Go Back

Last Updated :

Last Updated :

Jan 15, 2026

Jan 15, 2026

Learn how startup founders can use Form 1099-MISC to report miscellaneous income like rent or legal fees without risking IRS penalties. Step-by-step guide.

For founders navigating the financial complexities of startups, agencies, and e-commerce businesses, understanding Form 1099-MISC is essential. This tax form plays a crucial role in reporting various types of miscellaneous income and avoiding IRS penalties.

In this guide, we break down everything you need to know about Form 1099-MISC from a founder’s perspective, focusing on practical steps and insights to help you streamline your bookkeeping, maximize compliance, and confidently manage your tax filings.

What Is Form 1099-MISC and Why Founders Need It

Form 1099-MISC is an IRS tax document used to report payments made in the course of business to non-employees. If your startup or agency hires independent contractors, rents office space, pays legal settlements, or engages in other miscellaneous transactions, you will likely need to issue this form.

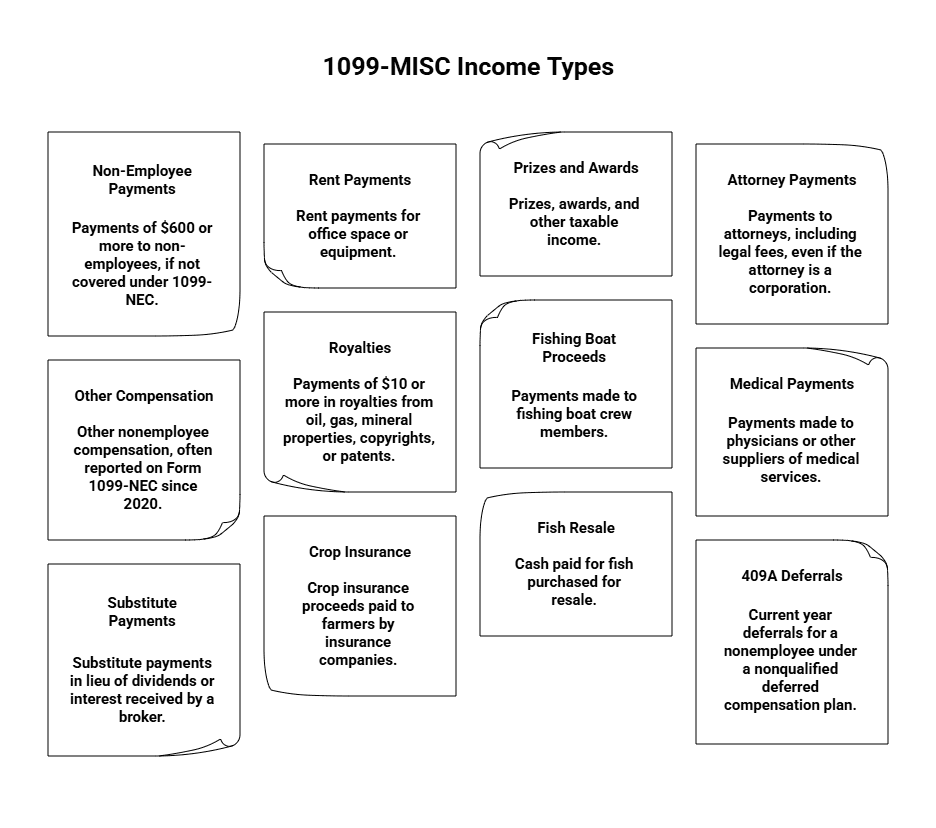

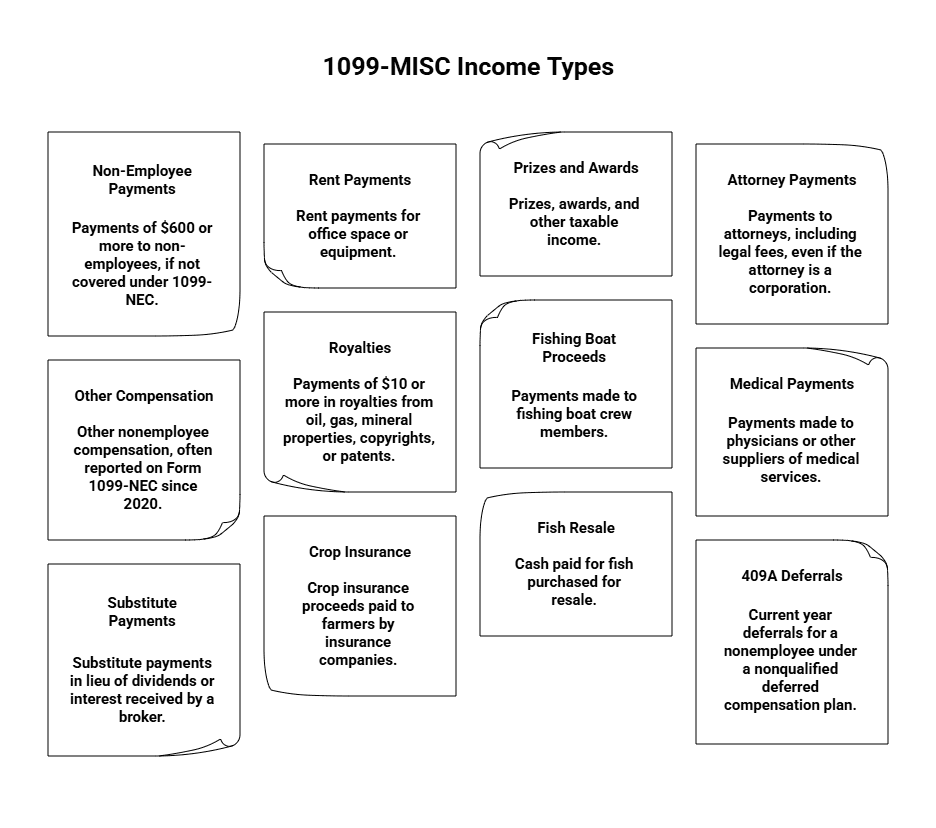

Key Miscellaneous Income Types Reported on Form 1099-MISC

Payments of $600 or more to non-employees (if not covered under 1099-NEC)

Rent payments, such as for office space or equipment

Prizes, awards, and other taxable income

Payments to attorneys, including legal fees (even if the attorney is a corporation)

Other nonemployee compensation (Note: Since 2020, this is often reported on Form 1099-NEC, but 1099-MISC remains important for rent, legal fees, and other exceptions)

Understanding when and how to issue Form 1099-MISC helps founders stay compliant and maintain accurate expense records. This visibility is essential for strategic tax planning and financial decision-making.

For a detailed overview of all 1099 reporting rules, consider Haven’s guide on Form 1099 requirements.

Step-by-Step Guide to Reporting Miscellaneous Income Using Form 1099-MISC

1. Identify When You Must File Form 1099-MISC

Founders should review each payment made to vendors and service providers to determine if Form 1099-MISC is necessary. Here's a simple checklist:

Was the payment made to an individual, sole proprietor, or LLC?

Was the total payment $600 or more during the tax year?

Was the payment for rent, legal fees, or other miscellaneous income types defined by the IRS?

If yes, Form 1099-MISC likely needs to be filed.

2. Gather the Required Information from Payees

This is why it’s important to invest in accurate bookkeeping. Before filing, you'll need the following details from each payee:

Full legal name

Business name (if applicable)

Address

Taxpayer Identification Number (TIN) — typically collected using IRS Form W-9, which you can find via the IRS W-9 instructions

Embedding W-9 collection into your vendor onboarding helps avoid delays during tax season.

3. Complete the Appropriate Boxes

Here are some of the key sections of the form:

Box Number | Description | Example Use Case |

Box 1 | Rents | Office leasing, equipment rental |

Box 3 | Other Income | Taxable income outside normal business operations |

Box 14 | Gross Proceeds Paid to Attorney | Legal settlements, IP filings expenses |

Note: Payments to freelancers are generally reported on Form 1099-NEC since 2020.

Once complete, issue copies to:

The IRS (paper or electronic filing)

The income recipient

IRS deadlines:

January 31 → Furnish to recipients

February 28 (paper) / March 31 (electronic) → File with the IRS

For detailed guidance, refer to the official IRS instructions for Form 1099-MISC.

4. Retain Documentation

Keep copies of each 1099-MISC filed along with supporting payment records for at least four years. This is essential for audit protection and long-term financial clarity.

Common Pitfalls and Best Practices

Pitfall: Filing the Wrong Form (1099-MISC vs 1099-NEC)

It’s common to misclassify vendor payments due to changes made in 2020.

Use 1099-MISC → Rent, awards, gross proceeds to attorneys

Use 1099-NEC → Contractor payments for services

Pitfall: Missing the Filing Deadline

Late filings can trigger IRS penalties ranging from $50–$280 per form.

Avoid this by:

Using accounting platforms with automated reminders

Creating annual workflows for vendor review

Working with a tax team familiar with startup compliance

Best Practice: Employ Modern Tax & Bookkeeping Software

Tools like Haven help automate W-9 collection, form filing, and expense syncing–reducing error risk and saving founders valuable time. You can learn how this fits into a full accounting workflow in Haven’s business tax services overview.

Best Practice: Consider the Impact on Credits and Reporting

Some 1099-MISC categories—such as attorney fees related to IP or R&D—can affect eligibility for tax credits or early-stage deductions. Proper classification ensures accurate filings and maximized benefits.

How Founders Can Master Form 1099-MISC Reporting

Accurately managing Form 1099-MISC filings is fundamental to your startup’s financial health and compliance posture. When you collect data early, understand the filing rules, and implement reliable workflows, you reduce the risk of IRS penalties and strengthen your company’s accounting foundation.

Founders who prioritize compliance gain predictable tax outcomes—and often uncover additional financial benefits along the way.

Want help streamlining your reporting or powering your team with founder-first tax solutions?

For founders navigating the financial complexities of startups, agencies, and e-commerce businesses, understanding Form 1099-MISC is essential. This tax form plays a crucial role in reporting various types of miscellaneous income and avoiding IRS penalties.

In this guide, we break down everything you need to know about Form 1099-MISC from a founder’s perspective, focusing on practical steps and insights to help you streamline your bookkeeping, maximize compliance, and confidently manage your tax filings.

What Is Form 1099-MISC and Why Founders Need It

Form 1099-MISC is an IRS tax document used to report payments made in the course of business to non-employees. If your startup or agency hires independent contractors, rents office space, pays legal settlements, or engages in other miscellaneous transactions, you will likely need to issue this form.

Key Miscellaneous Income Types Reported on Form 1099-MISC

Payments of $600 or more to non-employees (if not covered under 1099-NEC)

Rent payments, such as for office space or equipment

Prizes, awards, and other taxable income

Payments to attorneys, including legal fees (even if the attorney is a corporation)

Other nonemployee compensation (Note: Since 2020, this is often reported on Form 1099-NEC, but 1099-MISC remains important for rent, legal fees, and other exceptions)

Understanding when and how to issue Form 1099-MISC helps founders stay compliant and maintain accurate expense records. This visibility is essential for strategic tax planning and financial decision-making.

For a detailed overview of all 1099 reporting rules, consider Haven’s guide on Form 1099 requirements.

Step-by-Step Guide to Reporting Miscellaneous Income Using Form 1099-MISC

1. Identify When You Must File Form 1099-MISC

Founders should review each payment made to vendors and service providers to determine if Form 1099-MISC is necessary. Here's a simple checklist:

Was the payment made to an individual, sole proprietor, or LLC?

Was the total payment $600 or more during the tax year?

Was the payment for rent, legal fees, or other miscellaneous income types defined by the IRS?

If yes, Form 1099-MISC likely needs to be filed.

2. Gather the Required Information from Payees

This is why it’s important to invest in accurate bookkeeping. Before filing, you'll need the following details from each payee:

Full legal name

Business name (if applicable)

Address

Taxpayer Identification Number (TIN) — typically collected using IRS Form W-9, which you can find via the IRS W-9 instructions

Embedding W-9 collection into your vendor onboarding helps avoid delays during tax season.

3. Complete the Appropriate Boxes

Here are some of the key sections of the form:

Box Number | Description | Example Use Case |

Box 1 | Rents | Office leasing, equipment rental |

Box 3 | Other Income | Taxable income outside normal business operations |

Box 14 | Gross Proceeds Paid to Attorney | Legal settlements, IP filings expenses |

Note: Payments to freelancers are generally reported on Form 1099-NEC since 2020.

Once complete, issue copies to:

The IRS (paper or electronic filing)

The income recipient

IRS deadlines:

January 31 → Furnish to recipients

February 28 (paper) / March 31 (electronic) → File with the IRS

For detailed guidance, refer to the official IRS instructions for Form 1099-MISC.

4. Retain Documentation

Keep copies of each 1099-MISC filed along with supporting payment records for at least four years. This is essential for audit protection and long-term financial clarity.

Common Pitfalls and Best Practices

Pitfall: Filing the Wrong Form (1099-MISC vs 1099-NEC)

It’s common to misclassify vendor payments due to changes made in 2020.

Use 1099-MISC → Rent, awards, gross proceeds to attorneys

Use 1099-NEC → Contractor payments for services

Pitfall: Missing the Filing Deadline

Late filings can trigger IRS penalties ranging from $50–$280 per form.

Avoid this by:

Using accounting platforms with automated reminders

Creating annual workflows for vendor review

Working with a tax team familiar with startup compliance

Best Practice: Employ Modern Tax & Bookkeeping Software

Tools like Haven help automate W-9 collection, form filing, and expense syncing–reducing error risk and saving founders valuable time. You can learn how this fits into a full accounting workflow in Haven’s business tax services overview.

Best Practice: Consider the Impact on Credits and Reporting

Some 1099-MISC categories—such as attorney fees related to IP or R&D—can affect eligibility for tax credits or early-stage deductions. Proper classification ensures accurate filings and maximized benefits.

How Founders Can Master Form 1099-MISC Reporting

Accurately managing Form 1099-MISC filings is fundamental to your startup’s financial health and compliance posture. When you collect data early, understand the filing rules, and implement reliable workflows, you reduce the risk of IRS penalties and strengthen your company’s accounting foundation.

Founders who prioritize compliance gain predictable tax outcomes—and often uncover additional financial benefits along the way.

Want help streamlining your reporting or powering your team with founder-first tax solutions?

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026