Go Back

Last Updated :

Last Updated :

Dec 11, 2025

Dec 11, 2025

Form 5695 Instructions: How to Claim Residential Energy Tax Credits

One effective but often overlooked tool is Form 5695, used to claim residential energy tax credits. Understanding how to complete this form correctly can enable your company — or even your home office setup — to benefit from valuable federal tax incentives that lower energy costs and accelerate sustainability goals.

This guide breaks down Form 5695 instructions in practical terms with a focus on how founders and operations leaders can claim residential energy tax credits, integrate these benefits with your broader tax strategy, and align them with your financial planning for R&D and operational expenditures.

What is Form 5695 and Why It Matters for Founders

Form 5695, officially titled “Residential Energy Credits,” is the IRS form used to claim tax credits for qualified energy-efficient home improvements and residential energy property costs. These credits directly lower your tax liability dollar-for-dollar, unlike deductions which reduce taxable income. Residential energy tax credits mainly cover:

Installation of solar panels or solar water heaters

Energy-efficient windows and doors

Certain insulation and roofing materials

Geothermal heat pumps

Other qualifying energy-conserving equipment

For startup founders who work from home or operators managing employee home-related energy upgrades, these credits can meaningfully reduce personal or business tax burdens.

If you are incorporating R&D tax credit planning into your financial strategy, coordinating with residential energy credits helps optimize overall tax positioning. For instance, if heat pumps improve your home workspace environment and are eligible, Form 5695 helps claim those savings separately from business equipment credits.

How Form 5695 Fits into Your Business Tax Planning

If your startup or agency is filing taxes this year, exploring the business tax services Haven offers can help integrate these residential credits with broader tax filings. Founders juggling multiple tax incentive strategies can benefit from using Form 5695 correctly to:

Reduce personal tax liability related to home office energy upgrades

Offset tax owed from profits generated by your startup

Combine with federal R&D credits where applicable

Maximize cash flow retention to reinvest into your business

Step-by-Step Instructions for Completing Form 5695

Before filling out Form 5695, it helps to understand how the form is organized. The IRS splits energy-related credits into two major sections, each covering different types of improvements and credit rules:

Understanding the Two Parts of Form 5695

Form 5695 is divided into:

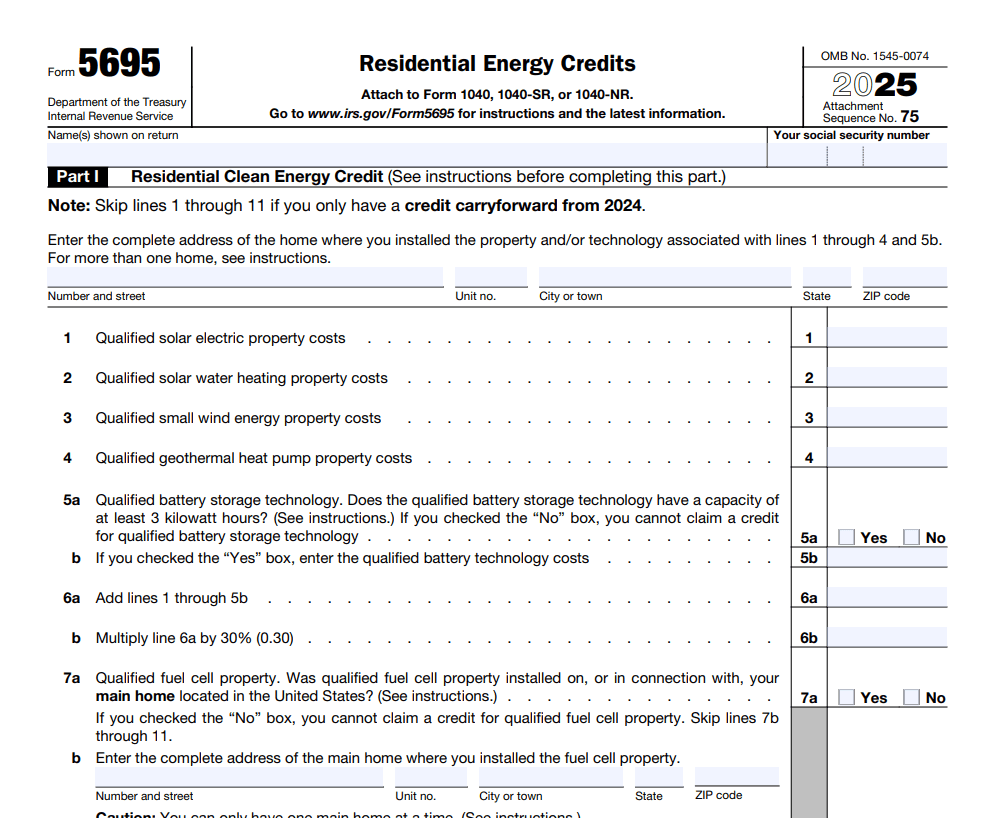

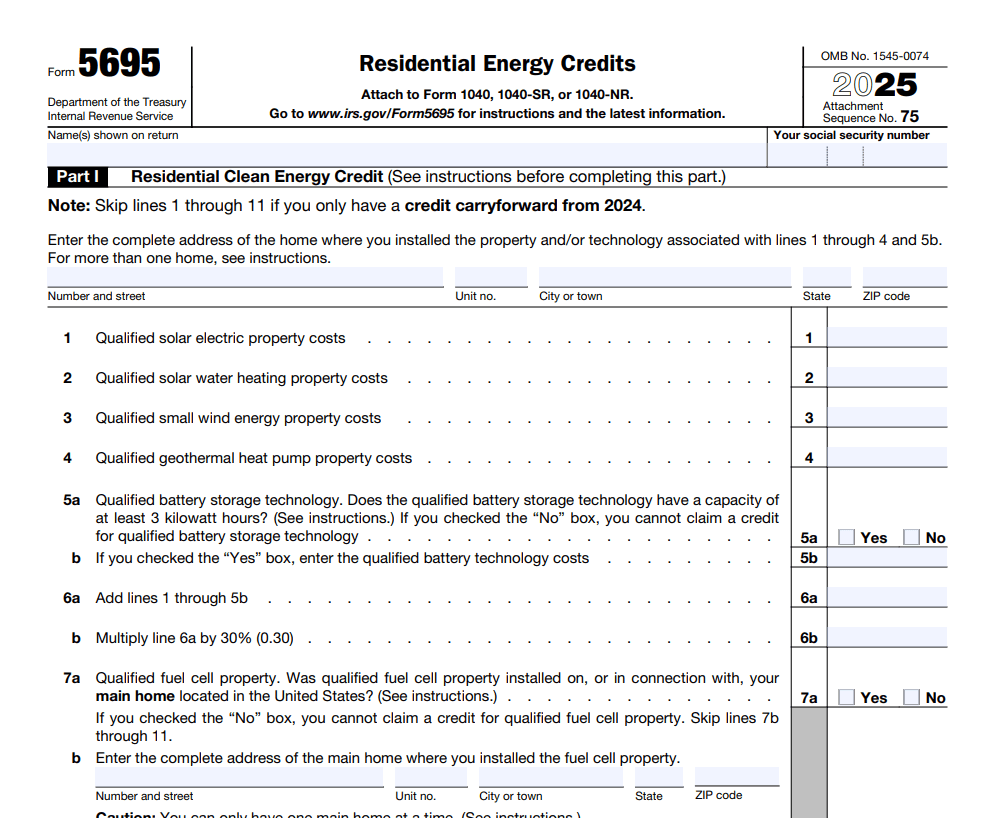

• Part I - Residential Clean Energy Credit

This section covers big-ticket clean energy systems like solar electric panels, solar water heaters, geothermal heat pumps, small wind turbines, and fuel cells. These credits typically range from 26%–30% of the installation cost and are used for equipment placed in service during the tax year. Some unused credits can carry forward to future years.

• Part II - Nonbusiness Energy Property Credit

This part applies to smaller energy-efficiency upgrades such as insulation, energy-efficient windows and doors, roofing, and certain HVAC improvements. These credits often have lower percentages and lifetime limits—for example, the $500 lifetime cap for specific improvements.

This table provides a quick comparison:

Part of Form 5695 | What It Covers | Key Considerations for Founders |

Part I – Residential Energy Efficient Property Credit | Solar electric, solar water heating, geothermal heat pumps, small wind turbines, fuel cells | Claim current-year credits for installed eligible systems. Confirm IRS qualification. |

Part II – Nonbusiness Energy Property Credit | Insulation, windows, doors, roofing, energy-efficient improvements | Contains annual/lifetime limits. Verify item eligibility via product specs. |

How to Complete Each Part of Form 5695

Once you understand which part applies to your home or rental property upgrades, follow these steps to complete the form accurately.

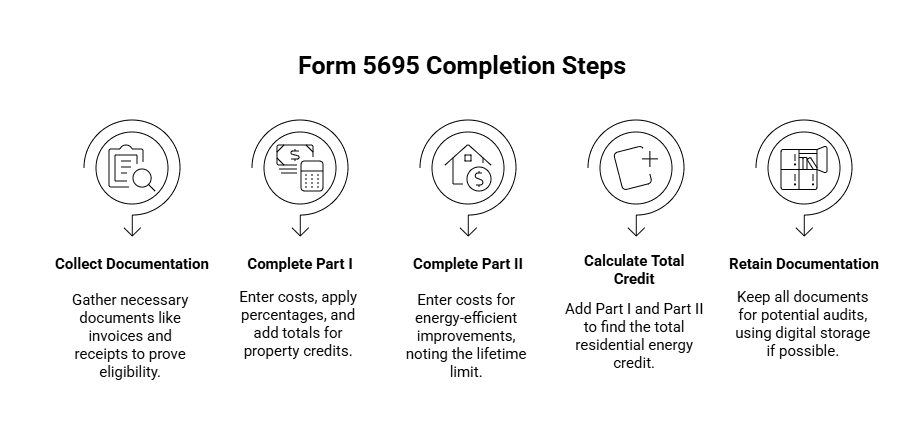

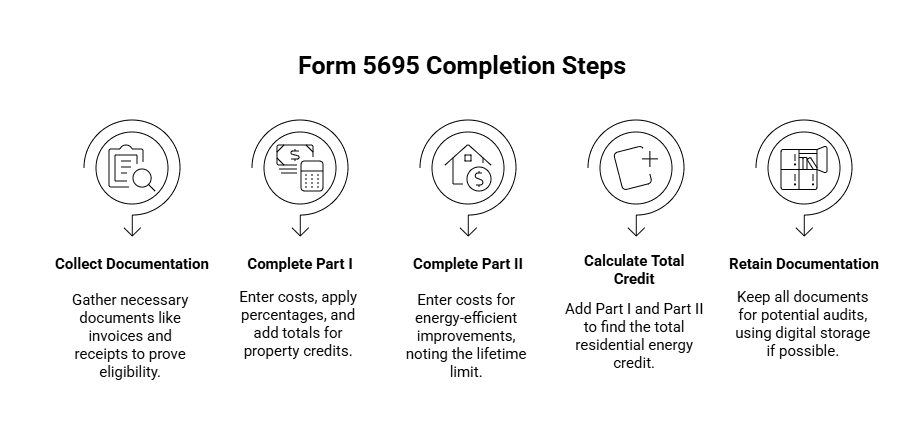

Step 1: Collect Documentation Before You Start

Gather certification statements, invoices, and installation receipts. The IRS requires proof that the equipment meets efficiency standards outlined in IRS Publication 17 and the official residential energy credit guidance.

Step 2: Complete Part I – Claiming Property Credits

Enter costs under the appropriate categories

Apply the applicable percentage (often 26%–30%)

Add totals

Some unused credits can be carried forward to future years.

Step 3: Complete Part II – Nonbusiness Energy Property Credit

Enter costs for insulation, windows, or energy-efficient improvements

Note the $500 lifetime limit for these credits

Confirm equipment meets Energy Star or IRS criteria

Step 4: Calculate Your Total Residential Energy Credit

Add Part I and Part II. The total will be reported on Form 1040, Schedule 3, Line 5.

Step 5: Retain All Documentation for Audit Purposes

Keep all receipts, certifications, and forms. Using digital document storage synced with bookkeeping software is recommended.

Practical Tips for Founders Claiming Residential Energy Credits

Coordinate with business tax filings: Use Haven’s tax guide for startups to align energy credits with revenue, R&D credits, and other filings.

Plan improvements strategically: Some credits phase out or change year to year.

Leverage home office upgrades: Energy-efficient improvements can support both comfort and tax efficiency.

Stay updated: IRS rules evolve—consult tax professionals and refer to the IRS residential energy credit page.

Common Qualified Improvements

The IRS allows a variety of home and property upgrades to qualify for the Residential Clean Energy Credit and the Energy Efficient Home Improvement Credit. These improvements can significantly reduce your tax bill if you make eligible upgrades during the year.

The table below highlights the most common qualifying improvements, their typical credit percentages, and any applicable limits—giving founders a quick reference for identifying potential tax-saving opportunities.

Improvement | Credit Percentage | Limits |

Solar electric systems | 26%–30% | No upper limit |

Solar water heaters | 26%–30% | No upper limit |

Geothermal heat pumps | 26%–30% | No upper limit |

Insulation | 10% | $500 lifetime limit |

Energy-efficient windows | 10% | Within $500 lifetime limit |

How Haven Supports Founders with Form 5695 and Tax Credits

At Haven, we understand that every dollar matters when you're building or scaling a startup. Our integrated approach helps you:

Identify eligibility for energy-related credits

Align residential + business tax strategies

Manage documentation effortlessly

Reduce audit risk through compliance

Boost cash flow by minimizing tax liabilities

Use our 10-step guide to saving money on taxes for small businesses to complement your Form 5695 strategy.

Unlock Savings with Form 5695 on Your Founder Journey

Form 5695 is an underutilized but powerful tool that founders can leverage for significant energy-related tax savings. By following IRS instructions carefully and integrating these credits into your broader tax and financial planning, you minimize liability and create more headroom for business investment.

Sustainable upgrades to your workspace or home office don’t just support environmental goals — Form 5695 converts them into meaningful tax benefits.

One effective but often overlooked tool is Form 5695, used to claim residential energy tax credits. Understanding how to complete this form correctly can enable your company — or even your home office setup — to benefit from valuable federal tax incentives that lower energy costs and accelerate sustainability goals.

This guide breaks down Form 5695 instructions in practical terms with a focus on how founders and operations leaders can claim residential energy tax credits, integrate these benefits with your broader tax strategy, and align them with your financial planning for R&D and operational expenditures.

What is Form 5695 and Why It Matters for Founders

Form 5695, officially titled “Residential Energy Credits,” is the IRS form used to claim tax credits for qualified energy-efficient home improvements and residential energy property costs. These credits directly lower your tax liability dollar-for-dollar, unlike deductions which reduce taxable income. Residential energy tax credits mainly cover:

Installation of solar panels or solar water heaters

Energy-efficient windows and doors

Certain insulation and roofing materials

Geothermal heat pumps

Other qualifying energy-conserving equipment

For startup founders who work from home or operators managing employee home-related energy upgrades, these credits can meaningfully reduce personal or business tax burdens.

If you are incorporating R&D tax credit planning into your financial strategy, coordinating with residential energy credits helps optimize overall tax positioning. For instance, if heat pumps improve your home workspace environment and are eligible, Form 5695 helps claim those savings separately from business equipment credits.

How Form 5695 Fits into Your Business Tax Planning

If your startup or agency is filing taxes this year, exploring the business tax services Haven offers can help integrate these residential credits with broader tax filings. Founders juggling multiple tax incentive strategies can benefit from using Form 5695 correctly to:

Reduce personal tax liability related to home office energy upgrades

Offset tax owed from profits generated by your startup

Combine with federal R&D credits where applicable

Maximize cash flow retention to reinvest into your business

Step-by-Step Instructions for Completing Form 5695

Before filling out Form 5695, it helps to understand how the form is organized. The IRS splits energy-related credits into two major sections, each covering different types of improvements and credit rules:

Understanding the Two Parts of Form 5695

Form 5695 is divided into:

• Part I - Residential Clean Energy Credit

This section covers big-ticket clean energy systems like solar electric panels, solar water heaters, geothermal heat pumps, small wind turbines, and fuel cells. These credits typically range from 26%–30% of the installation cost and are used for equipment placed in service during the tax year. Some unused credits can carry forward to future years.

• Part II - Nonbusiness Energy Property Credit

This part applies to smaller energy-efficiency upgrades such as insulation, energy-efficient windows and doors, roofing, and certain HVAC improvements. These credits often have lower percentages and lifetime limits—for example, the $500 lifetime cap for specific improvements.

This table provides a quick comparison:

Part of Form 5695 | What It Covers | Key Considerations for Founders |

Part I – Residential Energy Efficient Property Credit | Solar electric, solar water heating, geothermal heat pumps, small wind turbines, fuel cells | Claim current-year credits for installed eligible systems. Confirm IRS qualification. |

Part II – Nonbusiness Energy Property Credit | Insulation, windows, doors, roofing, energy-efficient improvements | Contains annual/lifetime limits. Verify item eligibility via product specs. |

How to Complete Each Part of Form 5695

Once you understand which part applies to your home or rental property upgrades, follow these steps to complete the form accurately.

Step 1: Collect Documentation Before You Start

Gather certification statements, invoices, and installation receipts. The IRS requires proof that the equipment meets efficiency standards outlined in IRS Publication 17 and the official residential energy credit guidance.

Step 2: Complete Part I – Claiming Property Credits

Enter costs under the appropriate categories

Apply the applicable percentage (often 26%–30%)

Add totals

Some unused credits can be carried forward to future years.

Step 3: Complete Part II – Nonbusiness Energy Property Credit

Enter costs for insulation, windows, or energy-efficient improvements

Note the $500 lifetime limit for these credits

Confirm equipment meets Energy Star or IRS criteria

Step 4: Calculate Your Total Residential Energy Credit

Add Part I and Part II. The total will be reported on Form 1040, Schedule 3, Line 5.

Step 5: Retain All Documentation for Audit Purposes

Keep all receipts, certifications, and forms. Using digital document storage synced with bookkeeping software is recommended.

Practical Tips for Founders Claiming Residential Energy Credits

Coordinate with business tax filings: Use Haven’s tax guide for startups to align energy credits with revenue, R&D credits, and other filings.

Plan improvements strategically: Some credits phase out or change year to year.

Leverage home office upgrades: Energy-efficient improvements can support both comfort and tax efficiency.

Stay updated: IRS rules evolve—consult tax professionals and refer to the IRS residential energy credit page.

Common Qualified Improvements

The IRS allows a variety of home and property upgrades to qualify for the Residential Clean Energy Credit and the Energy Efficient Home Improvement Credit. These improvements can significantly reduce your tax bill if you make eligible upgrades during the year.

The table below highlights the most common qualifying improvements, their typical credit percentages, and any applicable limits—giving founders a quick reference for identifying potential tax-saving opportunities.

Improvement | Credit Percentage | Limits |

Solar electric systems | 26%–30% | No upper limit |

Solar water heaters | 26%–30% | No upper limit |

Geothermal heat pumps | 26%–30% | No upper limit |

Insulation | 10% | $500 lifetime limit |

Energy-efficient windows | 10% | Within $500 lifetime limit |

How Haven Supports Founders with Form 5695 and Tax Credits

At Haven, we understand that every dollar matters when you're building or scaling a startup. Our integrated approach helps you:

Identify eligibility for energy-related credits

Align residential + business tax strategies

Manage documentation effortlessly

Reduce audit risk through compliance

Boost cash flow by minimizing tax liabilities

Use our 10-step guide to saving money on taxes for small businesses to complement your Form 5695 strategy.

Unlock Savings with Form 5695 on Your Founder Journey

Form 5695 is an underutilized but powerful tool that founders can leverage for significant energy-related tax savings. By following IRS instructions carefully and integrating these credits into your broader tax and financial planning, you minimize liability and create more headroom for business investment.

Sustainable upgrades to your workspace or home office don’t just support environmental goals — Form 5695 converts them into meaningful tax benefits.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026