Go Back

Last Updated :

Last Updated :

Feb 2, 2026

Feb 2, 2026

Form 6198: Calculating Your At-Risk Tax Limitations

Managing a growing startup or e-commerce business, understanding the nuances of tax regulations can feel overwhelming. Yet, mastering these details not only helps you stay compliant but also unlocks opportunities to optimize your tax position. One crucial but often overlooked form is Form 6198, the IRS tool designed to calculate your at-risk tax limitations and determine how much loss you can deduct from certain business activities.

In this guide, we break down what Form 6198 is, why at-risk limitations matter, who needs to file it, and exactly how to calculate your amount at risk — all explained in practical terms for founders like you who want to make smarter accounting decisions with confidence. We’ll also explore how Form 6198 interacts with other tax rules and offer actionable insights to manage your business’s tax exposure effectively.

Why Form 6198 Matters for Startup Founders

At its core, Form 6198 helps you track your economic ‘skin in the game’ for activities subject to at-risk rules. The IRS created these rules to prevent taxpayers from claiming losses that exceed the actual financial risk they have invested in a business or activity.

What Are At-Risk Limitations?

The at-risk rules limit the amount of loss deduction to the amount you stand to lose economically in a trade or business activity. If your deductible loss exceeds this amount, the excess is deferred until you replenish your at-risk amount or dispose of the activity.

For founders, this means that even if your records show a larger accounting loss, you can only write off losses to the extent you have “at-risk” money invested — your own cash, recourse loans (loans you're personally liable for), and certain qualified nonrecourse financing. Other nonrecourse loans (where you have no personal liability) generally don’t count unless they meet strict IRS criteria.

Incorrectly disregarding these limitations could lead to IRS adjustments, unexpected tax bills, or missed loss deductions you were entitled to claim.

Who Must File IRS Form 6198?

The IRS requires taxpayers engaged in activities involving at-risk rules to file Form 6198. This typically applies when you:

Participate in a business or investment activity subject to at-risk rules (e.g., partnerships, S corporations, sole proprietorships).

Claim losses related to these activities on your income tax return.

Have certain financing in place, such as recourse or qualified nonrecourse loans.

If you are claiming a loss on Schedule E of your Form 1040 related to an activity governed by at-risk limits, you probably need to file.

Startups structured as passthrough entities or those using complex financing arrangements should pay particular attention.

Breaking Down the Key Components of Form 6198

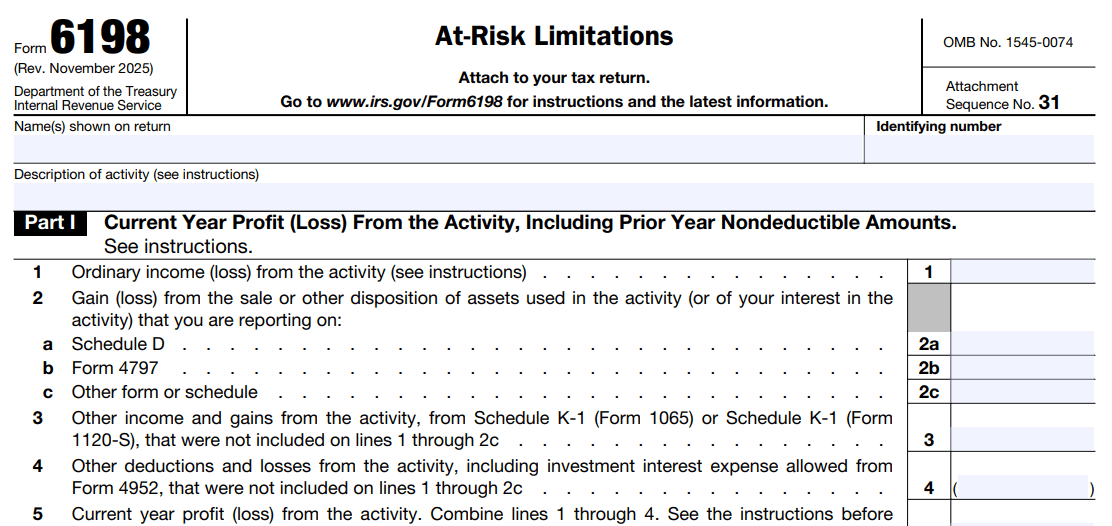

Understanding the structure of the form helps demystify the process. Here are the main sections:

Part of Form 6198 | Purpose | What Founders Should Know |

Part I: Income or Loss From Activity | Report the activity’s income or loss for the tax year | Helps identify the net annual result from the specific marketplace, product line, or investment |

Part II: Amount At Risk | Calculate how much you're economically at risk for | Includes initial investment, recourse loans, and qualified nonrecourse financing |

Part III: Deductible Loss or Carryover | Determine how much of the current-year loss can be deducted | Excess losses are deferred until additional risk basis is created |

Part IV: Worksheets | Add detail for complex calculations | Ensures accurate reconciliation for your financials and IRS filing |

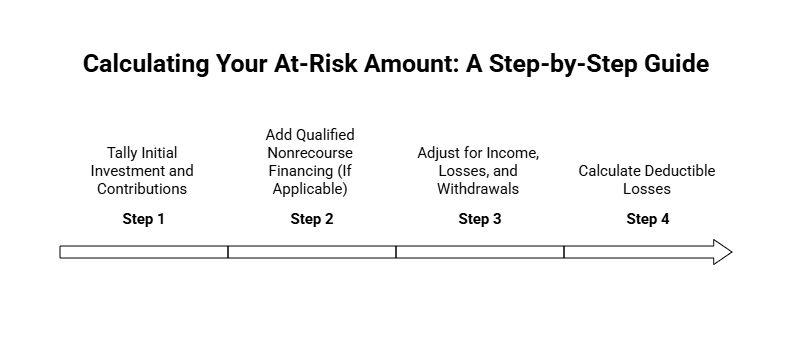

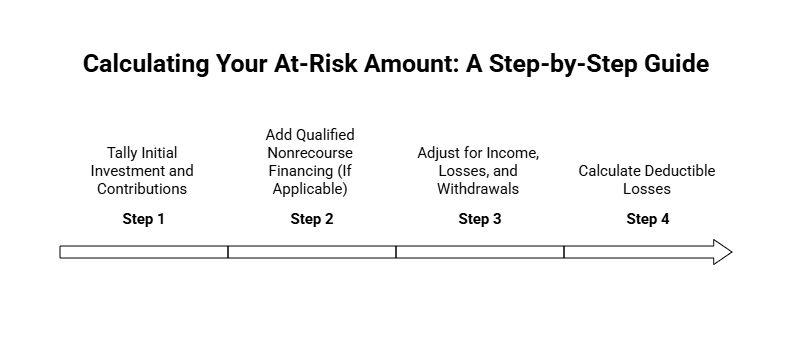

How to Calculate Your At-Risk Amount: Step-by-Step

Working through Form 6198 starts with a clear understanding of what you've put into the business, where your risk lies, and what income or losses you’ve realized during the year.

Step 1: Tally Initial Investment and Contributions

Count all cash contributions to the activity.

Add the adjusted basis of the property you contributed.

Include amounts of recourse debt you’re personally liable for.

For example, if you've invested $75,000 in capital and personally guarantee a $25,000 startup loan, your at-risk amount starts at $100,000.

Step 2: Add Qualified Nonrecourse Financing (If Applicable)

Qualified nonrecourse financing is a key exception. It applies if the loan:

Is borrowed from a qualified lender,

Is secured by real property used in the activity,

Follows IRS regulations under Section 465.

This is often relevant for real estate investments but rare in tech startups. Still, if applicable, it boosts your at-risk amount.

Step 3: Adjust for Income, Losses, and Withdrawals

Add any current-year income derived from the activity.

Subtract prior-year deducted losses.

Subtract cash or property distributions taken from the company.

This determines your net economic exposure in real-time.

Step 4: Calculate Deductible Losses

Deductible losses are limited to your net at-risk amount. Any portion above that is suspended and carried forward for deduction in a future year when at-risk levels increase or when the activity is sold or dissolved.

How Form 6198 Interacts With Other Tax Limitation Rules

At-risk rules are just one layer of the tax-loss framework. Other relevant limits include:

Basis limitations – Determines total investment you can deduct in passthroughs like partnerships.

Passive activity rules (Form 8582) – Activities where you don’t materially participate may further restrict deductions.

Alternative Minimum Tax (AMT) – May offset some losses allowed under general rules.

For passive activity, you must file Form 8582.

Common Questions Founders Have About Form 6198

Do I Need a Separate Form 6198 for Each Activity?

Yes. Each separate business or investment subject to at-risk rules requires its own copy of Form 6198. Activities with different ownerships, industries, or financing usually don’t get aggregated.

What Happens If My At-Risk Amount Drops Below Zero?

Loss deductions are limited to $0 that year. Excess losses roll forward. Don’t report a negative at-risk balance on your return.

Do Nonrecourse Loans Count Toward My At-Risk Amount?

Only if they qualify as ""qualified nonrecourse financing"" under IRS rules. Typical nonrecourse debt—such as unsecured loans where you have no personal liability—does not.

What Are Examples of Qualifying Activities?

Businesses operated as sole proprietorships

Partnerships and S-corporations with active operations

Investment activities with the intent to generate profit

Non-business assets like personal portfolios generally don’t qualify.

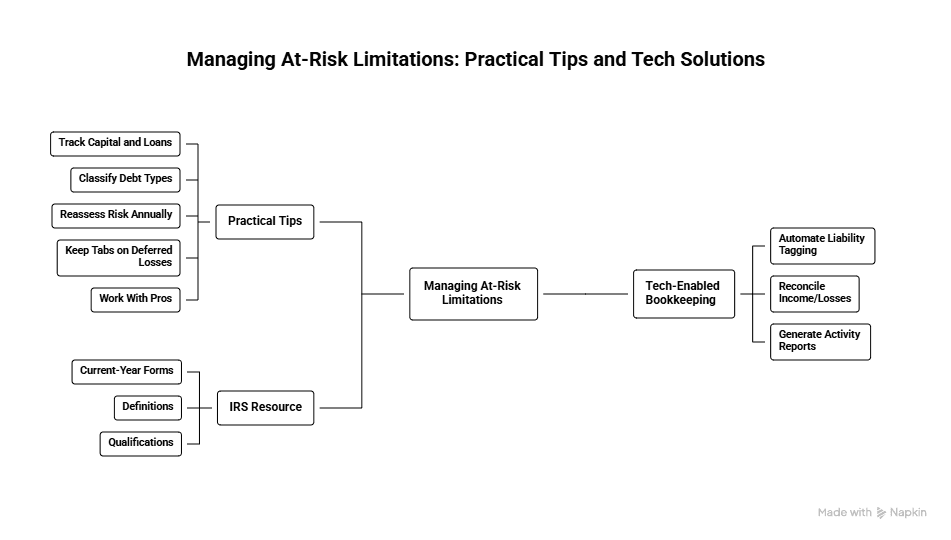

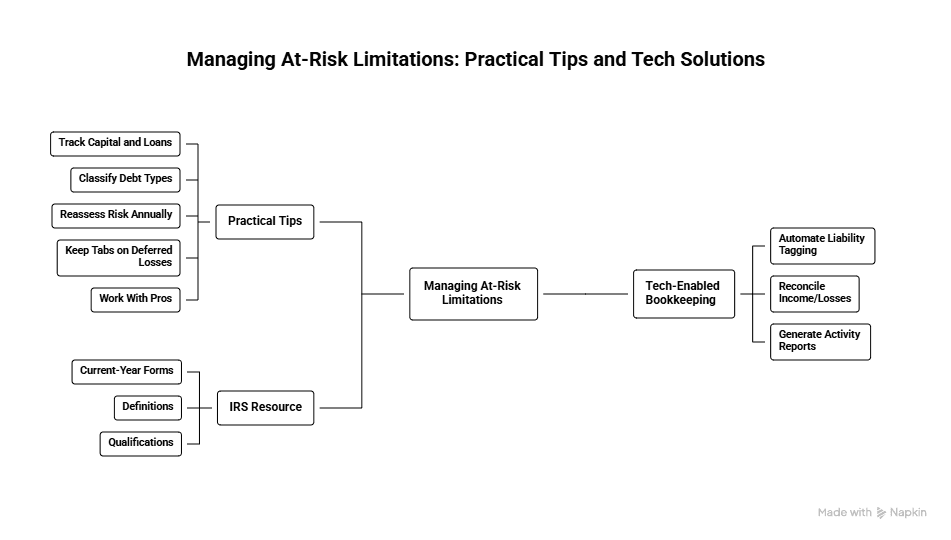

Five Practical Tips for Managing At-Risk Limitations

Track Capital and Loans Accurately

Maintain clear documentation of cash contributions, loans, and ownership changes.Classify Debt Types Carefully

Keep records distinguishing between recourse vs. nonrecourse financing and confirm any safe harbor terms.Reassess Risk Annually

Update your at-risk basis each year with changes in income, withdrawals, or financing structures.Keep Tabs on Deferred Losses

Suspended losses aren’t gone—they’re waiting to be claimed when your risk increases. Track them year-to-year.Work With Bookkeeping and Tax Pros

Use systems and advisors that understand at-risk calculations—especially for passthrough structures.

How Tech-Enabled Bookkeeping Helps With Form 6198

Sophisticated accounting platforms can automate much of the tracking needed for Form 6198 compliance:

Automatically tag recourse vs. nonrecourse liabilities

Reconcile income/losses to specific activities

Generate at-risk activity reports for your CPA or tax team

With smarter data reporting, you can avoid manual errors and clarify your deduction limits faster.

Form 6198 Is a Strategic Advantage

Understanding and properly applying Form 6198 rules ensures that your business only deducts losses you’re financially responsible for—while capturing every valid tax benefit you're entitled to. This approach protects your business from audit risk and positions you to take advantage of loss deductions in the years they benefit you most.

As your business grows and financing becomes more complex, keeping your at-risk tracking compliant and current will safeguard long-term success.

Managing a growing startup or e-commerce business, understanding the nuances of tax regulations can feel overwhelming. Yet, mastering these details not only helps you stay compliant but also unlocks opportunities to optimize your tax position. One crucial but often overlooked form is Form 6198, the IRS tool designed to calculate your at-risk tax limitations and determine how much loss you can deduct from certain business activities.

In this guide, we break down what Form 6198 is, why at-risk limitations matter, who needs to file it, and exactly how to calculate your amount at risk — all explained in practical terms for founders like you who want to make smarter accounting decisions with confidence. We’ll also explore how Form 6198 interacts with other tax rules and offer actionable insights to manage your business’s tax exposure effectively.

Why Form 6198 Matters for Startup Founders

At its core, Form 6198 helps you track your economic ‘skin in the game’ for activities subject to at-risk rules. The IRS created these rules to prevent taxpayers from claiming losses that exceed the actual financial risk they have invested in a business or activity.

What Are At-Risk Limitations?

The at-risk rules limit the amount of loss deduction to the amount you stand to lose economically in a trade or business activity. If your deductible loss exceeds this amount, the excess is deferred until you replenish your at-risk amount or dispose of the activity.

For founders, this means that even if your records show a larger accounting loss, you can only write off losses to the extent you have “at-risk” money invested — your own cash, recourse loans (loans you're personally liable for), and certain qualified nonrecourse financing. Other nonrecourse loans (where you have no personal liability) generally don’t count unless they meet strict IRS criteria.

Incorrectly disregarding these limitations could lead to IRS adjustments, unexpected tax bills, or missed loss deductions you were entitled to claim.

Who Must File IRS Form 6198?

The IRS requires taxpayers engaged in activities involving at-risk rules to file Form 6198. This typically applies when you:

Participate in a business or investment activity subject to at-risk rules (e.g., partnerships, S corporations, sole proprietorships).

Claim losses related to these activities on your income tax return.

Have certain financing in place, such as recourse or qualified nonrecourse loans.

If you are claiming a loss on Schedule E of your Form 1040 related to an activity governed by at-risk limits, you probably need to file.

Startups structured as passthrough entities or those using complex financing arrangements should pay particular attention.

Breaking Down the Key Components of Form 6198

Understanding the structure of the form helps demystify the process. Here are the main sections:

Part of Form 6198 | Purpose | What Founders Should Know |

Part I: Income or Loss From Activity | Report the activity’s income or loss for the tax year | Helps identify the net annual result from the specific marketplace, product line, or investment |

Part II: Amount At Risk | Calculate how much you're economically at risk for | Includes initial investment, recourse loans, and qualified nonrecourse financing |

Part III: Deductible Loss or Carryover | Determine how much of the current-year loss can be deducted | Excess losses are deferred until additional risk basis is created |

Part IV: Worksheets | Add detail for complex calculations | Ensures accurate reconciliation for your financials and IRS filing |

How to Calculate Your At-Risk Amount: Step-by-Step

Working through Form 6198 starts with a clear understanding of what you've put into the business, where your risk lies, and what income or losses you’ve realized during the year.

Step 1: Tally Initial Investment and Contributions

Count all cash contributions to the activity.

Add the adjusted basis of the property you contributed.

Include amounts of recourse debt you’re personally liable for.

For example, if you've invested $75,000 in capital and personally guarantee a $25,000 startup loan, your at-risk amount starts at $100,000.

Step 2: Add Qualified Nonrecourse Financing (If Applicable)

Qualified nonrecourse financing is a key exception. It applies if the loan:

Is borrowed from a qualified lender,

Is secured by real property used in the activity,

Follows IRS regulations under Section 465.

This is often relevant for real estate investments but rare in tech startups. Still, if applicable, it boosts your at-risk amount.

Step 3: Adjust for Income, Losses, and Withdrawals

Add any current-year income derived from the activity.

Subtract prior-year deducted losses.

Subtract cash or property distributions taken from the company.

This determines your net economic exposure in real-time.

Step 4: Calculate Deductible Losses

Deductible losses are limited to your net at-risk amount. Any portion above that is suspended and carried forward for deduction in a future year when at-risk levels increase or when the activity is sold or dissolved.

How Form 6198 Interacts With Other Tax Limitation Rules

At-risk rules are just one layer of the tax-loss framework. Other relevant limits include:

Basis limitations – Determines total investment you can deduct in passthroughs like partnerships.

Passive activity rules (Form 8582) – Activities where you don’t materially participate may further restrict deductions.

Alternative Minimum Tax (AMT) – May offset some losses allowed under general rules.

For passive activity, you must file Form 8582.

Common Questions Founders Have About Form 6198

Do I Need a Separate Form 6198 for Each Activity?

Yes. Each separate business or investment subject to at-risk rules requires its own copy of Form 6198. Activities with different ownerships, industries, or financing usually don’t get aggregated.

What Happens If My At-Risk Amount Drops Below Zero?

Loss deductions are limited to $0 that year. Excess losses roll forward. Don’t report a negative at-risk balance on your return.

Do Nonrecourse Loans Count Toward My At-Risk Amount?

Only if they qualify as ""qualified nonrecourse financing"" under IRS rules. Typical nonrecourse debt—such as unsecured loans where you have no personal liability—does not.

What Are Examples of Qualifying Activities?

Businesses operated as sole proprietorships

Partnerships and S-corporations with active operations

Investment activities with the intent to generate profit

Non-business assets like personal portfolios generally don’t qualify.

Five Practical Tips for Managing At-Risk Limitations

Track Capital and Loans Accurately

Maintain clear documentation of cash contributions, loans, and ownership changes.Classify Debt Types Carefully

Keep records distinguishing between recourse vs. nonrecourse financing and confirm any safe harbor terms.Reassess Risk Annually

Update your at-risk basis each year with changes in income, withdrawals, or financing structures.Keep Tabs on Deferred Losses

Suspended losses aren’t gone—they’re waiting to be claimed when your risk increases. Track them year-to-year.Work With Bookkeeping and Tax Pros

Use systems and advisors that understand at-risk calculations—especially for passthrough structures.

How Tech-Enabled Bookkeeping Helps With Form 6198

Sophisticated accounting platforms can automate much of the tracking needed for Form 6198 compliance:

Automatically tag recourse vs. nonrecourse liabilities

Reconcile income/losses to specific activities

Generate at-risk activity reports for your CPA or tax team

With smarter data reporting, you can avoid manual errors and clarify your deduction limits faster.

Form 6198 Is a Strategic Advantage

Understanding and properly applying Form 6198 rules ensures that your business only deducts losses you’re financially responsible for—while capturing every valid tax benefit you're entitled to. This approach protects your business from audit risk and positions you to take advantage of loss deductions in the years they benefit you most.

As your business grows and financing becomes more complex, keeping your at-risk tracking compliant and current will safeguard long-term success.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026