Go Back

Last Updated :

Last Updated :

Jan 20, 2026

Jan 20, 2026

Form 8233: Securing Tax Treaty Exemptions for International Contractors and Consultants

Navigating international contractor payments is complex — especially for startups, agencies, and e-commerce businesses aiming to stay compliant yet optimally manage costs. One often overlooked but vital component is Form 8233: a key IRS form enabling nonresident alien contractors to claim tax treaty benefits and reduce or eliminate withholding taxes on compensation for personal services.

For founders, COOs, and finance leaders managing remote international talent, understanding how to use Form 8233 can unlock tax savings, streamline withholding requirements, and foster a more growth-friendly operating model.

Understanding Form 8233 and Why It Matters to Founders

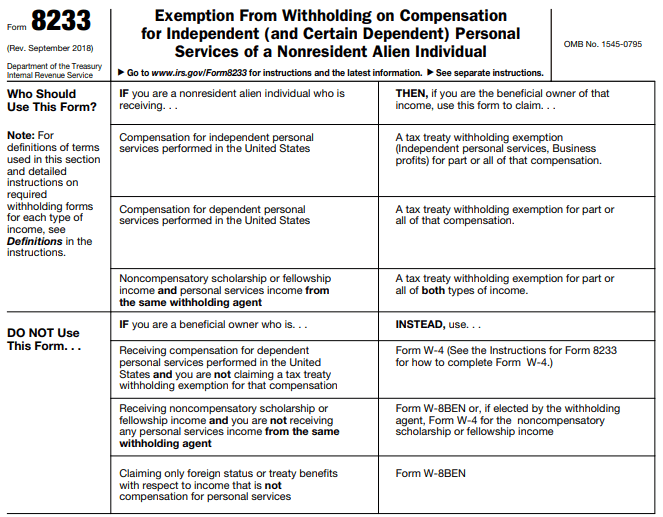

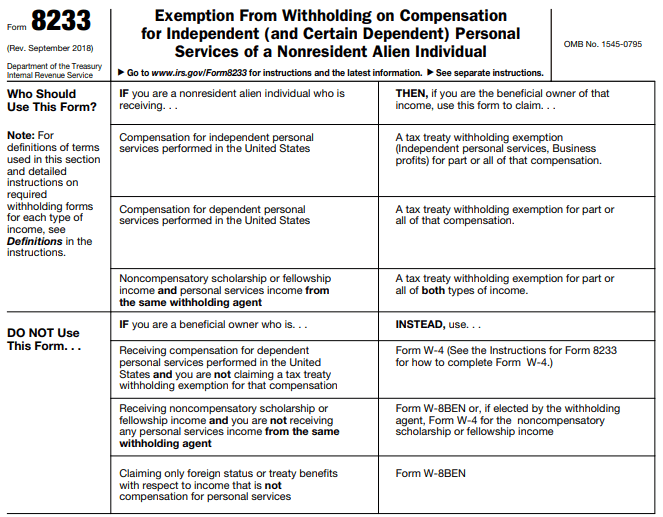

What is Form 8233?

Form 8233, officially titled “Exemption From Withholding on Compensation for Independent (and Certain Dependent) Personal Services of a Nonresident Alien Individual,” is an IRS form used by non-U.S. persons to claim exemption from withholding on income that’s eligible under a tax treaty between the U.S. and their country of residence.

This primarily applies to compensation for personal services—in other words, wages or contractor payments for services performed in the U.S.

Why Founders Should Care About Form 8233

If your startup or agency engages international consultants or contractors who perform services in the U.S., the default withholding tax rate for payments to nonresidents is 30%. This can result in sudden cash flow issues and inflated costs. When these contractors qualify for tax treaty benefits, Form 8233 allows them to claim exemption or reduced withholding rates, optimizing your financial outlays.

Benefits to your startup include:

Reduced tax withholding from contractor payments

Lower administrative burden and improved compliance

Clearer budgeting for international contract work

Enhanced professional experience for global hires

If you want to integrate these strategies into a broader tax plan, our complete startup tax guide offers practical insights tailored to founders.

Who Should File Form 8233?

Eligible Claimants

Not every international contractor needs this form. Here's who does:

Nonresident alien individuals providing independent personal services (freelancers, consultants)

Certain dependent personal services employees (under specific treaties)

Foreign individuals performing services within the U.S. that are covered by a treaty

Requirements for Filing

To qualify for tax treaty withholding exemption:

The individual must reside in a country that has a U.S. tax treaty

The services must fall under an eligible treaty article

The form must be submitted before payment is made

Form 8233 does not apply to:

U.S. citizens or residents

Foreign residents from countries lacking a U.S. tax treaty

Income that doesn’t come from services performed

Validating contractor eligibility early helps prevent errors and unnecessary withholding burdens.

How Tax Treaties Interact with Form 8233

What Are Tax Treaties?

Tax treaties are formal agreements between the U.S. and other countries designed to prevent double taxation and promote cross-border collaboration. Many include income-specific provisions allowing nonresident aliens to avoid or lower U.S. withholding taxes.

Common Benefits Leveraged Through Form 8233

Complete exemption from withholding on contractor pay, up to set limits

Reduced withholding tax rates, often well below 30%

Special exemptions for teachers, researchers, or artists under select treaties

Examples of Treaty Countries

The U.S. has treaties with over 60 individual nations, including:

United Kingdom

Canada

Japan

Germany

Australia

France

India

The specific language in each treaty governs income scope, exemption limits, and duration. Contractors and startup teams must consult the respective treaty to ensure eligibility when filing Form 8233.

Key Sections of Form 8233: A Founder’s Walkthrough

Accurate completion of Form 8233 is crucial to gaining IRS approval. Founders should support contractors in getting everything right.

Section | What to Provide | Tips & Pitfalls |

Part I — Identification | Name, addresses, citizenship, SSN or ITIN | Make sure contractors apply for an ITIN early if they don’t already have one |

Part II — Claim for Benefits | Treaty article, income type, exemption amount | Validate treaty article aligns with the service provided |

Part III — Employer Certification | Name, taxpayer ID, signature | EIN must match IRS records exactly |

Signatures | Contractor and payer signatures | IRS will reject unsigned or partially signed forms |

Attachments | Treaty statement, ITIN confirmation, or other required docs | Some treaties require supplemental explanations or third-party documentation |

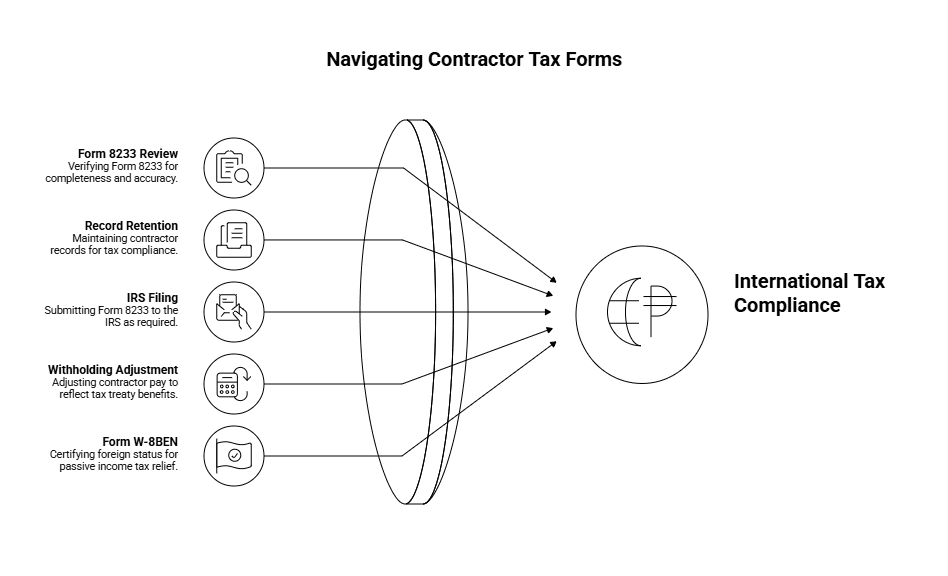

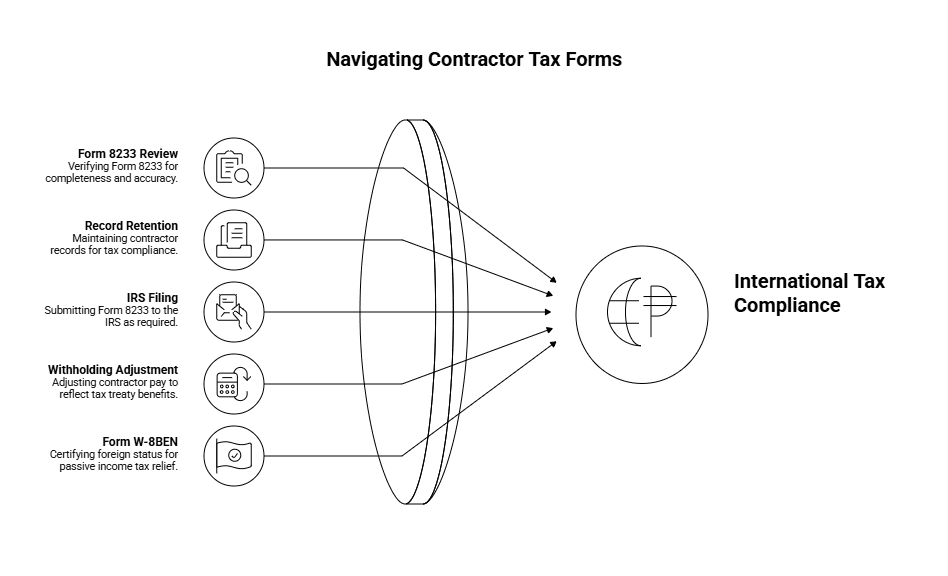

Filing and Compliance Considerations for Employers

Once the contractor submits the form, your startup must:

Review and verify Form 8233 for completeness and accuracy

Retain a copy in your records (suggested retention: 3 years)

File it with the IRS if required

Adjust withholding on contractor pay accordingly

Errors or omissions may leave you liable for the 30% withholding — even if the contractor later qualifies for exemption. Embedding international tax compliance into your onboarding workflow is key.

For holistic contractor tax handling, our business tax services offer scalable solutions designed for startups.

Comparing Form 8233 and Form W-8BEN

While both forms help establish foreign tax status, they apply to different income types:

Criteria | Form 8233 | Form W-8BEN |

Purpose | Claim treaty exemption on services compensation | Certify foreign status for passive income tax relief |

Used By | Independent contractors and foreign wage earners | Foreign individuals/entities earning interest, royalties, etc. |

Tax Impact | Lowers or eliminates withholding on personal services | Reduces taxes on non-service income like dividends or rents |

Submitted To | Employer or contract payer | Financial institutions or other payers |

If your contractor is earning active income through services in the U.S., Form 8233 is the appropriate route.

Common Errors and How to Avoid Them

Missteps in handling Form 8233 can lead to delays, rejections, or unnecessary taxes. Watch out for:

Missing ITIN or SSN: Nonresidents need one to get withholding relief. Work with contractors early to secure IDs.

Wrong treaty article: Crosscheck the service description with IRS treaty tables to confirm accuracy.

Lack of supporting statements: Some treaties and IRS instructions require a written explanation to verify eligibility.

Post-payment submission: Form 8233 must be filed before the payment is made to qualify. Late filings won’t shield payments from backup withholding.

A standardized checklist for international contractor onboarding helps prevent avoidable mistakes.

Leveraging Tech and Expert Support to Streamline Form 8233

Startup teams are lean. Managing detailed IRS processes like Form 8233 doesn’t need to slow growth.

You can reduce time and legal exposure by tapping into:

Platforms designed to collect, validate, and store IRS forms digitally

Expert tax service providers with treaty-specific knowledge

Payroll tools integrated with contractor databases and IRS requirements

On-demand advisors who stay current with IRS updates and treaty adjustments

Final Thoughts: Why Form 8233 is Essential for Founders Paying International Contractors

To recap, Form 8233 plays a pivotal role in running compliant and cost-efficient contractor operations across borders. Founders who grasp its application gain:

Lawful tax savings via eligible treaty exemptions

Fewer IRS-related headaches from incorrect withholding

Better cash flow planning and team budgeting

An edge in retaining remote talent through transparent professionalism

For detailed, authoritative IRS guidance, visit the IRS official instructions for Form 8233.

Action Step: Take 10 minutes today to audit your onboarding process and confirm whether Form 8233 is being correctly used. The ROI on compliance here is exponential.

Navigating international contractor payments is complex — especially for startups, agencies, and e-commerce businesses aiming to stay compliant yet optimally manage costs. One often overlooked but vital component is Form 8233: a key IRS form enabling nonresident alien contractors to claim tax treaty benefits and reduce or eliminate withholding taxes on compensation for personal services.

For founders, COOs, and finance leaders managing remote international talent, understanding how to use Form 8233 can unlock tax savings, streamline withholding requirements, and foster a more growth-friendly operating model.

Understanding Form 8233 and Why It Matters to Founders

What is Form 8233?

Form 8233, officially titled “Exemption From Withholding on Compensation for Independent (and Certain Dependent) Personal Services of a Nonresident Alien Individual,” is an IRS form used by non-U.S. persons to claim exemption from withholding on income that’s eligible under a tax treaty between the U.S. and their country of residence.

This primarily applies to compensation for personal services—in other words, wages or contractor payments for services performed in the U.S.

Why Founders Should Care About Form 8233

If your startup or agency engages international consultants or contractors who perform services in the U.S., the default withholding tax rate for payments to nonresidents is 30%. This can result in sudden cash flow issues and inflated costs. When these contractors qualify for tax treaty benefits, Form 8233 allows them to claim exemption or reduced withholding rates, optimizing your financial outlays.

Benefits to your startup include:

Reduced tax withholding from contractor payments

Lower administrative burden and improved compliance

Clearer budgeting for international contract work

Enhanced professional experience for global hires

If you want to integrate these strategies into a broader tax plan, our complete startup tax guide offers practical insights tailored to founders.

Who Should File Form 8233?

Eligible Claimants

Not every international contractor needs this form. Here's who does:

Nonresident alien individuals providing independent personal services (freelancers, consultants)

Certain dependent personal services employees (under specific treaties)

Foreign individuals performing services within the U.S. that are covered by a treaty

Requirements for Filing

To qualify for tax treaty withholding exemption:

The individual must reside in a country that has a U.S. tax treaty

The services must fall under an eligible treaty article

The form must be submitted before payment is made

Form 8233 does not apply to:

U.S. citizens or residents

Foreign residents from countries lacking a U.S. tax treaty

Income that doesn’t come from services performed

Validating contractor eligibility early helps prevent errors and unnecessary withholding burdens.

How Tax Treaties Interact with Form 8233

What Are Tax Treaties?

Tax treaties are formal agreements between the U.S. and other countries designed to prevent double taxation and promote cross-border collaboration. Many include income-specific provisions allowing nonresident aliens to avoid or lower U.S. withholding taxes.

Common Benefits Leveraged Through Form 8233

Complete exemption from withholding on contractor pay, up to set limits

Reduced withholding tax rates, often well below 30%

Special exemptions for teachers, researchers, or artists under select treaties

Examples of Treaty Countries

The U.S. has treaties with over 60 individual nations, including:

United Kingdom

Canada

Japan

Germany

Australia

France

India

The specific language in each treaty governs income scope, exemption limits, and duration. Contractors and startup teams must consult the respective treaty to ensure eligibility when filing Form 8233.

Key Sections of Form 8233: A Founder’s Walkthrough

Accurate completion of Form 8233 is crucial to gaining IRS approval. Founders should support contractors in getting everything right.

Section | What to Provide | Tips & Pitfalls |

Part I — Identification | Name, addresses, citizenship, SSN or ITIN | Make sure contractors apply for an ITIN early if they don’t already have one |

Part II — Claim for Benefits | Treaty article, income type, exemption amount | Validate treaty article aligns with the service provided |

Part III — Employer Certification | Name, taxpayer ID, signature | EIN must match IRS records exactly |

Signatures | Contractor and payer signatures | IRS will reject unsigned or partially signed forms |

Attachments | Treaty statement, ITIN confirmation, or other required docs | Some treaties require supplemental explanations or third-party documentation |

Filing and Compliance Considerations for Employers

Once the contractor submits the form, your startup must:

Review and verify Form 8233 for completeness and accuracy

Retain a copy in your records (suggested retention: 3 years)

File it with the IRS if required

Adjust withholding on contractor pay accordingly

Errors or omissions may leave you liable for the 30% withholding — even if the contractor later qualifies for exemption. Embedding international tax compliance into your onboarding workflow is key.

For holistic contractor tax handling, our business tax services offer scalable solutions designed for startups.

Comparing Form 8233 and Form W-8BEN

While both forms help establish foreign tax status, they apply to different income types:

Criteria | Form 8233 | Form W-8BEN |

Purpose | Claim treaty exemption on services compensation | Certify foreign status for passive income tax relief |

Used By | Independent contractors and foreign wage earners | Foreign individuals/entities earning interest, royalties, etc. |

Tax Impact | Lowers or eliminates withholding on personal services | Reduces taxes on non-service income like dividends or rents |

Submitted To | Employer or contract payer | Financial institutions or other payers |

If your contractor is earning active income through services in the U.S., Form 8233 is the appropriate route.

Common Errors and How to Avoid Them

Missteps in handling Form 8233 can lead to delays, rejections, or unnecessary taxes. Watch out for:

Missing ITIN or SSN: Nonresidents need one to get withholding relief. Work with contractors early to secure IDs.

Wrong treaty article: Crosscheck the service description with IRS treaty tables to confirm accuracy.

Lack of supporting statements: Some treaties and IRS instructions require a written explanation to verify eligibility.

Post-payment submission: Form 8233 must be filed before the payment is made to qualify. Late filings won’t shield payments from backup withholding.

A standardized checklist for international contractor onboarding helps prevent avoidable mistakes.

Leveraging Tech and Expert Support to Streamline Form 8233

Startup teams are lean. Managing detailed IRS processes like Form 8233 doesn’t need to slow growth.

You can reduce time and legal exposure by tapping into:

Platforms designed to collect, validate, and store IRS forms digitally

Expert tax service providers with treaty-specific knowledge

Payroll tools integrated with contractor databases and IRS requirements

On-demand advisors who stay current with IRS updates and treaty adjustments

Final Thoughts: Why Form 8233 is Essential for Founders Paying International Contractors

To recap, Form 8233 plays a pivotal role in running compliant and cost-efficient contractor operations across borders. Founders who grasp its application gain:

Lawful tax savings via eligible treaty exemptions

Fewer IRS-related headaches from incorrect withholding

Better cash flow planning and team budgeting

An edge in retaining remote talent through transparent professionalism

For detailed, authoritative IRS guidance, visit the IRS official instructions for Form 8233.

Action Step: Take 10 minutes today to audit your onboarding process and confirm whether Form 8233 is being correctly used. The ROI on compliance here is exponential.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026