Go Back

Last Updated :

Last Updated :

Dec 1, 2025

Dec 1, 2025

A Founder-Friendly Guide to Bookkeeping Services for Real Estate Investors

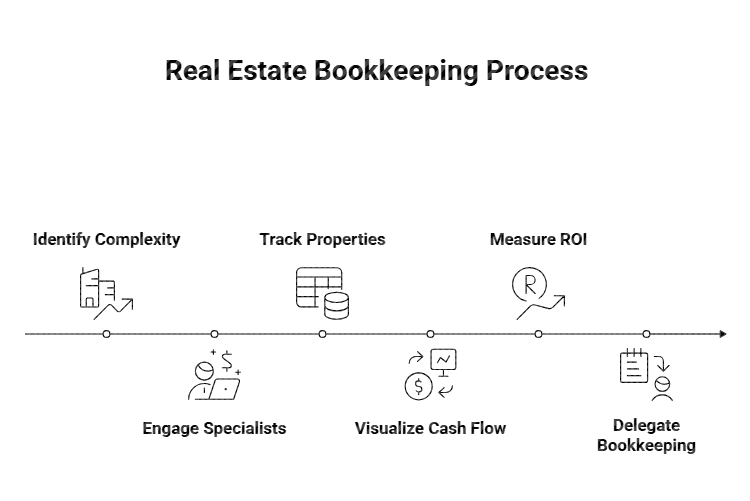

Successful real estate investing hinges on clear visibility into your financials. Whether you hold residential rental properties, commercial spaces, or flips, meticulous accounting is crucial to making savvy decisions that maximize returns and manage risks. This guide explores how bookkeeping services for real estate investors can help you efficiently track properties, manage cash flow, and accurately calculate ROI — all tailored for founders and operators who want practical, actionable financial management without drowning in complexity.

Why Specialized Bookkeeping Matters for Real Estate Investors

Real estate investing is uniquely complex compared to typical business accounting. You’re managing multiple asset types, varied income streams (rent, deposits, fees), nuanced expenses (repairs, property management fees, mortgage interest), and tax considerations like depreciation and passive loss limits. Common bookkeeping approaches fail to capture this complexity, risking cash flow mismanagement and inaccurate profitability assessment.

For startup founders and real estate entrepreneurs, working with bookkeeping specialists who understand these nuances can transform your financial clarity:

Comprehensive Property Tracking: Systematically record each property as a distinct asset, with detail on purchase price, loans, improvements, and depreciation schedules.

Cash Flow Visibility: Organize income and expenses by property to identify cash-positive assets or those needing strategic attention.

Accurate ROI Measurement: Calculate true returns by factoring in all costs, financing, and tax effects rather than just top-line rental income.

Partnering with expert bookkeeping services for real estate investors — such as those offered through Haven’s bookkeeping services — allows founders to delegate this critical but time-consuming function and focus on business growth and deal analysis. To explore broader finance support, review Haven’s full services offering.

Core Components: How to Track Properties, Cash Flow, and ROI Effectively

Property-Level Bookkeeping: The Asset Ledger

Imagine trying to manage a portfolio by lump-sum numbers only — you’d miss the nuances that differentiate high-performers from underachievers. Real estate bookkeeping begins with setting up property-level ledgers in your accounting system.

Key elements to track per property:

Element | Description | Why It Matters |

Purchase Details | Acquisition price, closing costs | Basis for depreciation and capital gains |

Financing Info | Loan amounts, interest rates, payment schedules | Essential for cash flow planning and deductions |

Capital Improvements | Renovation costs, upgrades | Impacts asset value and depreciation timing |

Rental Income | Lease payments, late fees, other income streams | Measures property performance and rental yield |

Operating Expenses | Taxes, insurance, management, utilities, maintenance | Influences net cash flow and expense management |

Depreciation Schedules | IRS-approved depreciation (e.g., 27.5 years residential) | Reduces taxable income and impacts gain/loss |

A modern bookkeeping platform paired with financial experts can automate categorization and depreciation — critical for error reduction and audit readiness.

Cash Flow Management: From Rent Collection to Tax Time

Cash flow is king in real estate, especially for startups dependent on steady income to cover operations and debt.

Best practices include:

Categorize all inflows/outflows by property to keep operational vs. investment costs separate.

Track security deposits and escrows as liabilities, not income.

Reconcile bank statements monthly to catch discrepancies early.

Maintain a reserve fund for vacancies, repairs, or emergencies.

For deeper workflow insights, Haven shares additional strategies in its article on bookkeeping best practices.

Calculating True ROI: More Than Just Rent Minus Expenses

A founder-grade ROI approach considers:

Adjusted basis after renovations

Debt leverage and interest costs

Tax implications (depreciation, passive losses, recapture)

Market appreciation and holding period

Accurate bookkeeping produces the integrated reporting needed to assess these factors fairly — empowering smarter decisions about holding, selling, or improving properties.

Leveraging Technology and Expertise: The Haven Advantage

For founders balancing growth with financial control, Haven blends technology with expert support to simplify real estate bookkeeping:

Feature | Benefit for Real Estate Investors |

Automated Transaction Import | Saves time, reduces errors |

Custom Chart of Accounts | Tailored for real estate asset tracking |

Integrated Depreciation Tools | Ensures compliance and tax optimization |

Regular Financial Reporting | Enables investor updates and data-driven decisions |

Responsive Founder-Focused Service | Scales with your business and answers questions fast |

Haven’s dedicated team helps founders avoid costly mistakes and maintain clean, audit-ready financials. Learn more about these services through Haven’s bookkeeping solutions.

Tax Focus for Real Estate Investors: Don’t Overlook This

Many investors miss out on tax advantages that bookkeeping can reveal:

Depreciation deductions reduce taxable income significantly.

Section 199A (QBI) deduction may apply to qualified real estate businesses.

R&D credits can apply to real estate tech innovators.

For authoritative guidance, consult IRS resources on real estate income.

Practical Steps to Get Started With Real Estate Bookkeeping

If you’re ready to streamline operations:

Evaluate your current accounting system for gaps in property-level tracking.

Standardize leases, contracts, and income workflows.

Consider a specialist provider like Haven to combine automation with expert oversight.

Schedule recurring financial reviews to align bookkeeping with growth goals.

Build Real Estate Wealth with Confidence Through Expert Bookkeeping

Investors who leverage robust bookkeeping services for real estate investors gain reliable data and insights to drive smarter property management and more profitable portfolios. With precise asset tracking, strong cash flow visibility, and accurate ROI analysis — supported by founder-friendly expertise and tools — your business is set for scalable, confident growth.

Haven is here to support that growth every step of the way.

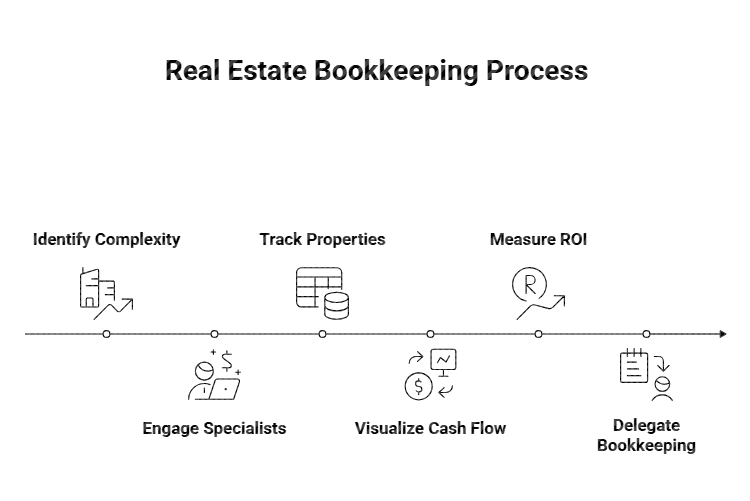

Successful real estate investing hinges on clear visibility into your financials. Whether you hold residential rental properties, commercial spaces, or flips, meticulous accounting is crucial to making savvy decisions that maximize returns and manage risks. This guide explores how bookkeeping services for real estate investors can help you efficiently track properties, manage cash flow, and accurately calculate ROI — all tailored for founders and operators who want practical, actionable financial management without drowning in complexity.

Why Specialized Bookkeeping Matters for Real Estate Investors

Real estate investing is uniquely complex compared to typical business accounting. You’re managing multiple asset types, varied income streams (rent, deposits, fees), nuanced expenses (repairs, property management fees, mortgage interest), and tax considerations like depreciation and passive loss limits. Common bookkeeping approaches fail to capture this complexity, risking cash flow mismanagement and inaccurate profitability assessment.

For startup founders and real estate entrepreneurs, working with bookkeeping specialists who understand these nuances can transform your financial clarity:

Comprehensive Property Tracking: Systematically record each property as a distinct asset, with detail on purchase price, loans, improvements, and depreciation schedules.

Cash Flow Visibility: Organize income and expenses by property to identify cash-positive assets or those needing strategic attention.

Accurate ROI Measurement: Calculate true returns by factoring in all costs, financing, and tax effects rather than just top-line rental income.

Partnering with expert bookkeeping services for real estate investors — such as those offered through Haven’s bookkeeping services — allows founders to delegate this critical but time-consuming function and focus on business growth and deal analysis. To explore broader finance support, review Haven’s full services offering.

Core Components: How to Track Properties, Cash Flow, and ROI Effectively

Property-Level Bookkeeping: The Asset Ledger

Imagine trying to manage a portfolio by lump-sum numbers only — you’d miss the nuances that differentiate high-performers from underachievers. Real estate bookkeeping begins with setting up property-level ledgers in your accounting system.

Key elements to track per property:

Element | Description | Why It Matters |

Purchase Details | Acquisition price, closing costs | Basis for depreciation and capital gains |

Financing Info | Loan amounts, interest rates, payment schedules | Essential for cash flow planning and deductions |

Capital Improvements | Renovation costs, upgrades | Impacts asset value and depreciation timing |

Rental Income | Lease payments, late fees, other income streams | Measures property performance and rental yield |

Operating Expenses | Taxes, insurance, management, utilities, maintenance | Influences net cash flow and expense management |

Depreciation Schedules | IRS-approved depreciation (e.g., 27.5 years residential) | Reduces taxable income and impacts gain/loss |

A modern bookkeeping platform paired with financial experts can automate categorization and depreciation — critical for error reduction and audit readiness.

Cash Flow Management: From Rent Collection to Tax Time

Cash flow is king in real estate, especially for startups dependent on steady income to cover operations and debt.

Best practices include:

Categorize all inflows/outflows by property to keep operational vs. investment costs separate.

Track security deposits and escrows as liabilities, not income.

Reconcile bank statements monthly to catch discrepancies early.

Maintain a reserve fund for vacancies, repairs, or emergencies.

For deeper workflow insights, Haven shares additional strategies in its article on bookkeeping best practices.

Calculating True ROI: More Than Just Rent Minus Expenses

A founder-grade ROI approach considers:

Adjusted basis after renovations

Debt leverage and interest costs

Tax implications (depreciation, passive losses, recapture)

Market appreciation and holding period

Accurate bookkeeping produces the integrated reporting needed to assess these factors fairly — empowering smarter decisions about holding, selling, or improving properties.

Leveraging Technology and Expertise: The Haven Advantage

For founders balancing growth with financial control, Haven blends technology with expert support to simplify real estate bookkeeping:

Feature | Benefit for Real Estate Investors |

Automated Transaction Import | Saves time, reduces errors |

Custom Chart of Accounts | Tailored for real estate asset tracking |

Integrated Depreciation Tools | Ensures compliance and tax optimization |

Regular Financial Reporting | Enables investor updates and data-driven decisions |

Responsive Founder-Focused Service | Scales with your business and answers questions fast |

Haven’s dedicated team helps founders avoid costly mistakes and maintain clean, audit-ready financials. Learn more about these services through Haven’s bookkeeping solutions.

Tax Focus for Real Estate Investors: Don’t Overlook This

Many investors miss out on tax advantages that bookkeeping can reveal:

Depreciation deductions reduce taxable income significantly.

Section 199A (QBI) deduction may apply to qualified real estate businesses.

R&D credits can apply to real estate tech innovators.

For authoritative guidance, consult IRS resources on real estate income.

Practical Steps to Get Started With Real Estate Bookkeeping

If you’re ready to streamline operations:

Evaluate your current accounting system for gaps in property-level tracking.

Standardize leases, contracts, and income workflows.

Consider a specialist provider like Haven to combine automation with expert oversight.

Schedule recurring financial reviews to align bookkeeping with growth goals.

Build Real Estate Wealth with Confidence Through Expert Bookkeeping

Investors who leverage robust bookkeeping services for real estate investors gain reliable data and insights to drive smarter property management and more profitable portfolios. With precise asset tracking, strong cash flow visibility, and accurate ROI analysis — supported by founder-friendly expertise and tools — your business is set for scalable, confident growth.

Haven is here to support that growth every step of the way.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026