Go Back

Last Updated :

Last Updated :

Dec 6, 2025

Dec 6, 2025

Bookkeeping for Architects: A Guide to Managing Project-Based Finances

For founders steering architecture firms or architectural projects within agencies and startups, bookkeeping for architects is a vital discipline that can define your company’s financial health and growth trajectory. Unlike standard bookkeeping, managing project-based finances in architecture requires precise tracking of costs, revenues, billable hours, and client payments on a per-project basis.

This guide aims to arm with practical, startup-native strategies to streamline bookkeeping, optimize cash flow, and maintain compliance without getting bogged down in unnecessary complexity.

Why Specialized Bookkeeping for Architects Matters

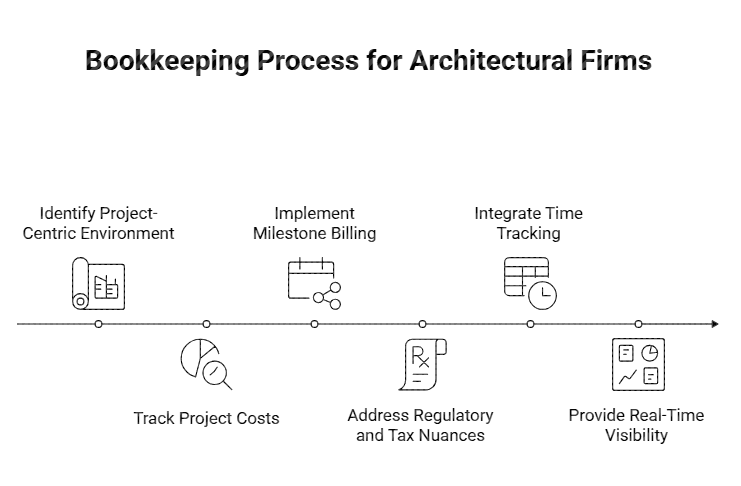

Architectural firms operate in a uniquely project-centric environment. Each project—from residential buildings to commercial complexes—involves a complex web of subcontractors, design phases, material purchases, and billing milestones. Without tailored bookkeeping systems, it’s easy for finances to become opaque, leading to delayed invoicing, missed deductions, or inaccurate profit analyses.

Key differences in bookkeeping for architects include:

Project cost tracking: Unlike flat-fee or product sales businesses, architecture projects incur diverse direct and indirect expenses throughout a timeline.

Milestone billing: Revenue recognition often aligns with project milestones, requiring synchronized bookkeeping to reflect true cash flow.

Regulatory and tax nuances: Architectural firms may capitalize certain costs or qualify for credits like the R&D tax credit relevant to design innovation and engineering efforts.

Time tracking integration: Billable hours by architects and consultants need precise capture for client billing.

Modern bookkeeping systems built with these factors in mind provide founders with real-time visibility and insights, enabling responsive decision-making essential for startups and lean agencies.

Core Elements of Effective Bookkeeping for Architects

Establish Project-Centric Accounting

Create financial records and reports that isolate each architectural project’s income, costs, and profit metrics. This means:

Using job-cost accounting or dedicated project codes in your bookkeeping software.

Tracking labor, subcontractor payments, materials, and other direct costs against each project.

Assigning revenue based on contracts or completed milestones.

This segmentation prevents the mixing of funds between projects and improves profitability insights. Tools like QuickBooks Online and Xero offer strong project-accounting features.

Integrate Time and Expense Tracking With Your Bookkeeping

Accurate billing requires capturing billable hours and reimbursable expenses. Your team should log hours and expenses directly into an integrated system.

Time-tracking tools should feed into your invoices.

Travel, material expenses, and subcontractor receipts should merge seamlessly into bookkeeping.

This reduces administrative overhead and ensures faster billing cycles.

Leverage Milestone Billing to Align Invoicing With Project Phases

Architecture projects commonly use phased billing tied to design stages or construction approvals.

Your bookkeeping workflow must:

Reflect milestone-tied invoicing.

Track retainers and partial payments.

Send reminders for overdue payments.

Improving billing alignment strengthens cash flow and client transparency.

Prepare for Tax-Specific Needs in Architecture

Architecture firms encounter unique tax considerations:

Some design and engineering efforts may qualify for R&D tax credits, helping reduce tax burdens.

Certain equipment or BIM software licenses may need capitalization rather than direct expensing.

States may impose industry-specific sales or service taxes.

Navigating Common Challenges in Bookkeeping for Architecture Firms

Managing Multiple Projects Efficiently

Architectural teams juggle several projects with varying scopes and budgets.

Solutions:

Use multi-project dashboards.

Conduct weekly project financial reviews.

Automate reconciliation and reporting tasks.

Coordinating With Subcontractors and Vendors

Invoices, retainers, and cost allocations must be tracked precisely.

Solutions:

Maintain accurate subcontractor files linked to projects.

Schedule payments intentionally.

Review accounts payable regularly.

Maintaining Cash Flow for Long-Term Projects

Architecture projects often extend over months or years — cash flow planning is crucial.

Solutions:

Forecast based on future invoicing milestones.

Use milestone billing rather than completion billing.

Keep contingency reserves.

For more on cash flow for service businesses, review the SBA’s guide on managing cash flow.

Using Bookkeeping Insights for Strategic Decisions

Bookkeeping should support growth, not just compliance.

Examples include:

Pricing refinement: Analyze labor allocation, overhead, and subcontractor costs to improve future bids.

Resource planning: Evaluate which project types or clients require disproportionate time or budget.

Investment decisions: Identify bottlenecks solvable through automation or staffing.

Tax planning: Use insights to prepare for quarterly tax expectations.

Founder-Friendly Tools and Bookkeeping Best Practices for Architecture Firms

Modern bookkeeping for architects goes beyond software choices — it requires systems that support project visibility, faster billing, and cleaner financial signals. The tools and routines below help founders keep projects on track and prevent financial drift:

Project-accounting platforms: QuickBooks Online, Xero, or architecture-focused systems allow job-cost tracking, milestone billing, and structured reporting across multiple builds.

Integrated time + expense capture: Logging hours, reimbursables, and subcontractor costs directly into your bookkeeping workflow prevents underbilling and shortens invoice cycles.

Automated financial workflows: Bank feeds, recurring invoices, expense categorization, and payment reminders reduce manual work and keep projects current.

Consistent financial cadence: Weekly or biweekly reviews help you catch overruns early, maintain cash-flow visibility, and ensure invoices align with project phases.

Specialized advisory support: Firms experienced with startup architecture practices — including R&D tax credit evaluation — can help founders streamline compliance and unlock tax advantages tied to design and engineering efforts.

Mastering Bookkeeping for Architects to Drive Business Success

For founders navigating multiple projects, subcontractor relationships, and long billing cycles, strong bookkeeping becomes a stabilizing force — not just an operational task. When your financial systems are built around project visibility, accurate time tracking, and milestone-based billing, decisions become clearer and growth becomes more predictable.

That’s where specialized partners like Haven add real value: helping architecture-led teams build structured financial workflows, stay ahead of tax requirements, and maintain cash-flow discipline as projects evolve.

For founders steering architecture firms or architectural projects within agencies and startups, bookkeeping for architects is a vital discipline that can define your company’s financial health and growth trajectory. Unlike standard bookkeeping, managing project-based finances in architecture requires precise tracking of costs, revenues, billable hours, and client payments on a per-project basis.

This guide aims to arm with practical, startup-native strategies to streamline bookkeeping, optimize cash flow, and maintain compliance without getting bogged down in unnecessary complexity.

Why Specialized Bookkeeping for Architects Matters

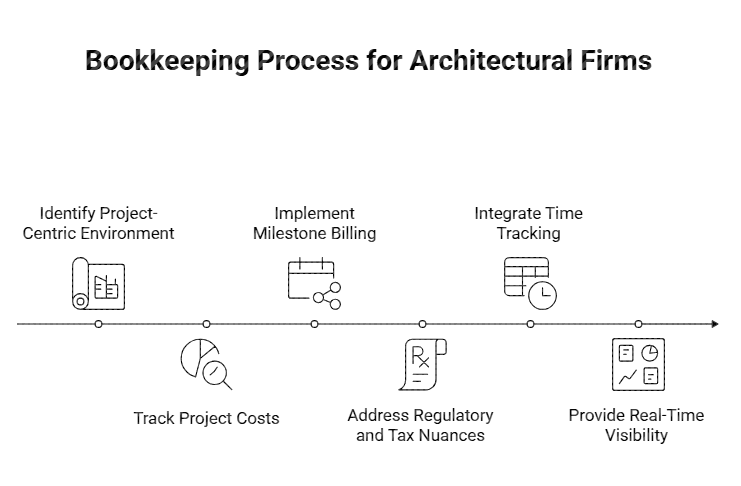

Architectural firms operate in a uniquely project-centric environment. Each project—from residential buildings to commercial complexes—involves a complex web of subcontractors, design phases, material purchases, and billing milestones. Without tailored bookkeeping systems, it’s easy for finances to become opaque, leading to delayed invoicing, missed deductions, or inaccurate profit analyses.

Key differences in bookkeeping for architects include:

Project cost tracking: Unlike flat-fee or product sales businesses, architecture projects incur diverse direct and indirect expenses throughout a timeline.

Milestone billing: Revenue recognition often aligns with project milestones, requiring synchronized bookkeeping to reflect true cash flow.

Regulatory and tax nuances: Architectural firms may capitalize certain costs or qualify for credits like the R&D tax credit relevant to design innovation and engineering efforts.

Time tracking integration: Billable hours by architects and consultants need precise capture for client billing.

Modern bookkeeping systems built with these factors in mind provide founders with real-time visibility and insights, enabling responsive decision-making essential for startups and lean agencies.

Core Elements of Effective Bookkeeping for Architects

Establish Project-Centric Accounting

Create financial records and reports that isolate each architectural project’s income, costs, and profit metrics. This means:

Using job-cost accounting or dedicated project codes in your bookkeeping software.

Tracking labor, subcontractor payments, materials, and other direct costs against each project.

Assigning revenue based on contracts or completed milestones.

This segmentation prevents the mixing of funds between projects and improves profitability insights. Tools like QuickBooks Online and Xero offer strong project-accounting features.

Integrate Time and Expense Tracking With Your Bookkeeping

Accurate billing requires capturing billable hours and reimbursable expenses. Your team should log hours and expenses directly into an integrated system.

Time-tracking tools should feed into your invoices.

Travel, material expenses, and subcontractor receipts should merge seamlessly into bookkeeping.

This reduces administrative overhead and ensures faster billing cycles.

Leverage Milestone Billing to Align Invoicing With Project Phases

Architecture projects commonly use phased billing tied to design stages or construction approvals.

Your bookkeeping workflow must:

Reflect milestone-tied invoicing.

Track retainers and partial payments.

Send reminders for overdue payments.

Improving billing alignment strengthens cash flow and client transparency.

Prepare for Tax-Specific Needs in Architecture

Architecture firms encounter unique tax considerations:

Some design and engineering efforts may qualify for R&D tax credits, helping reduce tax burdens.

Certain equipment or BIM software licenses may need capitalization rather than direct expensing.

States may impose industry-specific sales or service taxes.

Navigating Common Challenges in Bookkeeping for Architecture Firms

Managing Multiple Projects Efficiently

Architectural teams juggle several projects with varying scopes and budgets.

Solutions:

Use multi-project dashboards.

Conduct weekly project financial reviews.

Automate reconciliation and reporting tasks.

Coordinating With Subcontractors and Vendors

Invoices, retainers, and cost allocations must be tracked precisely.

Solutions:

Maintain accurate subcontractor files linked to projects.

Schedule payments intentionally.

Review accounts payable regularly.

Maintaining Cash Flow for Long-Term Projects

Architecture projects often extend over months or years — cash flow planning is crucial.

Solutions:

Forecast based on future invoicing milestones.

Use milestone billing rather than completion billing.

Keep contingency reserves.

For more on cash flow for service businesses, review the SBA’s guide on managing cash flow.

Using Bookkeeping Insights for Strategic Decisions

Bookkeeping should support growth, not just compliance.

Examples include:

Pricing refinement: Analyze labor allocation, overhead, and subcontractor costs to improve future bids.

Resource planning: Evaluate which project types or clients require disproportionate time or budget.

Investment decisions: Identify bottlenecks solvable through automation or staffing.

Tax planning: Use insights to prepare for quarterly tax expectations.

Founder-Friendly Tools and Bookkeeping Best Practices for Architecture Firms

Modern bookkeeping for architects goes beyond software choices — it requires systems that support project visibility, faster billing, and cleaner financial signals. The tools and routines below help founders keep projects on track and prevent financial drift:

Project-accounting platforms: QuickBooks Online, Xero, or architecture-focused systems allow job-cost tracking, milestone billing, and structured reporting across multiple builds.

Integrated time + expense capture: Logging hours, reimbursables, and subcontractor costs directly into your bookkeeping workflow prevents underbilling and shortens invoice cycles.

Automated financial workflows: Bank feeds, recurring invoices, expense categorization, and payment reminders reduce manual work and keep projects current.

Consistent financial cadence: Weekly or biweekly reviews help you catch overruns early, maintain cash-flow visibility, and ensure invoices align with project phases.

Specialized advisory support: Firms experienced with startup architecture practices — including R&D tax credit evaluation — can help founders streamline compliance and unlock tax advantages tied to design and engineering efforts.

Mastering Bookkeeping for Architects to Drive Business Success

For founders navigating multiple projects, subcontractor relationships, and long billing cycles, strong bookkeeping becomes a stabilizing force — not just an operational task. When your financial systems are built around project visibility, accurate time tracking, and milestone-based billing, decisions become clearer and growth becomes more predictable.

That’s where specialized partners like Haven add real value: helping architecture-led teams build structured financial workflows, stay ahead of tax requirements, and maintain cash-flow discipline as projects evolve.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026