Go Back

Last Updated :

Last Updated :

Jan 26, 2026

Jan 26, 2026

Form 3468: Claim the Investment Credit for Your Business

Navigating business tax credits can feel complex, but understanding and leveraging forms like Form 3468 can unlock valuable savings and fuel your startup’s growth. For founders, COOs, and finance leads managing startup finances, the investment tax credit available through Form 3468 is a powerful tool to reduce tax liability and improve cash flow.

This guide walks you through what Form 3468 is, who should file it, the types of credits it covers, and how to maximize your benefits efficiently. Along the way, we’ll link to relevant resources like our business tax services and deep dives on R&D tax credits to help you integrate this credit into your overall tax strategy.

What Is Form 3468 and Why It Matters for Your Business

Form 3468 is the IRS form used by eligible businesses to claim the investment credit — a key federal tax credit designed to encourage investment in certain property and projects. It consolidates several credit types that reward businesses for activities like renewable energy installations, rehabilitation of historic buildings, and general business investment in specific assets.

From a leadership perspective, understanding Form 3468 is critical because:

It can significantly reduce your business’s effective tax rate.

It supports investments that align with strategic growth (e.g., energy-efficient equipment, property improvements).

It streamlines claiming multiple credits under one form rather than multiple filings.

Types of Investment Credits Claimed on Form 3468

Form 3468 is segmented to capture various credit categories:

Form 3468 Part | Types of Investment Credits | Common Examples |

Part I – General Business Investment Credit | Credits related to investments in certain tangible property and specific qualified expenditures | Rehabilitation Credit (often historic rehab), Energy Credit |

Part II – Energy Property Credit | Credits for qualified energy property, such as solar panels, wind facilities, and geothermal property | Renewable Energy Equipment (solar, wind) |

Part III – Rehabilitation Investment Credit | Credits for expenses related to rehabilitating certified historic structures or buildings in older districts | Historic Building Rehab costs |

Founders of startups or ecommerce companies investing in property improvements, or those who have made qualified investments in renewable energy solutions, should pay special attention to Form 3468’s sections relevant to their asset portfolio. This ensures you don’t miss out on available credits.

Who Should File Form 3468? Eligibility and Filing Requirements

Understanding if your business qualifies to file Form 3468 is essential to avoid missing the chance to claim these credits.

Eligible Entities

Corporations, Partnerships & LLCs: Generally eligible if they have made qualified investments.

S-Corporations & Partnerships: Typically report credits through passthrough mechanisms to owners, but the entity generally files to calculate credits.

Tax-Exempt Organizations: Can claim certain credits related to rehabilitation expenditures.

Startups and Growing Companies: Particularly in capital-intensive sectors or investing in energy-efficient improvements.

When to File

You file Form 3468 with your annual income tax return — usually alongside the corporate return (Form 1120) or partnership return (Form 1065).

Supporting Documentation

To support your Form 3468 filing and reduce audit risk, maintain thorough documentation:

Receipts and invoices for qualifying assets and expenditures.

Certificates for energy property (e.g., solar equipment certifications).

Documentation for historic rehabilitation approval, if applicable.

Any relevant engineering or professional reports for energy projects.

If your business invests heavily in R&D and innovation, you might also be eligible for the R&D tax credit, which can complement the investment credit.

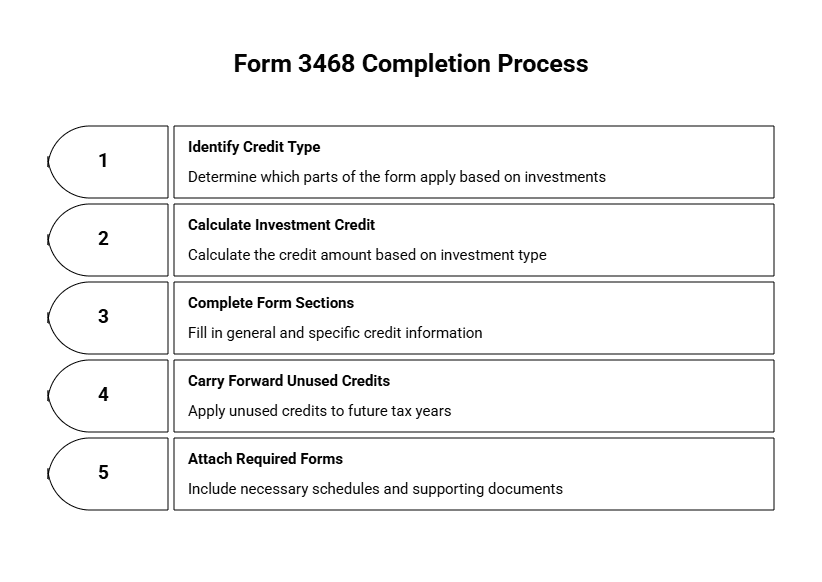

How to Complete Form 3468: Step-by-Step Overview

While tax preparation software or your CPA can handle the actual form completion, founders and finance leads should understand the form’s components and how needed data points affect your tax position.

Step 1: Identify the Credit Type(s) You Are Claiming

Review your recent investments to determine which parts (I, II, or III) apply.

For example, if you've installed solar panels, focus on Energy Property Credit (Part II).

For building improvements in certified historic districts, use Part III.

Step 2: Calculate Investment Credit Amounts

Part I covers general business investment credits, which often require calculating expenditure-based percentages.

Part II credits generally equal a percentage of qualified energy property costs (typically 10–30%).

Part III credit amounts usually depend on rehabilitation expenses approved by relevant agencies.

Step 3: Complete Form Sections Accurately

Fill in general information (business name, EIN).

Complete the specific lines related to your credits.

Ensure you carry forward any unused credits — often businesses cannot use the entire credit amount in one tax year and can apply it over subsequent years.

Step 4: Attach Required Schedules and Supporting Forms

Attach Certification Forms if applicable (for example, for Energy Investment Credits).

Attach Form 3800 (General Business Credit) if claiming multiple credits, as the investment credit is often part of a broader business credit portfolio.

Errors on Form 3468 could lead to IRS delays or denials, so review carefully or delegate to trusted tax specialists.

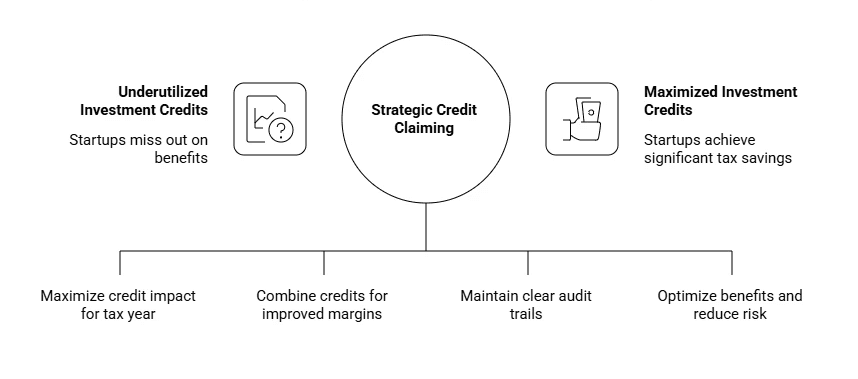

Maximizing the Benefits of Investment Credits for Your Startup

Startup founders and finance leaders should align claiming Form 3468 credits with overall business planning. Here are pragmatic tips:

Plan Investment Timing Strategically

Time capital spending to maximize credit impact for the tax year.

Coordinate with business milestones — e.g., equipment purchases during funding rounds or budget planning.

Leverage Credits alongside Other Incentives

Use Form 3468 credits in tandem with R&D credits and other incentives.

For companies that develop energy solutions, combining credits can improve margins significantly.

Learn more about stacking R&D credits with other tax savings strategies on our R&D tax credits page.

Keep Diligent Records

Maintain clear audit trails.

Document the business purpose for expenditures to defend credit claims.

Consult Experts Early

Given the form’s complexities and interaction with other tax credits, partnering with experienced tax advisors can optimize benefits and reduce risk. Explore our founder-focused business tax services tailored to startups and fast-growing companies.

Important Considerations and Common FAQs

Can startups with no taxable income benefit?

Yes. Unused investment credits can often be carried forward up to 20 years — preserving value as you scale.

How do passthrough entities handle Form 3468?

Passthroughs report credits to individual owners via Schedule K-1. The entity files Form 3468 to calculate the total credit.

Is there an expiration on credits?

Typically, credits have carry-forward periods (often 20 years), but check for updates on the IRS’s official Business Credits page.

Are state-level credits available?

Many states mirror federal investment credits or offer additional programs. Review your state’s tax incentives for potential double savings.

Take Control of Your Investment Tax Credits with Form 3468

By understanding eligibility, filing requirements, and practical tips to maximize benefits, you can confidently integrate the investment credit into your broader tax planning. For expert guidance and integrated support, connect with our team specializing in business tax services and unlock further savings through applicable credits, including R&D.

Remember, Form 3468 is not just about filing a form — it’s about strategic investment and growth. Approach it proactively and reap the rewards of startup-native tax credit management.

Navigating business tax credits can feel complex, but understanding and leveraging forms like Form 3468 can unlock valuable savings and fuel your startup’s growth. For founders, COOs, and finance leads managing startup finances, the investment tax credit available through Form 3468 is a powerful tool to reduce tax liability and improve cash flow.

This guide walks you through what Form 3468 is, who should file it, the types of credits it covers, and how to maximize your benefits efficiently. Along the way, we’ll link to relevant resources like our business tax services and deep dives on R&D tax credits to help you integrate this credit into your overall tax strategy.

What Is Form 3468 and Why It Matters for Your Business

Form 3468 is the IRS form used by eligible businesses to claim the investment credit — a key federal tax credit designed to encourage investment in certain property and projects. It consolidates several credit types that reward businesses for activities like renewable energy installations, rehabilitation of historic buildings, and general business investment in specific assets.

From a leadership perspective, understanding Form 3468 is critical because:

It can significantly reduce your business’s effective tax rate.

It supports investments that align with strategic growth (e.g., energy-efficient equipment, property improvements).

It streamlines claiming multiple credits under one form rather than multiple filings.

Types of Investment Credits Claimed on Form 3468

Form 3468 is segmented to capture various credit categories:

Form 3468 Part | Types of Investment Credits | Common Examples |

Part I – General Business Investment Credit | Credits related to investments in certain tangible property and specific qualified expenditures | Rehabilitation Credit (often historic rehab), Energy Credit |

Part II – Energy Property Credit | Credits for qualified energy property, such as solar panels, wind facilities, and geothermal property | Renewable Energy Equipment (solar, wind) |

Part III – Rehabilitation Investment Credit | Credits for expenses related to rehabilitating certified historic structures or buildings in older districts | Historic Building Rehab costs |

Founders of startups or ecommerce companies investing in property improvements, or those who have made qualified investments in renewable energy solutions, should pay special attention to Form 3468’s sections relevant to their asset portfolio. This ensures you don’t miss out on available credits.

Who Should File Form 3468? Eligibility and Filing Requirements

Understanding if your business qualifies to file Form 3468 is essential to avoid missing the chance to claim these credits.

Eligible Entities

Corporations, Partnerships & LLCs: Generally eligible if they have made qualified investments.

S-Corporations & Partnerships: Typically report credits through passthrough mechanisms to owners, but the entity generally files to calculate credits.

Tax-Exempt Organizations: Can claim certain credits related to rehabilitation expenditures.

Startups and Growing Companies: Particularly in capital-intensive sectors or investing in energy-efficient improvements.

When to File

You file Form 3468 with your annual income tax return — usually alongside the corporate return (Form 1120) or partnership return (Form 1065).

Supporting Documentation

To support your Form 3468 filing and reduce audit risk, maintain thorough documentation:

Receipts and invoices for qualifying assets and expenditures.

Certificates for energy property (e.g., solar equipment certifications).

Documentation for historic rehabilitation approval, if applicable.

Any relevant engineering or professional reports for energy projects.

If your business invests heavily in R&D and innovation, you might also be eligible for the R&D tax credit, which can complement the investment credit.

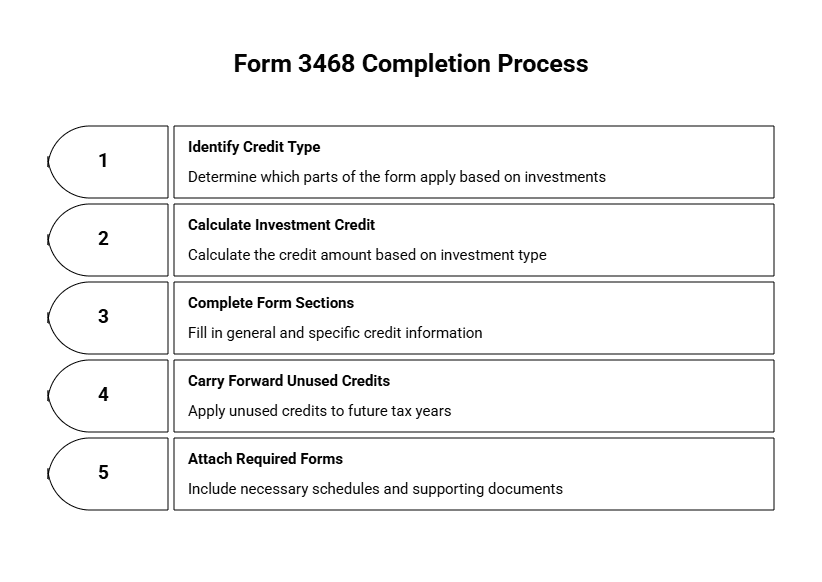

How to Complete Form 3468: Step-by-Step Overview

While tax preparation software or your CPA can handle the actual form completion, founders and finance leads should understand the form’s components and how needed data points affect your tax position.

Step 1: Identify the Credit Type(s) You Are Claiming

Review your recent investments to determine which parts (I, II, or III) apply.

For example, if you've installed solar panels, focus on Energy Property Credit (Part II).

For building improvements in certified historic districts, use Part III.

Step 2: Calculate Investment Credit Amounts

Part I covers general business investment credits, which often require calculating expenditure-based percentages.

Part II credits generally equal a percentage of qualified energy property costs (typically 10–30%).

Part III credit amounts usually depend on rehabilitation expenses approved by relevant agencies.

Step 3: Complete Form Sections Accurately

Fill in general information (business name, EIN).

Complete the specific lines related to your credits.

Ensure you carry forward any unused credits — often businesses cannot use the entire credit amount in one tax year and can apply it over subsequent years.

Step 4: Attach Required Schedules and Supporting Forms

Attach Certification Forms if applicable (for example, for Energy Investment Credits).

Attach Form 3800 (General Business Credit) if claiming multiple credits, as the investment credit is often part of a broader business credit portfolio.

Errors on Form 3468 could lead to IRS delays or denials, so review carefully or delegate to trusted tax specialists.

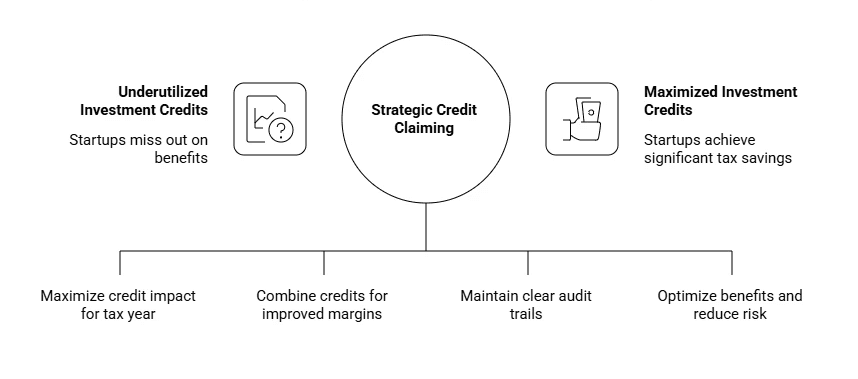

Maximizing the Benefits of Investment Credits for Your Startup

Startup founders and finance leaders should align claiming Form 3468 credits with overall business planning. Here are pragmatic tips:

Plan Investment Timing Strategically

Time capital spending to maximize credit impact for the tax year.

Coordinate with business milestones — e.g., equipment purchases during funding rounds or budget planning.

Leverage Credits alongside Other Incentives

Use Form 3468 credits in tandem with R&D credits and other incentives.

For companies that develop energy solutions, combining credits can improve margins significantly.

Learn more about stacking R&D credits with other tax savings strategies on our R&D tax credits page.

Keep Diligent Records

Maintain clear audit trails.

Document the business purpose for expenditures to defend credit claims.

Consult Experts Early

Given the form’s complexities and interaction with other tax credits, partnering with experienced tax advisors can optimize benefits and reduce risk. Explore our founder-focused business tax services tailored to startups and fast-growing companies.

Important Considerations and Common FAQs

Can startups with no taxable income benefit?

Yes. Unused investment credits can often be carried forward up to 20 years — preserving value as you scale.

How do passthrough entities handle Form 3468?

Passthroughs report credits to individual owners via Schedule K-1. The entity files Form 3468 to calculate the total credit.

Is there an expiration on credits?

Typically, credits have carry-forward periods (often 20 years), but check for updates on the IRS’s official Business Credits page.

Are state-level credits available?

Many states mirror federal investment credits or offer additional programs. Review your state’s tax incentives for potential double savings.

Take Control of Your Investment Tax Credits with Form 3468

By understanding eligibility, filing requirements, and practical tips to maximize benefits, you can confidently integrate the investment credit into your broader tax planning. For expert guidance and integrated support, connect with our team specializing in business tax services and unlock further savings through applicable credits, including R&D.

Remember, Form 3468 is not just about filing a form — it’s about strategic investment and growth. Approach it proactively and reap the rewards of startup-native tax credit management.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026