Go Back

Last Updated :

Last Updated :

Dec 22, 2025

Dec 22, 2025

Form 709 Guide: How to File the Gift Tax Return

For founders and executives steering startups, agencies, and e-commerce companies, understanding the landscape of tax reporting beyond typical business income and expenses is crucial. One important but often overlooked area is the Form 709 — the United States Gift (and Generation-Skipping Transfer) Tax Return.

Knowing when and how to file Form 709 can prevent costly penalties, protect your lifetime exemption, and enhance your company’s tax planning strategy, particularly when it involves transferring ownership, compensating employees with equity, or building your personal estate plan.

This guide demystifies Form 709 with clear, practical advice tailored for busy business leaders.

What is Form 709 and Why Does it Matter for Founders?

Form 709 is the official IRS form used by individuals to report gifts made during a tax year that exceed the annual exclusion amount. It also tracks the use of your lifetime exemption.

The form serves two main, mandatory purposes:

Reporting Taxable Gifts: Declaring gifts to any individual that exceed the annual exclusion (e.g., $19,000 in 2025).

Applying the Lifetime Exemption: Calculating and applying the total amount of wealth you can transfer during life or at death without triggering federal gift or estate tax ($13.99 million in 2025).

Why Founders Should Care

Entrepreneurs frequently make personal or business-related transfers that trigger gift tax implications, such as:

Transferring equity shares or stock options to family members (e.g., in a trust).

Gifting company assets or valuable intellectual property to a non-spouse/non-charity entity.

Making significant personal gifts (e.g., a down payment on a house) that affect your overall estate plan.

Filing Form 709 correctly lets you avoid IRS penalties and strategically use your available exclusions and exemptions to reduce future estate taxes.

Who Needs to File Form 709?

Only individuals must file Form 709. (A trust, partnership, or corporation does not file the return, though its underlying individual owners/beneficiaries may be considered the donors).

You must file Form 709 if you are a U.S. citizen or resident and you made any of the following gifts in the calendar year:

Filing Trigger | Details |

Gifts Over the Annual Exclusion | You gave more than $19,000 (for 2025) to any one person (who is not your spouse or a charity). |

Gift Splitting Election | You and your spouse elect to treat a single gift to a third party as being made one-half by each of you. (Filing is mandatory for both spouses, even if no tax is due.) |

Gifts of Future Interest | You transferred a gift, regardless of amount, where the recipient does not have immediate access, possession, or enjoyment (e.g., funding certain complex trusts). |

Gifts to a Non-Citizen Spouse | You gifted more than the special exclusion amount to a spouse who is not a U.S. citizen ($190,000 for 2025). |

You Do NOT Need to File if:

You made no gifts over the $19,000 annual exclusion per person.

The gift was a direct payment of tuition or medical expenses made directly to the educational institution or health provider (these are unlimited exclusions).

The gift was to your U.S. citizen spouse (unlimited marital deduction).

The gift was to a qualified charity.

When is Form 709 Due?

Form 709 is an annual return, and it is due:

Due Date: April 15 of the year following the gift.

Automatic Extension: If you file for an extension on your individual income tax return (Form 4868), the Form 709 deadline is automatically extended to October 15.

How to Fill Out Form 709: A Guidance-Oriented, Step-by-Step Walkthrough

The Form 709 is structured into three main sections: Part 1 (Donor Info), Schedule A (The Gifts), and Part 2 (Tax Computation).

Step 1: Gather Required Information (Documentation is Key)

Required Detail | Why It's Needed | Founder/Equity Note |

Recipient Info | Names, addresses, and Taxpayer ID Numbers (TINs/SSNs) for all donees. | Mandatory for all donees, even if no tax is owed. |

Gift Description | Clear description of the asset (e.g., 5,000 shares of common stock in [Startup Name], a 2025 valuation). | Must clearly distinguish between cash, property, and equity. |

Valuation/Basis | The fair market value (FMV) of the gift on the date of the transfer, and your adjusted basis. | Crucial: For privately held shares, you must attach a formal, independent appraisal to validate the FMV. |

Prior Filings | Copies of all previous Forms 709 filed (if any). | Needed to calculate your total remaining Lifetime Exemption. |

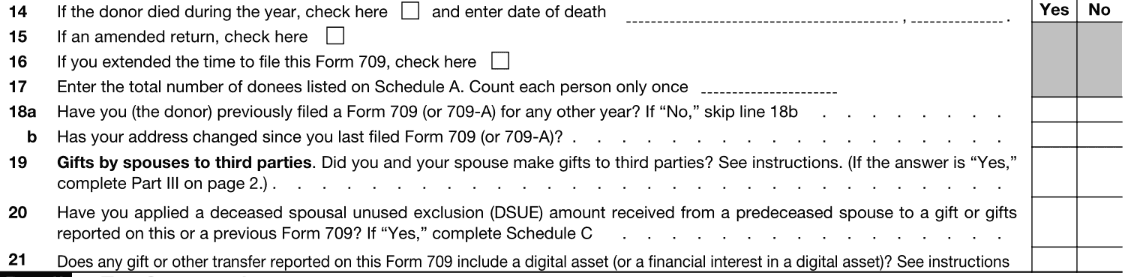

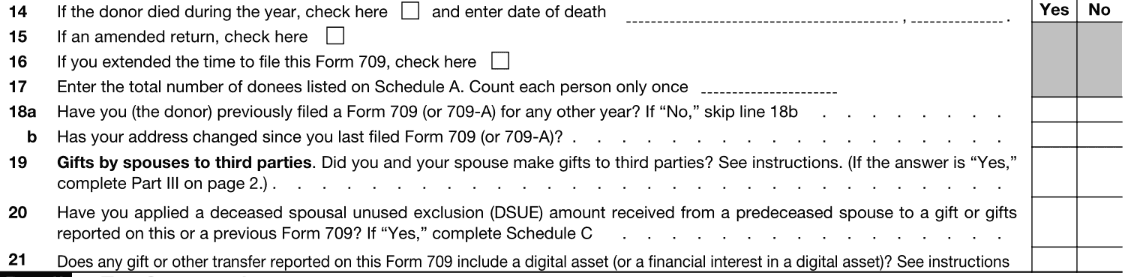

Step 2: Complete Part 1 — General Information

This section is for basic data and the crucial Gift Splitting Election.

Lines 1–11: Fill in your personal information (donor name, SSN, address).

Line 12 (Gift Splitting): If you are married and wish to split gifts, check "Yes." This requires your spouse to sign and complete their own separate Form 709.

Step 3: Detail Gifts on Schedule A — Computation of Taxable Gifts

This is where you list every reportable gift made during the year. Schedule A is divided into parts based on the type of gift.

Part 1: Gifts Subject Only to Gift Tax. Use this for straightforward gifts (e.g., cash, stock, real estate) to non-skip persons (not grandchildren or future generations).

Column (d): Provide a detailed description of the gift.

Column (g): Enter the Fair Market Value (FMV) of the gift.

Column (h) (If Splitting): Enter 1/2 of the FMV from column (g).

Column (i): Calculate the net transfer amount.

Parts 2 & 3: Direct/Indirect Skips and Trusts. Use these sections for generation-skipping transfers (GST) or gifts into specific trusts. These are complex and almost always require professional tax or legal advice.

Part 4: Summary of Annual Exclusion and Totals. This section nets out all reportable gifts, applies the annual exclusions (up to $19,000 per donee), and arrives at the Total Taxable Gifts for the current year.

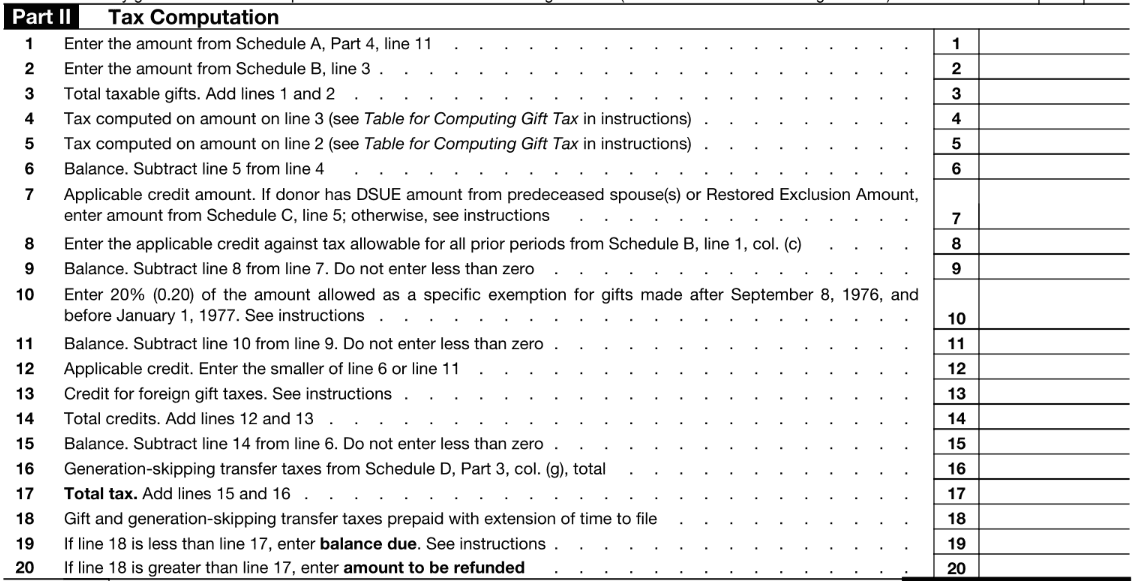

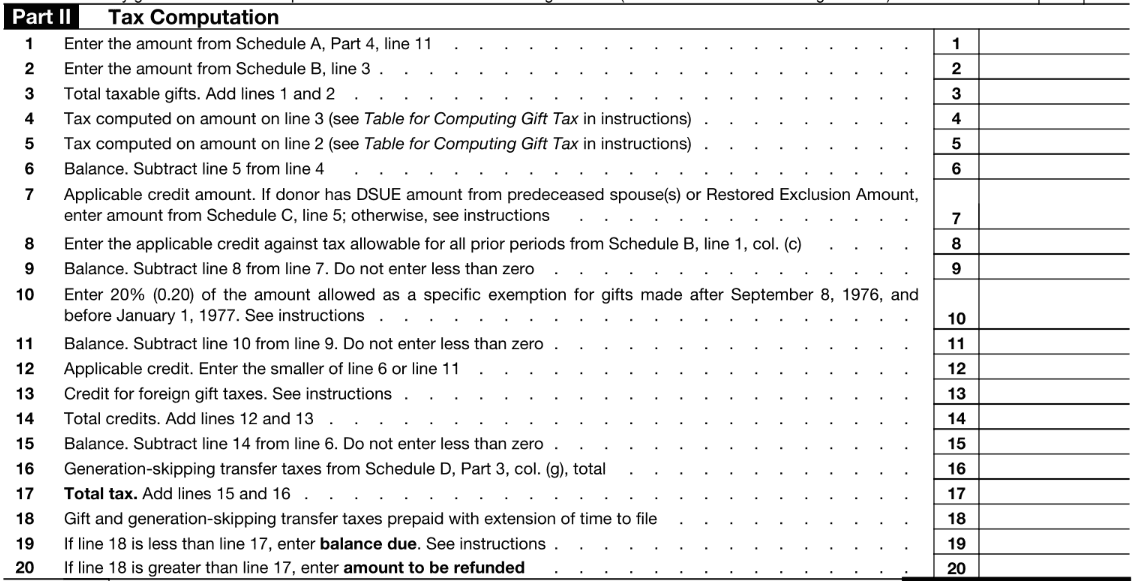

Step 4: Complete Part 2 (Page 1) — Tax Computation

This section applies your prior gift history and the lifetime exemption to determine if any tax is currently due.

Line 1: Enter the total taxable gifts from Schedule A, Part 4.

Line 2: Enter the total amount of taxable gifts made in all prior years.

Lines 4-10 (The Core Math): These lines calculate the tax on your current and prior gifts, then subtract the tax on prior gifts to find the tax on the current year's gifts.

Line 13 (Applicable Credit/Exemption): This line applies the Unified Credit (the tax equivalent of the Lifetime Exemption). This is where you reduce your tax liability to zero, provided you have enough of your $13.99 million exemption remaining.

Step 5: Sign and File

The donor must sign and date the return.

If gift splitting was elected, the spouse must sign in Part III.

File the return and all required attachments (e.g., stock appraisals, trust documents) by April 15.

Gift Tax Exclusions, Exemptions, and Strategic Uses for Business Founders

Understanding these concepts can unlock smart financial moves for entrepreneurs.

Term | 2025 Limit | Practical Impact for Founders |

Annual Exclusion | $19,000 per recipient, per year | Enables gifting smaller equity shares to employees or family without filing Form 709 or using the lifetime exemption. |

Lifetime Exemption | $13.99 Million per person | Strategic use reduces taxable estate size, crucial for founders with high-growth companies. Every dollar of taxable gifts reduces this amount. |

Gift Splitting | $38,000 total per recipient per year (married couple) | [Diagram Suggestion: Simple flow chart showing a single $30k gift from Donor A being split into two $15k gifts, both falling under the exclusion, preventing use of the lifetime exemption.] Helps married couples transfer wealth more tax-efficiently, fully utilizing two annual exclusions. |

Valuation | Fair Market Value (FMV) on Date of Gift | Crucial: Accurate, documented appraisals of gifted business assets (especially startup shares) prevent IRS disputes and penalties. |

Strategy Spotlight: Gifting Founder Shares Early

Gifting highly appreciating assets, like founder shares, early in a company's life (when their valuation is lower) is a common, powerful strategy.

Benefit: You use a smaller amount of your Lifetime Exemption now to transfer an asset that will have a much higher value later, saving potentially millions in future estate taxes.

Requirement: This strategy relies entirely on having a robust, defensible valuation report for the gifted shares that is attached to Form 709.

Common Mistakes to Avoid When Filing Form 709

To prevent costly errors and IRS scrutiny, be mindful of these pitfalls:

Failing to File When Required: Even if no tax is due (because you are using your Lifetime Exemption), failure to file Form 709 when a reporting trigger occurs (e.g., gift splitting, over the annual exclusion) can lead to penalties and leave the gift's value vulnerable to IRS scrutiny forever.

Incorrect/Missing Valuation: Understating the value of gifted shares or property is a major audit trigger. Always obtain a formal, independent valuation (especially for C-corp or LLC equity) and attach the documentation.

Ignoring Gift Splitting: Married founders often overlook this election, missing out on effectively doubling the annual exclusion and unnecessarily using their Lifetime Exemption. Remember: Both spouses must file a Form 709 to elect splitting, even if one spouse's gift alone was not taxable.

Misclassifying Gifts: Ensure gifts reported on Form 709 are strictly personal transfers. Do not confuse them with:

Business compensation (reported on W-2 or 1099).

Business expenses.

Gifts to a U.S. citizen spouse (which are not reported).

FAQs

Q: Does filing Form 709 mean I will owe tax?

A: No. Filing Form 709 simply reports the gift. You only owe tax if the total amount of your taxable gifts (gifts over the annual exclusion) throughout your lifetime exceeds your $13.99 million Lifetime Exemption. Most founders file to report the gift and use the exemption, not to pay tax.

Q: What if I transfer shares in my startup?

A: You must report it. If the value of the gifted shares exceeds the annual exclusion ($19,000 in 2025), you must file Form 709. Crucially, attach an independent, qualified appraisal to justify the Fair Market Value (FMV) of the private shares at the time of the gift.

Q: Can a business entity (LLC/Corp) file Form 709?

A: No. Only individuals can be donors. If a business entity makes a transfer that is considered a gift, the individual owners or shareholders are typically deemed the donors and must file Form 709 personally.

Q: What if the gift is a payment for tuition or medical bills?

A: No filing required, regardless of the amount. Direct payments of tuition to an educational institution or medical costs to a healthcare provider are entirely excluded from the definition of a gift and do not need to be reported on Form 709.

For founders and executives steering startups, agencies, and e-commerce companies, understanding the landscape of tax reporting beyond typical business income and expenses is crucial. One important but often overlooked area is the Form 709 — the United States Gift (and Generation-Skipping Transfer) Tax Return.

Knowing when and how to file Form 709 can prevent costly penalties, protect your lifetime exemption, and enhance your company’s tax planning strategy, particularly when it involves transferring ownership, compensating employees with equity, or building your personal estate plan.

This guide demystifies Form 709 with clear, practical advice tailored for busy business leaders.

What is Form 709 and Why Does it Matter for Founders?

Form 709 is the official IRS form used by individuals to report gifts made during a tax year that exceed the annual exclusion amount. It also tracks the use of your lifetime exemption.

The form serves two main, mandatory purposes:

Reporting Taxable Gifts: Declaring gifts to any individual that exceed the annual exclusion (e.g., $19,000 in 2025).

Applying the Lifetime Exemption: Calculating and applying the total amount of wealth you can transfer during life or at death without triggering federal gift or estate tax ($13.99 million in 2025).

Why Founders Should Care

Entrepreneurs frequently make personal or business-related transfers that trigger gift tax implications, such as:

Transferring equity shares or stock options to family members (e.g., in a trust).

Gifting company assets or valuable intellectual property to a non-spouse/non-charity entity.

Making significant personal gifts (e.g., a down payment on a house) that affect your overall estate plan.

Filing Form 709 correctly lets you avoid IRS penalties and strategically use your available exclusions and exemptions to reduce future estate taxes.

Who Needs to File Form 709?

Only individuals must file Form 709. (A trust, partnership, or corporation does not file the return, though its underlying individual owners/beneficiaries may be considered the donors).

You must file Form 709 if you are a U.S. citizen or resident and you made any of the following gifts in the calendar year:

Filing Trigger | Details |

Gifts Over the Annual Exclusion | You gave more than $19,000 (for 2025) to any one person (who is not your spouse or a charity). |

Gift Splitting Election | You and your spouse elect to treat a single gift to a third party as being made one-half by each of you. (Filing is mandatory for both spouses, even if no tax is due.) |

Gifts of Future Interest | You transferred a gift, regardless of amount, where the recipient does not have immediate access, possession, or enjoyment (e.g., funding certain complex trusts). |

Gifts to a Non-Citizen Spouse | You gifted more than the special exclusion amount to a spouse who is not a U.S. citizen ($190,000 for 2025). |

You Do NOT Need to File if:

You made no gifts over the $19,000 annual exclusion per person.

The gift was a direct payment of tuition or medical expenses made directly to the educational institution or health provider (these are unlimited exclusions).

The gift was to your U.S. citizen spouse (unlimited marital deduction).

The gift was to a qualified charity.

When is Form 709 Due?

Form 709 is an annual return, and it is due:

Due Date: April 15 of the year following the gift.

Automatic Extension: If you file for an extension on your individual income tax return (Form 4868), the Form 709 deadline is automatically extended to October 15.

How to Fill Out Form 709: A Guidance-Oriented, Step-by-Step Walkthrough

The Form 709 is structured into three main sections: Part 1 (Donor Info), Schedule A (The Gifts), and Part 2 (Tax Computation).

Step 1: Gather Required Information (Documentation is Key)

Required Detail | Why It's Needed | Founder/Equity Note |

Recipient Info | Names, addresses, and Taxpayer ID Numbers (TINs/SSNs) for all donees. | Mandatory for all donees, even if no tax is owed. |

Gift Description | Clear description of the asset (e.g., 5,000 shares of common stock in [Startup Name], a 2025 valuation). | Must clearly distinguish between cash, property, and equity. |

Valuation/Basis | The fair market value (FMV) of the gift on the date of the transfer, and your adjusted basis. | Crucial: For privately held shares, you must attach a formal, independent appraisal to validate the FMV. |

Prior Filings | Copies of all previous Forms 709 filed (if any). | Needed to calculate your total remaining Lifetime Exemption. |

Step 2: Complete Part 1 — General Information

This section is for basic data and the crucial Gift Splitting Election.

Lines 1–11: Fill in your personal information (donor name, SSN, address).

Line 12 (Gift Splitting): If you are married and wish to split gifts, check "Yes." This requires your spouse to sign and complete their own separate Form 709.

Step 3: Detail Gifts on Schedule A — Computation of Taxable Gifts

This is where you list every reportable gift made during the year. Schedule A is divided into parts based on the type of gift.

Part 1: Gifts Subject Only to Gift Tax. Use this for straightforward gifts (e.g., cash, stock, real estate) to non-skip persons (not grandchildren or future generations).

Column (d): Provide a detailed description of the gift.

Column (g): Enter the Fair Market Value (FMV) of the gift.

Column (h) (If Splitting): Enter 1/2 of the FMV from column (g).

Column (i): Calculate the net transfer amount.

Parts 2 & 3: Direct/Indirect Skips and Trusts. Use these sections for generation-skipping transfers (GST) or gifts into specific trusts. These are complex and almost always require professional tax or legal advice.

Part 4: Summary of Annual Exclusion and Totals. This section nets out all reportable gifts, applies the annual exclusions (up to $19,000 per donee), and arrives at the Total Taxable Gifts for the current year.

Step 4: Complete Part 2 (Page 1) — Tax Computation

This section applies your prior gift history and the lifetime exemption to determine if any tax is currently due.

Line 1: Enter the total taxable gifts from Schedule A, Part 4.

Line 2: Enter the total amount of taxable gifts made in all prior years.

Lines 4-10 (The Core Math): These lines calculate the tax on your current and prior gifts, then subtract the tax on prior gifts to find the tax on the current year's gifts.

Line 13 (Applicable Credit/Exemption): This line applies the Unified Credit (the tax equivalent of the Lifetime Exemption). This is where you reduce your tax liability to zero, provided you have enough of your $13.99 million exemption remaining.

Step 5: Sign and File

The donor must sign and date the return.

If gift splitting was elected, the spouse must sign in Part III.

File the return and all required attachments (e.g., stock appraisals, trust documents) by April 15.

Gift Tax Exclusions, Exemptions, and Strategic Uses for Business Founders

Understanding these concepts can unlock smart financial moves for entrepreneurs.

Term | 2025 Limit | Practical Impact for Founders |

Annual Exclusion | $19,000 per recipient, per year | Enables gifting smaller equity shares to employees or family without filing Form 709 or using the lifetime exemption. |

Lifetime Exemption | $13.99 Million per person | Strategic use reduces taxable estate size, crucial for founders with high-growth companies. Every dollar of taxable gifts reduces this amount. |

Gift Splitting | $38,000 total per recipient per year (married couple) | [Diagram Suggestion: Simple flow chart showing a single $30k gift from Donor A being split into two $15k gifts, both falling under the exclusion, preventing use of the lifetime exemption.] Helps married couples transfer wealth more tax-efficiently, fully utilizing two annual exclusions. |

Valuation | Fair Market Value (FMV) on Date of Gift | Crucial: Accurate, documented appraisals of gifted business assets (especially startup shares) prevent IRS disputes and penalties. |

Strategy Spotlight: Gifting Founder Shares Early

Gifting highly appreciating assets, like founder shares, early in a company's life (when their valuation is lower) is a common, powerful strategy.

Benefit: You use a smaller amount of your Lifetime Exemption now to transfer an asset that will have a much higher value later, saving potentially millions in future estate taxes.

Requirement: This strategy relies entirely on having a robust, defensible valuation report for the gifted shares that is attached to Form 709.

Common Mistakes to Avoid When Filing Form 709

To prevent costly errors and IRS scrutiny, be mindful of these pitfalls:

Failing to File When Required: Even if no tax is due (because you are using your Lifetime Exemption), failure to file Form 709 when a reporting trigger occurs (e.g., gift splitting, over the annual exclusion) can lead to penalties and leave the gift's value vulnerable to IRS scrutiny forever.

Incorrect/Missing Valuation: Understating the value of gifted shares or property is a major audit trigger. Always obtain a formal, independent valuation (especially for C-corp or LLC equity) and attach the documentation.

Ignoring Gift Splitting: Married founders often overlook this election, missing out on effectively doubling the annual exclusion and unnecessarily using their Lifetime Exemption. Remember: Both spouses must file a Form 709 to elect splitting, even if one spouse's gift alone was not taxable.

Misclassifying Gifts: Ensure gifts reported on Form 709 are strictly personal transfers. Do not confuse them with:

Business compensation (reported on W-2 or 1099).

Business expenses.

Gifts to a U.S. citizen spouse (which are not reported).

FAQs

Q: Does filing Form 709 mean I will owe tax?

A: No. Filing Form 709 simply reports the gift. You only owe tax if the total amount of your taxable gifts (gifts over the annual exclusion) throughout your lifetime exceeds your $13.99 million Lifetime Exemption. Most founders file to report the gift and use the exemption, not to pay tax.

Q: What if I transfer shares in my startup?

A: You must report it. If the value of the gifted shares exceeds the annual exclusion ($19,000 in 2025), you must file Form 709. Crucially, attach an independent, qualified appraisal to justify the Fair Market Value (FMV) of the private shares at the time of the gift.

Q: Can a business entity (LLC/Corp) file Form 709?

A: No. Only individuals can be donors. If a business entity makes a transfer that is considered a gift, the individual owners or shareholders are typically deemed the donors and must file Form 709 personally.

Q: What if the gift is a payment for tuition or medical bills?

A: No filing required, regardless of the amount. Direct payments of tuition to an educational institution or medical costs to a healthcare provider are entirely excluded from the definition of a gift and do not need to be reported on Form 709.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026