Go Back

Last Updated :

Last Updated :

Jan 5, 2026

Jan 5, 2026

Form 8283 Guide: Reporting Noncash Charitable Contributions

For founders navigating the complexities of tax reporting, Form 8283 is an essential tool for unlocking tax benefits from noncash donations. Whether you are donating old office hardware, excess e-commerce inventory, or intellectual property, reporting these contributions correctly ensures you maximize your deduction while staying safely within IRS compliance.

What is Form 8283?

Form 8283, Noncash Charitable Contributions, is used to report information about noncash property given to qualified organizations. While cash donations are simple to track, property—from laptops to software—requires a specific reporting format to justify its "Fair Market Value" (FMV).

The $500 Threshold

You must file Form 8283 if the total deduction you claim for all noncash contributions is greater than $500.

Who Needs to File?

This form is required for:

Individuals, Partnerships, and Corporations (including S-corps and C-corps).

Founders donating business assets (like server equipment or office furniture).

E-commerce brands donating inventory to nonprofits.

Step-by-Step: How to Fill Out Form 8283

The form is split into two main sections based on the value of the items donated.

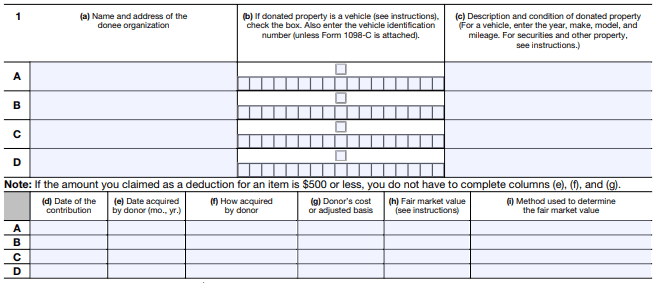

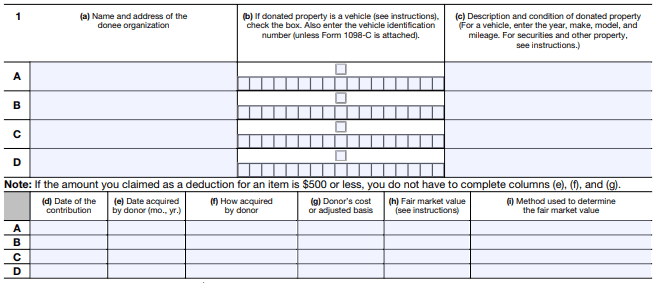

Section A: Donations of $5,000 or Less

Use this section for items (or groups of similar items) where the total claimed value is $5,000 or less. This also includes publicly traded securities, even if they exceed $5,000.

Column (a): Enter the name and address of the charity (Donee).

Column (c): Provide a brief description of the property and its condition (e.g., "Used MacBook Pro, Good Condition").

Column (f): How did you acquire the property? (e.g., Purchase, Gift, Exchange).

Column (g): Your cost or "adjusted basis" in the property.

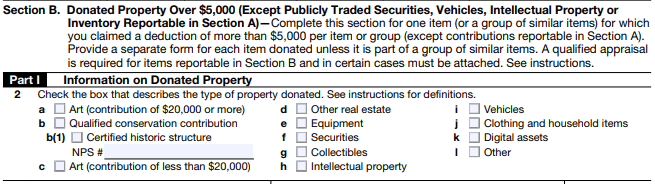

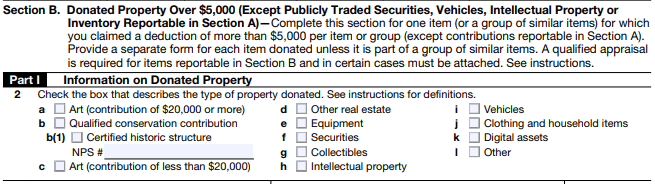

Section B: Donations Over $5,000

If you donate an item (or group of similar items) valued at more than $5,000, the IRS requires a higher level of scrutiny, including a qualified appraisal.

Part I: Detailed description of the property.

Part IV: The Qualified Appraiser must sign here to certify the value.

Part V: The Donee Acknowledgment—the charity must sign this section to confirm they received the property.

When is Form 8283 Due?

You must attach Form 8283 to the tax return on which you are claiming the deduction. For most founders, this is the annual deadline for your 1040 or your business's 1120/1065 (typically April 15 or March 15).

Common Pitfalls to Avoid

Skipping the Appraisal: For items over $5,000 (excluding certain securities), the IRS requires an appraisal by a qualified professional. Without it, your deduction will likely be denied.

Grouping Incorrectly: Similar items (like 10 different laptops) must be grouped together to see if they cross the $5,000 threshold.

Missing Signatures: If you are filing Section B, ensure both the appraiser and the charity have signed the form before you submit.

Vague Descriptions: "Office supplies" is too broad. Use specific terms like "10 Ergon chairs and 5 standing desks."

FAQs

Q: Can I donate my startup's software/IP? A: Yes, but intellectual property has very specific valuation rules. You generally can only deduct your "basis" (the cost to produce it) rather than its potential market value.

Q: What if I donate a vehicle? A: Vehicle donations often require Form 1098-C. Your deduction is usually limited to the gross proceeds the charity receives from selling the car.

Optimize Your Giving Strategy with Haven

Noncash donations are a great way for startups to clear out assets while doing good—but the paperwork shouldn't slow you down. Haven’s founder-friendly tax and bookkeeping services ensure your charitable giving is both impactful and compliant.

Asset Tracking: We help you track the basis of equipment and inventory so your Form 8283 is accurate from the start.

Valuation Guidance: We'll help you determine when you need an appraiser and connect you with qualified pros.

Unified Tax Strategy: We reconcile your donations with your R&D credits and other startup incentives to minimize your total tax bill.

For founders navigating the complexities of tax reporting, Form 8283 is an essential tool for unlocking tax benefits from noncash donations. Whether you are donating old office hardware, excess e-commerce inventory, or intellectual property, reporting these contributions correctly ensures you maximize your deduction while staying safely within IRS compliance.

What is Form 8283?

Form 8283, Noncash Charitable Contributions, is used to report information about noncash property given to qualified organizations. While cash donations are simple to track, property—from laptops to software—requires a specific reporting format to justify its "Fair Market Value" (FMV).

The $500 Threshold

You must file Form 8283 if the total deduction you claim for all noncash contributions is greater than $500.

Who Needs to File?

This form is required for:

Individuals, Partnerships, and Corporations (including S-corps and C-corps).

Founders donating business assets (like server equipment or office furniture).

E-commerce brands donating inventory to nonprofits.

Step-by-Step: How to Fill Out Form 8283

The form is split into two main sections based on the value of the items donated.

Section A: Donations of $5,000 or Less

Use this section for items (or groups of similar items) where the total claimed value is $5,000 or less. This also includes publicly traded securities, even if they exceed $5,000.

Column (a): Enter the name and address of the charity (Donee).

Column (c): Provide a brief description of the property and its condition (e.g., "Used MacBook Pro, Good Condition").

Column (f): How did you acquire the property? (e.g., Purchase, Gift, Exchange).

Column (g): Your cost or "adjusted basis" in the property.

Section B: Donations Over $5,000

If you donate an item (or group of similar items) valued at more than $5,000, the IRS requires a higher level of scrutiny, including a qualified appraisal.

Part I: Detailed description of the property.

Part IV: The Qualified Appraiser must sign here to certify the value.

Part V: The Donee Acknowledgment—the charity must sign this section to confirm they received the property.

When is Form 8283 Due?

You must attach Form 8283 to the tax return on which you are claiming the deduction. For most founders, this is the annual deadline for your 1040 or your business's 1120/1065 (typically April 15 or March 15).

Common Pitfalls to Avoid

Skipping the Appraisal: For items over $5,000 (excluding certain securities), the IRS requires an appraisal by a qualified professional. Without it, your deduction will likely be denied.

Grouping Incorrectly: Similar items (like 10 different laptops) must be grouped together to see if they cross the $5,000 threshold.

Missing Signatures: If you are filing Section B, ensure both the appraiser and the charity have signed the form before you submit.

Vague Descriptions: "Office supplies" is too broad. Use specific terms like "10 Ergon chairs and 5 standing desks."

FAQs

Q: Can I donate my startup's software/IP? A: Yes, but intellectual property has very specific valuation rules. You generally can only deduct your "basis" (the cost to produce it) rather than its potential market value.

Q: What if I donate a vehicle? A: Vehicle donations often require Form 1098-C. Your deduction is usually limited to the gross proceeds the charity receives from selling the car.

Optimize Your Giving Strategy with Haven

Noncash donations are a great way for startups to clear out assets while doing good—but the paperwork shouldn't slow you down. Haven’s founder-friendly tax and bookkeeping services ensure your charitable giving is both impactful and compliant.

Asset Tracking: We help you track the basis of equipment and inventory so your Form 8283 is accurate from the start.

Valuation Guidance: We'll help you determine when you need an appraiser and connect you with qualified pros.

Unified Tax Strategy: We reconcile your donations with your R&D credits and other startup incentives to minimize your total tax bill.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026