Go Back

Last Updated :

Last Updated :

Jan 19, 2026

Jan 19, 2026

Agricultural Employer Tax Compliance: Founder’s Guide to Form 943 Filing

As a founder or operations lead of a growing startup or e-commerce company, understanding your tax obligations can feel overwhelming—especially when you have employees engaged in agricultural work. One critical compliance area that can slip under the radar is Form 943, which specifically targets agricultural employers.

This guide breaks down what Form 943 entails, who uses it, and how to navigate its filing requirements efficiently, so you can stay ahead of tax deadlines without disrupting your core business.

What is Form 943 and Why It Matters to Your Business

Form 943 is the Employer’s Annual Tax Return for Agricultural Employees. Unlike the commonly used Form 941, which covers general employment taxes quarterly, Form 943 is designed exclusively for employers with agricultural workers.

Founders must get familiar with this form to avoid costly errors and ensure compliance with the IRS.

Who Must File Form 943?

Usually, if your business employs farmworkers and pays them wages subject to Social Security and Medicare taxes, you fall under this category. Common scenarios include:

Seasonal or year-round farm laborers

Employees involved in cultivating or harvesting crops, raising livestock, or performing related agricultural work

If your farm employees receive over $1,500 in wages during any quarter of the year, or if you withheld any Social Security or Medicare tax, the IRS expects you to file Form 943 annually.

Key Differences Between Form 943 and Form 941

Startups often confuse Form 943 with Form 941, but they serve different purposes and reporting schedules.

Feature | Form 943 (Agricultural Employers) | Form 941 (General Employers) |

Filing Frequency | Annually | Quarterly |

Who Must File? | Employers of agricultural workers | Employers of general employees |

Tax Types Reported | Social Security, Medicare, withheld taxes | Social Security, Medicare, withheld taxes |

Deposit Schedule | Monthly or semiweekly | Weekly or semiweekly |

Understanding these distinctions helps founders allocate timely resources to tax compliance and avoid mixing up forms.

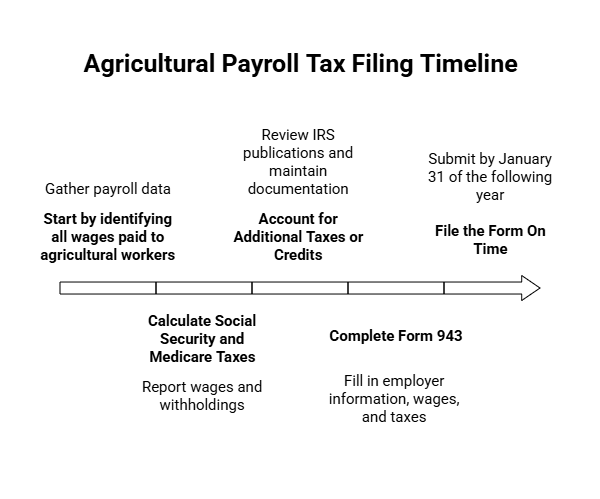

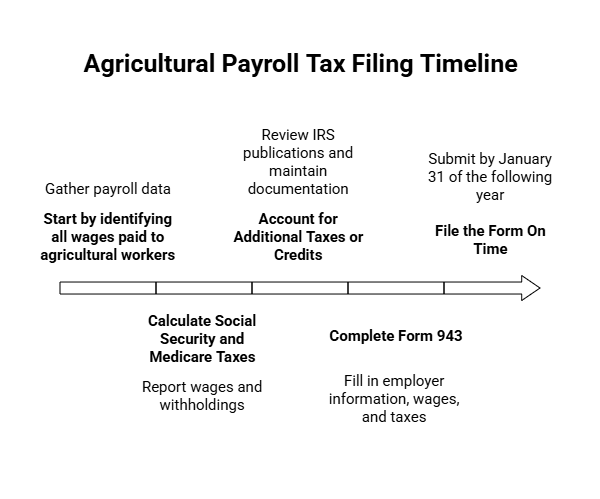

How to File Form 943: A Step-by-Step Guide

Completing Form 943 accurately requires careful record-keeping and awareness of current IRS rules. Here are actionable steps to get started:

1. Gather Your Payroll Data for Agricultural Employees

Start by identifying all wages paid to agricultural workers through your payroll system. Ensure this encompasses regular wages, tips, and taxable fringe benefits. Be consistent in classifying employees properly to distinguish agricultural labor from other roles.

2. Calculate Social Security and Medicare Taxes

Form 943 requires reporting wages subject to Social Security and Medicare taxes and the associated amounts withheld.

Social Security rate: 12.4% combined

Medicare rate: 2.9% combined

Rates may change; refer to current IRS updates

3. Account for Additional Taxes or Credits

Agricultural employers may be eligible for specific tax credits. Review IRS publications and maintain documentation for audit protection.

If your startup also hires non-agricultural employees, file the appropriate forms like Form 941 for general employees.

4. Complete Form 943

Key sections include employer information, total wages, Social Security and Medicare wages and taxes, federal income tax withheld, and adjustments or credits. Access the official instructions and form.

5. File the Form On Time

The deadline is January 31 of the year following the tax year. E-filing is encouraged. Late submissions may result in penalties and interest.

Tips to Avoid Common Mistakes with Form 943

Separate payroll records to distinguish agricultural workers

Track deposits carefully to prevent missed payments

Use modern payroll software to reduce errors

Stay informed on IRS updates for agricultural employe

How Haven Supports Startups with Form 943 and Agricultural Payroll

Haven provides modern bookkeeping and tax services tailored for startups and e-commerce firms operating across industries, including agriculture. Services include:

Expert payroll setup

Automated tax calculation and deposit tracking

Annual filing assistance for agricultural and general forms

Responsive compliance support

Learn more at: https://www.usehaven.com/services

Grow Smarter with Confident Form 943 Filing

For founders managing agricultural labor alongside traditional employees, Form 943 is a specialized but essential part of your tax responsibilities. By understanding filing requirements, maintaining accurate payroll records, and keeping up with IRS updates, you reduce risk and remain compliant.

Don’t let complex tax forms slow your growth.

As a founder or operations lead of a growing startup or e-commerce company, understanding your tax obligations can feel overwhelming—especially when you have employees engaged in agricultural work. One critical compliance area that can slip under the radar is Form 943, which specifically targets agricultural employers.

This guide breaks down what Form 943 entails, who uses it, and how to navigate its filing requirements efficiently, so you can stay ahead of tax deadlines without disrupting your core business.

What is Form 943 and Why It Matters to Your Business

Form 943 is the Employer’s Annual Tax Return for Agricultural Employees. Unlike the commonly used Form 941, which covers general employment taxes quarterly, Form 943 is designed exclusively for employers with agricultural workers.

Founders must get familiar with this form to avoid costly errors and ensure compliance with the IRS.

Who Must File Form 943?

Usually, if your business employs farmworkers and pays them wages subject to Social Security and Medicare taxes, you fall under this category. Common scenarios include:

Seasonal or year-round farm laborers

Employees involved in cultivating or harvesting crops, raising livestock, or performing related agricultural work

If your farm employees receive over $1,500 in wages during any quarter of the year, or if you withheld any Social Security or Medicare tax, the IRS expects you to file Form 943 annually.

Key Differences Between Form 943 and Form 941

Startups often confuse Form 943 with Form 941, but they serve different purposes and reporting schedules.

Feature | Form 943 (Agricultural Employers) | Form 941 (General Employers) |

Filing Frequency | Annually | Quarterly |

Who Must File? | Employers of agricultural workers | Employers of general employees |

Tax Types Reported | Social Security, Medicare, withheld taxes | Social Security, Medicare, withheld taxes |

Deposit Schedule | Monthly or semiweekly | Weekly or semiweekly |

Understanding these distinctions helps founders allocate timely resources to tax compliance and avoid mixing up forms.

How to File Form 943: A Step-by-Step Guide

Completing Form 943 accurately requires careful record-keeping and awareness of current IRS rules. Here are actionable steps to get started:

1. Gather Your Payroll Data for Agricultural Employees

Start by identifying all wages paid to agricultural workers through your payroll system. Ensure this encompasses regular wages, tips, and taxable fringe benefits. Be consistent in classifying employees properly to distinguish agricultural labor from other roles.

2. Calculate Social Security and Medicare Taxes

Form 943 requires reporting wages subject to Social Security and Medicare taxes and the associated amounts withheld.

Social Security rate: 12.4% combined

Medicare rate: 2.9% combined

Rates may change; refer to current IRS updates

3. Account for Additional Taxes or Credits

Agricultural employers may be eligible for specific tax credits. Review IRS publications and maintain documentation for audit protection.

If your startup also hires non-agricultural employees, file the appropriate forms like Form 941 for general employees.

4. Complete Form 943

Key sections include employer information, total wages, Social Security and Medicare wages and taxes, federal income tax withheld, and adjustments or credits. Access the official instructions and form.

5. File the Form On Time

The deadline is January 31 of the year following the tax year. E-filing is encouraged. Late submissions may result in penalties and interest.

Tips to Avoid Common Mistakes with Form 943

Separate payroll records to distinguish agricultural workers

Track deposits carefully to prevent missed payments

Use modern payroll software to reduce errors

Stay informed on IRS updates for agricultural employe

How Haven Supports Startups with Form 943 and Agricultural Payroll

Haven provides modern bookkeeping and tax services tailored for startups and e-commerce firms operating across industries, including agriculture. Services include:

Expert payroll setup

Automated tax calculation and deposit tracking

Annual filing assistance for agricultural and general forms

Responsive compliance support

Learn more at: https://www.usehaven.com/services

Grow Smarter with Confident Form 943 Filing

For founders managing agricultural labor alongside traditional employees, Form 943 is a specialized but essential part of your tax responsibilities. By understanding filing requirements, maintaining accurate payroll records, and keeping up with IRS updates, you reduce risk and remain compliant.

Don’t let complex tax forms slow your growth.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026