Go Back

Last Updated :

Last Updated :

Jan 6, 2026

Jan 6, 2026

Form 4797 Filing Guide: Reporting Business Property Sales

For startup founders and finance leaders, navigating the complexities of asset disposal can lead to significant tax savings if handled correctly. IRS Form 4797 is the primary tool for reporting gains and losses from the sale or exchange of business property—including equipment, buildings, and even certain intangible assets.

Properly mastering this filing allows your team to avoid costly errors, optimize deductions, and maintain the robust records essential for a growing company.

What is Form 4797 and Why It Matters for Founders

Form 4797 is used to report the sale of depreciable assets, real estate, and other business-use property. For startups, this form is critical for:

Accurate Gain/Loss Reporting: It distinguishes between ordinary gains, capital gains, and losses, which directly impacts your tax rate.

Depreciation Recapture: If you've claimed depreciation on an asset, this form reconciles that "recaptured" amount, which is often taxed as ordinary income.

Strategic Cash Flow: Understanding these filings helps you plan acquisitions or business disposals with a clear view of the tax impact.

Who Needs to File?

You must file Form 4797 if you:

Sold or exchanged business property held for more than one year.

Disposed of depreciable property at a gain (triggering recapture rules).

Experienced involuntary conversions (like theft or casualty) of business assets.

Key Categories of Business Property

Before filling out the form, identify which category your transaction falls into to ensure the best tax treatment.

Category | Description | Example | Tax Treatment |

Section 1231 Property | Real or depreciable property used in business >1 year. | Machinery, office buildings. | Gains as capital gains; losses as ordinary. |

Ordinary Property | Assets held <1 year or ineligible for capital gains. | Inventory or short-term assets. | Gains/losses treated as ordinary income. |

Installment Sales | Sales where payment is received over time. | Equipment sold on a payment plan. | Income reported over time to aid cash flow. |

Step-by-Step: How to Fill Out Form 4797

1. Gather Documentation

Assemble purchase/sale invoices, acquisition dates, cost basis, and accumulated depreciation details.

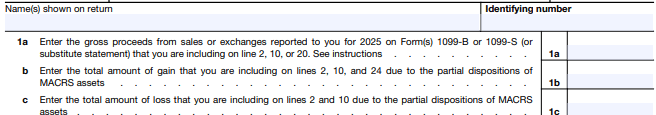

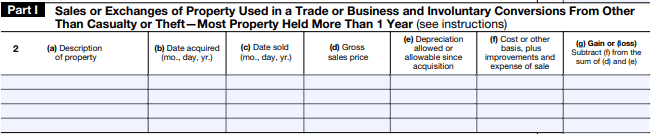

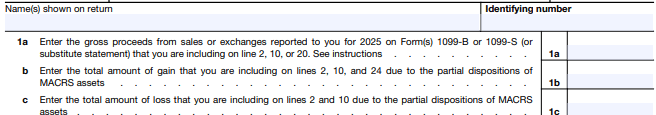

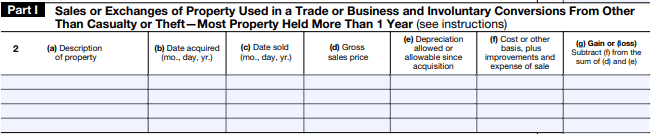

2. Complete Part I: Section 1231 Assets

This section is for property used in your business for more than 12 months.

Enter Proceeds: List gross sales price in column (d).

Calculate Basis: Subtract depreciation in column (e) from the cost in column (f).

Find Gain/Loss: Subtract the basis from the sales price.

3. Complete Part II: Ordinary Gains and Losses

Use this for property held for one year or less or for ordinary assets like inventory. Reporting here prevents misclassifying short-term holdings, which reduces your audit risk.

4. Complete Part III: Depreciation Recapture

Report gains from dispositions subject to recapture under Sections 1245 or 1250. This is vital when selling an asset for more than its depreciated value.

Line 22: Enter total depreciation allowed or allowable.

Line 24: Calculate total gain.

Lines 25–29: Determine the portion taxed as ordinary income based on the specific asset type.

Common Mistakes to Avoid

Inaccurate Depreciation Schedules: Outdated tracking leads to errors in recapture calculations.

Miscalculating Holding Periods: Selling an asset at 11 months instead of 13 months can cost you favorable Section 1231 capital gains treatment.

Ignoring R&D Synergies: Failing to track asset purchases used for R&D can mean missing out on added tax credits.

FAQs

When is Form 4797 due?

It is attached to your annual business tax return (e.g., Form 1065, 1120, or 1040) and is due at the same time as that return.

What if I have a loss on a business asset sale?

Section 1231 losses are generally treated as ordinary losses, meaning they can be used to offset your ordinary business income, which is often a significant tax advantage.

Maximize Your Tax Strategy with Haven

Handling asset disposals shouldn't be a source of stress. Haven’s expert team supports startups and e-commerce brands with modern, tailored tax filing services that ensure your property sales are reported advantageously.

Strategic Planning: We help you time asset sales to qualify for better tax rates.

Accurate Recapture: Our systems integrate your depreciation schedules directly into Part III calculations to prevent costly IRS errors.

For startup founders and finance leaders, navigating the complexities of asset disposal can lead to significant tax savings if handled correctly. IRS Form 4797 is the primary tool for reporting gains and losses from the sale or exchange of business property—including equipment, buildings, and even certain intangible assets.

Properly mastering this filing allows your team to avoid costly errors, optimize deductions, and maintain the robust records essential for a growing company.

What is Form 4797 and Why It Matters for Founders

Form 4797 is used to report the sale of depreciable assets, real estate, and other business-use property. For startups, this form is critical for:

Accurate Gain/Loss Reporting: It distinguishes between ordinary gains, capital gains, and losses, which directly impacts your tax rate.

Depreciation Recapture: If you've claimed depreciation on an asset, this form reconciles that "recaptured" amount, which is often taxed as ordinary income.

Strategic Cash Flow: Understanding these filings helps you plan acquisitions or business disposals with a clear view of the tax impact.

Who Needs to File?

You must file Form 4797 if you:

Sold or exchanged business property held for more than one year.

Disposed of depreciable property at a gain (triggering recapture rules).

Experienced involuntary conversions (like theft or casualty) of business assets.

Key Categories of Business Property

Before filling out the form, identify which category your transaction falls into to ensure the best tax treatment.

Category | Description | Example | Tax Treatment |

Section 1231 Property | Real or depreciable property used in business >1 year. | Machinery, office buildings. | Gains as capital gains; losses as ordinary. |

Ordinary Property | Assets held <1 year or ineligible for capital gains. | Inventory or short-term assets. | Gains/losses treated as ordinary income. |

Installment Sales | Sales where payment is received over time. | Equipment sold on a payment plan. | Income reported over time to aid cash flow. |

Step-by-Step: How to Fill Out Form 4797

1. Gather Documentation

Assemble purchase/sale invoices, acquisition dates, cost basis, and accumulated depreciation details.

2. Complete Part I: Section 1231 Assets

This section is for property used in your business for more than 12 months.

Enter Proceeds: List gross sales price in column (d).

Calculate Basis: Subtract depreciation in column (e) from the cost in column (f).

Find Gain/Loss: Subtract the basis from the sales price.

3. Complete Part II: Ordinary Gains and Losses

Use this for property held for one year or less or for ordinary assets like inventory. Reporting here prevents misclassifying short-term holdings, which reduces your audit risk.

4. Complete Part III: Depreciation Recapture

Report gains from dispositions subject to recapture under Sections 1245 or 1250. This is vital when selling an asset for more than its depreciated value.

Line 22: Enter total depreciation allowed or allowable.

Line 24: Calculate total gain.

Lines 25–29: Determine the portion taxed as ordinary income based on the specific asset type.

Common Mistakes to Avoid

Inaccurate Depreciation Schedules: Outdated tracking leads to errors in recapture calculations.

Miscalculating Holding Periods: Selling an asset at 11 months instead of 13 months can cost you favorable Section 1231 capital gains treatment.

Ignoring R&D Synergies: Failing to track asset purchases used for R&D can mean missing out on added tax credits.

FAQs

When is Form 4797 due?

It is attached to your annual business tax return (e.g., Form 1065, 1120, or 1040) and is due at the same time as that return.

What if I have a loss on a business asset sale?

Section 1231 losses are generally treated as ordinary losses, meaning they can be used to offset your ordinary business income, which is often a significant tax advantage.

Maximize Your Tax Strategy with Haven

Handling asset disposals shouldn't be a source of stress. Haven’s expert team supports startups and e-commerce brands with modern, tailored tax filing services that ensure your property sales are reported advantageously.

Strategic Planning: We help you time asset sales to qualify for better tax rates.

Accurate Recapture: Our systems integrate your depreciation schedules directly into Part III calculations to prevent costly IRS errors.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026