Go Back

Last Updated :

Last Updated :

Dec 19, 2025

Dec 19, 2025

How to File Form 1099-NEC: Reporting Nonemployee Compensation Guide

For founders and financial leaders at startups, agencies, and e-commerce businesses, Form 1099-NEC is an essential piece of the tax compliance puzzle. Mistakes or delays in filing this form can lead to penalties, complicate your tax season, and disrupt your bookkeeping workflows.

This guide explains what you need to know to file Form 1099-NEC correctly, focusing on practical steps and considerations tailored for modern startups and fast-moving companies.

What Is Form 1099-NEC and Why Does It Matter to Founders?

Form 1099-NEC is used to report payments made to nonemployees — typically independent contractors or freelancers — who you have paid at least $600 during the tax year for services rendered to your business.

Reinstated by the IRS starting in the 2020 tax year, Form 1099-NEC separates nonemployee compensation reporting from other income reporting types like the 1099-MISC.

Key Considerations for Startup Founders

Who receives a 1099-NEC? Any individual, sole proprietorship, or LLC taxed as a disregarded entity or partnership (not as a corporation) who received $600+ for services.

When to file? The deadline to submit Form 1099-NEC to the IRS and provide a copy to the contractor is January 31 of the year following payment.

Penalties for errors or late filing can add up quickly, so staying on top of this reporting is crucial for operational peace of mind.

Because many startups rely on contractors to move fast and remain lean, understanding this form is vital. It’s not just a bureaucratic obligation—it’s about protecting your company’s finances, maintaining clean books, and safeguarding relationships with service providers.

For founders looking to streamline this filing process and broader tax workflows, efficient solutions are available through Haven's Business Tax Services.

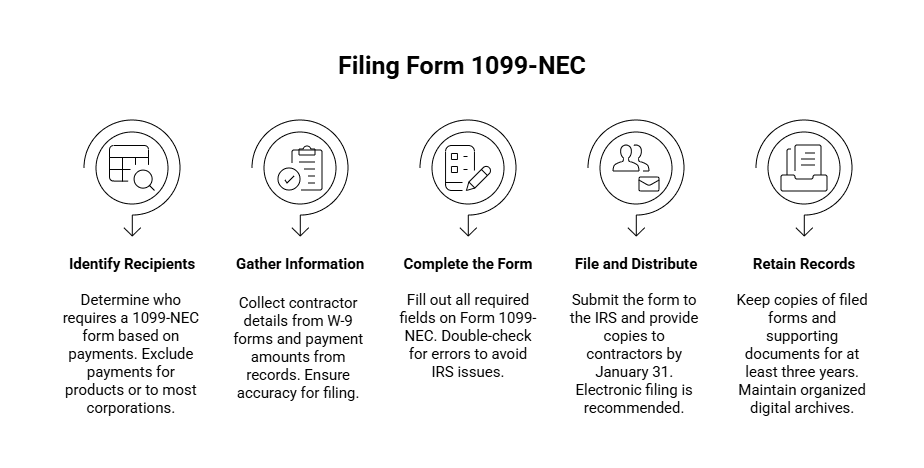

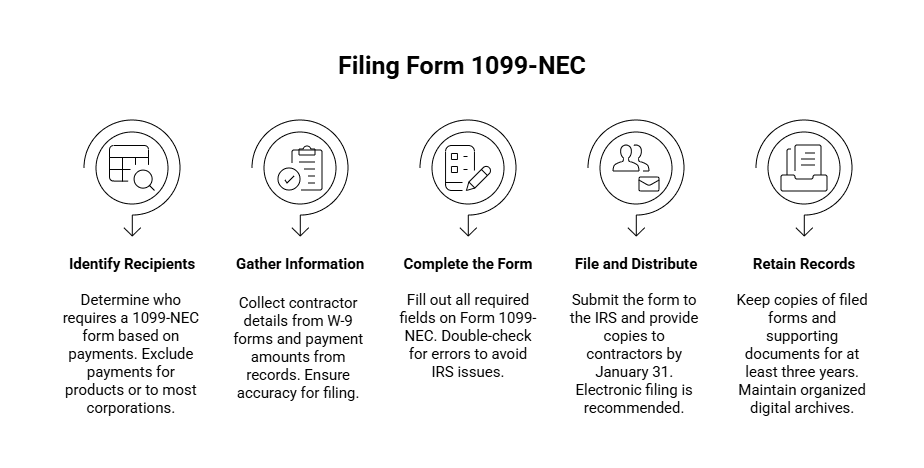

Step-by-Step Guide to Filing Form 1099-NEC

1. Identify Who Needs a Form 1099-NEC

Start by reviewing your annual payments. Your bookkeeping software or accountant should be able to generate a list of all vendors and contractors paid for services.

Payments for products, merchandise, or reimbursements do not require filing.

Payments to corporations are generally exempt, except for certain legal or medical services.

Other income types such as rents or awards fall under 1099-MISC.

Ask all new vendors to complete a W-9 form during onboarding. This ensures you have their tax ID, legal name, and address on file.

2. Gather the Necessary Information

Before filing, collect everything needed for a complete and accurate form:

Information | Source |

Contractor's Legal Name and Address | W-9 form or vendor records |

Taxpayer Identification Number (TIN) | W-9 form |

Total Amount Paid | Bookkeeping records |

Your Business Information | EIN, address from tax records |

Digitally organizing all records saves time and supports audit readiness.

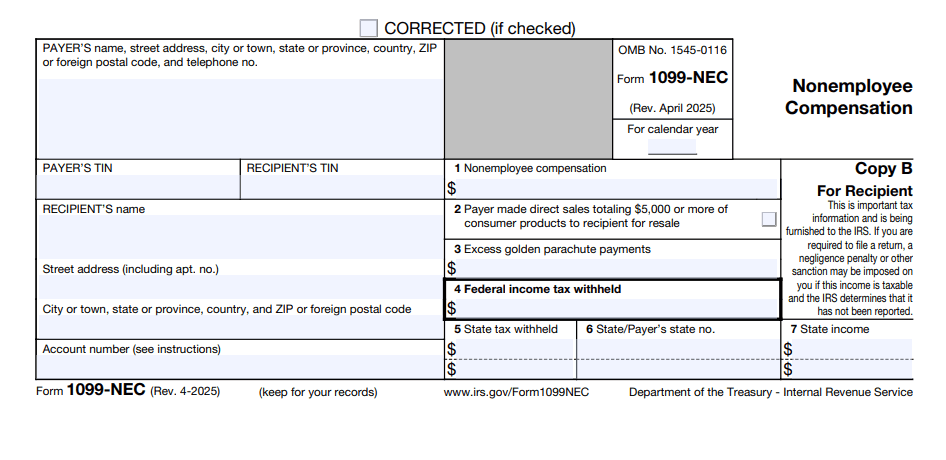

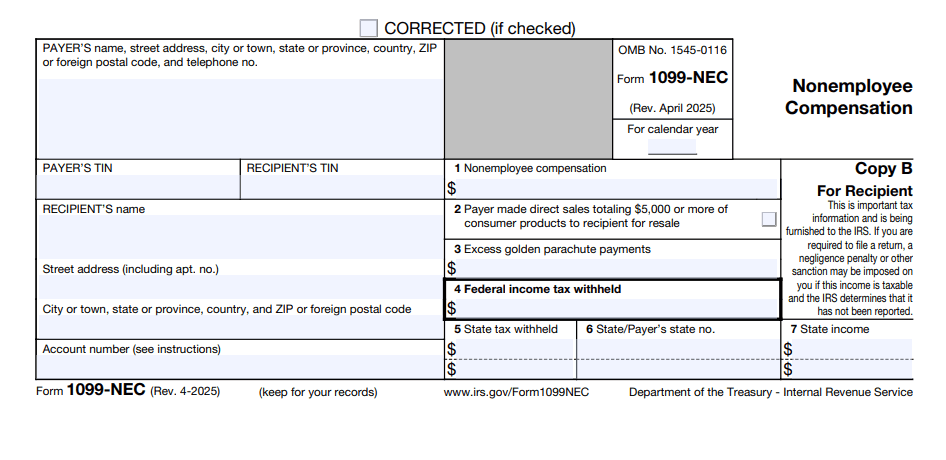

3. Complete Form 1099-NEC Accurately

The critical fields on the form include:

Box 1: Nonemployee Compensation – Total amount paid for services.

Payer Information – Your company’s name, EIN, and address.

Recipient Information – Contractor’s name, TIN, and address.

Be cautious with typos, incorrect amounts, or mismatched TINs and names—these are the most common sources of IRS issues.

4. File Form 1099-NEC With the IRS and Distribute Copies

The form must be filed with the IRS and supplied to each contractor by January 31.

Electronic Filing: Required if submitting 250+ forms, but recommended regardless due to reduced error rates and faster processing.

Paper filing: Use red-ink official IRS forms—not printed copies. These must be ordered in advance.

Late filings or incorrect submissions may incur penalties unless reasonable cause is demonstrated.

5. Retain Records for Compliance and Audit Protection

Keep copies of filed forms—and corresponding records such as W-9s and payment evidence—for at least three years. Having well-organized digital archives supports your audit readiness and strengthens your bookkeeping integrity.

Further tax prep tools for startups can be found in our comprehensive tax guide.

Common Pitfalls Startups Should Avoid When Filing Form 1099-NEC

Even experienced founders make mistakes when filing nonemployee compensation. These common pitfalls are worth noting:

Not collecting W-9s early: An incomplete contractor record delays your filing process.

Worker misclassification: Confusing employees with contractors can result in serious tax penalties.

Overlooking sub-$600 payments: While you don't have to file for these, tracking them can improve readiness for future filings.

Missing the filing deadline: Adopt calendar reminders and automate contractor follow-ups to stay compliant.

TIN/name mismatches: Ensure information perfectly matches IRS databases by using the IRS TIN Matching Program.

Leverage tools or professionals familiar with startup workflows to reduce errors and maintain efficiency.

How Technology Streamlines Form 1099-NEC Filing for Founders

Early-stage companies and solo founders often lack the bandwidth for manual tracking. Integrated software can automate your Form 1099-NEC compliance:

Benefit | How It Helps |

Real-time contractor thresholds | Alerts when vendors cross $600 limit |

Digital W-9 collection | Easy onboarding and storage |

Data syncing | Auto-sync with credit card and bank records |

Error checks | Validate TINs and flag mismatches pre-filing |

E-filing built-in | One-click submission to IRS |

Investing in digital tools not only cuts admin work but also drastically reduces your risk of filing errors—and the stress that accompanies tax season.

Master Form 1099-NEC Filing to Protect Your Startup's Financial Health

Correctly filing Form 1099-NEC is a non-negotiable aspect of startup financial operations. As a founder or operations lead, aligning on accurate recordkeeping, filing deadlines, and eligibility reporting ensures your startup is audit-ready and penalty-safe.

From collecting W-9s early to using smart software and verifying every data point before submission, these practical habits build trust with contractors and resilience into your financial stack. And if you're seeking extra assurance with startup-savvy guidance, Haven is here to help.

For founders and financial leaders at startups, agencies, and e-commerce businesses, Form 1099-NEC is an essential piece of the tax compliance puzzle. Mistakes or delays in filing this form can lead to penalties, complicate your tax season, and disrupt your bookkeeping workflows.

This guide explains what you need to know to file Form 1099-NEC correctly, focusing on practical steps and considerations tailored for modern startups and fast-moving companies.

What Is Form 1099-NEC and Why Does It Matter to Founders?

Form 1099-NEC is used to report payments made to nonemployees — typically independent contractors or freelancers — who you have paid at least $600 during the tax year for services rendered to your business.

Reinstated by the IRS starting in the 2020 tax year, Form 1099-NEC separates nonemployee compensation reporting from other income reporting types like the 1099-MISC.

Key Considerations for Startup Founders

Who receives a 1099-NEC? Any individual, sole proprietorship, or LLC taxed as a disregarded entity or partnership (not as a corporation) who received $600+ for services.

When to file? The deadline to submit Form 1099-NEC to the IRS and provide a copy to the contractor is January 31 of the year following payment.

Penalties for errors or late filing can add up quickly, so staying on top of this reporting is crucial for operational peace of mind.

Because many startups rely on contractors to move fast and remain lean, understanding this form is vital. It’s not just a bureaucratic obligation—it’s about protecting your company’s finances, maintaining clean books, and safeguarding relationships with service providers.

For founders looking to streamline this filing process and broader tax workflows, efficient solutions are available through Haven's Business Tax Services.

Step-by-Step Guide to Filing Form 1099-NEC

1. Identify Who Needs a Form 1099-NEC

Start by reviewing your annual payments. Your bookkeeping software or accountant should be able to generate a list of all vendors and contractors paid for services.

Payments for products, merchandise, or reimbursements do not require filing.

Payments to corporations are generally exempt, except for certain legal or medical services.

Other income types such as rents or awards fall under 1099-MISC.

Ask all new vendors to complete a W-9 form during onboarding. This ensures you have their tax ID, legal name, and address on file.

2. Gather the Necessary Information

Before filing, collect everything needed for a complete and accurate form:

Information | Source |

Contractor's Legal Name and Address | W-9 form or vendor records |

Taxpayer Identification Number (TIN) | W-9 form |

Total Amount Paid | Bookkeeping records |

Your Business Information | EIN, address from tax records |

Digitally organizing all records saves time and supports audit readiness.

3. Complete Form 1099-NEC Accurately

The critical fields on the form include:

Box 1: Nonemployee Compensation – Total amount paid for services.

Payer Information – Your company’s name, EIN, and address.

Recipient Information – Contractor’s name, TIN, and address.

Be cautious with typos, incorrect amounts, or mismatched TINs and names—these are the most common sources of IRS issues.

4. File Form 1099-NEC With the IRS and Distribute Copies

The form must be filed with the IRS and supplied to each contractor by January 31.

Electronic Filing: Required if submitting 250+ forms, but recommended regardless due to reduced error rates and faster processing.

Paper filing: Use red-ink official IRS forms—not printed copies. These must be ordered in advance.

Late filings or incorrect submissions may incur penalties unless reasonable cause is demonstrated.

5. Retain Records for Compliance and Audit Protection

Keep copies of filed forms—and corresponding records such as W-9s and payment evidence—for at least three years. Having well-organized digital archives supports your audit readiness and strengthens your bookkeeping integrity.

Further tax prep tools for startups can be found in our comprehensive tax guide.

Common Pitfalls Startups Should Avoid When Filing Form 1099-NEC

Even experienced founders make mistakes when filing nonemployee compensation. These common pitfalls are worth noting:

Not collecting W-9s early: An incomplete contractor record delays your filing process.

Worker misclassification: Confusing employees with contractors can result in serious tax penalties.

Overlooking sub-$600 payments: While you don't have to file for these, tracking them can improve readiness for future filings.

Missing the filing deadline: Adopt calendar reminders and automate contractor follow-ups to stay compliant.

TIN/name mismatches: Ensure information perfectly matches IRS databases by using the IRS TIN Matching Program.

Leverage tools or professionals familiar with startup workflows to reduce errors and maintain efficiency.

How Technology Streamlines Form 1099-NEC Filing for Founders

Early-stage companies and solo founders often lack the bandwidth for manual tracking. Integrated software can automate your Form 1099-NEC compliance:

Benefit | How It Helps |

Real-time contractor thresholds | Alerts when vendors cross $600 limit |

Digital W-9 collection | Easy onboarding and storage |

Data syncing | Auto-sync with credit card and bank records |

Error checks | Validate TINs and flag mismatches pre-filing |

E-filing built-in | One-click submission to IRS |

Investing in digital tools not only cuts admin work but also drastically reduces your risk of filing errors—and the stress that accompanies tax season.

Master Form 1099-NEC Filing to Protect Your Startup's Financial Health

Correctly filing Form 1099-NEC is a non-negotiable aspect of startup financial operations. As a founder or operations lead, aligning on accurate recordkeeping, filing deadlines, and eligibility reporting ensures your startup is audit-ready and penalty-safe.

From collecting W-9s early to using smart software and verifying every data point before submission, these practical habits build trust with contractors and resilience into your financial stack. And if you're seeking extra assurance with startup-savvy guidance, Haven is here to help.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026