Go Back

Last Updated :

Last Updated :

Jan 15, 2026

Jan 15, 2026

How to File Form 706: Estate Tax Return Filing Essentials

Founders, especially those building startups poised for long-term growth and eventual legacy planning, must understand Form 706. This form, formally known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is vital for managing how estates are handled after a business owner’s passing. Proper handling of this form ensures that your company’s value and personal wealth transfers to heirs without unexpected tax complications.

In this guide, we’ll cover everything founders need to know about Form 706 — when and why it applies, what information you’ll need to gather, and how to work with professional services to file this correctly and efficiently. We’ll also highlight related tax considerations relevant to entrepreneurs, from corporate filings to potential additional taxes, providing resources and steps tailored to your busy startup lifecycle.

What is Form 706 and Why Should Founders Care?

Form 706 is the federal estate tax return that covers assets transferred after death if the total estate value exceeds a certain threshold ($12.92 million for 2023, subject to inflation adjustments). While many startups and small businesses may fall below this exemption level today, many founders anticipate growth or want to ensure their succession planning is airtight.

Why Founders Need to Understand Form 706

Estate Planning and Succession: For founders planning to pass ownership to family or partners, Form 706 is critical for documenting asset values, including business interests.

Tax Liability Management: Early planning allows founders to implement strategies to minimize estate tax exposure, preserving startup equity and personal wealth.

Charitable and Generation-Skipping Transfers: Founders with philanthropic or multigenerational goals must understand how Form 706 reports these asset movements.

Taking a proactive approach with estate taxes helps avoid last-minute scrambles and unexpected financial drains when it’s time to file.

For a related essential resource, founders may also want to review our Form 2848 Guide on IRS Representation to prepare for appointing trusted advisors in your tax matters.

When Is Form 706 Required, and What’s Included?

Form 706 must be filed within nine months after the death of an individual whose estate exceeds the exemption threshold. The document aggregates detailed information to calculate whether the estate owes federal estate tax.

Filing Requirements at a Glance

Filing Threshold | Deadline | Extensions Allowed? | Who Prepares |

Estates over $12.92 million (2023) | 9 months after death | Yes, 6-month extension possible | Executor or Personal Representative |

What Information Does IRS Form 706 Include?

Gross estate value: Real estate, business interests, investment accounts, and personal property.

Lifetime gifts: Certain gifts made before death reduce the estate’s taxable value.

Deductions: Debts, administrative expenses, charitable donations.

Generation-Skipping Transfer Tax (GST): If assets pass to grandchildren or individuals more than one generation below.

For startup founders, valuing private shares accurately can be a sticking point. IRS scrutiny of these valuations is high, and using a qualified appraiser familiar with startup equity is vital.

If your startup files corporate taxes, our streamlined Form 1120 Guide for Founders can help complement estate planning with corporate tax clarity.

Strategies for Founders to Manage Estate Tax Exposure

Estate tax planning is just as strategic as raising capital or issuing equity. By starting early, founders can reduce tax burdens and protect their startup’s future.

Early Valuation and Documentation of Startup Equity

Keep a diligent record of stock issuances, equity splits, and cap table updates.

Regular 409A valuations can help support post-death equity valuation on Form 706.

Transparent documentation can significantly speed up the filing process and reduce audit risk.

Use Lifetime Gifts Strategically

Gifts made more than three years before death help reduce your taxable estate.

Take advantage of annual gift exclusions and the lifetime gift tax exemption.

For more on related reporting, check out our Form 5329 Guide.

Incorporate Trusts and Family Partnerships

Irrevocable trusts can move equity out of the taxable estate.

Family limited partnerships (FLPs) allow founders to transfer business interests over time with valuation discounts.

These tools must be set up with help from legal and tax experts familiar with founder wealth.

Stay Updated on U.S. Tax Law Changes

The federal estate tax exemption often adjusts with inflation or tax code changes.

Proposals to reduce exemption amounts or increase estate tax rates resurface frequently.

Monitor updates from trusted sources like the IRS Estate and Gift Taxes Portal.

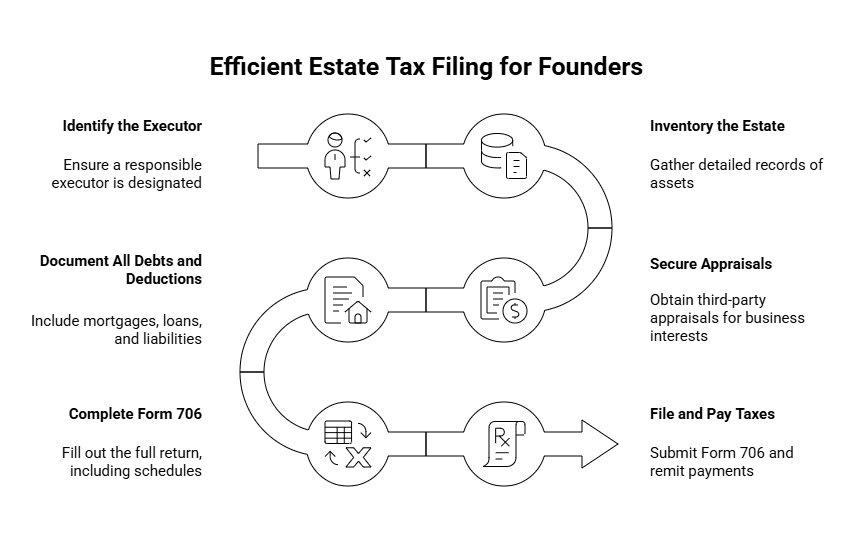

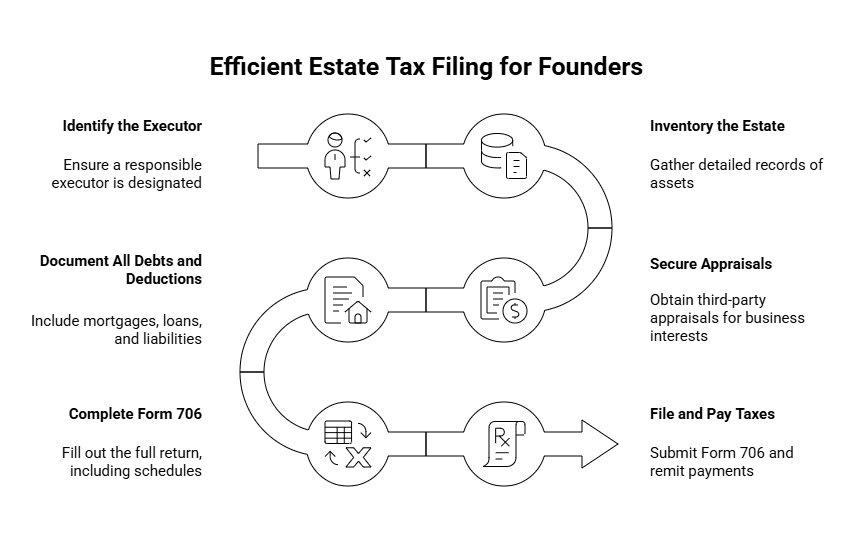

Step-by-Step: How to Prepare and File Form 706 Efficiently

Filing Form 706 is time-sensitive and detail-intensive. Here’s an actionable roadmap designed for busy founders:

Filing Checklist for Founders

Step | Action |

Identify the Executor | Ensure a responsible executor is designated under the will or by court. |

Inventory the Estate | Gather detailed records: startup equity, real estate, bank accounts, retirement plans, etc. |

Secure Appraisals | Obtain third-party appraisals for business interests and real estate. |

Document All Debts and Deductions | Include mortgages, loans, legal fees, and business-related liabilities. |

Complete Form 706 | Fill out the full return, including required schedules. |

File and Pay Taxes | Submit Form 706 and remit any estate tax payments. |

For representation in tax matters, our detailed Form 2848 Guide explains how to authorize experts to act on your behalf.

Form 706 Isn’t Just Compliance—It’s Founder Foresight

Understanding and preparing for Form 706 is an integral part of a founder’s financial strategy. It ensures the company you've built survives major transitions—and that the wealth you've created benefits future generations as planned.

Key takeaways:

Plan proactively: Begin estate planning before your company scales dramatically.

Document with intention: Treat accurate valuation and recordkeeping as strategic assets.

Use tools like gifting and trusts: These reduce exposure and preserve oversight.

Align with advisors who get startups: You'll avoid generic advice and optimize for your unique situation.

At Haven, we specialize in founder-focused tax, advisory, and estate planning solutions that scale with your startup’s growth. From bookkeeping to tax strategy, we ensure compliance never hinders your momentum.

Founders, especially those building startups poised for long-term growth and eventual legacy planning, must understand Form 706. This form, formally known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is vital for managing how estates are handled after a business owner’s passing. Proper handling of this form ensures that your company’s value and personal wealth transfers to heirs without unexpected tax complications.

In this guide, we’ll cover everything founders need to know about Form 706 — when and why it applies, what information you’ll need to gather, and how to work with professional services to file this correctly and efficiently. We’ll also highlight related tax considerations relevant to entrepreneurs, from corporate filings to potential additional taxes, providing resources and steps tailored to your busy startup lifecycle.

What is Form 706 and Why Should Founders Care?

Form 706 is the federal estate tax return that covers assets transferred after death if the total estate value exceeds a certain threshold ($12.92 million for 2023, subject to inflation adjustments). While many startups and small businesses may fall below this exemption level today, many founders anticipate growth or want to ensure their succession planning is airtight.

Why Founders Need to Understand Form 706

Estate Planning and Succession: For founders planning to pass ownership to family or partners, Form 706 is critical for documenting asset values, including business interests.

Tax Liability Management: Early planning allows founders to implement strategies to minimize estate tax exposure, preserving startup equity and personal wealth.

Charitable and Generation-Skipping Transfers: Founders with philanthropic or multigenerational goals must understand how Form 706 reports these asset movements.

Taking a proactive approach with estate taxes helps avoid last-minute scrambles and unexpected financial drains when it’s time to file.

For a related essential resource, founders may also want to review our Form 2848 Guide on IRS Representation to prepare for appointing trusted advisors in your tax matters.

When Is Form 706 Required, and What’s Included?

Form 706 must be filed within nine months after the death of an individual whose estate exceeds the exemption threshold. The document aggregates detailed information to calculate whether the estate owes federal estate tax.

Filing Requirements at a Glance

Filing Threshold | Deadline | Extensions Allowed? | Who Prepares |

Estates over $12.92 million (2023) | 9 months after death | Yes, 6-month extension possible | Executor or Personal Representative |

What Information Does IRS Form 706 Include?

Gross estate value: Real estate, business interests, investment accounts, and personal property.

Lifetime gifts: Certain gifts made before death reduce the estate’s taxable value.

Deductions: Debts, administrative expenses, charitable donations.

Generation-Skipping Transfer Tax (GST): If assets pass to grandchildren or individuals more than one generation below.

For startup founders, valuing private shares accurately can be a sticking point. IRS scrutiny of these valuations is high, and using a qualified appraiser familiar with startup equity is vital.

If your startup files corporate taxes, our streamlined Form 1120 Guide for Founders can help complement estate planning with corporate tax clarity.

Strategies for Founders to Manage Estate Tax Exposure

Estate tax planning is just as strategic as raising capital or issuing equity. By starting early, founders can reduce tax burdens and protect their startup’s future.

Early Valuation and Documentation of Startup Equity

Keep a diligent record of stock issuances, equity splits, and cap table updates.

Regular 409A valuations can help support post-death equity valuation on Form 706.

Transparent documentation can significantly speed up the filing process and reduce audit risk.

Use Lifetime Gifts Strategically

Gifts made more than three years before death help reduce your taxable estate.

Take advantage of annual gift exclusions and the lifetime gift tax exemption.

For more on related reporting, check out our Form 5329 Guide.

Incorporate Trusts and Family Partnerships

Irrevocable trusts can move equity out of the taxable estate.

Family limited partnerships (FLPs) allow founders to transfer business interests over time with valuation discounts.

These tools must be set up with help from legal and tax experts familiar with founder wealth.

Stay Updated on U.S. Tax Law Changes

The federal estate tax exemption often adjusts with inflation or tax code changes.

Proposals to reduce exemption amounts or increase estate tax rates resurface frequently.

Monitor updates from trusted sources like the IRS Estate and Gift Taxes Portal.

Step-by-Step: How to Prepare and File Form 706 Efficiently

Filing Form 706 is time-sensitive and detail-intensive. Here’s an actionable roadmap designed for busy founders:

Filing Checklist for Founders

Step | Action |

Identify the Executor | Ensure a responsible executor is designated under the will or by court. |

Inventory the Estate | Gather detailed records: startup equity, real estate, bank accounts, retirement plans, etc. |

Secure Appraisals | Obtain third-party appraisals for business interests and real estate. |

Document All Debts and Deductions | Include mortgages, loans, legal fees, and business-related liabilities. |

Complete Form 706 | Fill out the full return, including required schedules. |

File and Pay Taxes | Submit Form 706 and remit any estate tax payments. |

For representation in tax matters, our detailed Form 2848 Guide explains how to authorize experts to act on your behalf.

Form 706 Isn’t Just Compliance—It’s Founder Foresight

Understanding and preparing for Form 706 is an integral part of a founder’s financial strategy. It ensures the company you've built survives major transitions—and that the wealth you've created benefits future generations as planned.

Key takeaways:

Plan proactively: Begin estate planning before your company scales dramatically.

Document with intention: Treat accurate valuation and recordkeeping as strategic assets.

Use tools like gifting and trusts: These reduce exposure and preserve oversight.

Align with advisors who get startups: You'll avoid generic advice and optimize for your unique situation.

At Haven, we specialize in founder-focused tax, advisory, and estate planning solutions that scale with your startup’s growth. From bookkeeping to tax strategy, we ensure compliance never hinders your momentum.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026