Go Back

Last Updated :

Last Updated :

Dec 1, 2025

Dec 1, 2025

Bookkeeping for Construction Business: How to Track Costs and Cash Flow

For founders leading construction businesses, bookkeeping for construction business isn’t just a regulatory requirement—it’s the backbone of operational success. Managing projects, materials, subcontractors, and cash flow demands precision and insight. Without clear financial records, even the best construction projects can face budget overruns, missed deadlines, or cash shortages. This guide is designed to help founders like you implement modern, effective bookkeeping practices to navigate the unique financial challenges your business faces.

Why Bookkeeping Is Essential for Construction Businesses

Construction ventures are project-based, often spanning weeks or months, with fluctuating expenses and delayed revenue streams. Traditional bookkeeping falls short in capturing the nuances here. Proper bookkeeping enables you to:

Track real-time project costs: From raw materials to labor, with clarity on allocated vs. actual spend.

Monitor cash flow meticulously: Construction is notoriously cash-intensive; visibility prevents payment delays and keeps projects moving.

Support strategic decision-making: Understand profitability trends by project, client, or job type.

Simplify tax preparation and compliance: Reduce audit risks and leverage credits like the R&D tax credit if applicable.

Given the complexity, founders typically benefit from specialized bookkeeping services tailored to construction’s workflows. Haven’s bookkeeping services combine startup-native agility with industry know-how, ensuring your books empower rather than overwhelm.

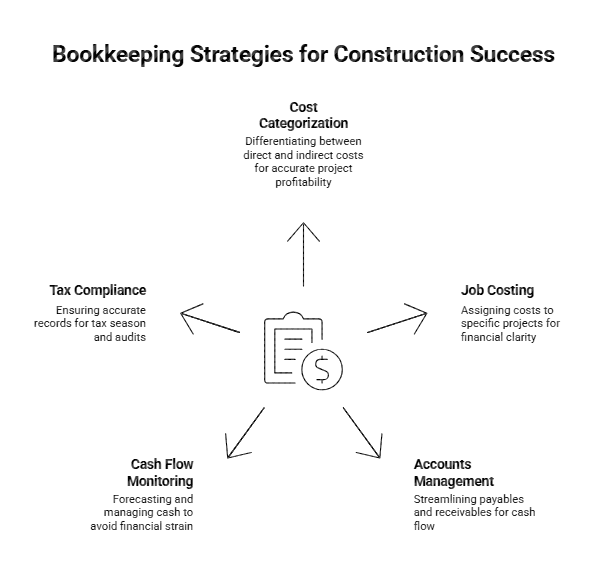

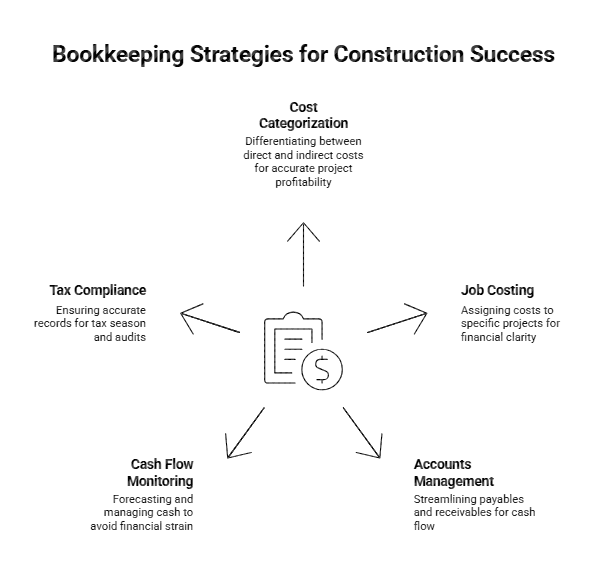

Key Elements of Bookkeeping for Construction Business Success

1. Categorize Costs Correctly

Delineate between direct costs (materials, labor, subcontractors) and indirect costs (equipment depreciation, administrative expenses). This categorization enables you to measure project-specific profitability and informs bidding on new jobs.

Practical steps:

Use a chart of accounts customized to construction operations.

Include separate accounts for payroll taxes and insurance tied to projects.

Track overhead expenses separately—don’t lump project and general costs together.

2. Implement Job Costing for Each Project

Job costing is the process of attributing all costs and revenues to a specific project, providing a clear picture of its financial performance.

How to do it right:

Assign a unique job number for every construction project.

Record every expense and invoice against the specific job.

Regularly reconcile project budgets against actual spend.

This level of detail supports proactive management—enabling quick reaction to overruns or under-budget situations.

3. Manage Accounts Payable and Receivable with Precision

Delays in payments create cash flow headaches that ripple into project delays and strained supplier relationships.

Steps to take:

Streamline invoice processing with a digital system.

Schedule payments to optimize cash flow without late fees.

Monitor receivables closely, following up promptly on overdue invoices.

These steps help maintain strong vendor relationships and keep your business financially agile.

4. Monitor Cash Flow Continuously

For construction businesses, cash isn’t just king—it’s the whole kingdom. Projects may require significant upfront investments before payments arrive.

Actionable guidance:

Use cash flow forecasts aligned with project timelines.

Account for retainage held by clients until project completion.

Prepare for seasonal or market fluctuations in work volume.

Modern construction bookkeeping software solutions can automate many of these tasks, integrating with your accounting to provide real-time dashboards.

5. Maintain Compliance and Prepare for Taxes

Construction businesses have specific tax considerations, including different treatment for inventory (materials), labor, and equipment.

Track labor-related taxes carefully.

Capitalize equipment costs over time appropriately.

Identify opportunities for credits such as the R&D tax credit when innovating in construction methods or materials.

By keeping your books accurate and detailed, you streamline tax season and reduce audit risk. Haven also offers expert services beyond bookkeeping to support your tax filing and credit claims efficiently.

Common Challenges Founders Face with Construction Bookkeeping and How to Overcome Them

Challenge | Impact on Business | Founder-Friendly Solutions |

Complex multi-project accounting | Confusing cost allocation; unclear profits | Adopt cloud-based bookkeeping with project tracking modules |

Manual data entry errors | Financial inaccuracies and wasted time | Automate data capture with integrated tools and mobile invoicing |

Cash flow unpredictability | Delayed supplier payments; job delays | Use rolling forecasts updated weekly to anticipate shortfalls |

Lack of timely financial insights | Reactive decisions; missed growth | Generate weekly snapshot reports covering key metrics |

Addressing these early helps founders regain control and instill confidence in financial management.

How Haven Helps Streamline Your Bookkeeping for Construction Business

At Haven, we understand the unique nature of construction bookkeeping. Our tailored solutions include:

Setup of custom chart of accounts aligned to your project workflows

Full job costing implementation and project-by-project reporting

Integration with contractor payroll and vendor payment services

Data visualizations and financial reporting optimized for fast-moving founders

Expert support to ensure tax compliance and unlock incentives like the R&D credit

To explore what efficient and scalable bookkeeping looks like, check out our bookkeeping best practices. It’s designed for high-growth construction companies who want clarity without compromise.

By partnering with Haven, you gain more than compliance—you gain a financial system that grows with you.

Resources for Construction Business Owners

For authoritative guidance on tax filing, labor regulations, and business structure considerations, visit the IRS Small Business and Self-Employed Tax Center. Staying ahead of tax regulations and leveraging digital tools will help your construction company build stronger financial foundations.

Strengthening Your Financial Foundation

Establishing robust bookkeeping for construction business practices is foundational to your venture’s success. By categorizing costs meticulously, implementing precise job costing, managing payables and receivables, monitoring cash flow, and maintaining compliance, you empower your construction business to thrive. Haven’s services deliver fast, modern, and startup-native support tailored for founders who demand clarity and control over their financials.

For founders leading construction businesses, bookkeeping for construction business isn’t just a regulatory requirement—it’s the backbone of operational success. Managing projects, materials, subcontractors, and cash flow demands precision and insight. Without clear financial records, even the best construction projects can face budget overruns, missed deadlines, or cash shortages. This guide is designed to help founders like you implement modern, effective bookkeeping practices to navigate the unique financial challenges your business faces.

Why Bookkeeping Is Essential for Construction Businesses

Construction ventures are project-based, often spanning weeks or months, with fluctuating expenses and delayed revenue streams. Traditional bookkeeping falls short in capturing the nuances here. Proper bookkeeping enables you to:

Track real-time project costs: From raw materials to labor, with clarity on allocated vs. actual spend.

Monitor cash flow meticulously: Construction is notoriously cash-intensive; visibility prevents payment delays and keeps projects moving.

Support strategic decision-making: Understand profitability trends by project, client, or job type.

Simplify tax preparation and compliance: Reduce audit risks and leverage credits like the R&D tax credit if applicable.

Given the complexity, founders typically benefit from specialized bookkeeping services tailored to construction’s workflows. Haven’s bookkeeping services combine startup-native agility with industry know-how, ensuring your books empower rather than overwhelm.

Key Elements of Bookkeeping for Construction Business Success

1. Categorize Costs Correctly

Delineate between direct costs (materials, labor, subcontractors) and indirect costs (equipment depreciation, administrative expenses). This categorization enables you to measure project-specific profitability and informs bidding on new jobs.

Practical steps:

Use a chart of accounts customized to construction operations.

Include separate accounts for payroll taxes and insurance tied to projects.

Track overhead expenses separately—don’t lump project and general costs together.

2. Implement Job Costing for Each Project

Job costing is the process of attributing all costs and revenues to a specific project, providing a clear picture of its financial performance.

How to do it right:

Assign a unique job number for every construction project.

Record every expense and invoice against the specific job.

Regularly reconcile project budgets against actual spend.

This level of detail supports proactive management—enabling quick reaction to overruns or under-budget situations.

3. Manage Accounts Payable and Receivable with Precision

Delays in payments create cash flow headaches that ripple into project delays and strained supplier relationships.

Steps to take:

Streamline invoice processing with a digital system.

Schedule payments to optimize cash flow without late fees.

Monitor receivables closely, following up promptly on overdue invoices.

These steps help maintain strong vendor relationships and keep your business financially agile.

4. Monitor Cash Flow Continuously

For construction businesses, cash isn’t just king—it’s the whole kingdom. Projects may require significant upfront investments before payments arrive.

Actionable guidance:

Use cash flow forecasts aligned with project timelines.

Account for retainage held by clients until project completion.

Prepare for seasonal or market fluctuations in work volume.

Modern construction bookkeeping software solutions can automate many of these tasks, integrating with your accounting to provide real-time dashboards.

5. Maintain Compliance and Prepare for Taxes

Construction businesses have specific tax considerations, including different treatment for inventory (materials), labor, and equipment.

Track labor-related taxes carefully.

Capitalize equipment costs over time appropriately.

Identify opportunities for credits such as the R&D tax credit when innovating in construction methods or materials.

By keeping your books accurate and detailed, you streamline tax season and reduce audit risk. Haven also offers expert services beyond bookkeeping to support your tax filing and credit claims efficiently.

Common Challenges Founders Face with Construction Bookkeeping and How to Overcome Them

Challenge | Impact on Business | Founder-Friendly Solutions |

Complex multi-project accounting | Confusing cost allocation; unclear profits | Adopt cloud-based bookkeeping with project tracking modules |

Manual data entry errors | Financial inaccuracies and wasted time | Automate data capture with integrated tools and mobile invoicing |

Cash flow unpredictability | Delayed supplier payments; job delays | Use rolling forecasts updated weekly to anticipate shortfalls |

Lack of timely financial insights | Reactive decisions; missed growth | Generate weekly snapshot reports covering key metrics |

Addressing these early helps founders regain control and instill confidence in financial management.

How Haven Helps Streamline Your Bookkeeping for Construction Business

At Haven, we understand the unique nature of construction bookkeeping. Our tailored solutions include:

Setup of custom chart of accounts aligned to your project workflows

Full job costing implementation and project-by-project reporting

Integration with contractor payroll and vendor payment services

Data visualizations and financial reporting optimized for fast-moving founders

Expert support to ensure tax compliance and unlock incentives like the R&D credit

To explore what efficient and scalable bookkeeping looks like, check out our bookkeeping best practices. It’s designed for high-growth construction companies who want clarity without compromise.

By partnering with Haven, you gain more than compliance—you gain a financial system that grows with you.

Resources for Construction Business Owners

For authoritative guidance on tax filing, labor regulations, and business structure considerations, visit the IRS Small Business and Self-Employed Tax Center. Staying ahead of tax regulations and leveraging digital tools will help your construction company build stronger financial foundations.

Strengthening Your Financial Foundation

Establishing robust bookkeeping for construction business practices is foundational to your venture’s success. By categorizing costs meticulously, implementing precise job costing, managing payables and receivables, monitoring cash flow, and maintaining compliance, you empower your construction business to thrive. Haven’s services deliver fast, modern, and startup-native support tailored for founders who demand clarity and control over their financials.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026