Go Back

Last Updated :

Last Updated :

Nov 17, 2025

Nov 17, 2025

5 Bookkeeping Best Practices for Fast-Moving Startups

Behind every successful startup is a clean set of books. Investors look at your financials to judge growth, spending, and data accuracy—so they need to be right. When your financials are accurate, fundraising moves faster, audits feel lighter, and decisions come with fewer surprises.

This guide breaks down 5 bookkeeping best practices built from working with 400+ startups across every stage of growth. You’ll learn what separates “good enough” books from investor-ready financials—and how to set up a system that scales with you.

What Exactly Do Bookkeepers Do for Startups?

A bookkeeper keeps your financial data clean, organized, and ready whenever you need it. They handle the day-to-day work that keeps your statements accurate and prevents surprises during fundraising, audits, or internal reviews.

A bookkeeper will:

Record and categorize transactions so your books stay current

Reconcile your accounts to catch errors before they snowball

Prepare reliable financial statements you can use for decisions or investor updates

Track outstanding bills and invoices to keep cash flow predictable

Maintain audit-ready documentation across receipts, vendors, and records

Flag missing or inconsistent data before it becomes a problem

5 Essential Bookkeeping Best Practices for Startups

So, your startup is taking off – exciting! But behind every great idea is a solid financial foundation. Ignoring bookkeeping is a common, and often costly, misstep for new businesses. Think of it: unclear cash flow, messy tax season, lost investor confidence – these are real risks.

But it doesn't have to be complicated.

We've broken down the essential bookkeeping practices into actionable, easy-to-digest steps.

1. Establish Core Financial Foundations

Set Up Organized Records from Day One

Categorize every transaction accurately. Clearly define and assign income, expenses, payroll, and taxes to the right categories. This streamlines reporting and highlights spending patterns.

Separate Business and Personal Finances

Always maintain distinct business and personal accounts. Avoid confusion, missed deductions, and messy audits.

Maintain an Updated Chart of Accounts (COA)

Maintain an up-to-date COA listing all assets, liabilities, equity, expenses, and revenue. It’s your snapshot of financial health.

2. Manage Daily Operations Efficiently

Reconcile Accounts Monthly

Compare records with bank and credit card statements each month. Catch errors or unauthorized charges early.

Stay on Top of Invoices and Payments

Send invoices promptly, follow up before payments are overdue, and pay vendors on schedule. Implement automated reminders to keep cash flowing.

Monitor Cash Flow in Real Time

Use tools that provide live insights into inflows and outflows. Review trends weekly to identify profitable products and cost drains.

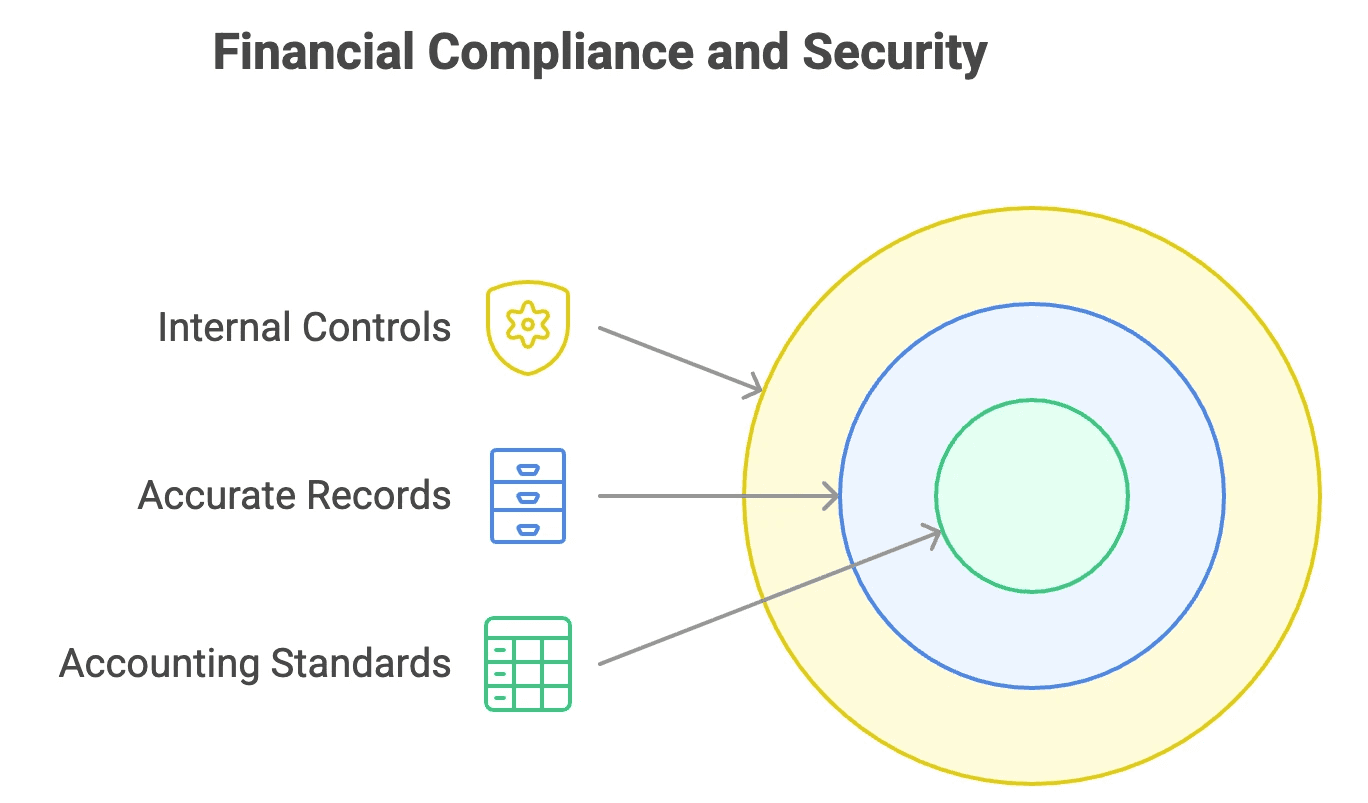

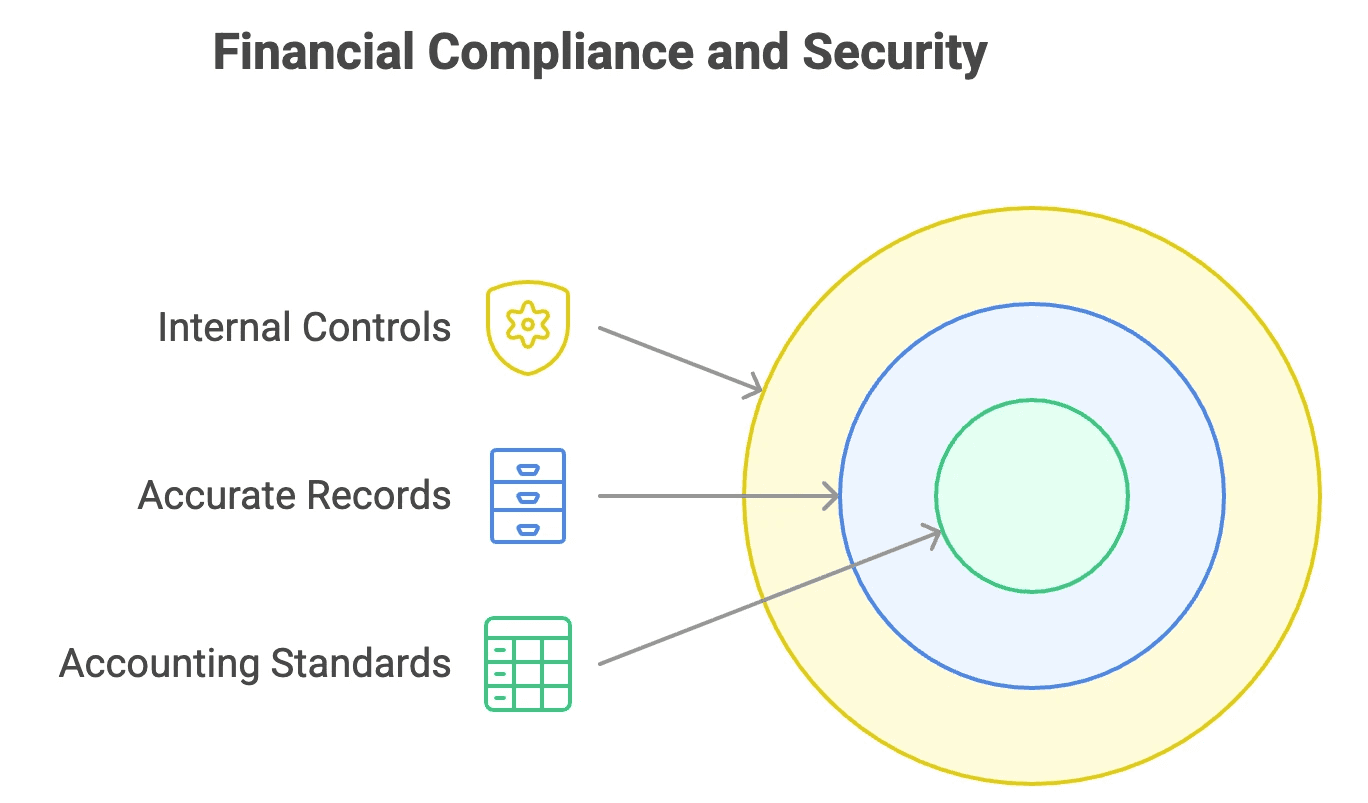

3. Ensure Compliance and Security

Follow Accounting Standards (GAAP or IFRS)

Adhere to GAAP for U.S. reporting or IFRS if operating globally. These principles keep financials transparent and audit-ready. Learn more about GAAP standards through trusted small business resources.

Maintain Accurate, Audit-Ready Records

Keep receipts, invoices, and tax files organized. Digital copies simplify audits and support deductions.

Implement Internal Controls

Establish policies to prevent fraud and maintain accuracy. Separate transaction entry, approval, and payment roles; use secure access permissions.

4. Leverage Tools and Expertise for Growth

Use Reliable Bookkeeping Software

Select accounting software built for startups that syncs directly with your bank. Automated reconciliation reduces manual work and error risk.

Automate Repetitive Tasks

Let software handle data entry and categorization so your team focuses on strategy, not spreadsheets.

Document Procedures and Review Regularly

Write down every step of your bookkeeping workflow and review monthly or quarterly for trends and accuracy.

Consider Outsourcing to Experts

If bookkeeping drains founder bandwidth, outsource it. Haven’s startup-focused team ensures compliance and clean books while you scale.

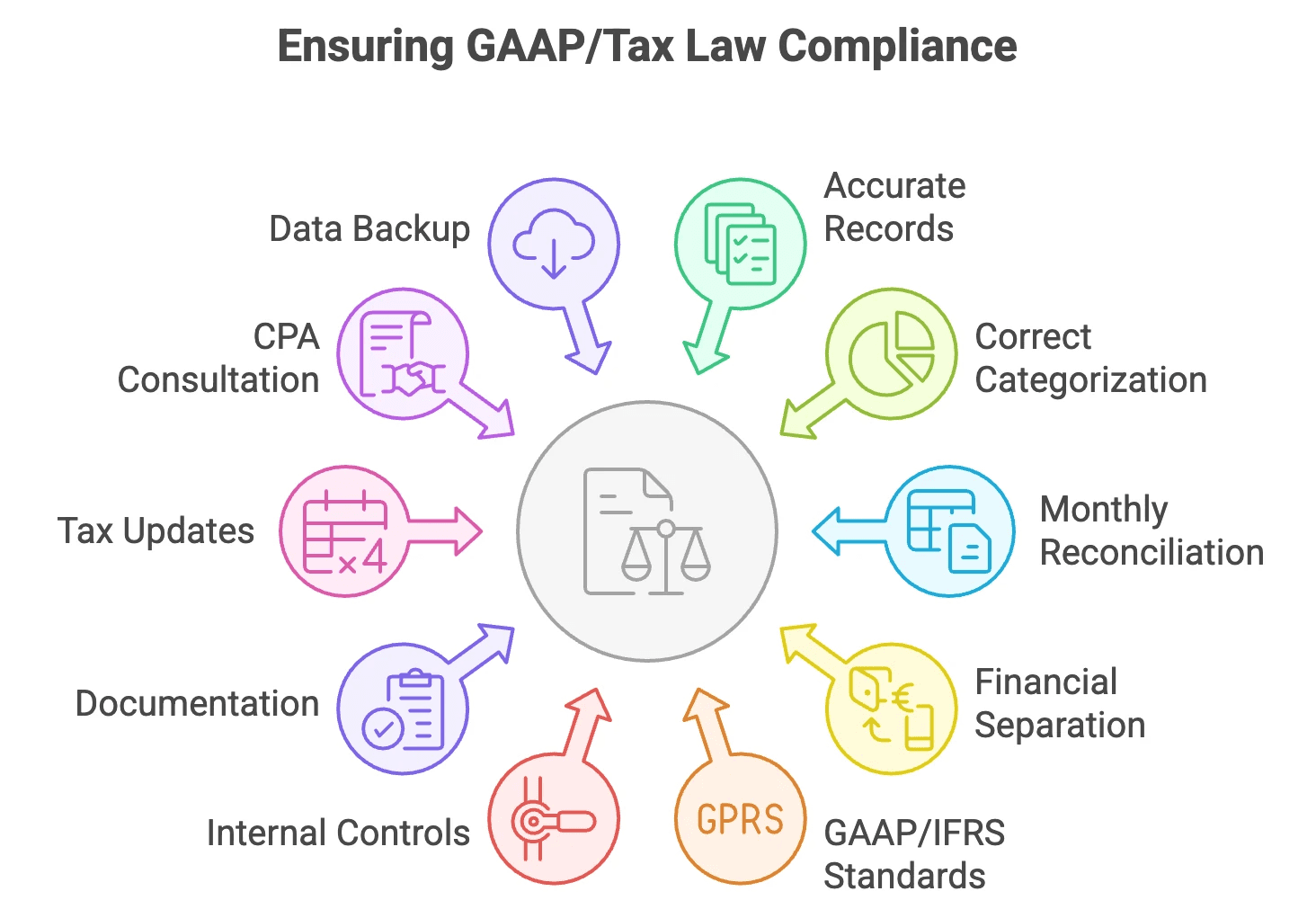

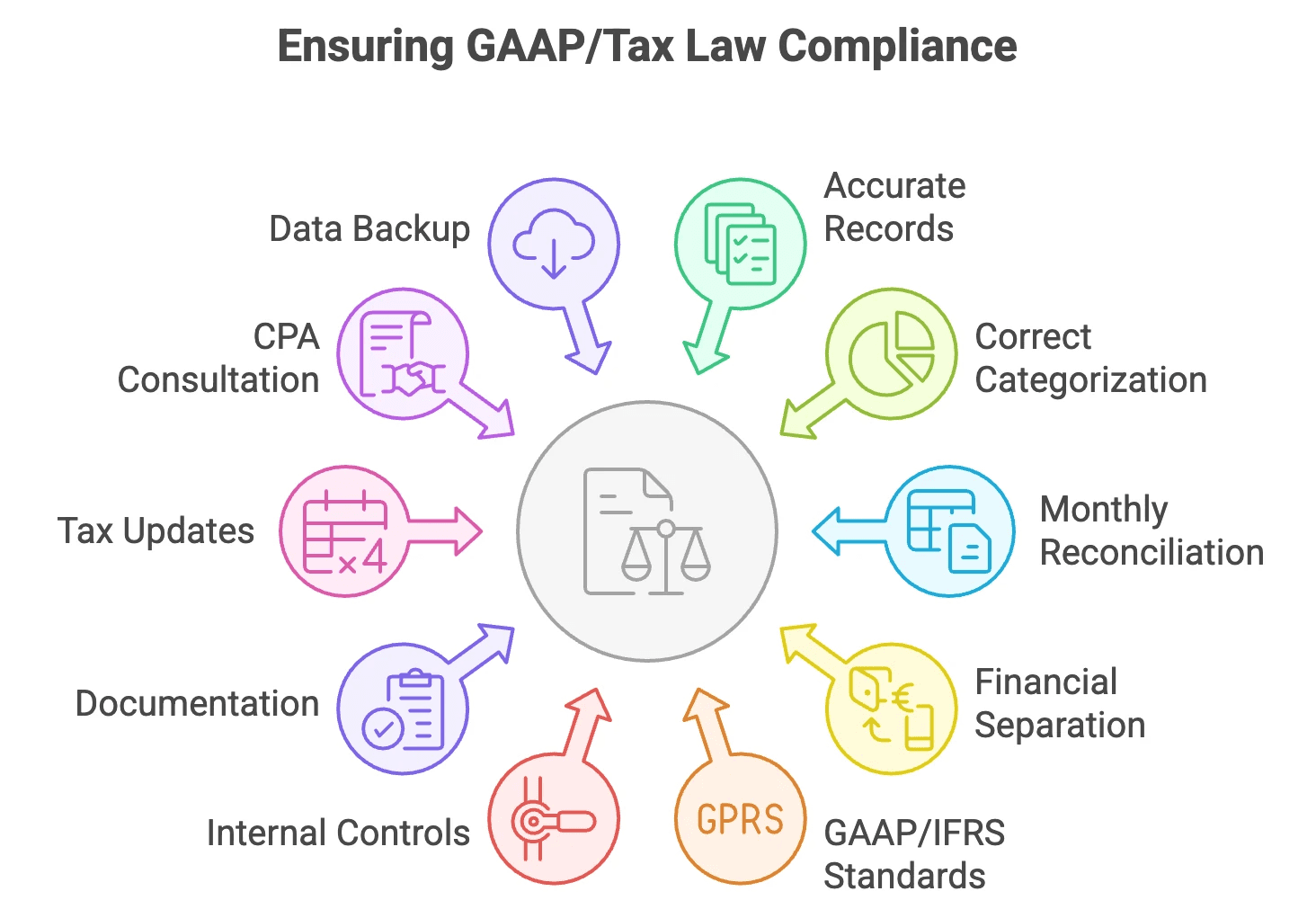

5. Compliance & Financial Controls Checklist

Following tax laws and local regulations is crucial. Adhering to GAAP or International Financial Reporting Standards (IFRS) is key. Implement internal controls like segregation of duties and audit trails. Secure financial data to prevent unauthorized access. Understand that non-compliance results in penalties and reputational risk.

Checklist for GAAP / Tax Law Compliance

Maintain accurate and complete records

Categorize transactions correctly

Reconcile statements monthly

Separate business and personal finances

Follow GAAP or IFRS standards

Implement internal controls and approval workflows

Keep documentation for all deductions and credits

Stay updated on tax regulations

Consult with a CPA quarterly

Securely back up all financial data

Choosing the Right Bookkeeping Tools for Your Startup

Choosing the right tools depends on the transaction volume, number of integrations, and stage of development. For very early founders, spreadsheets work until monthly transactions surpass ~100.

At Seed and beyond, we recommend cloud solutions that link to payroll and bank feeds to reduce reconciliation time.

Focus on solutions that offer automated bank feeds, robust integrations, and audit trails. Consider accounting software for startups that scales with your growth; the best accounting software for startups offers flexibility and automation.

Tool Type | Cost | Features | Scalability |

Manual (Pen & Paper) | Low | Basic record keeping | Low |

Spreadsheets | Low | Simple calculations, manual updates | Moderate |

Basic Software | Moderate | Automated calculations, limited integrations | Moderate |

Cloud-Based Software | Higher | Bank linking, invoicing, real-time access, robust reporting | High |

When and How to Hire a Professional Bookkeeper

Most founders start out managing their own books — and that’s fine in the early days. But as your business grows, DIY bookkeeping can quickly turn from practical to risky. There are three clear signs it’s time to bring in a professional bookkeeper.

1. You don’t have real-time visibility into your financials.

If you can’t see your current cash position, burn rate, or runway at a glance, it’s time for help. Without accurate, timely data, every decision — hiring, pricing, fundraising — becomes a guess.

2. Your financial statements aren’t investor-ready.

Investors expect accrual-based financials, not cash-basis spreadsheets. If you can’t confidently produce accurate balance sheets, P&Ls, or cash flow statements, a professional bookkeeper ensures your numbers meet due diligence standards.

3. Tax season feels like crisis mode.

When tax filings are stressful or delayed, it usually means your books aren’t clean or compliant. A dedicated startup bookkeeper can keep you audit-ready year-round and eliminate last-minute scrambling.

Qualities to Look For in a Professional Bookkeeper

A great bookkeeper isn’t just accurate — they’re proactive, tech-savvy, and startup fluent. Look for:

Automation expertise: Comfort with tools like QuickBooks Online, Ramp, and Gusto.

Startup experience: Understanding of venture-backed accounting (SAFEs, cap tables, burn rate).

Responsiveness: Real-time communication and clear escalation paths.

Oversight: Access to CPA review or fractional CFO guidance when needed.

When to consider outsourcing

If you’re behind on books, need investor-ready statements, or face complex tax filings, it’s time to outsource. Accurate bookkeeping isn’t just about compliance — it’s the backbone of growth and investor trust.

At Haven, bookkeeping comes with CPA oversight, 24/7 Slack support, and fractional CFO options. We currently support 400+ startups and maintain an average 4-minute initial response time on Slack — so founders never wait days for answers.

FAQs

What are the basic bookkeeping best practices for startups?

Startups should keep accurate records, categorize transactions properly, reconcile bank statements regularly, manage invoices on time, separate business and personal finances, and comply with tax laws. This answers "how to organize bookkeeping for startups.

When should a startup hire a professional bookkeeper?

Hire when financial data becomes overwhelming, investor-ready statements are needed, or tax compliance grows complex. This addresses "when to hire a bookkeeper for a startup.

Which accounting software is best for startups?

It depends on startup size and budget. Options range from spreadsheets for small operations to cloud-based software offering automation and integration. Cloud-based solutions offer significant advantages through real-time access and automation, making cloud-based accounting software a valuable option.

How can startups maintain compliance in bookkeeping?

By following GAAP or IFRS principles, implementing internal controls, keeping detailed records, and consulting tax professionals.

What are the benefits of outsourcing bookkeeping for startups?

Outsourcing saves time, reduces errors, improves accuracy, ensures compliance, and allows startups to focus on core activities, providing significant "outsourced bookkeeping benefits."

Behind every successful startup is a clean set of books. Investors look at your financials to judge growth, spending, and data accuracy—so they need to be right. When your financials are accurate, fundraising moves faster, audits feel lighter, and decisions come with fewer surprises.

This guide breaks down 5 bookkeeping best practices built from working with 400+ startups across every stage of growth. You’ll learn what separates “good enough” books from investor-ready financials—and how to set up a system that scales with you.

What Exactly Do Bookkeepers Do for Startups?

A bookkeeper keeps your financial data clean, organized, and ready whenever you need it. They handle the day-to-day work that keeps your statements accurate and prevents surprises during fundraising, audits, or internal reviews.

A bookkeeper will:

Record and categorize transactions so your books stay current

Reconcile your accounts to catch errors before they snowball

Prepare reliable financial statements you can use for decisions or investor updates

Track outstanding bills and invoices to keep cash flow predictable

Maintain audit-ready documentation across receipts, vendors, and records

Flag missing or inconsistent data before it becomes a problem

5 Essential Bookkeeping Best Practices for Startups

So, your startup is taking off – exciting! But behind every great idea is a solid financial foundation. Ignoring bookkeeping is a common, and often costly, misstep for new businesses. Think of it: unclear cash flow, messy tax season, lost investor confidence – these are real risks.

But it doesn't have to be complicated.

We've broken down the essential bookkeeping practices into actionable, easy-to-digest steps.

1. Establish Core Financial Foundations

Set Up Organized Records from Day One

Categorize every transaction accurately. Clearly define and assign income, expenses, payroll, and taxes to the right categories. This streamlines reporting and highlights spending patterns.

Separate Business and Personal Finances

Always maintain distinct business and personal accounts. Avoid confusion, missed deductions, and messy audits.

Maintain an Updated Chart of Accounts (COA)

Maintain an up-to-date COA listing all assets, liabilities, equity, expenses, and revenue. It’s your snapshot of financial health.

2. Manage Daily Operations Efficiently

Reconcile Accounts Monthly

Compare records with bank and credit card statements each month. Catch errors or unauthorized charges early.

Stay on Top of Invoices and Payments

Send invoices promptly, follow up before payments are overdue, and pay vendors on schedule. Implement automated reminders to keep cash flowing.

Monitor Cash Flow in Real Time

Use tools that provide live insights into inflows and outflows. Review trends weekly to identify profitable products and cost drains.

3. Ensure Compliance and Security

Follow Accounting Standards (GAAP or IFRS)

Adhere to GAAP for U.S. reporting or IFRS if operating globally. These principles keep financials transparent and audit-ready. Learn more about GAAP standards through trusted small business resources.

Maintain Accurate, Audit-Ready Records

Keep receipts, invoices, and tax files organized. Digital copies simplify audits and support deductions.

Implement Internal Controls

Establish policies to prevent fraud and maintain accuracy. Separate transaction entry, approval, and payment roles; use secure access permissions.

4. Leverage Tools and Expertise for Growth

Use Reliable Bookkeeping Software

Select accounting software built for startups that syncs directly with your bank. Automated reconciliation reduces manual work and error risk.

Automate Repetitive Tasks

Let software handle data entry and categorization so your team focuses on strategy, not spreadsheets.

Document Procedures and Review Regularly

Write down every step of your bookkeeping workflow and review monthly or quarterly for trends and accuracy.

Consider Outsourcing to Experts

If bookkeeping drains founder bandwidth, outsource it. Haven’s startup-focused team ensures compliance and clean books while you scale.

5. Compliance & Financial Controls Checklist

Following tax laws and local regulations is crucial. Adhering to GAAP or International Financial Reporting Standards (IFRS) is key. Implement internal controls like segregation of duties and audit trails. Secure financial data to prevent unauthorized access. Understand that non-compliance results in penalties and reputational risk.

Checklist for GAAP / Tax Law Compliance

Maintain accurate and complete records

Categorize transactions correctly

Reconcile statements monthly

Separate business and personal finances

Follow GAAP or IFRS standards

Implement internal controls and approval workflows

Keep documentation for all deductions and credits

Stay updated on tax regulations

Consult with a CPA quarterly

Securely back up all financial data

Choosing the Right Bookkeeping Tools for Your Startup

Choosing the right tools depends on the transaction volume, number of integrations, and stage of development. For very early founders, spreadsheets work until monthly transactions surpass ~100.

At Seed and beyond, we recommend cloud solutions that link to payroll and bank feeds to reduce reconciliation time.

Focus on solutions that offer automated bank feeds, robust integrations, and audit trails. Consider accounting software for startups that scales with your growth; the best accounting software for startups offers flexibility and automation.

Tool Type | Cost | Features | Scalability |

Manual (Pen & Paper) | Low | Basic record keeping | Low |

Spreadsheets | Low | Simple calculations, manual updates | Moderate |

Basic Software | Moderate | Automated calculations, limited integrations | Moderate |

Cloud-Based Software | Higher | Bank linking, invoicing, real-time access, robust reporting | High |

When and How to Hire a Professional Bookkeeper

Most founders start out managing their own books — and that’s fine in the early days. But as your business grows, DIY bookkeeping can quickly turn from practical to risky. There are three clear signs it’s time to bring in a professional bookkeeper.

1. You don’t have real-time visibility into your financials.

If you can’t see your current cash position, burn rate, or runway at a glance, it’s time for help. Without accurate, timely data, every decision — hiring, pricing, fundraising — becomes a guess.

2. Your financial statements aren’t investor-ready.

Investors expect accrual-based financials, not cash-basis spreadsheets. If you can’t confidently produce accurate balance sheets, P&Ls, or cash flow statements, a professional bookkeeper ensures your numbers meet due diligence standards.

3. Tax season feels like crisis mode.

When tax filings are stressful or delayed, it usually means your books aren’t clean or compliant. A dedicated startup bookkeeper can keep you audit-ready year-round and eliminate last-minute scrambling.

Qualities to Look For in a Professional Bookkeeper

A great bookkeeper isn’t just accurate — they’re proactive, tech-savvy, and startup fluent. Look for:

Automation expertise: Comfort with tools like QuickBooks Online, Ramp, and Gusto.

Startup experience: Understanding of venture-backed accounting (SAFEs, cap tables, burn rate).

Responsiveness: Real-time communication and clear escalation paths.

Oversight: Access to CPA review or fractional CFO guidance when needed.

When to consider outsourcing

If you’re behind on books, need investor-ready statements, or face complex tax filings, it’s time to outsource. Accurate bookkeeping isn’t just about compliance — it’s the backbone of growth and investor trust.

At Haven, bookkeeping comes with CPA oversight, 24/7 Slack support, and fractional CFO options. We currently support 400+ startups and maintain an average 4-minute initial response time on Slack — so founders never wait days for answers.

FAQs

What are the basic bookkeeping best practices for startups?

Startups should keep accurate records, categorize transactions properly, reconcile bank statements regularly, manage invoices on time, separate business and personal finances, and comply with tax laws. This answers "how to organize bookkeeping for startups.

When should a startup hire a professional bookkeeper?

Hire when financial data becomes overwhelming, investor-ready statements are needed, or tax compliance grows complex. This addresses "when to hire a bookkeeper for a startup.

Which accounting software is best for startups?

It depends on startup size and budget. Options range from spreadsheets for small operations to cloud-based software offering automation and integration. Cloud-based solutions offer significant advantages through real-time access and automation, making cloud-based accounting software a valuable option.

How can startups maintain compliance in bookkeeping?

By following GAAP or IFRS principles, implementing internal controls, keeping detailed records, and consulting tax professionals.

What are the benefits of outsourcing bookkeeping for startups?

Outsourcing saves time, reduces errors, improves accuracy, ensures compliance, and allows startups to focus on core activities, providing significant "outsourced bookkeeping benefits."

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026