Go Back

Last Updated :

Last Updated :

Jan 5, 2026

Jan 5, 2026

Form 5498-SA Guide: HSA, Archer MSA & MA MSA Contribution Reporting

For founders steering startups, agencies, or e-commerce ventures in the United States, understanding the intricacies of tax forms like Form 5498-SA is essential to maintaining compliant, efficient financial operations.

This guide simplifies the role of Form 5498-SA in reporting Health Savings Account (HSA), Archer Medical Savings Account (MSA), and Medicare Advantage Medical Savings Account (MA MSA) contributions. It will help you navigate contribution reporting confidently, optimize your tax position, and avoid costly mistakes.

What is Form 5498-SA and Why Founders Should Care

Form 5498-SA is an IRS information return used chiefly by HSA custodians and MSA trustees to report contributions made to these health savings accounts during the tax year. While this form is primarily filed by the custodian, as a founder familiar with your company's benefits and compensation structure, reviewing and understanding this form ensures your startup's healthcare benefits and employee contributions align with IRS requirement.

Specifically, Form 5498-SA reports contributions for three account types:

Health Savings Accounts (HSAs): Popular among startups offering high-deductible health plans (HDHPs).

Archer MSAs: Often used by small business owners and self-employed individuals to manage medical costs.

Medicare Advantage MSAs (MA MSAs): Health savings accounts associated with Medicare Advantage plans.

Who Needs to File?

The custodian or trustee of the account (usually a bank or insurance company) is responsible for filing Form 5498-SA with the IRS and providing a copy to the participant.

As a founder, you are not the primary filer, but you must ensure your HR or payroll systems correctly track and report employer contributions to these custodians. If you are self-employed and manage your own HSA or MSA, you must ensure your custodian receives accurate data for this form.

When is it Due?

Form 5498-SA has a unique timeline because contributions for a given tax year can often be made until the tax filing deadline (usually April 15 of the following year).

Deadline to Participant: Custodians must provide Copy B to the account holder by May 31.

Deadline to IRS: The form must be filed with the IRS by May 31.

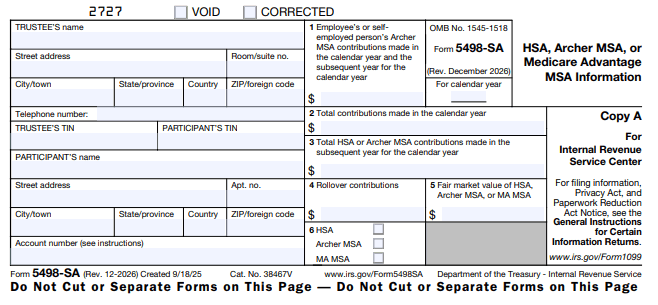

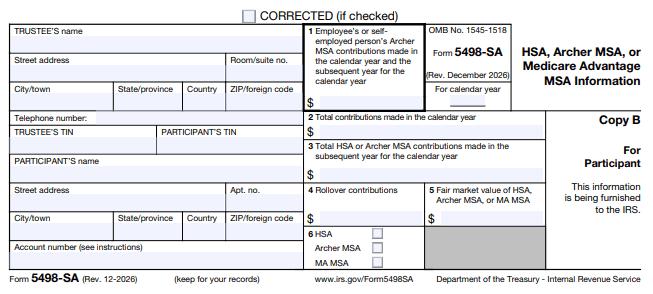

Step-by-Step: Understanding the Key Boxes

Step 1: Employee/Self-Employed Contributions (Box 1)

What it is: Reports contributions made to an Archer MSA by the participant or a self-employed person during the calendar year and by April 15 of the following year.

Step 2: Total HSA/MSA Contributions (Box 2)

What it is: This box shows the total contributions made specifically to an HSA or Archer MSA during the calendar year.

Step 3: Subsequent Year Contributions (Box 3)

What it is: Shows contributions made between January 1 and April 15 of the current year that are designated for the prior tax year. This is a common way for founders to maximize their tax benefits after the year has ended.

Step 4: Rollover Contributions (Box 4)

What it is: Reports any "rollover" contributions—money moved from one HSA or Archer MSA to another. Note: Rollovers do not count toward your annual contribution limits.

Step 5: Fair Market Value (Box 5)

What it is: The total value of the account as of December 31. This is useful for your internal financial tracking and net worth assessments.

Step 6: Identify the Account Type (Box 6)

What it is: Indicates whether the account is an HSA, Archer MSA, or MA MSA.

Common Mistakes to Avoid

Exceeding Annual Limits: If employer + employee contributions exceed the annual IRS limit, you may face a 6% excise tax on the excess.

Confusing 5498-SA with 1099-SA: Form 5498-SA is for contributions (money in); Form 1099-SA is for distributions (money out).

Ignoring Rollovers: Failing to ensure rollovers are correctly coded in Box 4 can lead the IRS to think you’ve exceeded your annual contribution limit.

FAQs

Q: Do I need to attach Form 5498-SA to my tax return?

A: No. It is an information return for your records. The IRS already has a copy from your custodian.

Q: Can I contribute to an HSA if I don't have an HDHP?

A: No. You must be enrolled in a qualifying High-Deductible Health Plan to make or receive HSA contributions.

Master Your Benefits Strategy with Haven

As you scale, managing employee benefits and the resulting tax compliance shouldn't be a hurdle. Haven provides founder-friendly tax and bookkeeping support to keep your operations lean and compliant.

Integrated Benefits Tracking: We help reconcile payroll data with custodian reports to ensure Box 2 and Box 3 accuracy.

Compliance Monitoring: We flag potential over-contributions before they trigger IRS excise taxes.

Agile Reporting: Our platform centralizes your tax documents, from 5498-SA to R&D credits, in one clear dashboard.

For founders steering startups, agencies, or e-commerce ventures in the United States, understanding the intricacies of tax forms like Form 5498-SA is essential to maintaining compliant, efficient financial operations.

This guide simplifies the role of Form 5498-SA in reporting Health Savings Account (HSA), Archer Medical Savings Account (MSA), and Medicare Advantage Medical Savings Account (MA MSA) contributions. It will help you navigate contribution reporting confidently, optimize your tax position, and avoid costly mistakes.

What is Form 5498-SA and Why Founders Should Care

Form 5498-SA is an IRS information return used chiefly by HSA custodians and MSA trustees to report contributions made to these health savings accounts during the tax year. While this form is primarily filed by the custodian, as a founder familiar with your company's benefits and compensation structure, reviewing and understanding this form ensures your startup's healthcare benefits and employee contributions align with IRS requirement.

Specifically, Form 5498-SA reports contributions for three account types:

Health Savings Accounts (HSAs): Popular among startups offering high-deductible health plans (HDHPs).

Archer MSAs: Often used by small business owners and self-employed individuals to manage medical costs.

Medicare Advantage MSAs (MA MSAs): Health savings accounts associated with Medicare Advantage plans.

Who Needs to File?

The custodian or trustee of the account (usually a bank or insurance company) is responsible for filing Form 5498-SA with the IRS and providing a copy to the participant.

As a founder, you are not the primary filer, but you must ensure your HR or payroll systems correctly track and report employer contributions to these custodians. If you are self-employed and manage your own HSA or MSA, you must ensure your custodian receives accurate data for this form.

When is it Due?

Form 5498-SA has a unique timeline because contributions for a given tax year can often be made until the tax filing deadline (usually April 15 of the following year).

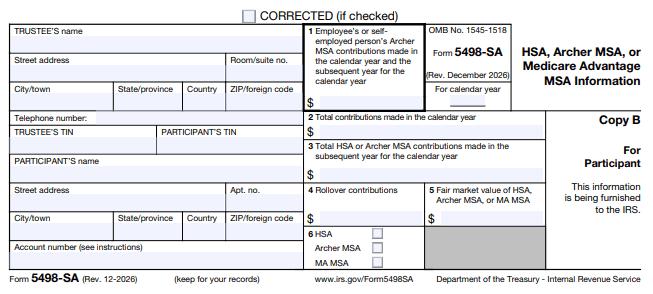

Deadline to Participant: Custodians must provide Copy B to the account holder by May 31.

Deadline to IRS: The form must be filed with the IRS by May 31.

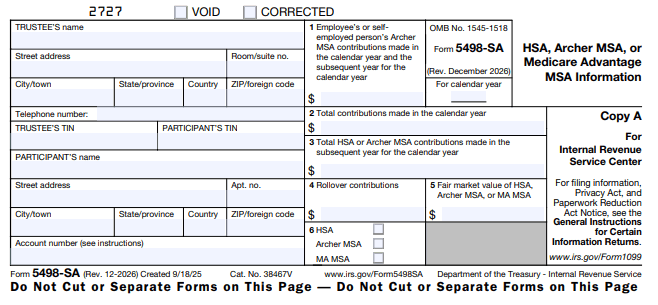

Step-by-Step: Understanding the Key Boxes

Step 1: Employee/Self-Employed Contributions (Box 1)

What it is: Reports contributions made to an Archer MSA by the participant or a self-employed person during the calendar year and by April 15 of the following year.

Step 2: Total HSA/MSA Contributions (Box 2)

What it is: This box shows the total contributions made specifically to an HSA or Archer MSA during the calendar year.

Step 3: Subsequent Year Contributions (Box 3)

What it is: Shows contributions made between January 1 and April 15 of the current year that are designated for the prior tax year. This is a common way for founders to maximize their tax benefits after the year has ended.

Step 4: Rollover Contributions (Box 4)

What it is: Reports any "rollover" contributions—money moved from one HSA or Archer MSA to another. Note: Rollovers do not count toward your annual contribution limits.

Step 5: Fair Market Value (Box 5)

What it is: The total value of the account as of December 31. This is useful for your internal financial tracking and net worth assessments.

Step 6: Identify the Account Type (Box 6)

What it is: Indicates whether the account is an HSA, Archer MSA, or MA MSA.

Common Mistakes to Avoid

Exceeding Annual Limits: If employer + employee contributions exceed the annual IRS limit, you may face a 6% excise tax on the excess.

Confusing 5498-SA with 1099-SA: Form 5498-SA is for contributions (money in); Form 1099-SA is for distributions (money out).

Ignoring Rollovers: Failing to ensure rollovers are correctly coded in Box 4 can lead the IRS to think you’ve exceeded your annual contribution limit.

FAQs

Q: Do I need to attach Form 5498-SA to my tax return?

A: No. It is an information return for your records. The IRS already has a copy from your custodian.

Q: Can I contribute to an HSA if I don't have an HDHP?

A: No. You must be enrolled in a qualifying High-Deductible Health Plan to make or receive HSA contributions.

Master Your Benefits Strategy with Haven

As you scale, managing employee benefits and the resulting tax compliance shouldn't be a hurdle. Haven provides founder-friendly tax and bookkeeping support to keep your operations lean and compliant.

Integrated Benefits Tracking: We help reconcile payroll data with custodian reports to ensure Box 2 and Box 3 accuracy.

Compliance Monitoring: We flag potential over-contributions before they trigger IRS excise taxes.

Agile Reporting: Our platform centralizes your tax documents, from 5498-SA to R&D credits, in one clear dashboard.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026