Go Back

Last Updated :

Last Updated :

Jan 6, 2026

Jan 6, 2026

Form 1095-C Guide for Employers: ACA Reporting Requirements

For startups and scaling agencies, hitting the 50-employee mark is a major milestone—but it also triggers new regulatory responsibilities under the Affordable Care Act (ACA). One of the most critical is Form 1095-C. This form is your way of proving to the IRS that you’ve provided affordable health insurance to your team, helping you avoid massive non-compliance penalties.

What is Form 1095-C?

Form 1095-C, Employer-Provided Health Insurance Offer and Coverage, is an annual report that Applicable Large Employers (ALEs) must provide to their employees and the IRS.

It serves two primary purposes:

For the IRS: It confirms your company met its "employer shared responsibility" by offering Minimum Essential Coverage (MEC).

For Employees: It helps them determine if they qualify for premium tax credits when filing their personal returns.

Who Needs to File?

You are required to file Form 1095-C if your company is an Applicable Large Employer (ALE).

The 50-Employee Rule: If you employed an average of 50 or more full-time employees (including full-time equivalents) during the prior calendar year, filing is mandatory.

Smaller Businesses: If you have fewer than 50 employees, you generally do not need to file Form 1095-C, though your health insurer might file Form 1095-B on your behalf.

Important Deadlines and Penalties

Missing these dates can be a costly mistake for a growing company.

Deadline | Action Required |

January 31 | Furnish copies of Form 1095-C to all eligible employees. |

February 28 | File paper forms with the IRS. |

March 31 | File electronically with the IRS (required for most modern companies). |

The Cost of Non-Compliance (2024/2025)

Failure to File/Provide Correct Forms: $310 per form, with a maximum cap of over $3.7 million.

Intentional Disregard: $630 per form with no maximum cap.

Step-by-Step: How to Fill Out Form 1095-C

Part I: Employee and Employer Information

This section is straightforward but requires absolute accuracy.

Lines 1–6: Employee's name, SSN, and address. Ensure the SSN matches your payroll records to avoid IRS mismatches.

Lines 7–13: Your company’s name, EIN, address, and a contact phone number.

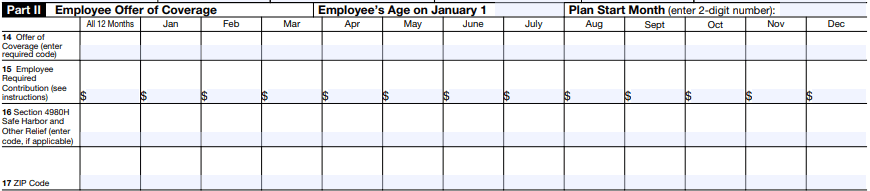

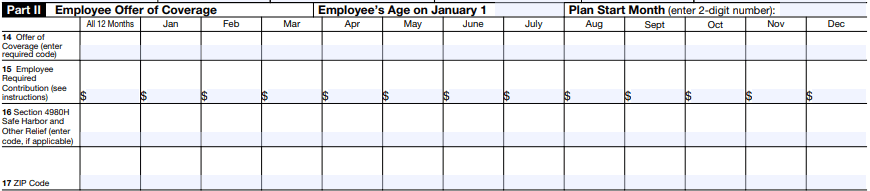

Part II: Employee Offer of Coverage

This is the most technical part of the form and where most errors occur.

Line 14 (Offer Code): Enter the 2-character code (1A–1S) that describes the type of coverage offered. For example, 1E indicates coverage was offered to the employee, their spouse, and their dependents.

Line 15 (Employee Contribution): Enter the monthly cost for the lowest-cost, self-only plan offered to that employee. If the coverage was free, enter "0.00."

Line 16 (Safe Harbor Code): Use these codes (2A–2I) to tell the IRS why you aren't liable for a penalty for that employee (e.g., they weren't full-time or they enrolled in the plan).

Part III: Covered Individuals (Self-Insured Plans Only)

If your startup is self-insured, you must complete this section.

List every individual covered by the plan, including the employee’s dependents.

Provide their SSN or date of birth and check the boxes for the months they were covered.

Common Mistakes Founders Make

Data Mismatches: Using incorrect SSNs or names that don't match Social Security records.

Wrong Codes: Misinterpreting Part II codes, such as coding a month as "no offer" when the employee simply declined a valid offer.

Missing Part III: Forgetting that self-insured plans require dependent information that isn't always in the standard payroll file.

FAQs

Do I need to file for part-time employees?

Generally, no, unless they were actually enrolled in your self-insured plan. However, part-time employees do count toward your "Full-Time Equivalent" (FTE) total when determining if you are an ALE.

What if I have multiple companies (EINs)?

A: If the companies are part of a "Controlled Group," you must aggregate the employees across all companies to determine your ALE status.

Master Your ACA Compliance with Haven

Managing 1095-C filings while scaling a business is a distraction you don't need. Haven provides founder-friendly tax support that integrates directly with your bookkeeping and payroll.

Automated Data Sync: We centralize payroll and benefits data to make form generation seamless.

Expert Review: We ensure your Part II codes are accurate to protect you from IRS penalties.

Timely Filing: We handle the electronic submission to the IRS and distribution to your team

For startups and scaling agencies, hitting the 50-employee mark is a major milestone—but it also triggers new regulatory responsibilities under the Affordable Care Act (ACA). One of the most critical is Form 1095-C. This form is your way of proving to the IRS that you’ve provided affordable health insurance to your team, helping you avoid massive non-compliance penalties.

What is Form 1095-C?

Form 1095-C, Employer-Provided Health Insurance Offer and Coverage, is an annual report that Applicable Large Employers (ALEs) must provide to their employees and the IRS.

It serves two primary purposes:

For the IRS: It confirms your company met its "employer shared responsibility" by offering Minimum Essential Coverage (MEC).

For Employees: It helps them determine if they qualify for premium tax credits when filing their personal returns.

Who Needs to File?

You are required to file Form 1095-C if your company is an Applicable Large Employer (ALE).

The 50-Employee Rule: If you employed an average of 50 or more full-time employees (including full-time equivalents) during the prior calendar year, filing is mandatory.

Smaller Businesses: If you have fewer than 50 employees, you generally do not need to file Form 1095-C, though your health insurer might file Form 1095-B on your behalf.

Important Deadlines and Penalties

Missing these dates can be a costly mistake for a growing company.

Deadline | Action Required |

January 31 | Furnish copies of Form 1095-C to all eligible employees. |

February 28 | File paper forms with the IRS. |

March 31 | File electronically with the IRS (required for most modern companies). |

The Cost of Non-Compliance (2024/2025)

Failure to File/Provide Correct Forms: $310 per form, with a maximum cap of over $3.7 million.

Intentional Disregard: $630 per form with no maximum cap.

Step-by-Step: How to Fill Out Form 1095-C

Part I: Employee and Employer Information

This section is straightforward but requires absolute accuracy.

Lines 1–6: Employee's name, SSN, and address. Ensure the SSN matches your payroll records to avoid IRS mismatches.

Lines 7–13: Your company’s name, EIN, address, and a contact phone number.

Part II: Employee Offer of Coverage

This is the most technical part of the form and where most errors occur.

Line 14 (Offer Code): Enter the 2-character code (1A–1S) that describes the type of coverage offered. For example, 1E indicates coverage was offered to the employee, their spouse, and their dependents.

Line 15 (Employee Contribution): Enter the monthly cost for the lowest-cost, self-only plan offered to that employee. If the coverage was free, enter "0.00."

Line 16 (Safe Harbor Code): Use these codes (2A–2I) to tell the IRS why you aren't liable for a penalty for that employee (e.g., they weren't full-time or they enrolled in the plan).

Part III: Covered Individuals (Self-Insured Plans Only)

If your startup is self-insured, you must complete this section.

List every individual covered by the plan, including the employee’s dependents.

Provide their SSN or date of birth and check the boxes for the months they were covered.

Common Mistakes Founders Make

Data Mismatches: Using incorrect SSNs or names that don't match Social Security records.

Wrong Codes: Misinterpreting Part II codes, such as coding a month as "no offer" when the employee simply declined a valid offer.

Missing Part III: Forgetting that self-insured plans require dependent information that isn't always in the standard payroll file.

FAQs

Do I need to file for part-time employees?

Generally, no, unless they were actually enrolled in your self-insured plan. However, part-time employees do count toward your "Full-Time Equivalent" (FTE) total when determining if you are an ALE.

What if I have multiple companies (EINs)?

A: If the companies are part of a "Controlled Group," you must aggregate the employees across all companies to determine your ALE status.

Master Your ACA Compliance with Haven

Managing 1095-C filings while scaling a business is a distraction you don't need. Haven provides founder-friendly tax support that integrates directly with your bookkeeping and payroll.

Automated Data Sync: We centralize payroll and benefits data to make form generation seamless.

Expert Review: We ensure your Part II codes are accurate to protect you from IRS penalties.

Timely Filing: We handle the electronic submission to the IRS and distribution to your team

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026