Go Back

Last Updated :

Last Updated :

Nov 17, 2025

Nov 17, 2025

Best AI Bookkeeping Tools for Small Businesses in 2025

AI now powers nearly every corner of modern business — from marketing automation to customer support — and finance is no exception. AI bookkeeping tools are changing how startups and small businesses manage accounting by making reconciliations faster, reporting smarter, and processes more efficient.

In this guide, we’ve compared the best AI bookkeeping software of 2025. Whether you’re looking for a fully automated system or a hybrid solution with real-time CPA oversight, these platforms show how artificial intelligence can make your bookkeeping easier, cleaner, and more accurate.

5 AI Bookkeeping Platforms for Startups That Need Clarity, Fast

If you want to spend less time managing books and more time growing your business, these AI bookkeeping solutions for small businesses stand out in 2025.

Bookeeping.ai — Virtual AI Accountant in Real Time

Bookeeping.ai is a fully automated accounting platform powered by a virtual accountant called Paula AI.

You can chat directly with Paula to categorize expenses, generate reports, send invoices, or review cash flow in real time — no manual input required.

Bookkeeping.ai dashboard

What You Get with Bookeeping.ai

Bookeeping.ai focuses heavily on automation, real-time insights, and natural-language interaction:

AI Financial Assistant: Chat with Paula to prepare invoices, categorize expenses, or review income and spending summaries.

Automatic Bookkeeping: Upload CSVs or bank statements; Paula automatically creates and categorizes transactions.

Financial Reporting: Generates P&L and balance sheets instantly — no manual setup required.

Smart Invoicing: Create and send invoices through chat, accept card payments via Stripe, and set up recurring billing.

AI Audit Score: Paula monitors your books 24/7 for errors, anomalies, or tax opportunities.

Document Automation: e-sign contracts, fill 1099/W-2 forms, and manage tax documents directly within the platform.

Paula also integrates with Plaid for secure banking connections.

It is still relatively new, so there are fewer integrations and a limited track record. Since it's AI-only, it also lacks CPA oversight or human review at lower pricing plans.

Pricing for Bookeeping.ai

Bookeeping.ai offers a free trial to explore Paula’s features, with paid plans starting from $29/month. Every plan here includes unlimited transactions, invoices, and AI-powered tools like auto-categorization, reconciliation, document chat, and real-time reporting. Higher tiers add premium AI models (ChatGPT + Claude) and optional human support.

Zeni — AI Accounting for Growing Startups

Zeni is an AI accounting software platform that automates bookkeeping, accounting, and reporting while keeping human verification at the core. Its “AI Accountant Agent” manages reconciliations and journal entries automatically and is reviewed by Zeni’s in-house finance team.

Zeni AI bookkeeping platform

What You Get with Zeni

Zeni’s AI Accountant Agent automates nearly all bookkeeping tasks while keeping oversight in place.

Automated Accounting: Handles journal entries, reconciliations, vendor corrections, and receipt matching.

Smart Categorization: Classifies transactions and corrects errors in real time with continuous learning.

AI Audit Checks: Detects anomalies, spending spikes, or unusual trends before they affect reports.

Real-Time Reporting: P&L, balance sheet, and cash flow reports update automatically as transactions occur.

Human Verification: A team of finance experts reviews AI outputs to maintain GAAP compliance.

Integrations: Syncs with banks, credit cards, and major financial platforms.

Pricing for Zeni

Zeni’s pricing is built around three main tiers: Starter ($549/month), Growth ($799/month), and Enterprise (custom). All are billed annually, with discounts for pre-revenue startups.

For funded startups managing high transaction volumes or investor reporting, the value is in the accuracy and time saved. For early-stage founders or small SMBs, though, the cost may be steep compared to hybrid services like Haven that deliver similar accuracy with less fee.

Truewind — AI Tools for Accounting Teams

Truewind is designed for accounting firms and finance teams that want to close books faster. Instead of replacing staff accountants, it serves as a digital assistant, automating reconciliation and review tasks to reduce manual work.

Truewind AI bookkeeping platform

What You Get with Truewind

Truewind’s AI agents work behind the scenes to handle the heavy lifting of bookkeeping. It gives you:

AI Accountant Agent: Automates entries, reconciliations, and accuracy checks across accounts.

Bank & Deposit Reconciliation: Matches Stripe, Shopify, and Amazon payouts to lump-sum deposits automatically.

AI Anomaly Detection: Flags errors or mis-categorizations and learns from feedback for continuous accuracy.

Accrual & Workpaper Automation: Prepares reconciliations, prepaid amortization, and fixed-asset schedules without spreadsheets.

Flux & Variance Analysis: Generates AI-driven explanations for spending or revenue fluctuations.

AI Assistant: Answers questions about your books and provides insights directly from financial data.

Truewind integrates with QuickBooks and Sage, offers SOC 2-certified security, and provides a transparent audit trail for every AI action.

Digits — Real-Time AI Bookkeeping and Reporting

Digits is an AI-powered accounting platform built to automate categorization, reconciliation, and reporting. It connects with over 12,000 financial institutions for continuous syncing of payroll, bank, and credit card data.

Digits AI bookkeeping platform

What You Get with Digits

Digits runs a suite of AI agents that handle different aspects of bookkeeping and reporting automatically:

Bookkeeping Agent: Categorizes transactions 24/7, detects anomalies, and learns your business patterns over time.

Payments Agent: Tracks and reconciles bills and invoices automatically, eliminating manual data entry.

Finance Agent: Creates real-time dashboards and financial statements with trend analysis.

Reporting Agent: Publishes interactive management reports and executive summaries with AI-generated insights.

Collaboration Tools: Unlimited team seats with in-app commenting and live updates so everyone stays on the same page.

Pricing for Digits

Pricing starts at $65/month for the Essentials plan and $100/month for the Core plan, with a Professional tier available at custom pricing for larger teams or accounting firms. The main differences between tiers come down to reporting depth and AI agent access: higher plans unlock full automation for reconciliation, accruals, and management reports.

Haven — Expert Accounting, Powered by AI

Haven is a modern accounting partner that blends AI-powered automation with human expertise to keep your books, taxes, and financials accurate and audit-ready. It’s not an AI bookkeeping app — it’s a full-service solution for founders who want precision without managing the details themselves.

Haven Bookkeeping Dashboard

How Haven Uses AI

Behind the scenes, Haven’s proprietary systems handle:

Expense auto-categorization

PDF data extraction

Anomaly detection for transactions

Faster, AI-assisted customer support

Every output is reviewed by experienced accountants, ensuring automation improves speed while humans safeguard accuracy.

What You Get with Haven

When you work with Haven, you get:

Your books handled end-to-end: Get monthly reconciliations, reporting, and tax prep done for you.

AI-assisted accuracy: Our internal AI systems speed up expense categorization and document processing, while our accountants review every detail for accuracy.

Instant support in Slack: Ask a question, get an answer, no tickets or waiting.

A financial dashboard: See profit & loss, cash flow, burn rate, and runway in real time.

Startup-specific accounting: Get expert help for things like deferred revenue, accruals, and SaaS metrics.

Haven is ideal for founders, agencies, and small businesses that want expert bookkeeping supported by intelligent automation — not another DIY tool.

Talk to our team. A free strategy call is the fastest way to see how Haven can simplify your bookkeeping.

Pricing for AI Bookkeeping Platform

Plans start around $300/month for businesses spending about $20K monthly, with pricing that scales based on complexity (multi-entity, crypto, or inventory). Every plan includes a dedicated accountant and complete financial reporting.

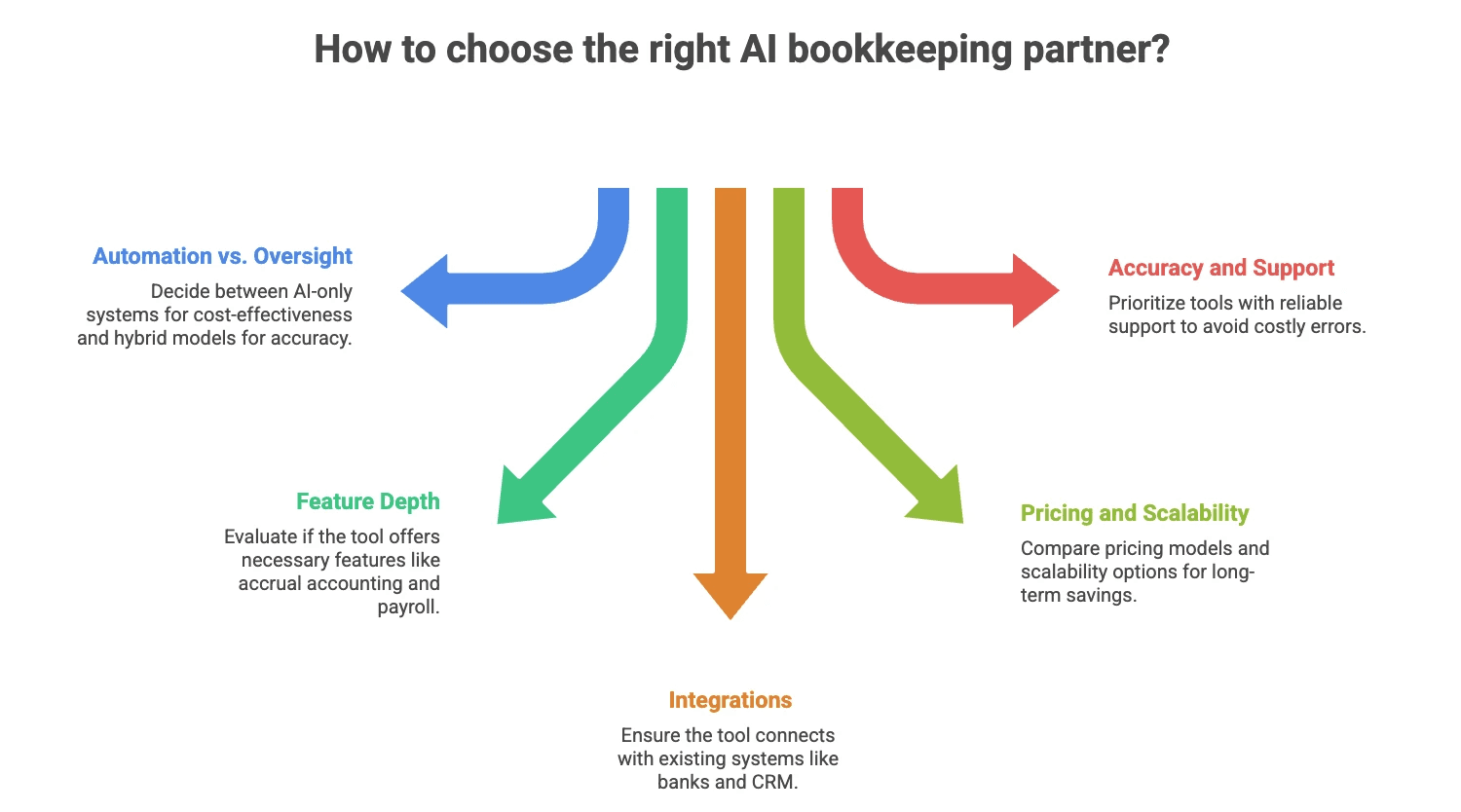

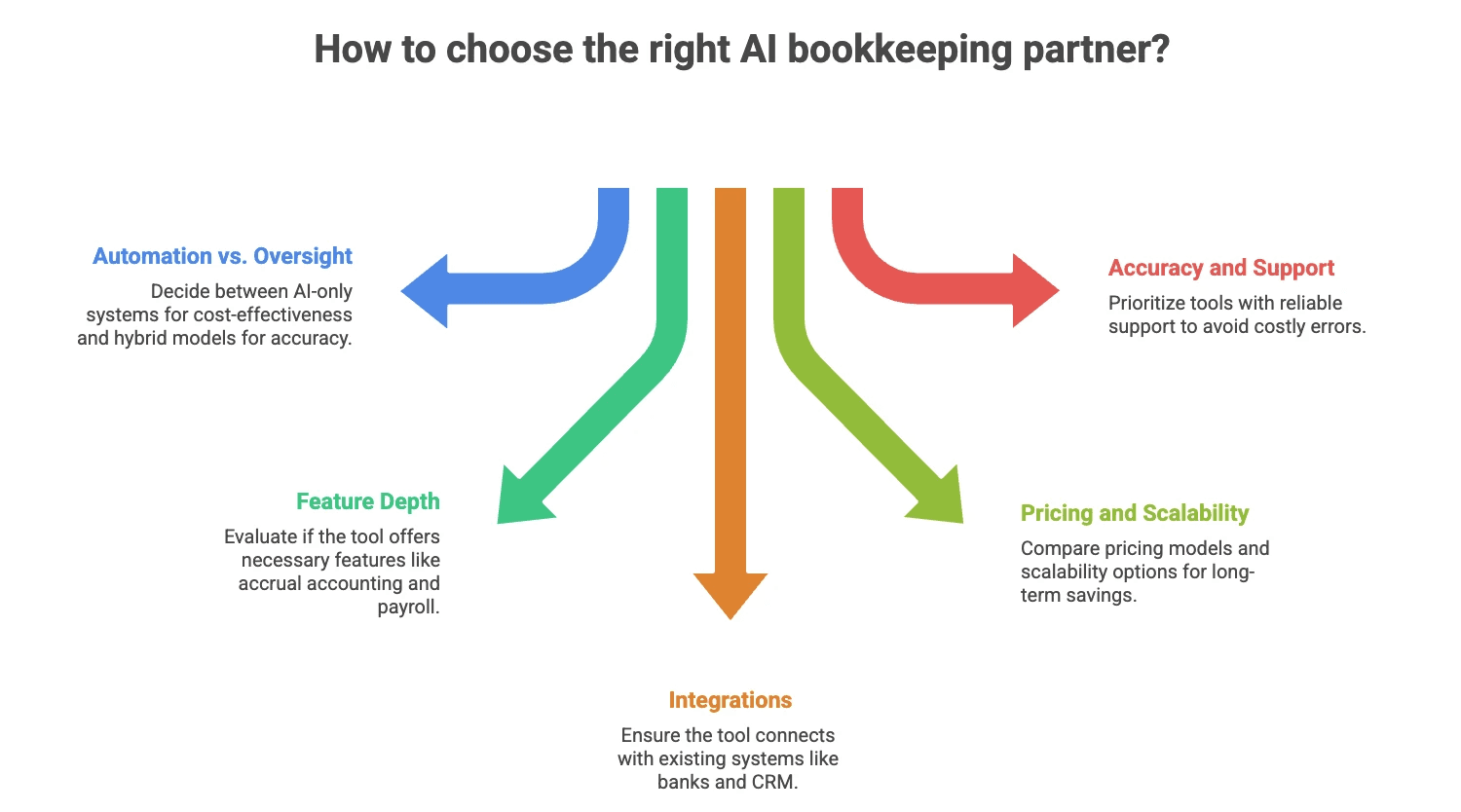

How to Choose the Right AI Bookkeeping Partner

The best AI bookkeeping tools for small businesses aren’t necessarily the ones with the most features — they’re the ones that fit your workflow and offer the right balance of automation and oversight.

Here’s how to choose the right partner:

Decide if you need full automation or CPA oversight.

AI-only systems are cheaper but lack professional review. Hybrid models, like Haven, ensure human accuracy.Evaluate feature depth.

Do you need accrual accounting, payroll, or multi-entity support? Some tools handle these automatically; others require manual setup.Check integrations.

Make sure it connects with your bank, payment platforms, and CRM.Assess pricing and scalability.

Compare flat-rate AI tools to managed bookkeeping services. Hybrid platforms often save more time and reduce risk long-term.Prioritize accuracy and support.

Errors in bookkeeping cost more to fix later. Reliable support — ideally in real time — matters as much as automation.

Why Founders Choose Haven for Bookkeeping and Taxes

If you want accurate books, tax-ready reports, and proactive financial insight — without juggling software — Haven is your best AI-driven bookkeeping partner.

We combine automation with real accountants who understand startups, giving you clear, confident numbers year-round. From reconciliations to R&D credits, we manage your books so you can focus on growth.

Book a free strategy call to see how Haven can simplify your financial operations and scale with your business.

AI now powers nearly every corner of modern business — from marketing automation to customer support — and finance is no exception. AI bookkeeping tools are changing how startups and small businesses manage accounting by making reconciliations faster, reporting smarter, and processes more efficient.

In this guide, we’ve compared the best AI bookkeeping software of 2025. Whether you’re looking for a fully automated system or a hybrid solution with real-time CPA oversight, these platforms show how artificial intelligence can make your bookkeeping easier, cleaner, and more accurate.

5 AI Bookkeeping Platforms for Startups That Need Clarity, Fast

If you want to spend less time managing books and more time growing your business, these AI bookkeeping solutions for small businesses stand out in 2025.

Bookeeping.ai — Virtual AI Accountant in Real Time

Bookeeping.ai is a fully automated accounting platform powered by a virtual accountant called Paula AI.

You can chat directly with Paula to categorize expenses, generate reports, send invoices, or review cash flow in real time — no manual input required.

Bookkeeping.ai dashboard

What You Get with Bookeeping.ai

Bookeeping.ai focuses heavily on automation, real-time insights, and natural-language interaction:

AI Financial Assistant: Chat with Paula to prepare invoices, categorize expenses, or review income and spending summaries.

Automatic Bookkeeping: Upload CSVs or bank statements; Paula automatically creates and categorizes transactions.

Financial Reporting: Generates P&L and balance sheets instantly — no manual setup required.

Smart Invoicing: Create and send invoices through chat, accept card payments via Stripe, and set up recurring billing.

AI Audit Score: Paula monitors your books 24/7 for errors, anomalies, or tax opportunities.

Document Automation: e-sign contracts, fill 1099/W-2 forms, and manage tax documents directly within the platform.

Paula also integrates with Plaid for secure banking connections.

It is still relatively new, so there are fewer integrations and a limited track record. Since it's AI-only, it also lacks CPA oversight or human review at lower pricing plans.

Pricing for Bookeeping.ai

Bookeeping.ai offers a free trial to explore Paula’s features, with paid plans starting from $29/month. Every plan here includes unlimited transactions, invoices, and AI-powered tools like auto-categorization, reconciliation, document chat, and real-time reporting. Higher tiers add premium AI models (ChatGPT + Claude) and optional human support.

Zeni — AI Accounting for Growing Startups

Zeni is an AI accounting software platform that automates bookkeeping, accounting, and reporting while keeping human verification at the core. Its “AI Accountant Agent” manages reconciliations and journal entries automatically and is reviewed by Zeni’s in-house finance team.

Zeni AI bookkeeping platform

What You Get with Zeni

Zeni’s AI Accountant Agent automates nearly all bookkeeping tasks while keeping oversight in place.

Automated Accounting: Handles journal entries, reconciliations, vendor corrections, and receipt matching.

Smart Categorization: Classifies transactions and corrects errors in real time with continuous learning.

AI Audit Checks: Detects anomalies, spending spikes, or unusual trends before they affect reports.

Real-Time Reporting: P&L, balance sheet, and cash flow reports update automatically as transactions occur.

Human Verification: A team of finance experts reviews AI outputs to maintain GAAP compliance.

Integrations: Syncs with banks, credit cards, and major financial platforms.

Pricing for Zeni

Zeni’s pricing is built around three main tiers: Starter ($549/month), Growth ($799/month), and Enterprise (custom). All are billed annually, with discounts for pre-revenue startups.

For funded startups managing high transaction volumes or investor reporting, the value is in the accuracy and time saved. For early-stage founders or small SMBs, though, the cost may be steep compared to hybrid services like Haven that deliver similar accuracy with less fee.

Truewind — AI Tools for Accounting Teams

Truewind is designed for accounting firms and finance teams that want to close books faster. Instead of replacing staff accountants, it serves as a digital assistant, automating reconciliation and review tasks to reduce manual work.

Truewind AI bookkeeping platform

What You Get with Truewind

Truewind’s AI agents work behind the scenes to handle the heavy lifting of bookkeeping. It gives you:

AI Accountant Agent: Automates entries, reconciliations, and accuracy checks across accounts.

Bank & Deposit Reconciliation: Matches Stripe, Shopify, and Amazon payouts to lump-sum deposits automatically.

AI Anomaly Detection: Flags errors or mis-categorizations and learns from feedback for continuous accuracy.

Accrual & Workpaper Automation: Prepares reconciliations, prepaid amortization, and fixed-asset schedules without spreadsheets.

Flux & Variance Analysis: Generates AI-driven explanations for spending or revenue fluctuations.

AI Assistant: Answers questions about your books and provides insights directly from financial data.

Truewind integrates with QuickBooks and Sage, offers SOC 2-certified security, and provides a transparent audit trail for every AI action.

Digits — Real-Time AI Bookkeeping and Reporting

Digits is an AI-powered accounting platform built to automate categorization, reconciliation, and reporting. It connects with over 12,000 financial institutions for continuous syncing of payroll, bank, and credit card data.

Digits AI bookkeeping platform

What You Get with Digits

Digits runs a suite of AI agents that handle different aspects of bookkeeping and reporting automatically:

Bookkeeping Agent: Categorizes transactions 24/7, detects anomalies, and learns your business patterns over time.

Payments Agent: Tracks and reconciles bills and invoices automatically, eliminating manual data entry.

Finance Agent: Creates real-time dashboards and financial statements with trend analysis.

Reporting Agent: Publishes interactive management reports and executive summaries with AI-generated insights.

Collaboration Tools: Unlimited team seats with in-app commenting and live updates so everyone stays on the same page.

Pricing for Digits

Pricing starts at $65/month for the Essentials plan and $100/month for the Core plan, with a Professional tier available at custom pricing for larger teams or accounting firms. The main differences between tiers come down to reporting depth and AI agent access: higher plans unlock full automation for reconciliation, accruals, and management reports.

Haven — Expert Accounting, Powered by AI

Haven is a modern accounting partner that blends AI-powered automation with human expertise to keep your books, taxes, and financials accurate and audit-ready. It’s not an AI bookkeeping app — it’s a full-service solution for founders who want precision without managing the details themselves.

Haven Bookkeeping Dashboard

How Haven Uses AI

Behind the scenes, Haven’s proprietary systems handle:

Expense auto-categorization

PDF data extraction

Anomaly detection for transactions

Faster, AI-assisted customer support

Every output is reviewed by experienced accountants, ensuring automation improves speed while humans safeguard accuracy.

What You Get with Haven

When you work with Haven, you get:

Your books handled end-to-end: Get monthly reconciliations, reporting, and tax prep done for you.

AI-assisted accuracy: Our internal AI systems speed up expense categorization and document processing, while our accountants review every detail for accuracy.

Instant support in Slack: Ask a question, get an answer, no tickets or waiting.

A financial dashboard: See profit & loss, cash flow, burn rate, and runway in real time.

Startup-specific accounting: Get expert help for things like deferred revenue, accruals, and SaaS metrics.

Haven is ideal for founders, agencies, and small businesses that want expert bookkeeping supported by intelligent automation — not another DIY tool.

Talk to our team. A free strategy call is the fastest way to see how Haven can simplify your bookkeeping.

Pricing for AI Bookkeeping Platform

Plans start around $300/month for businesses spending about $20K monthly, with pricing that scales based on complexity (multi-entity, crypto, or inventory). Every plan includes a dedicated accountant and complete financial reporting.

How to Choose the Right AI Bookkeeping Partner

The best AI bookkeeping tools for small businesses aren’t necessarily the ones with the most features — they’re the ones that fit your workflow and offer the right balance of automation and oversight.

Here’s how to choose the right partner:

Decide if you need full automation or CPA oversight.

AI-only systems are cheaper but lack professional review. Hybrid models, like Haven, ensure human accuracy.Evaluate feature depth.

Do you need accrual accounting, payroll, or multi-entity support? Some tools handle these automatically; others require manual setup.Check integrations.

Make sure it connects with your bank, payment platforms, and CRM.Assess pricing and scalability.

Compare flat-rate AI tools to managed bookkeeping services. Hybrid platforms often save more time and reduce risk long-term.Prioritize accuracy and support.

Errors in bookkeeping cost more to fix later. Reliable support — ideally in real time — matters as much as automation.

Why Founders Choose Haven for Bookkeeping and Taxes

If you want accurate books, tax-ready reports, and proactive financial insight — without juggling software — Haven is your best AI-driven bookkeeping partner.

We combine automation with real accountants who understand startups, giving you clear, confident numbers year-round. From reconciliations to R&D credits, we manage your books so you can focus on growth.

Book a free strategy call to see how Haven can simplify your financial operations and scale with your business.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026