Go Back

Last Updated :

Last Updated :

Feb 6, 2026

Feb 6, 2026

Accounting for Venture-Backed Startups: What Changes After Your First Round

Raising your first round of venture capital is a pivotal milestone for your startup. It unlocks new growth opportunities, requires sharper financial discipline, and introduces a level of accountability to investors that fundamentally changes how you manage your books and finance functions. But what exactly changes in accounting for venture backed startups post-funding, and how can you prepare your business to navigate this transition effectively?

In this guide, we’ll break down the most important accounting shifts that occur after your startup secures venture backing. Whether you’re a founder, COO, or head of finance, understanding these changes will empower you to streamline your financial operations, improve investor communications, and position your company for sustained success.

Why Accounting Matters More After Your First Venture Round

Before venture funding, many startups operate lean with informal bookkeeping and simplified cash management. Once you raise outside capital, the stakes rise sharply:

Investor expectations: VCs expect clear, detailed financial reporting and evidence of strong internal controls.

Compliance and transparency: Fundraising introduces compliance requirements around financial statements, tax filings, and corporate governance.

Financial complexity: Equity injections, stock options, and milestones create bookkeeping intricacies unfamiliar to pre-funding startups.

Cash flow management: Enlarged budgets and burn rates demand disciplined forecasting and cash runway monitoring.

Scalability: Your finance function needs to scale alongside your business and investor demands.

Accounting is no longer just record-keeping; it becomes a strategic tool to drive decision-making, prove your startup’s trajectory, and build trust with investors.

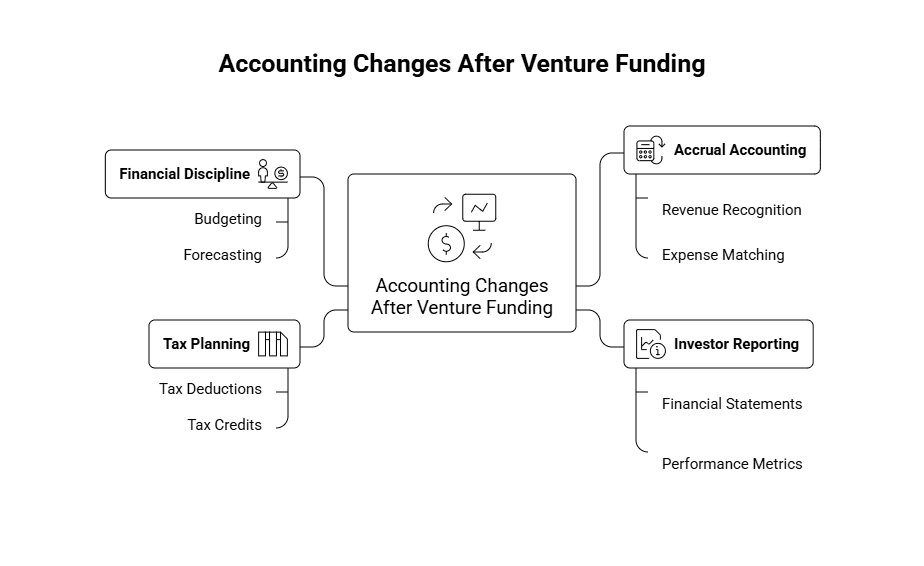

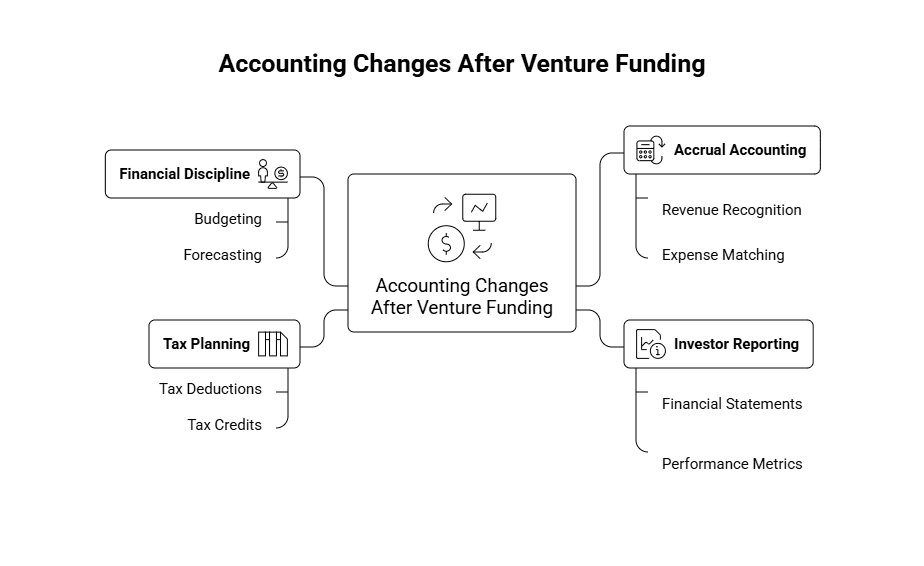

Key Changes in Accounting for Venture-Backed Startups

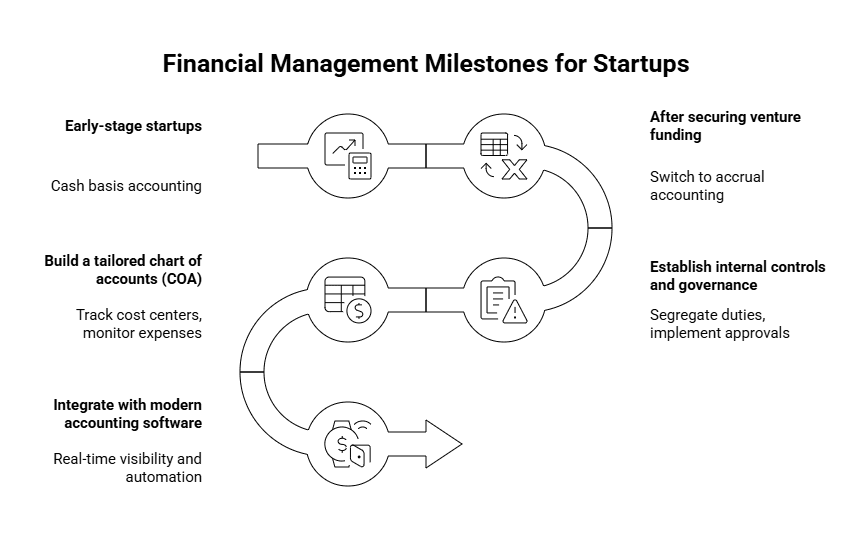

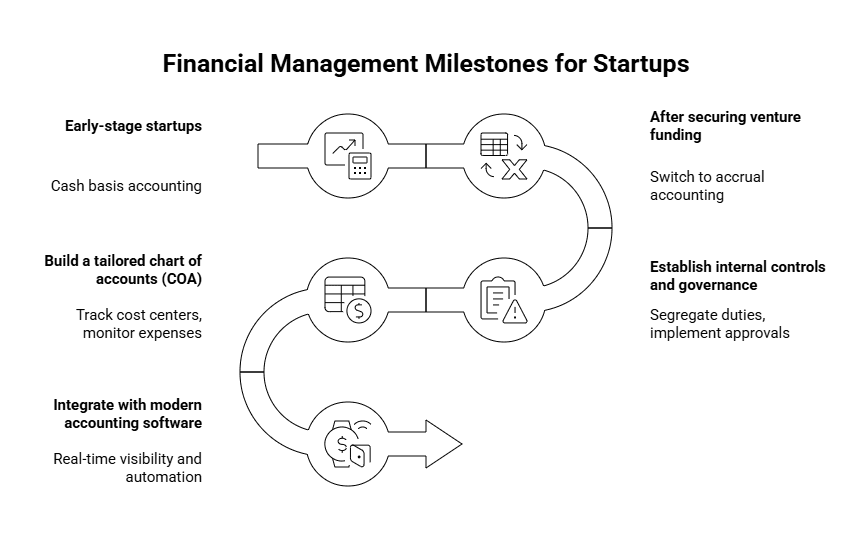

Transition from Cash to Accrual Accounting

Many early-stage startups rely on cash basis accounting, which recognizes revenues and expenses only when cash changes hands. This is simple but provides limited visibility, especially as your company grows and incurs costs such as payroll, vendor invoices, or prepaid expenses.

After securing venture funding, you should switch to accrual accounting, which records revenues and expenses when they are earned or incurred regardless of cash flow timing. This method aligns better with GAAP (Generally Accepted Accounting Principles) and gives investors a more accurate picture of your startup’s financial health over a period.

Benefits of Accrual Accounting:

Benefit | Explanation |

More Accurate Financial Picture | Matches revenues with related expenses in the period. |

Investor-Friendly Reporting | Aligns with common VC expectations and GAAP standards. |

Improved Planning | Enables recognition of obligations and receivables. |

Establish Internal Controls and Governance

Venture investors expect transparency and rigor in your financial processes to reduce risks, prevent fraud, and protect their investment.

Actionable steps:

Segregate duties within your finance team.

Implement approvals for large expenditures.

Maintain clear audit trails through software tools.

Regularly reconcile bank and credit card statements.

Schedule periodic internal and external audits.

Strong governance gives investors confidence in your ability to manage capital responsibly and scale efficiently.

Build a Tailored Chart of Accounts (COA)

As funding increases, your startup’s accounting needs become more complex. You’ll need a detailed chart of accounts customized for your business model and investor reporting requirements.

A refined COA allows you to:

Track key cost centers such as R&D, sales, and marketing.

Monitor capital expenditures vs. operating expenses.

Segment revenue streams to understand driver performance.

Integrate with modern accounting software that supports scalability, automation, and real-time visibility. Tools like QuickBooks Online, Xero, or NetSuite offer flexibility based on your stage of growth.

Financial Metrics and Reporting Expectations

Focus on Startup-Specific KPIs

Venture-backed investors don’t just want your P&L and balance sheet. They want to see metrics that demonstrate traction, efficiency, and unit economics.

High-priority KPIs include:

Burn Rate: How quickly are you spending capital?

Cash Runway: How long can you operate before needing more funding?

Gross Margin: What’s left after covering your cost of goods sold?

Customer Acquisition Cost (CAC): How cost-efficient is your growth?

Lifetime Value (LTV): What’s the average revenue per customer over time?

Make these KPIs part of your monthly dashboard to provide real-time insights for internal and investor decision-making.

Investor Reporting & Communication

After your venture round, timely and accurate reporting becomes non-negotiable.

Report Type | Frequency | Purpose |

Financial Statements | Monthly/Quarterly | Monitor performance and maintain transparency |

KPI Dashboards | Monthly | Show trajectory and efficiency |

Budget vs. Actuals | Quarterly | Evaluate plan vs. performance |

Cap Table Updates | Post-Funding Events | Track equity ownership changes |

Audit or Review Reports | Annually | Offer assurance to investors and potential acquirers |

Include narratives with financial reports to contextualize results and set expectations proactively.

Tax Planning and Compliance for Venture-Backed Startups

Prepare for Startup Tax Complexities

Equity transactions, stock options, and investor agreements bring tax complexities. Leverage expert guidance to avoid pitfalls and unlock tax-saving opportunities.

Key strategies include:

Accurately accounting for stock-based compensation.

Claiming federal or state R&D tax credits.

Filing compliant and timely returns with the IRS.

For example, many tech startups are eligible for the Research and Experimentation Credit, which can offset income or payroll taxes. Learn more from the IRS guide on business credits.

Designing a Scalable Accounting Function

In-House vs. Outsourced Accounting

Factor | In-House | Outsourced |

Cost | Higher fixed costs | Lower upfront investment, subscription models |

Control | Direct team management | Access to experts with startup finance specialization |

Flexibility | Slower to adjust | Easily scales up/down with business needs |

Expertise | Depends on hiring quality | Advisory built-in with experienced startup pros |

Outsourcing often gives startups the flexibility and depth they need without bloated overhead. Specialized providers offer modern accounting streamlined for scale.

Selecting the Right Accounting Software

Having the right tools saves time and lowers error rates. Choose software that:

Supports accrual accounting and GAAP compliance.

Integrates with payment platforms, CRMs, and payroll.

Handles equity management and cap table updates.

Delivers real-time dashboards tracking MRR, CAC, and LTV.

Many early-stage startups begin with QuickBooks Online or Xero and later migrate to more advanced tools like NetSuite based on growth.

Common Pitfalls and How to Avoid Them

Challenge | Impact | Solution |

Poor bookkeeping discipline | Blocks funding or causes errors | Use professional bookkeeping support with monthly closes |

Missing cash flow forecasting | Unexpected shortfalls | Use startup-specific forecasting templates or tools |

Confusing tax handling | Risk of penalties and audits | Work with a CPA experienced in venture-backed companies |

Disorganized reporting | Erodes investor confidence | Standardize reports and metrics across stakeholder updates |

Avoiding these mistakes early leaves fewer issues to fix later—and builds investor confidence.

Your Accounting Moves Post-Raise

Post-funding, accounting for venture backed startups is more than compliance—it's a growth enabler that fuels your trajectory and strengthens investor trust.

Make sure your startup embraces:

Accrual accounting for accurate data.

Governance and internal control policies.

Investor-grade metric dashboards and reporting.

Scalable software and service support.

Smart tax planning that lowers burn and risk.

Talk to an expert to future-proof your startup’s accounting and stay prepared for the next investment milestone.

Raising your first round of venture capital is a pivotal milestone for your startup. It unlocks new growth opportunities, requires sharper financial discipline, and introduces a level of accountability to investors that fundamentally changes how you manage your books and finance functions. But what exactly changes in accounting for venture backed startups post-funding, and how can you prepare your business to navigate this transition effectively?

In this guide, we’ll break down the most important accounting shifts that occur after your startup secures venture backing. Whether you’re a founder, COO, or head of finance, understanding these changes will empower you to streamline your financial operations, improve investor communications, and position your company for sustained success.

Why Accounting Matters More After Your First Venture Round

Before venture funding, many startups operate lean with informal bookkeeping and simplified cash management. Once you raise outside capital, the stakes rise sharply:

Investor expectations: VCs expect clear, detailed financial reporting and evidence of strong internal controls.

Compliance and transparency: Fundraising introduces compliance requirements around financial statements, tax filings, and corporate governance.

Financial complexity: Equity injections, stock options, and milestones create bookkeeping intricacies unfamiliar to pre-funding startups.

Cash flow management: Enlarged budgets and burn rates demand disciplined forecasting and cash runway monitoring.

Scalability: Your finance function needs to scale alongside your business and investor demands.

Accounting is no longer just record-keeping; it becomes a strategic tool to drive decision-making, prove your startup’s trajectory, and build trust with investors.

Key Changes in Accounting for Venture-Backed Startups

Transition from Cash to Accrual Accounting

Many early-stage startups rely on cash basis accounting, which recognizes revenues and expenses only when cash changes hands. This is simple but provides limited visibility, especially as your company grows and incurs costs such as payroll, vendor invoices, or prepaid expenses.

After securing venture funding, you should switch to accrual accounting, which records revenues and expenses when they are earned or incurred regardless of cash flow timing. This method aligns better with GAAP (Generally Accepted Accounting Principles) and gives investors a more accurate picture of your startup’s financial health over a period.

Benefits of Accrual Accounting:

Benefit | Explanation |

More Accurate Financial Picture | Matches revenues with related expenses in the period. |

Investor-Friendly Reporting | Aligns with common VC expectations and GAAP standards. |

Improved Planning | Enables recognition of obligations and receivables. |

Establish Internal Controls and Governance

Venture investors expect transparency and rigor in your financial processes to reduce risks, prevent fraud, and protect their investment.

Actionable steps:

Segregate duties within your finance team.

Implement approvals for large expenditures.

Maintain clear audit trails through software tools.

Regularly reconcile bank and credit card statements.

Schedule periodic internal and external audits.

Strong governance gives investors confidence in your ability to manage capital responsibly and scale efficiently.

Build a Tailored Chart of Accounts (COA)

As funding increases, your startup’s accounting needs become more complex. You’ll need a detailed chart of accounts customized for your business model and investor reporting requirements.

A refined COA allows you to:

Track key cost centers such as R&D, sales, and marketing.

Monitor capital expenditures vs. operating expenses.

Segment revenue streams to understand driver performance.

Integrate with modern accounting software that supports scalability, automation, and real-time visibility. Tools like QuickBooks Online, Xero, or NetSuite offer flexibility based on your stage of growth.

Financial Metrics and Reporting Expectations

Focus on Startup-Specific KPIs

Venture-backed investors don’t just want your P&L and balance sheet. They want to see metrics that demonstrate traction, efficiency, and unit economics.

High-priority KPIs include:

Burn Rate: How quickly are you spending capital?

Cash Runway: How long can you operate before needing more funding?

Gross Margin: What’s left after covering your cost of goods sold?

Customer Acquisition Cost (CAC): How cost-efficient is your growth?

Lifetime Value (LTV): What’s the average revenue per customer over time?

Make these KPIs part of your monthly dashboard to provide real-time insights for internal and investor decision-making.

Investor Reporting & Communication

After your venture round, timely and accurate reporting becomes non-negotiable.

Report Type | Frequency | Purpose |

Financial Statements | Monthly/Quarterly | Monitor performance and maintain transparency |

KPI Dashboards | Monthly | Show trajectory and efficiency |

Budget vs. Actuals | Quarterly | Evaluate plan vs. performance |

Cap Table Updates | Post-Funding Events | Track equity ownership changes |

Audit or Review Reports | Annually | Offer assurance to investors and potential acquirers |

Include narratives with financial reports to contextualize results and set expectations proactively.

Tax Planning and Compliance for Venture-Backed Startups

Prepare for Startup Tax Complexities

Equity transactions, stock options, and investor agreements bring tax complexities. Leverage expert guidance to avoid pitfalls and unlock tax-saving opportunities.

Key strategies include:

Accurately accounting for stock-based compensation.

Claiming federal or state R&D tax credits.

Filing compliant and timely returns with the IRS.

For example, many tech startups are eligible for the Research and Experimentation Credit, which can offset income or payroll taxes. Learn more from the IRS guide on business credits.

Designing a Scalable Accounting Function

In-House vs. Outsourced Accounting

Factor | In-House | Outsourced |

Cost | Higher fixed costs | Lower upfront investment, subscription models |

Control | Direct team management | Access to experts with startup finance specialization |

Flexibility | Slower to adjust | Easily scales up/down with business needs |

Expertise | Depends on hiring quality | Advisory built-in with experienced startup pros |

Outsourcing often gives startups the flexibility and depth they need without bloated overhead. Specialized providers offer modern accounting streamlined for scale.

Selecting the Right Accounting Software

Having the right tools saves time and lowers error rates. Choose software that:

Supports accrual accounting and GAAP compliance.

Integrates with payment platforms, CRMs, and payroll.

Handles equity management and cap table updates.

Delivers real-time dashboards tracking MRR, CAC, and LTV.

Many early-stage startups begin with QuickBooks Online or Xero and later migrate to more advanced tools like NetSuite based on growth.

Common Pitfalls and How to Avoid Them

Challenge | Impact | Solution |

Poor bookkeeping discipline | Blocks funding or causes errors | Use professional bookkeeping support with monthly closes |

Missing cash flow forecasting | Unexpected shortfalls | Use startup-specific forecasting templates or tools |

Confusing tax handling | Risk of penalties and audits | Work with a CPA experienced in venture-backed companies |

Disorganized reporting | Erodes investor confidence | Standardize reports and metrics across stakeholder updates |

Avoiding these mistakes early leaves fewer issues to fix later—and builds investor confidence.

Your Accounting Moves Post-Raise

Post-funding, accounting for venture backed startups is more than compliance—it's a growth enabler that fuels your trajectory and strengthens investor trust.

Make sure your startup embraces:

Accrual accounting for accurate data.

Governance and internal control policies.

Investor-grade metric dashboards and reporting.

Scalable software and service support.

Smart tax planning that lowers burn and risk.

Talk to an expert to future-proof your startup’s accounting and stay prepared for the next investment milestone.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026