 8594 for Startups

Tax Deductions & Amortization

Tangible Assets (Class V): Depreciated over 3–7 years.

Intangible Assets (Class VI): Amortized over 15 years.

Goodwill (Class VII): Amortized over 15 years unless impaired.

Capital Gains Management

Form 8594 determines how sellers recognize gain by asset category—some as ordinary income, others as capital gains.

Deal Structuring Impacts

Founders can improve outcomes by:

Allocating more value to depreciable/amortizable assets

Understanding how post-acquisition income and expenses shift

For guidance on broader tax filings, review Haven’s business tax services.

Best Practices and Resources for Founders

Review IRS Guidelines: See the official IRS Form 8594 instructions.

Engage Advisors Early: CPAs and tax counsel should be involved pre-LOI.

Ensure Consistency: Buyer and seller filings must match.

Update Your Books: Enter assets with correct FMVs immediately.

Model Ahead: Incorporate depreciation and amortization into forecasts.

How Haven Helps Founders Navigate IRS Form 8594

As a startup founder, you don’t need to go it alone. Haven specializes in founder-friendly accounting and tax services that simplify IRS forms like Form 8594 and integrate them into broader growth strategies. We help you:

Allocate assets accurately and draft compliant filings;

Prepare depreciation and amortization schedules;

File all relevant documents, including Form 8594 and Form 1120 (we also have a guide on how to fill out this form);

Optimize tax impacts while reducing administrative overhead.

Why Form 8594 Matters Now

In the journey of startup growth through acquisitions, Form 8594 is more than paperwork—it’s a foundation for accurate tax planning, financial reporting, and long-term growth strategy. Whether you're acquiring another business or preparing for a future exit, understanding this form empowers founders to make smarter decisions and protect their tax position.

With the right partners and processes, founders can navigate asset allocations confidently and compliantly.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026