Go Back

Last Updated :

Last Updated :

Dec 1, 2025

Dec 1, 2025

A Founder-Friendly Guide to Bookkeeping for a Cleaning Business

Managing bookkeeping for a cleaning business effectively is essential for maintaining healthy cash flow, staying compliant with tax requirements, and making data-driven decisions that fuel growth. As a founder or operator of a cleaning startup or small business, you don’t need to be an accounting expert to keep your financials in order — but understanding some practical bookkeeping fundamentals can make all the difference.

This guide will walk you through simple, founder-focused steps to streamline your bookkeeping, help you avoid common pitfalls, and guide you toward leveraging expert support when your business scales.

Why Bookkeeping Matters for Your Cleaning Business

Bookkeeping is more than just a regulatory box to check; it’s the financial backbone of your business. Keeping organized and timely records allows you to:

Understand your cash flow: When you track income and expenses accurately, you know if you’re profitable and can plan for leaner periods or growth investments.

Simplify tax time: Proper bookkeeping ensures you have the right documents and records for business deductions and tax filings, reducing costly errors and audit risks.

Make informed decisions: Whether you’re considering expanding your team, investing in new equipment, or setting pricing, solid financial data informs every choice.

Cleaning businesses often encounter unique expense items (e.g., supplies, vehicle costs, payroll for part-time workers) and revenue streams that make bookkeeping feel tricky. But by adopting a consistent system, you create clarity that drives smarter, faster business decisions.

To explore modern bookkeeping tailored for startups like yours, check out Haven’s bookkeeping services. Our founder-friendly approach helps you stay focused on operations while keeping your finances transparent and stress-free.

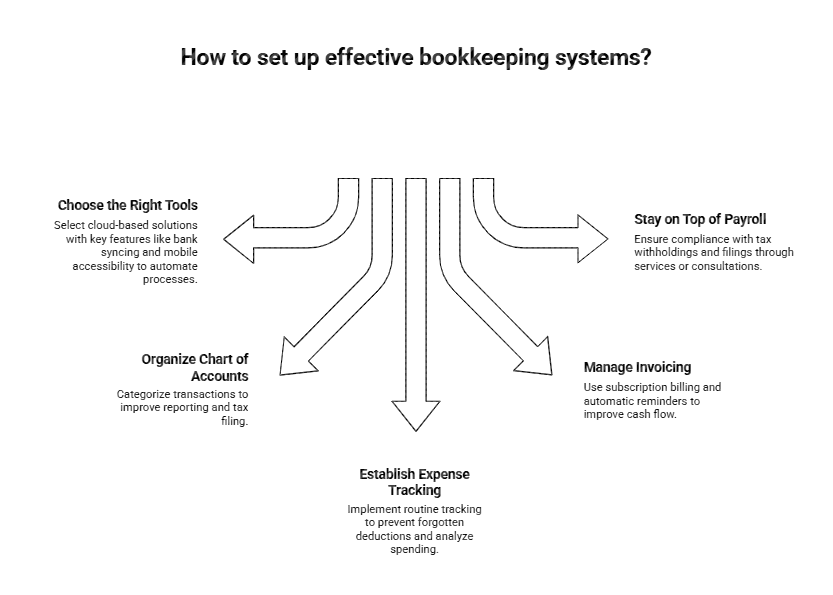

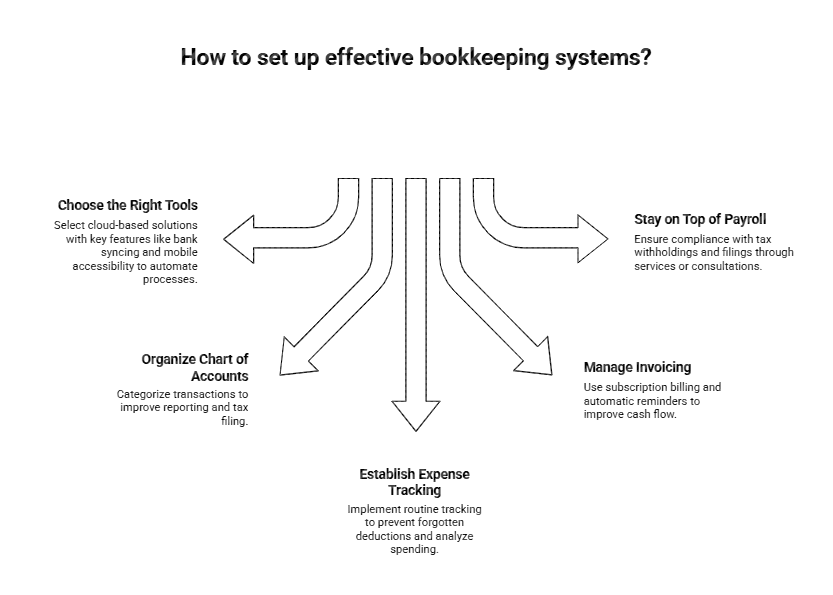

Setting Up Bookkeeping Systems That Work for Your Cleaning Business

1. Choose the Right Tools

Many founders resonate with simple, cloud-based solutions that automate manual entry while providing real-time access to financial data. Popular options include QuickBooks Online, Xero, or Wave — each offers user-friendly interfaces and integrations with bank accounts and payment processors.

Key features to prioritize for bookkeeping for a cleaning business include:

Feature | Why It Matters |

Bank & credit card syncing | Automates importing transactions |

Mobile app accessibility | Capture expenses on the go (e.g., supply purchases) |

Reporting capabilities | Generates profit & loss, cash flow, and tax reports |

Integration with payroll | Simplifies paying part-time or contract workers |

Automating data capture reduces manual errors and frees you up to focus on operational priorities.

2. Organize Your Chart of Accounts

A chart of accounts categorizes every transaction — making reporting sensible and tax filing easier. For cleaning companies, consider key categories like:

Revenue: residential cleaning, commercial contracts, one-time jobs

Supplies: cleaning products, protective gear

Equipment: vacuum cleaners, buffers

Vehicle expenses: mileage, fuel, maintenance

Payroll: wages for cleaners, administrative staff

General & administrative: rent, utilities, insurance

Clear categories help you monitor which revenue streams and expenses are most impactful. For example, you might discover that consumable supply costs heavily influence margins or that vehicle cost tracking unlocks new tax deductions.

3. Establish an Expense Tracking Routine

Routine tracking is critical. Encourage your cleaning staff or managers to submit receipts promptly, either physically or via apps. Centralize expense recording weekly or biweekly rather than waiting until the end of the month. Common expenses include:

Cleaning supplies (disinfectants, mops, buckets)

Fuel purchases or mileage logs for company vehicles

Uniforms or safety gear

Marketing or advertising spend

Software subscriptions (e.g., booking software, payroll)

Consistent expense capture prevents forgotten deductions and helps you analyze spending trends.

4. Manage Invoicing and Receivables Efficiently

For recurring clients, consider subscription billing or retainers, which simplify cash flow projections. For one-time jobs, timely invoicing with clear payment terms (e.g., net 15 days) improves collection speed. Use software that sends automatic reminders on overdue invoices to reduce follow-up time.

Accurate and frequent reconciliation of payments against invoices ensures you avoid gaps or double billing.

5. Stay on Top of Payroll and Taxes

Payroll handling can get complex, especially when managing multiple schedules, overtime, or 1099 contractors. Leverage payroll services or accountant consultations to ensure compliance with tax withholdings and filings.

Small cleaning businesses may also qualify for valuable credits like the R&D tax credit if you innovate in cleaning processes or products. Understanding these potential tax benefits can boost your bottom line.

Learn more about maximizing tax efficiency by reviewing tips in Haven’s bookkeeping best practices.

For additional resources, visit authoritative sources like this SBA guide on paying taxes.

How Bringing in Expert Support Amplifies Your Bookkeeping Efficiency

The founder-friendly route is not necessarily going it alone. Many cleaning business owners find that partnering with a specialized bookkeeping service tailored for startups can save significant time and reduce headaches. Key advantages include:

Expertise on industry-specific expenses and deductions

Faster, more accurate tax filing and credits optimization

Improved cash flow forecasting and financial insights

More time freed up to focus on client service and operations

At Haven, our bookkeeping services were built with founders in mind — balancing modern technology with human responsiveness. As your business grows, this partnership ensures your books scale correctly without the stress that often comes with growth.

Explore how professional bookkeeping support can unlock your business’s potential in our guide on the benefits of hiring a bookkeeper.

Practical Tips for Keeping Bookkeeping Simple in Your Cleaning Business

Separate personal and business accounts: This saves hours reconciling mixed expenses and simplifies tax audits.

Set aside a dedicated bookkeeping day or slot each week: Regular, small increments of work prevent overwhelming month-end crunches.

Digitize all documentation: Use cloud storage or expense tracking apps accessible to your team.

Review financial reports monthly: Understand revenue and cost drivers, and course-correct faster.

Use mileage tracking apps: If using personal vehicles for client visits, detailed logs maximize deductions.

Prioritize tax deductions: Common deductions include cleaning supplies, vehicle expenses, uniforms, and home-office costs.

Ask questions early: Engaging tax or bookkeeping professionals proactively saves costly errors later.

Mastering Bookkeeping for a Cleaning Business to Empower Growth

Bookkeeping for a cleaning business doesn’t have to be complex or time-consuming — when you use the right tools, establish practical workflows, and seek expert help when necessary, you gain a powerful advantage. Clear, accurate financial records help you manage cash flow, optimize tax strategies, and unlock growth.

By embracing modern bookkeeping practices that fit the realities of cleaning services, you can confidently steer your business to long-term success.

Managing bookkeeping for a cleaning business effectively is essential for maintaining healthy cash flow, staying compliant with tax requirements, and making data-driven decisions that fuel growth. As a founder or operator of a cleaning startup or small business, you don’t need to be an accounting expert to keep your financials in order — but understanding some practical bookkeeping fundamentals can make all the difference.

This guide will walk you through simple, founder-focused steps to streamline your bookkeeping, help you avoid common pitfalls, and guide you toward leveraging expert support when your business scales.

Why Bookkeeping Matters for Your Cleaning Business

Bookkeeping is more than just a regulatory box to check; it’s the financial backbone of your business. Keeping organized and timely records allows you to:

Understand your cash flow: When you track income and expenses accurately, you know if you’re profitable and can plan for leaner periods or growth investments.

Simplify tax time: Proper bookkeeping ensures you have the right documents and records for business deductions and tax filings, reducing costly errors and audit risks.

Make informed decisions: Whether you’re considering expanding your team, investing in new equipment, or setting pricing, solid financial data informs every choice.

Cleaning businesses often encounter unique expense items (e.g., supplies, vehicle costs, payroll for part-time workers) and revenue streams that make bookkeeping feel tricky. But by adopting a consistent system, you create clarity that drives smarter, faster business decisions.

To explore modern bookkeeping tailored for startups like yours, check out Haven’s bookkeeping services. Our founder-friendly approach helps you stay focused on operations while keeping your finances transparent and stress-free.

Setting Up Bookkeeping Systems That Work for Your Cleaning Business

1. Choose the Right Tools

Many founders resonate with simple, cloud-based solutions that automate manual entry while providing real-time access to financial data. Popular options include QuickBooks Online, Xero, or Wave — each offers user-friendly interfaces and integrations with bank accounts and payment processors.

Key features to prioritize for bookkeeping for a cleaning business include:

Feature | Why It Matters |

Bank & credit card syncing | Automates importing transactions |

Mobile app accessibility | Capture expenses on the go (e.g., supply purchases) |

Reporting capabilities | Generates profit & loss, cash flow, and tax reports |

Integration with payroll | Simplifies paying part-time or contract workers |

Automating data capture reduces manual errors and frees you up to focus on operational priorities.

2. Organize Your Chart of Accounts

A chart of accounts categorizes every transaction — making reporting sensible and tax filing easier. For cleaning companies, consider key categories like:

Revenue: residential cleaning, commercial contracts, one-time jobs

Supplies: cleaning products, protective gear

Equipment: vacuum cleaners, buffers

Vehicle expenses: mileage, fuel, maintenance

Payroll: wages for cleaners, administrative staff

General & administrative: rent, utilities, insurance

Clear categories help you monitor which revenue streams and expenses are most impactful. For example, you might discover that consumable supply costs heavily influence margins or that vehicle cost tracking unlocks new tax deductions.

3. Establish an Expense Tracking Routine

Routine tracking is critical. Encourage your cleaning staff or managers to submit receipts promptly, either physically or via apps. Centralize expense recording weekly or biweekly rather than waiting until the end of the month. Common expenses include:

Cleaning supplies (disinfectants, mops, buckets)

Fuel purchases or mileage logs for company vehicles

Uniforms or safety gear

Marketing or advertising spend

Software subscriptions (e.g., booking software, payroll)

Consistent expense capture prevents forgotten deductions and helps you analyze spending trends.

4. Manage Invoicing and Receivables Efficiently

For recurring clients, consider subscription billing or retainers, which simplify cash flow projections. For one-time jobs, timely invoicing with clear payment terms (e.g., net 15 days) improves collection speed. Use software that sends automatic reminders on overdue invoices to reduce follow-up time.

Accurate and frequent reconciliation of payments against invoices ensures you avoid gaps or double billing.

5. Stay on Top of Payroll and Taxes

Payroll handling can get complex, especially when managing multiple schedules, overtime, or 1099 contractors. Leverage payroll services or accountant consultations to ensure compliance with tax withholdings and filings.

Small cleaning businesses may also qualify for valuable credits like the R&D tax credit if you innovate in cleaning processes or products. Understanding these potential tax benefits can boost your bottom line.

Learn more about maximizing tax efficiency by reviewing tips in Haven’s bookkeeping best practices.

For additional resources, visit authoritative sources like this SBA guide on paying taxes.

How Bringing in Expert Support Amplifies Your Bookkeeping Efficiency

The founder-friendly route is not necessarily going it alone. Many cleaning business owners find that partnering with a specialized bookkeeping service tailored for startups can save significant time and reduce headaches. Key advantages include:

Expertise on industry-specific expenses and deductions

Faster, more accurate tax filing and credits optimization

Improved cash flow forecasting and financial insights

More time freed up to focus on client service and operations

At Haven, our bookkeeping services were built with founders in mind — balancing modern technology with human responsiveness. As your business grows, this partnership ensures your books scale correctly without the stress that often comes with growth.

Explore how professional bookkeeping support can unlock your business’s potential in our guide on the benefits of hiring a bookkeeper.

Practical Tips for Keeping Bookkeeping Simple in Your Cleaning Business

Separate personal and business accounts: This saves hours reconciling mixed expenses and simplifies tax audits.

Set aside a dedicated bookkeeping day or slot each week: Regular, small increments of work prevent overwhelming month-end crunches.

Digitize all documentation: Use cloud storage or expense tracking apps accessible to your team.

Review financial reports monthly: Understand revenue and cost drivers, and course-correct faster.

Use mileage tracking apps: If using personal vehicles for client visits, detailed logs maximize deductions.

Prioritize tax deductions: Common deductions include cleaning supplies, vehicle expenses, uniforms, and home-office costs.

Ask questions early: Engaging tax or bookkeeping professionals proactively saves costly errors later.

Mastering Bookkeeping for a Cleaning Business to Empower Growth

Bookkeeping for a cleaning business doesn’t have to be complex or time-consuming — when you use the right tools, establish practical workflows, and seek expert help when necessary, you gain a powerful advantage. Clear, accurate financial records help you manage cash flow, optimize tax strategies, and unlock growth.

By embracing modern bookkeeping practices that fit the realities of cleaning services, you can confidently steer your business to long-term success.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026