Go Back

Last Updated :

Last Updated :

Dec 6, 2025

Dec 6, 2025

Bookkeeping Services for Homebuilders: Manage Job Costs & Cash Flow

For founders steering homebuilding businesses, bookkeeping services for homebuilders aren’t just about tracking expenses—they’re a strategic tool to optimize project profitability and maintain healthy cash flow. Unlike traditional bookkeeping, work in residential construction demands granular attention to job costing, timing of cash inflows and outflows, and upfront planning to avoid project delays or financial strain.

At Haven, we understand the unique challenges homebuilders face: fluctuating materials costs, labor scheduling complexity, subcontractor management, and the critical need to control cash flow to meet milestones and keep your projects—and business—on track.

This guide dives into practical bookkeeping strategies tailored for homebuilders to help you take control of your financial data effectively, enabling smarter decisions from the foundation up.

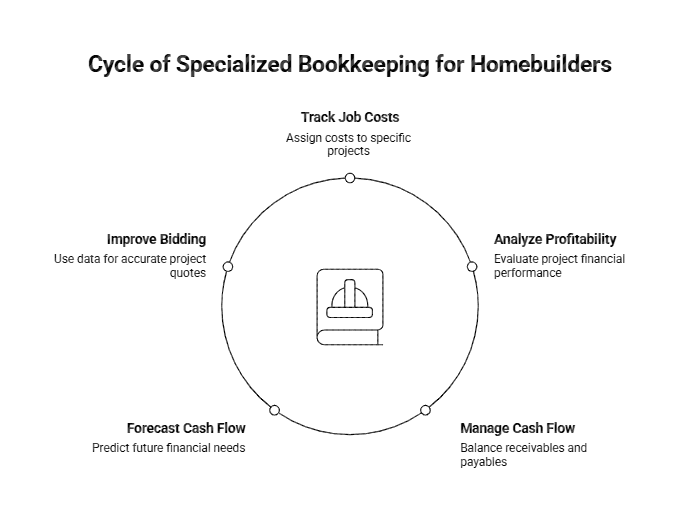

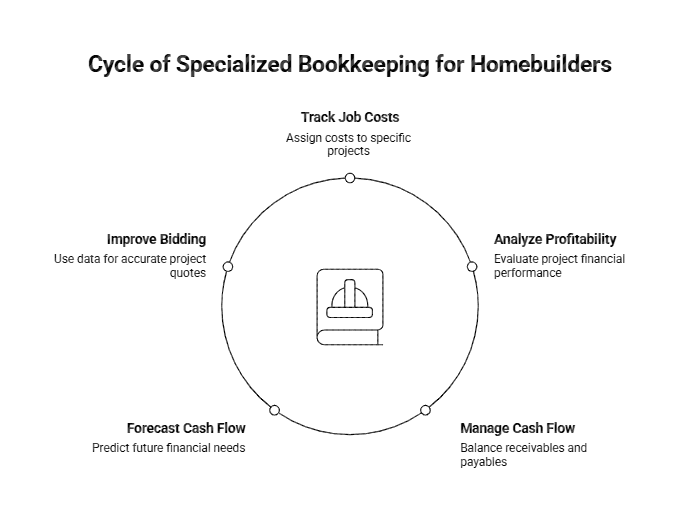

Why Specialized Bookkeeping Services for Homebuilders Matter

Standard bookkeeping falls short for homebuilders, who require more than just income and expense tracking. Job costing—assigning every dollar spent to a specific project or phase—is essential for profitability analysis and bidding accuracy. Without this, it’s easy to lose sight of which projects or phases are draining cash unnecessarily or delivering thin margins.

Moreover, cash flow management is an ongoing balancing act. You pay subcontractors and suppliers regularly but might not receive progress payments for weeks. Without careful monitoring of receivables and payables aligned with project timelines, even profitable projects can become cash flow nightmares.

A tailored bookkeeping approach delivers insights that power informed operational and financial decisions:

Real-time job cost visibility: Identify cost overruns early and adjust scope or spending

Cash flow forecasting: Plan ahead for bill payments and expected draws

Compliance with construction accounting standards: Proper revenue recognition and bonding requirements

Improved bidding and estimating: Historical data informs future project quotes and contingency buffers

Key Elements of Effective Homebuilder Bookkeeping

1. Job Cost Tracking and Allocation

At the heart of homebuilder accounting is accurately tracking every cost by project and phase:

Cost Category | Description | Examples |

Direct Materials | Materials directly consumed on the job | Lumber, drywall, windows |

Direct Labor | On-site labor hours charged to job | Carpenter wages, electrician time |

Subcontractor Costs | External specialists contracted | HVAC installation, roofing |

Equipment Rental | Tools and machinery rented per project | Scaffolding, excavators |

Overhead Allocations | Job-specific portions of business overhead | Insurance, permits related to job |

Use cloud-based bookkeeping software with jobs or classes functionality to allocate expenses correctly. For modern, founder-friendly support, Haven offers specialized bookkeeping services tailored for homebuilders — including job costing setup and implementation.

2. Progress Billing and Accounts Receivable Management

Homebuilders often invoice clients in progress or milestone payments. Precision bookkeeping enables clear visibility into what’s billed, outstanding, and when payments are expected.

Issue invoices aligned with contract milestones (e.g., foundation completion, roofing installed)

Track aging receivables diligently to minimize late payments

Reconcile payments with job costs to ensure profitability on each phase

Regular follow-ups, combined with clean bookkeeping records, accelerate collections and prevent cash crunches.

3. Vendor and Subcontractor Payables

Managing payables is equally important. Monitor due dates to avoid late fees or strained supplier relationships, and leverage early payment discounts where possible.

Maintain vendor accounts with job-specific expense tagging

Schedule payments to optimize cash flow around client receivables

Consider automated bill pay functions integrated with bookkeeping systems

Best Practices for Cash Flow Management in Homebuilding

Cash flow is critical—especially in residential construction with variable project timelines and upfront material needs. Tracking might be daily or weekly, not monthly.

Best Practice | Example Application |

Create rolling 13-week forecasts | Project expected billings and payments weekly |

Separate cash accounts by project | Simplifies tracking and avoids cross-use of funds |

Build contingency reserves | Set aside % of project funds for unexpected needs |

Use milestone invoicing | Align income with actual progress |

Compare job cost reports with budget | Catch overruns early and adjust if needed |

Implementing these cash-flow practices consistently can be challenging for homebuilders managing long project cycles, multiple crews, and fluctuating material costs. Turning forecasts, job-cost reports, and milestone schedules into a reliable financial rhythm requires systems that keep information current and aligned with how projects actually move.

That’s where specialized bookkeeping support adds value — helping homebuilders set up the right workflows, maintain real-time financial visibility, and prevent surprises before they affect margins. Haven’s full service offerings are designed to support this level of operational clarity for homebuilders and contractors.

Technology and Expertise: Why Choose Haven

Modern homebuilders benefit from a bookkeeping partner that understands startup sensibilities, construction-specific accounting, and tech-enabled automation. Haven blends these to elevate financial management:

Fully cloud-based bookkeeping for anytime, anywhere access

Integration with construction management tools for seamless data flow

Responsive support focused on clarity and actionability

Guidance on tax strategies — including R&D tax credits for innovative building methods or energy-efficient solutions

We’re not just bookkeepers; we’re partners in building your company’s financial foundation, letting you focus on delivering quality homes without bookkeeping distractions.

Build a Strong Financial Foundation with Specialized Bookkeeping Services for Homebuilders

Navigating the complexities of job costing and cash flow is non-negotiable for homebuilders aiming for sustained growth and profitability. With bookkeeping services for homebuilders that emphasize precise job cost tracking, progress billing management, and cash flow forecasting, founders can transform financial chaos into clarity.

Partner with Haven to gain a strategic bookkeeping ally that understands the nuances of residential construction and startup growth. Our modern, founder-friendly approach helps you make confident decisions backed by accurate, timely financial insights—letting you focus on what you do best: building great homes.

For founders steering homebuilding businesses, bookkeeping services for homebuilders aren’t just about tracking expenses—they’re a strategic tool to optimize project profitability and maintain healthy cash flow. Unlike traditional bookkeeping, work in residential construction demands granular attention to job costing, timing of cash inflows and outflows, and upfront planning to avoid project delays or financial strain.

At Haven, we understand the unique challenges homebuilders face: fluctuating materials costs, labor scheduling complexity, subcontractor management, and the critical need to control cash flow to meet milestones and keep your projects—and business—on track.

This guide dives into practical bookkeeping strategies tailored for homebuilders to help you take control of your financial data effectively, enabling smarter decisions from the foundation up.

Why Specialized Bookkeeping Services for Homebuilders Matter

Standard bookkeeping falls short for homebuilders, who require more than just income and expense tracking. Job costing—assigning every dollar spent to a specific project or phase—is essential for profitability analysis and bidding accuracy. Without this, it’s easy to lose sight of which projects or phases are draining cash unnecessarily or delivering thin margins.

Moreover, cash flow management is an ongoing balancing act. You pay subcontractors and suppliers regularly but might not receive progress payments for weeks. Without careful monitoring of receivables and payables aligned with project timelines, even profitable projects can become cash flow nightmares.

A tailored bookkeeping approach delivers insights that power informed operational and financial decisions:

Real-time job cost visibility: Identify cost overruns early and adjust scope or spending

Cash flow forecasting: Plan ahead for bill payments and expected draws

Compliance with construction accounting standards: Proper revenue recognition and bonding requirements

Improved bidding and estimating: Historical data informs future project quotes and contingency buffers

Key Elements of Effective Homebuilder Bookkeeping

1. Job Cost Tracking and Allocation

At the heart of homebuilder accounting is accurately tracking every cost by project and phase:

Cost Category | Description | Examples |

Direct Materials | Materials directly consumed on the job | Lumber, drywall, windows |

Direct Labor | On-site labor hours charged to job | Carpenter wages, electrician time |

Subcontractor Costs | External specialists contracted | HVAC installation, roofing |

Equipment Rental | Tools and machinery rented per project | Scaffolding, excavators |

Overhead Allocations | Job-specific portions of business overhead | Insurance, permits related to job |

Use cloud-based bookkeeping software with jobs or classes functionality to allocate expenses correctly. For modern, founder-friendly support, Haven offers specialized bookkeeping services tailored for homebuilders — including job costing setup and implementation.

2. Progress Billing and Accounts Receivable Management

Homebuilders often invoice clients in progress or milestone payments. Precision bookkeeping enables clear visibility into what’s billed, outstanding, and when payments are expected.

Issue invoices aligned with contract milestones (e.g., foundation completion, roofing installed)

Track aging receivables diligently to minimize late payments

Reconcile payments with job costs to ensure profitability on each phase

Regular follow-ups, combined with clean bookkeeping records, accelerate collections and prevent cash crunches.

3. Vendor and Subcontractor Payables

Managing payables is equally important. Monitor due dates to avoid late fees or strained supplier relationships, and leverage early payment discounts where possible.

Maintain vendor accounts with job-specific expense tagging

Schedule payments to optimize cash flow around client receivables

Consider automated bill pay functions integrated with bookkeeping systems

Best Practices for Cash Flow Management in Homebuilding

Cash flow is critical—especially in residential construction with variable project timelines and upfront material needs. Tracking might be daily or weekly, not monthly.

Best Practice | Example Application |

Create rolling 13-week forecasts | Project expected billings and payments weekly |

Separate cash accounts by project | Simplifies tracking and avoids cross-use of funds |

Build contingency reserves | Set aside % of project funds for unexpected needs |

Use milestone invoicing | Align income with actual progress |

Compare job cost reports with budget | Catch overruns early and adjust if needed |

Implementing these cash-flow practices consistently can be challenging for homebuilders managing long project cycles, multiple crews, and fluctuating material costs. Turning forecasts, job-cost reports, and milestone schedules into a reliable financial rhythm requires systems that keep information current and aligned with how projects actually move.

That’s where specialized bookkeeping support adds value — helping homebuilders set up the right workflows, maintain real-time financial visibility, and prevent surprises before they affect margins. Haven’s full service offerings are designed to support this level of operational clarity for homebuilders and contractors.

Technology and Expertise: Why Choose Haven

Modern homebuilders benefit from a bookkeeping partner that understands startup sensibilities, construction-specific accounting, and tech-enabled automation. Haven blends these to elevate financial management:

Fully cloud-based bookkeeping for anytime, anywhere access

Integration with construction management tools for seamless data flow

Responsive support focused on clarity and actionability

Guidance on tax strategies — including R&D tax credits for innovative building methods or energy-efficient solutions

We’re not just bookkeepers; we’re partners in building your company’s financial foundation, letting you focus on delivering quality homes without bookkeeping distractions.

Build a Strong Financial Foundation with Specialized Bookkeeping Services for Homebuilders

Navigating the complexities of job costing and cash flow is non-negotiable for homebuilders aiming for sustained growth and profitability. With bookkeeping services for homebuilders that emphasize precise job cost tracking, progress billing management, and cash flow forecasting, founders can transform financial chaos into clarity.

Partner with Haven to gain a strategic bookkeeping ally that understands the nuances of residential construction and startup growth. Our modern, founder-friendly approach helps you make confident decisions backed by accurate, timely financial insights—letting you focus on what you do best: building great homes.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026