Go Back

Last Updated :

Last Updated :

Jan 26, 2026

Jan 26, 2026

Form D: Filing Your SEC Notice for Private Offerings

When raising capital through private securities offerings, a Form D filing with the Securities and Exchange Commission (SEC) is often a critical—but sometimes overlooked—step.

For founders navigating startup fundraising, understanding the role of Form D, when and how to file it, and how it impacts your capital raise compliance is essential. This guide breaks down the key elements of Form D filings with practical, founder-friendly advice to help you stay SEC-compliant while focusing on growing your business.

What Is Form D and Why Does It Matter for Founders?

At its core, Form D is a short notice that companies file with the SEC after selling securities in a private offering that is exempt from full SEC registration, usually under Regulation D. It does not register your securities but rather notifies the government you sold securities under certain exemptions.

Why does that matter? Raising capital legally and transparently is key to avoiding fines, penalties, or investor disputes later. The filing signals to regulators and states that your offering qualifies under the SEC’s private placement rules. It also ensures you meet ongoing compliance requirements linked to your fundraising strategy.

Quick context on Regulation D:

It allows companies to raise capital without the costly and lengthy SEC registration process.

Most startups raise under Rules 506(b) or 506(c), which have different investor and solicitation rules.

Rule 504 is another exemption but with some dollar limits and different requirements.

For founders looking to keep fundraising streamlined yet compliant, filing Form D timely and accurately is one of the best practices in ensuring your offering remains exempt.

Who Must File Form D and When?

Any company conducting a securities offering under Regulation D exemptions must generally file Form D. This typically includes startups, agencies, e-commerce, and other private businesses issuing equity, convertible notes, or other securities.

The issuer (your company) is responsible for filing.

Related persons such as directors, officers, promoters may also be identified on the form.

Note: You don't file if you’re conducting a public offering or a fully registered transaction.

When is Form D due?

The SEC requires Form D to be filed within 15 calendar days after the first sale of securities in the offering. The ""first sale"" means the first time any investor is irrevocably committed to invest money or property.

Important founder action steps:

Track your timeline carefully from the first investor agreement.

Set internal reminders to file before the deadline.

Failing to file on time can lead to penalties for the company and complicate your ability to rely on the exemption in future offerings.

What Information Does Form D Require?

Form D is a brief document but must be completed with accuracy and care. Key sections include:

Section | What to Provide | Founder Tip |

Basic Issuer Info | Company name, address, type of business | Ensure your company name matches your legal business documents exactly |

Related Persons | Names and addresses of key persons involved | Identify directors, officers, promoters as they are material to the filing |

Offering Details | Total amount offered, amount sold, type of securities | Be precise about offering size and security class (e.g. common stock, notes) |

Exemption Claimed | Specify Rule 504, 506(b), or 506(c) | Know which Regulation D rule you are utilizing |

Investors | Number and type of investors (accredited vs non-accredited) | Differentiate investors correctly - impacts compliance and disclosure rules |

Optional Disclosures | Additional info such as use of proceeds, jurisdictions | Use this for clarity and to aid state-level filings if needed |

A well-prepared Form D minimizes follow-up requests from the SEC and builds a trustworthy record for future capital raises.

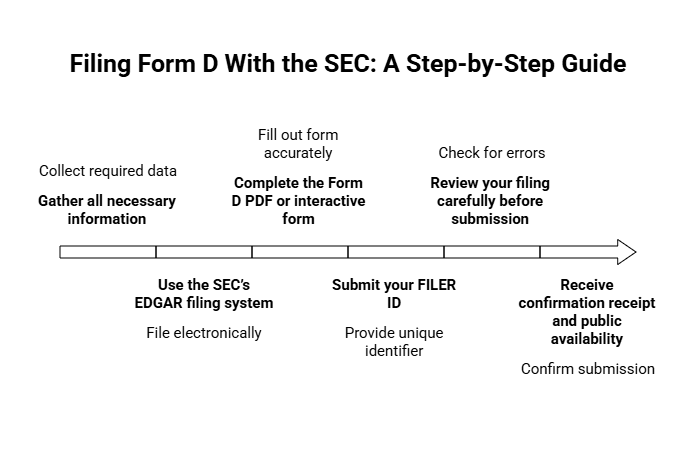

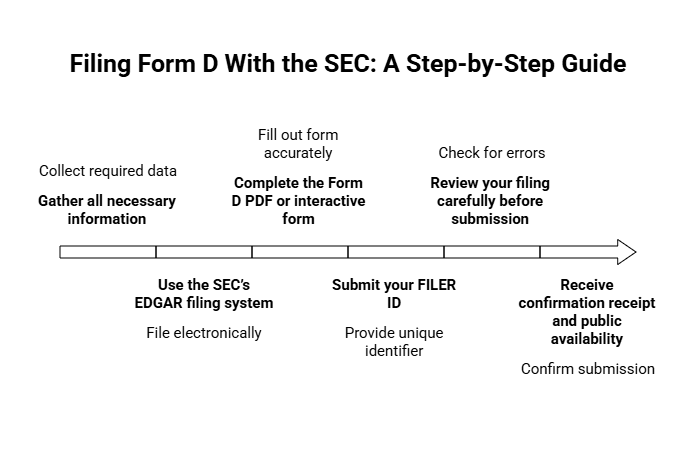

How to File Form D With the SEC

Step-by-step filing process:

Gather all necessary information as described above.

Use the SEC’s EDGAR filing system – Form D is filed electronically only.

Complete the Form D PDF or interactive form with accurate data.

Submit your FILER ID (you need one if this is your first time filing with EDGAR).

Review your filing carefully before submission.

After submission, you will receive a confirmation receipt and your Form D will be publicly available on the SEC’s EDGAR database.

Good to know: Some states require you to file a notice related to your Form D filing—familiarize yourself with rules from the North American Securities Administrators Association (NASAA) for your operating jurisdictions.

What Happens If You Miss the Form D Filing Deadline?

Late or non-filing of Form D can carry serious consequences:

Your capital raise may lose protection under the Regulation D exemption.

You risk triggering SEC investigations or enforcement action.

Some states impose fines or bar companies from future offerings if Form D is overdue.

Investors may question your legal compliance, potentially leading to disputes or difficulty raising further capital.

As a founder, it pays to maintain a simple calendar reminder system or utilize professional securities counsel or bookkeeping services specializing in startup compliance. This helps ensure deadlines are met without burdensome manual tracking.

When and How to Amend Your Form D

Your fundraising process is not always set in stone, so amendments to Form D are common and sometimes necessary.

When to file an amendment?

Material changes to offering size or terms.

Changes in your contact or company information.

Changes in related persons named in the original filing.

Adding new states where the offering is being made.

Correcting any errors or omissions.

Amendment timing:

Amendments must be filed promptly when changes occur.

Annual amendments are also due one year after the initial filing if the offering is still ongoing.

Maintaining accurate and updated Form D filings protects your ability to rely on Regulation D exemptions and signals transparency to investors and regulators.

Should You File Annual Amendments?

If your fundraising offering remains open or securities continue to be sold beyond one year from your original Form D filing, you are required to file an annual amendment to update the offering status.

This keeps your SEC filing records current.

Demonstrates continued compliance.

Some states require this for maintaining their notice filing compliance.

Even if you completed fundraising quickly, understanding the potential need for an annual amendment supports good governance for your startup’s long-term capital strategy.

Understanding Related Persons and Investor Reporting

Form D requires listing “related persons” involved in the offering such as directors, officers, and promoters. Clarifying these individuals is important for SEC transparency.

Related persons disclosures do not amount to full financial reporting.

Helps prevent conflicts of interest or undisclosed relationships.

Supports investor trust by demonstrating a clear leadership and promoter network.

On the investor side, Form D reports the number of accredited versus non-accredited investors, which links to offering rule compliance (for example, Rule 506(b) limits non-accredited investors, while Rule 506(c) permits only accredited investors).

Founders should ensure their investor documentation and due diligence match the data reported on Form D for smooth audits or reviews.

Comparing Form D to Other SEC Filings

One common confusion among founders is differentiating Form D from other filings such as registration statements or periodic reports under the Securities Exchange Act.

Filing Type | Purpose | Form D Relation |

Form D | Notice of exempt private offering | Required for all Regulation D private offerings |

S-1 (Registration) | Registers securities for public offering | Form D exempts companies from this expensive, extensive requirement |

Form 10-K, 10-Q | Financial/operational reporting for public companies | Not required for private companies under Form D rules |

State Blue Sky Notices | Additional notice to states related to securities offerings | Often filed alongside Form D to meet state law |

How Modern Bookkeeping and Compliance Services Streamline Form D Filings

For busy startup founders, managing SEC compliance on top of product, sales, and scaling demands can be challenging. Many startups benefit significantly from partnering with experienced bookkeeping and tax service providers focused on founders who:

Understand the nuances of private securities compliance.

Provide onboarding and reminders for Form D deadlines.

Support R&D tax credit filings connected to your engineering or product development spend.

Help with coordinated state notice filings and annual amendment tracking.

By integrating regulatory know-how with responsive service, these providers allow founders to avoid costly mistakes while freeing up time to focus on growth.

Framing Your Fundraising with Confidence Through Form D Compliance

Filing Form D is a foundational compliance step for startups raising money via private offerings under Regulation D exemptions. It ensures legal capital formation while enabling founder flexibility without full SEC registration burdens.

Key founder takeaways:

File Form D within 15 days of your first sale.

Provide precise offering, investor, and related person info.

Amend promptly when material changes occur.

Keep track of annual amendment deadlines if your offering is ongoing.

Leverage expert bookkeeping and legal-support services to stay ahead.

Staying on top of your Form D filings builds investor confidence, protects your exemption status, and establishes a solid foundation for future fundraising rounds.

When raising capital through private securities offerings, a Form D filing with the Securities and Exchange Commission (SEC) is often a critical—but sometimes overlooked—step.

For founders navigating startup fundraising, understanding the role of Form D, when and how to file it, and how it impacts your capital raise compliance is essential. This guide breaks down the key elements of Form D filings with practical, founder-friendly advice to help you stay SEC-compliant while focusing on growing your business.

What Is Form D and Why Does It Matter for Founders?

At its core, Form D is a short notice that companies file with the SEC after selling securities in a private offering that is exempt from full SEC registration, usually under Regulation D. It does not register your securities but rather notifies the government you sold securities under certain exemptions.

Why does that matter? Raising capital legally and transparently is key to avoiding fines, penalties, or investor disputes later. The filing signals to regulators and states that your offering qualifies under the SEC’s private placement rules. It also ensures you meet ongoing compliance requirements linked to your fundraising strategy.

Quick context on Regulation D:

It allows companies to raise capital without the costly and lengthy SEC registration process.

Most startups raise under Rules 506(b) or 506(c), which have different investor and solicitation rules.

Rule 504 is another exemption but with some dollar limits and different requirements.

For founders looking to keep fundraising streamlined yet compliant, filing Form D timely and accurately is one of the best practices in ensuring your offering remains exempt.

Who Must File Form D and When?

Any company conducting a securities offering under Regulation D exemptions must generally file Form D. This typically includes startups, agencies, e-commerce, and other private businesses issuing equity, convertible notes, or other securities.

The issuer (your company) is responsible for filing.

Related persons such as directors, officers, promoters may also be identified on the form.

Note: You don't file if you’re conducting a public offering or a fully registered transaction.

When is Form D due?

The SEC requires Form D to be filed within 15 calendar days after the first sale of securities in the offering. The ""first sale"" means the first time any investor is irrevocably committed to invest money or property.

Important founder action steps:

Track your timeline carefully from the first investor agreement.

Set internal reminders to file before the deadline.

Failing to file on time can lead to penalties for the company and complicate your ability to rely on the exemption in future offerings.

What Information Does Form D Require?

Form D is a brief document but must be completed with accuracy and care. Key sections include:

Section | What to Provide | Founder Tip |

Basic Issuer Info | Company name, address, type of business | Ensure your company name matches your legal business documents exactly |

Related Persons | Names and addresses of key persons involved | Identify directors, officers, promoters as they are material to the filing |

Offering Details | Total amount offered, amount sold, type of securities | Be precise about offering size and security class (e.g. common stock, notes) |

Exemption Claimed | Specify Rule 504, 506(b), or 506(c) | Know which Regulation D rule you are utilizing |

Investors | Number and type of investors (accredited vs non-accredited) | Differentiate investors correctly - impacts compliance and disclosure rules |

Optional Disclosures | Additional info such as use of proceeds, jurisdictions | Use this for clarity and to aid state-level filings if needed |

A well-prepared Form D minimizes follow-up requests from the SEC and builds a trustworthy record for future capital raises.

How to File Form D With the SEC

Step-by-step filing process:

Gather all necessary information as described above.

Use the SEC’s EDGAR filing system – Form D is filed electronically only.

Complete the Form D PDF or interactive form with accurate data.

Submit your FILER ID (you need one if this is your first time filing with EDGAR).

Review your filing carefully before submission.

After submission, you will receive a confirmation receipt and your Form D will be publicly available on the SEC’s EDGAR database.

Good to know: Some states require you to file a notice related to your Form D filing—familiarize yourself with rules from the North American Securities Administrators Association (NASAA) for your operating jurisdictions.

What Happens If You Miss the Form D Filing Deadline?

Late or non-filing of Form D can carry serious consequences:

Your capital raise may lose protection under the Regulation D exemption.

You risk triggering SEC investigations or enforcement action.

Some states impose fines or bar companies from future offerings if Form D is overdue.

Investors may question your legal compliance, potentially leading to disputes or difficulty raising further capital.

As a founder, it pays to maintain a simple calendar reminder system or utilize professional securities counsel or bookkeeping services specializing in startup compliance. This helps ensure deadlines are met without burdensome manual tracking.

When and How to Amend Your Form D

Your fundraising process is not always set in stone, so amendments to Form D are common and sometimes necessary.

When to file an amendment?

Material changes to offering size or terms.

Changes in your contact or company information.

Changes in related persons named in the original filing.

Adding new states where the offering is being made.

Correcting any errors or omissions.

Amendment timing:

Amendments must be filed promptly when changes occur.

Annual amendments are also due one year after the initial filing if the offering is still ongoing.

Maintaining accurate and updated Form D filings protects your ability to rely on Regulation D exemptions and signals transparency to investors and regulators.

Should You File Annual Amendments?

If your fundraising offering remains open or securities continue to be sold beyond one year from your original Form D filing, you are required to file an annual amendment to update the offering status.

This keeps your SEC filing records current.

Demonstrates continued compliance.

Some states require this for maintaining their notice filing compliance.

Even if you completed fundraising quickly, understanding the potential need for an annual amendment supports good governance for your startup’s long-term capital strategy.

Understanding Related Persons and Investor Reporting

Form D requires listing “related persons” involved in the offering such as directors, officers, and promoters. Clarifying these individuals is important for SEC transparency.

Related persons disclosures do not amount to full financial reporting.

Helps prevent conflicts of interest or undisclosed relationships.

Supports investor trust by demonstrating a clear leadership and promoter network.

On the investor side, Form D reports the number of accredited versus non-accredited investors, which links to offering rule compliance (for example, Rule 506(b) limits non-accredited investors, while Rule 506(c) permits only accredited investors).

Founders should ensure their investor documentation and due diligence match the data reported on Form D for smooth audits or reviews.

Comparing Form D to Other SEC Filings

One common confusion among founders is differentiating Form D from other filings such as registration statements or periodic reports under the Securities Exchange Act.

Filing Type | Purpose | Form D Relation |

Form D | Notice of exempt private offering | Required for all Regulation D private offerings |

S-1 (Registration) | Registers securities for public offering | Form D exempts companies from this expensive, extensive requirement |

Form 10-K, 10-Q | Financial/operational reporting for public companies | Not required for private companies under Form D rules |

State Blue Sky Notices | Additional notice to states related to securities offerings | Often filed alongside Form D to meet state law |

How Modern Bookkeeping and Compliance Services Streamline Form D Filings

For busy startup founders, managing SEC compliance on top of product, sales, and scaling demands can be challenging. Many startups benefit significantly from partnering with experienced bookkeeping and tax service providers focused on founders who:

Understand the nuances of private securities compliance.

Provide onboarding and reminders for Form D deadlines.

Support R&D tax credit filings connected to your engineering or product development spend.

Help with coordinated state notice filings and annual amendment tracking.

By integrating regulatory know-how with responsive service, these providers allow founders to avoid costly mistakes while freeing up time to focus on growth.

Framing Your Fundraising with Confidence Through Form D Compliance

Filing Form D is a foundational compliance step for startups raising money via private offerings under Regulation D exemptions. It ensures legal capital formation while enabling founder flexibility without full SEC registration burdens.

Key founder takeaways:

File Form D within 15 days of your first sale.

Provide precise offering, investor, and related person info.

Amend promptly when material changes occur.

Keep track of annual amendment deadlines if your offering is ongoing.

Leverage expert bookkeeping and legal-support services to stay ahead.

Staying on top of your Form D filings builds investor confidence, protects your exemption status, and establishes a solid foundation for future fundraising rounds.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026