Go Back

Last Updated :

Last Updated :

Jan 19, 2026

Jan 19, 2026

Form 3115 Guide for Founders: Changing Accounting Methods (Application Rules)

For founders steering startups, e-commerce businesses, or agencies, understanding how your company’s accounting methods impact tax strategy is not just academic—it’s a vital part of managing cash flow, minimizing tax risk, and positioning your business for scalable growth.

Form 3115, the IRS Application for Change in Accounting Method, is the formal portal for requesting such changes. This guide is tailored for founders and finance leads who want to confidently navigate the application rules and optimize their accounting practices.

What Is Form 3115 and Why Does It Matter for Founders?

Form 3115 is the IRS form used to request a change in your business’s accounting method. Founders often face the question: Should we switch from cash to accrual accounting, or vice versa? Or perhaps you want to change how inventory is accounted for, or how you handle depreciation and amortization strategies.

Making such a change can affect not only your tax returns but also financial reporting and cash management. A shift in accounting method is not something to take lightly—it requires IRS approval to avoid penalties and costly misfilings.

Key Reasons Why Founders Consider Filing Form 3115

Optimize tax liabilities by timing income and deductions more favorably.

Comply with evolving business needs, especially after rounds of funding, new revenue models, or cost structures.

Streamline internal reporting aligned with investor or lender expectations.

For startups and agencies, particularly those with complex revenue streams or significant R&D spending, consulting the rules in this form is the first step to a smoother tax and financial reporting process.

Early in your evaluation, you may also want to explore services that make tax filing less taxing—like Haven’s responsive bookkeeping and tax support designed for modern startups.

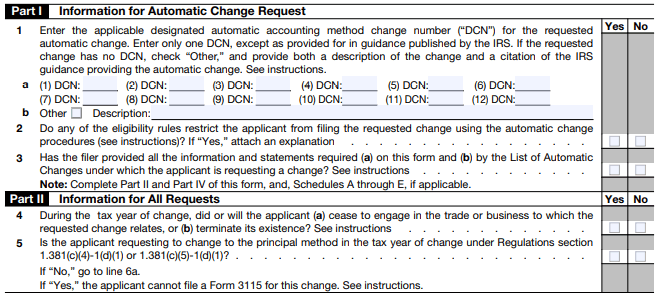

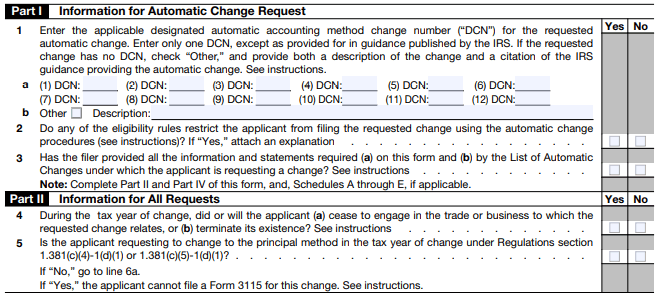

Understanding the Application Rules for Form 3115

The application rules for Form 3115 are grounded in IRS regulations and are broken down into procedural steps and timing requirements. A solid understanding will empower founders to make informed decisions without unnecessary delay.

1. Types of Accounting Method Changes

The IRS broadly classifies accounting method changes as:

Automatic Changes

These are routine changes pre-approved by the IRS if Form 3115 is correctly filed. Examples include:

Changing from cash to accrual accounting.

Updating depreciation methods listed in the IRS automatic change list.

Non-Automatic Changes

These require in-depth documentation and explicit approval, which tends to take more time.

Less common.

Often involves substantial changes to accounting policy or special business conditions.

Founders should review IRS guidance to determine whether their desired change is categorized as automatic. This distinction affects both the complexity and timing of your filing.

2. When and How to File

Timing: Generally, Form 3115 is filed with the tax return for the year of the change. In some cases, early filing with a prior year's return is permitted.

Attachments: You’ll need to provide:

A narrative detailing the change.

Financial justification.

A Section 481(a) adjustment calculation, if required.

Copies: A second copy must be mailed to the IRS National Office. Missing this step can delay the process.

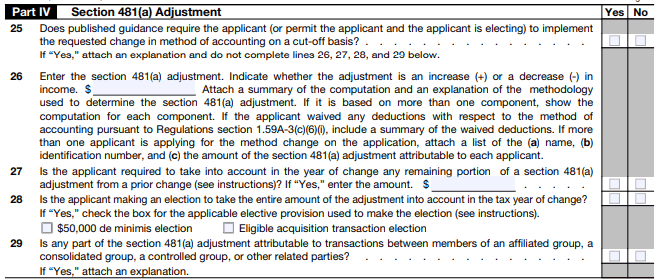

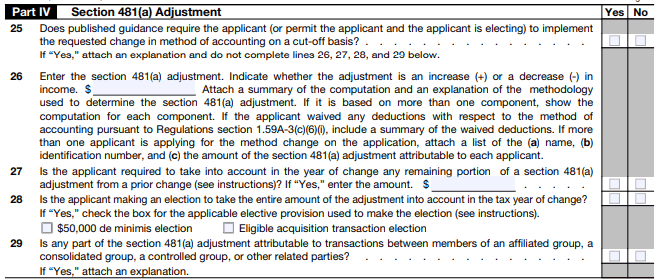

3. Section 481(a) Adjustment

A crucial element of accounting method changes is computing the Section 481(a) adjustment.

This calculation identifies the cumulative difference in income caused by the switch. It ensures income is reported only once—whether earned under the old or new method.

May result in additional income (and taxes) for one year.

In certain cases, the IRS allows the adjustment to be spread over four years, reducing the cash flow hit.

This is often the most technically complex part of the process and should be reviewed by a qualified tax professional.

4. Common Triggers for Filing Form 3115

Trigger Event | Example Scenario |

Changing the overall accounting method | Moving from cash to accrual for better accuracy |

Inventory accounting treatment | Switching to lower of cost or market method |

Depreciation or amortization method | Moving from straight-line to MACRS depreciation |

R&D cost treatment | Electing to capitalize rather than expensing immediately |

Startups with material R&D expenditures should time their Form 3115 submissions to align with R&D credit strategies, further enhancing tax savings. Haven offers dedicated support for combining these initiatives efficiently.

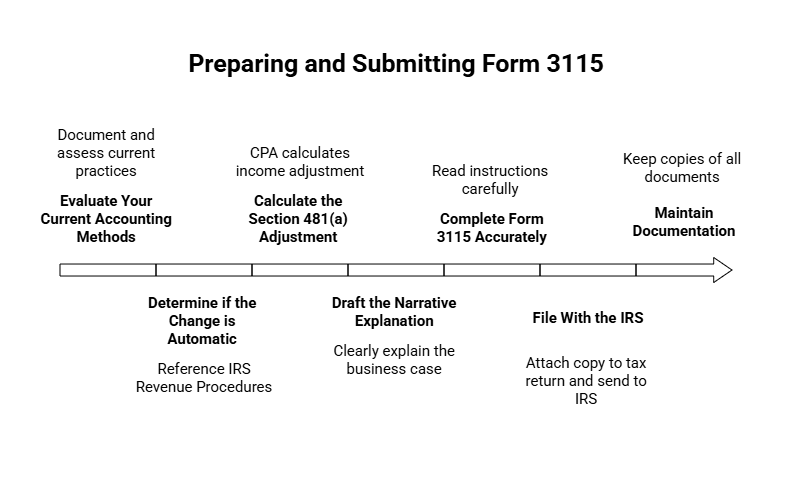

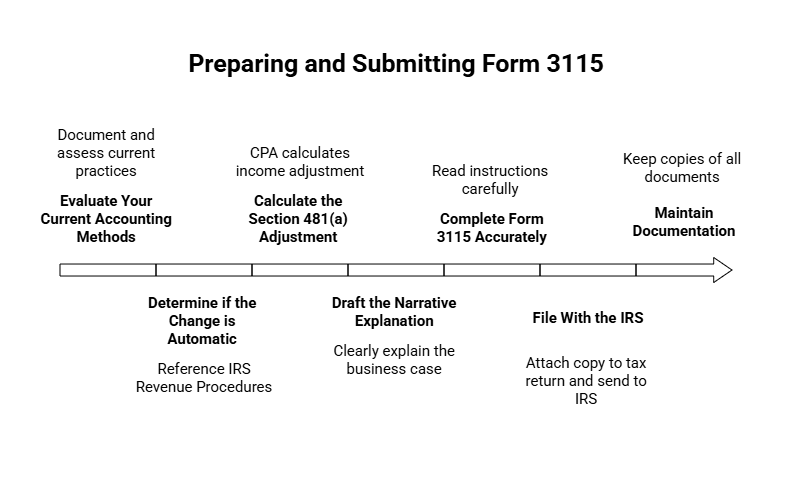

Practical Steps for Founders: Preparing and Submitting Form 3115

Here’s a step-by-step checklist for founders preparing to file Form 3115:

1. Evaluate Your Current Accounting Methods

Start by documenting how your company currently recognizes income and expenses. This usually means working with your controller, finance lead, or external accountant to outline existing accounting methods and assumptions.

At the same time, clarify why a change is needed. Common triggers include scaling revenue, shifting from cash to accrual accounting, preparing for due diligence, or aligning reporting with GAAP expectations.

2. Determine if the Change is Automatic

Not all accounting method changes require advance IRS approval. Many fall under the IRS’s automatic consent procedures, which streamline the filing process.

To confirm eligibility, review the relevant IRS revenue procedures—most notably Rev. Proc. 2015-13 and related updates. Automatic changes generally involve fewer administrative steps and faster resolution.

3. Calculate the Section 481(a) Adjustment

A required part of Form 3115 is the Section 481(a) adjustment, which accounts for the cumulative tax impact of switching methods.

This calculation can materially affect taxable income and near-term cash flow, so it’s typically prepared by an experienced CPA. The adjustment may increase or decrease income, depending on the direction of the change.

4. Draft the Narrative Explanation

Form 3115 requires a written explanation describing the accounting method change and the business rationale behind it.

Clarity matters here. The explanation should clearly outline what’s changing, why the change is appropriate, and how it aligns with IRS rules. Straightforward, factual language reduces the risk of follow-up questions from the IRS.

5. Complete Form 3115 Accurately

The form itself includes multiple sections, some of which may not apply depending on the type of change you’re making.

Carefully follow the IRS instructions and complete only the relevant portions. Errors or omissions can delay processing or invalidate the filing.

6. File With the IRS

Once complete, Form 3115 is generally filed by attaching a copy to your timely filed federal income tax return for the year of change. In many cases, an additional copy is sent separately to the IRS office specified in the instructions.

Filing correctly and on time is critical—late or incomplete submissions can result in the change being denied.

7. Maintain Documentation

Keep copies of everything: calculations, reason statements, and all correspondence.

This is especially vital if you're ever selected for audit or exam review.

If you'd rather avoid the administrative burden, Haven supports Form 3115 filings from planning through IRS correspondence—so you can focus on scaling.

How Form 3115 Intersects with Startup Financial Strategy

Accounting method changes have real implications for startup operations. Here's how strategic use of Form 3115 supports growth:

Cash Flow Management

Switching to cash accounting may temporarily defer income recognition, improving liquidity—especially helpful during rapid hiring or product launches.

Investor and GAAP Reporting

Shifting to accrual accounting supports Generally Accepted Accounting Principles (GAAP), aligning better with fundraising or M&A due diligence expectations.

Capital Expenditures and R&D

Capitalizing rather than expensing major investments (via accounting method change) can change the timing of deductions and improve EBITDA.

Tax Planning Synergies

Coordinate Form 3115 filings with credits like the federal R&D tax credit for amplified tax efficiency. Check out Haven’s article on Form 1120 corporate tax filing for complementary strategies.

Confidently Managing Your Form 3115 Filing for Business Growth

Successfully navigating Form 3115 and its complex application rules puts founders in control of their startup’s tax positioning and financial transparency. Whether you are changing from cash to accrual accounting, updating your depreciation methods, or adjusting inventory accounting, understanding this crucial IRS form protects against missteps and unlocks tax efficiencies.

For startup founders and financial leaders, aligning your accounting method with business strategy is a powerful lever—when done correctly with Form 3115 as your tool. At Haven, we specialize in guiding US startups and e-commerce companies through these changes with modern bookkeeping, tax filing, and R&D credit support.

For founders steering startups, e-commerce businesses, or agencies, understanding how your company’s accounting methods impact tax strategy is not just academic—it’s a vital part of managing cash flow, minimizing tax risk, and positioning your business for scalable growth.

Form 3115, the IRS Application for Change in Accounting Method, is the formal portal for requesting such changes. This guide is tailored for founders and finance leads who want to confidently navigate the application rules and optimize their accounting practices.

What Is Form 3115 and Why Does It Matter for Founders?

Form 3115 is the IRS form used to request a change in your business’s accounting method. Founders often face the question: Should we switch from cash to accrual accounting, or vice versa? Or perhaps you want to change how inventory is accounted for, or how you handle depreciation and amortization strategies.

Making such a change can affect not only your tax returns but also financial reporting and cash management. A shift in accounting method is not something to take lightly—it requires IRS approval to avoid penalties and costly misfilings.

Key Reasons Why Founders Consider Filing Form 3115

Optimize tax liabilities by timing income and deductions more favorably.

Comply with evolving business needs, especially after rounds of funding, new revenue models, or cost structures.

Streamline internal reporting aligned with investor or lender expectations.

For startups and agencies, particularly those with complex revenue streams or significant R&D spending, consulting the rules in this form is the first step to a smoother tax and financial reporting process.

Early in your evaluation, you may also want to explore services that make tax filing less taxing—like Haven’s responsive bookkeeping and tax support designed for modern startups.

Understanding the Application Rules for Form 3115

The application rules for Form 3115 are grounded in IRS regulations and are broken down into procedural steps and timing requirements. A solid understanding will empower founders to make informed decisions without unnecessary delay.

1. Types of Accounting Method Changes

The IRS broadly classifies accounting method changes as:

Automatic Changes

These are routine changes pre-approved by the IRS if Form 3115 is correctly filed. Examples include:

Changing from cash to accrual accounting.

Updating depreciation methods listed in the IRS automatic change list.

Non-Automatic Changes

These require in-depth documentation and explicit approval, which tends to take more time.

Less common.

Often involves substantial changes to accounting policy or special business conditions.

Founders should review IRS guidance to determine whether their desired change is categorized as automatic. This distinction affects both the complexity and timing of your filing.

2. When and How to File

Timing: Generally, Form 3115 is filed with the tax return for the year of the change. In some cases, early filing with a prior year's return is permitted.

Attachments: You’ll need to provide:

A narrative detailing the change.

Financial justification.

A Section 481(a) adjustment calculation, if required.

Copies: A second copy must be mailed to the IRS National Office. Missing this step can delay the process.

3. Section 481(a) Adjustment

A crucial element of accounting method changes is computing the Section 481(a) adjustment.

This calculation identifies the cumulative difference in income caused by the switch. It ensures income is reported only once—whether earned under the old or new method.

May result in additional income (and taxes) for one year.

In certain cases, the IRS allows the adjustment to be spread over four years, reducing the cash flow hit.

This is often the most technically complex part of the process and should be reviewed by a qualified tax professional.

4. Common Triggers for Filing Form 3115

Trigger Event | Example Scenario |

Changing the overall accounting method | Moving from cash to accrual for better accuracy |

Inventory accounting treatment | Switching to lower of cost or market method |

Depreciation or amortization method | Moving from straight-line to MACRS depreciation |

R&D cost treatment | Electing to capitalize rather than expensing immediately |

Startups with material R&D expenditures should time their Form 3115 submissions to align with R&D credit strategies, further enhancing tax savings. Haven offers dedicated support for combining these initiatives efficiently.

Practical Steps for Founders: Preparing and Submitting Form 3115

Here’s a step-by-step checklist for founders preparing to file Form 3115:

1. Evaluate Your Current Accounting Methods

Start by documenting how your company currently recognizes income and expenses. This usually means working with your controller, finance lead, or external accountant to outline existing accounting methods and assumptions.

At the same time, clarify why a change is needed. Common triggers include scaling revenue, shifting from cash to accrual accounting, preparing for due diligence, or aligning reporting with GAAP expectations.

2. Determine if the Change is Automatic

Not all accounting method changes require advance IRS approval. Many fall under the IRS’s automatic consent procedures, which streamline the filing process.

To confirm eligibility, review the relevant IRS revenue procedures—most notably Rev. Proc. 2015-13 and related updates. Automatic changes generally involve fewer administrative steps and faster resolution.

3. Calculate the Section 481(a) Adjustment

A required part of Form 3115 is the Section 481(a) adjustment, which accounts for the cumulative tax impact of switching methods.

This calculation can materially affect taxable income and near-term cash flow, so it’s typically prepared by an experienced CPA. The adjustment may increase or decrease income, depending on the direction of the change.

4. Draft the Narrative Explanation

Form 3115 requires a written explanation describing the accounting method change and the business rationale behind it.

Clarity matters here. The explanation should clearly outline what’s changing, why the change is appropriate, and how it aligns with IRS rules. Straightforward, factual language reduces the risk of follow-up questions from the IRS.

5. Complete Form 3115 Accurately

The form itself includes multiple sections, some of which may not apply depending on the type of change you’re making.

Carefully follow the IRS instructions and complete only the relevant portions. Errors or omissions can delay processing or invalidate the filing.

6. File With the IRS

Once complete, Form 3115 is generally filed by attaching a copy to your timely filed federal income tax return for the year of change. In many cases, an additional copy is sent separately to the IRS office specified in the instructions.

Filing correctly and on time is critical—late or incomplete submissions can result in the change being denied.

7. Maintain Documentation

Keep copies of everything: calculations, reason statements, and all correspondence.

This is especially vital if you're ever selected for audit or exam review.

If you'd rather avoid the administrative burden, Haven supports Form 3115 filings from planning through IRS correspondence—so you can focus on scaling.

How Form 3115 Intersects with Startup Financial Strategy

Accounting method changes have real implications for startup operations. Here's how strategic use of Form 3115 supports growth:

Cash Flow Management

Switching to cash accounting may temporarily defer income recognition, improving liquidity—especially helpful during rapid hiring or product launches.

Investor and GAAP Reporting

Shifting to accrual accounting supports Generally Accepted Accounting Principles (GAAP), aligning better with fundraising or M&A due diligence expectations.

Capital Expenditures and R&D

Capitalizing rather than expensing major investments (via accounting method change) can change the timing of deductions and improve EBITDA.

Tax Planning Synergies

Coordinate Form 3115 filings with credits like the federal R&D tax credit for amplified tax efficiency. Check out Haven’s article on Form 1120 corporate tax filing for complementary strategies.

Confidently Managing Your Form 3115 Filing for Business Growth

Successfully navigating Form 3115 and its complex application rules puts founders in control of their startup’s tax positioning and financial transparency. Whether you are changing from cash to accrual accounting, updating your depreciation methods, or adjusting inventory accounting, understanding this crucial IRS form protects against missteps and unlocks tax efficiencies.

For startup founders and financial leaders, aligning your accounting method with business strategy is a powerful lever—when done correctly with Form 3115 as your tool. At Haven, we specialize in guiding US startups and e-commerce companies through these changes with modern bookkeeping, tax filing, and R&D credit support.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026