Go Back

Last Updated :

Last Updated :

Dec 8, 2025

Dec 8, 2025

Bookkeeping for Plumbing Businesses: Build a Clear, Profitable Financial System

Setting up and maintaining bookkeeping for plumbing business operations is essential for founders who want to scale profitably while staying on top of financial health. Plumbing companies, with their job-based services, variable materials costs, and fluctuating work schedules, face unique accounting challenges that require a tailored bookkeeping system.

This guide will walk you step-by-step through practical strategies to track jobs, manage invoices, and control cash flow — all vital for founders aiming for streamlined operations and strong financial footing.

Why Bookkeeping for Plumbing Business Needs a Job-Centric Approach

Unlike product-based firms, plumbing companies operate on a job-by-job basis. Each project or service call involves labor, parts, subcontractors, and timing variables, making simple monthly bookkeeping insufficient to get a clear picture of financial performance.

The key to smart bookkeeping for plumbing business owners is tracking jobs as discrete financial units. This means assigning every expense, invoice, and payment to the corresponding job. Why?

Granular Profitability Insight: Understand which types of plumbing jobs or clients are most profitable.

Cost Control: Monitor materials and labor costs per job to avoid overruns.

Cash Flow Timing: Forecast collections based on individual contractor payments and customer invoices.

Accurate Tax Reporting & Compliance: Precise income and expense attribution facilitates tax deductions and credits relevant to your business type.

Organizing your bookkeeping around individual jobs gives plumbing business owners a clear view of costs, margins, and timelines — enabling faster, more accurate operational decisions.

Managing Plumbing Jobs: The Foundation of Your Books

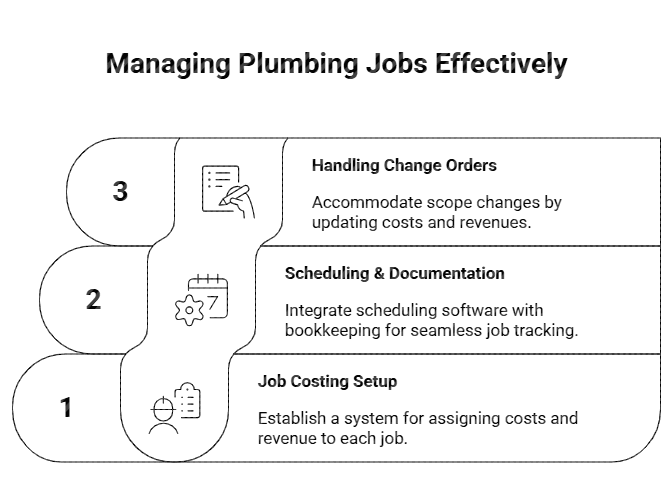

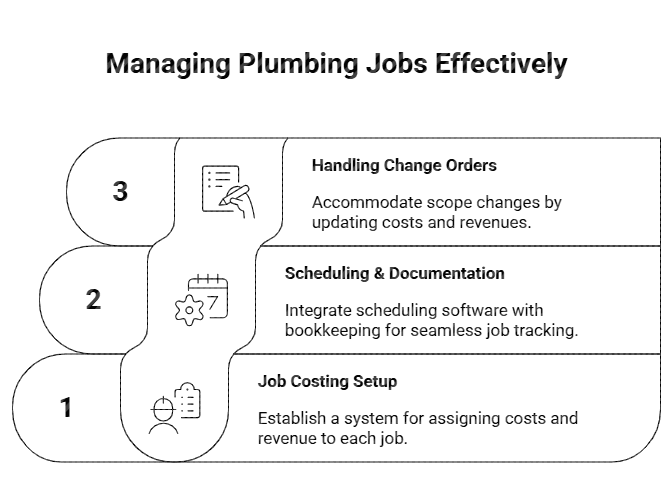

Effectively managing individual plumbing jobs within your bookkeeping system involves these core steps:

1. Job Costing Setup

Create a system for assigning costs (labor, parts, subcontractors) and revenue to each job. Your bookkeeping software or platform should support job costing or project-based accounting.

Best practices include:

Job Numbers or Codes: Assign unique identifiers for each job.

Cost Categories: Separate direct costs (materials, subcontractors) and indirect costs (overhead, travel) related to jobs.

Timesheets for Labor: Track plumber or technician hours per job digitally.

Material Tracking: Record parts used and their cost per job.

This job costing focus allows you to build real-time P&L reports for each service you deliver — a must-have for controlling budgets and pricing new bids competitively.

2. Scheduling & Job Documentation

Integrate your scheduling or dispatch software with bookkeeping to capture job details automatically. Ensuring a documented workflow from job acceptance through completion streamlines invoicing and reporting.

3. Handling Change Orders & Extras

Plumbing jobs often have scope changes mid-project. Your bookkeeping must accommodate change orders by updating costs and projected revenues while keeping a historical job record intact.

Linking Job Management to Billing: How to Make Invoices Fast, Accurate & Easy to Track

Invoices are where money enters your business, so managing them well is foundational to good bookkeeping.

Best Practices for Plumbing Business Invoices

Job-Specific Invoices: Generate invoices that reference the job number and list labor, parts, and other charges explicitly.

Standardized Templates: Use branded, clear templates with payment terms, deadlines, and licensing info.

Prompt Invoicing: Send invoices immediately after job completion to speed up the payment cycle.

Automate Reminders: Use software that automatically sends friendly payment reminders for overdue invoices.

By tying invoices directly to jobs, you can track which invoices are outstanding per client or project, enabling focused collections efforts. This visibility improves cash flow — a critical challenge for many plumbing businesses.

Learn additional strategies in Haven’s breakdown on effective cash management for founders.

Cash Flow Control: Avoid Surprises with Predictive Insights

Maintaining steady cash flow in plumbing services can be a balancing act between upfront material purchases, paying labor, and waiting for client payments. Strong bookkeeping turns your numbers from reactive snapshots into forward-looking signals.

Key Actions to Improve Cash Flow Management

Action | Description | Benefit |

Track Job-Level Receivables | Link payments due to specific jobs in a cash flow forecast | Anticipate cash shortfalls or surpluses |

Monitor Payables Scheduling | Align vendor payments with incoming receivables | Prevent late fees and maintain vendor trust |

Maintain a Cash Reserve | Set aside funds for unexpected cost spikes | Improves financial stability |

Use Automated Payment Platforms | Offer fast digital payment options | Accelerates cash inflows |

If your team needs help transitioning to predictive cash management integrated with job-level bookkeeping, Haven’s specialists can support your plumbing business with a streamlined workflow.

Tax Considerations & Credits for Plumbing Businesses

Proper bookkeeping directly influences your ability to maximize tax savings and comply seamlessly with tax regulations. Areas to consider:

Section 179 & Depreciation for vehicles, tools, and equipment

Work Opportunity Tax Credit (WOTC) for eligible hires

R&D Tax Credits for developing new methods, systems, or technologies

Accurate Expense Tracking to substantiate deductions

The IRS offers helpful guidance on allowable deductions; see the IRS Business Tax Deductions Guide.

Transitioning Plumbing Bookkeeping to a Modern, Founder-Friendly System

Many plumbing founders start with manual spreadsheets, which quickly become limiting as jobs, staff, and billing volume grow. A modern bookkeeping system provides:

Real-Time Insights into cash flow and job profitability

Automation & Integrations for invoicing, payroll, inventory, and job scheduling

Scalability to support business growth

Founder-Focused Support for faster decisions and fewer errors

To see how similar job-based accounting models work, explore Haven’s guide to bookkeeping for construction businesses.

Elevate Your Plumbing Business with Expert Bookkeeping

Good bookkeeping for plumbing business founders isn’t just about staying compliant — it’s a strategic asset that:

Improves job profitability

Accelerates collections

Helps you forecast cash flow with confidence

Supports deductions and tax credits for reinvestment

By adopting a job-centric bookkeeping system supported by modern tools and Haven’s expert team, plumbing founders can scale confidently and sustainably.

Ready to improve clarity and performance?

Setting up and maintaining bookkeeping for plumbing business operations is essential for founders who want to scale profitably while staying on top of financial health. Plumbing companies, with their job-based services, variable materials costs, and fluctuating work schedules, face unique accounting challenges that require a tailored bookkeeping system.

This guide will walk you step-by-step through practical strategies to track jobs, manage invoices, and control cash flow — all vital for founders aiming for streamlined operations and strong financial footing.

Why Bookkeeping for Plumbing Business Needs a Job-Centric Approach

Unlike product-based firms, plumbing companies operate on a job-by-job basis. Each project or service call involves labor, parts, subcontractors, and timing variables, making simple monthly bookkeeping insufficient to get a clear picture of financial performance.

The key to smart bookkeeping for plumbing business owners is tracking jobs as discrete financial units. This means assigning every expense, invoice, and payment to the corresponding job. Why?

Granular Profitability Insight: Understand which types of plumbing jobs or clients are most profitable.

Cost Control: Monitor materials and labor costs per job to avoid overruns.

Cash Flow Timing: Forecast collections based on individual contractor payments and customer invoices.

Accurate Tax Reporting & Compliance: Precise income and expense attribution facilitates tax deductions and credits relevant to your business type.

Organizing your bookkeeping around individual jobs gives plumbing business owners a clear view of costs, margins, and timelines — enabling faster, more accurate operational decisions.

Managing Plumbing Jobs: The Foundation of Your Books

Effectively managing individual plumbing jobs within your bookkeeping system involves these core steps:

1. Job Costing Setup

Create a system for assigning costs (labor, parts, subcontractors) and revenue to each job. Your bookkeeping software or platform should support job costing or project-based accounting.

Best practices include:

Job Numbers or Codes: Assign unique identifiers for each job.

Cost Categories: Separate direct costs (materials, subcontractors) and indirect costs (overhead, travel) related to jobs.

Timesheets for Labor: Track plumber or technician hours per job digitally.

Material Tracking: Record parts used and their cost per job.

This job costing focus allows you to build real-time P&L reports for each service you deliver — a must-have for controlling budgets and pricing new bids competitively.

2. Scheduling & Job Documentation

Integrate your scheduling or dispatch software with bookkeeping to capture job details automatically. Ensuring a documented workflow from job acceptance through completion streamlines invoicing and reporting.

3. Handling Change Orders & Extras

Plumbing jobs often have scope changes mid-project. Your bookkeeping must accommodate change orders by updating costs and projected revenues while keeping a historical job record intact.

Linking Job Management to Billing: How to Make Invoices Fast, Accurate & Easy to Track

Invoices are where money enters your business, so managing them well is foundational to good bookkeeping.

Best Practices for Plumbing Business Invoices

Job-Specific Invoices: Generate invoices that reference the job number and list labor, parts, and other charges explicitly.

Standardized Templates: Use branded, clear templates with payment terms, deadlines, and licensing info.

Prompt Invoicing: Send invoices immediately after job completion to speed up the payment cycle.

Automate Reminders: Use software that automatically sends friendly payment reminders for overdue invoices.

By tying invoices directly to jobs, you can track which invoices are outstanding per client or project, enabling focused collections efforts. This visibility improves cash flow — a critical challenge for many plumbing businesses.

Learn additional strategies in Haven’s breakdown on effective cash management for founders.

Cash Flow Control: Avoid Surprises with Predictive Insights

Maintaining steady cash flow in plumbing services can be a balancing act between upfront material purchases, paying labor, and waiting for client payments. Strong bookkeeping turns your numbers from reactive snapshots into forward-looking signals.

Key Actions to Improve Cash Flow Management

Action | Description | Benefit |

Track Job-Level Receivables | Link payments due to specific jobs in a cash flow forecast | Anticipate cash shortfalls or surpluses |

Monitor Payables Scheduling | Align vendor payments with incoming receivables | Prevent late fees and maintain vendor trust |

Maintain a Cash Reserve | Set aside funds for unexpected cost spikes | Improves financial stability |

Use Automated Payment Platforms | Offer fast digital payment options | Accelerates cash inflows |

If your team needs help transitioning to predictive cash management integrated with job-level bookkeeping, Haven’s specialists can support your plumbing business with a streamlined workflow.

Tax Considerations & Credits for Plumbing Businesses

Proper bookkeeping directly influences your ability to maximize tax savings and comply seamlessly with tax regulations. Areas to consider:

Section 179 & Depreciation for vehicles, tools, and equipment

Work Opportunity Tax Credit (WOTC) for eligible hires

R&D Tax Credits for developing new methods, systems, or technologies

Accurate Expense Tracking to substantiate deductions

The IRS offers helpful guidance on allowable deductions; see the IRS Business Tax Deductions Guide.

Transitioning Plumbing Bookkeeping to a Modern, Founder-Friendly System

Many plumbing founders start with manual spreadsheets, which quickly become limiting as jobs, staff, and billing volume grow. A modern bookkeeping system provides:

Real-Time Insights into cash flow and job profitability

Automation & Integrations for invoicing, payroll, inventory, and job scheduling

Scalability to support business growth

Founder-Focused Support for faster decisions and fewer errors

To see how similar job-based accounting models work, explore Haven’s guide to bookkeeping for construction businesses.

Elevate Your Plumbing Business with Expert Bookkeeping

Good bookkeeping for plumbing business founders isn’t just about staying compliant — it’s a strategic asset that:

Improves job profitability

Accelerates collections

Helps you forecast cash flow with confidence

Supports deductions and tax credits for reinvestment

By adopting a job-centric bookkeeping system supported by modern tools and Haven’s expert team, plumbing founders can scale confidently and sustainably.

Ready to improve clarity and performance?

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026