Go Back

Last Updated :

Last Updated :

Dec 19, 2025

Dec 19, 2025

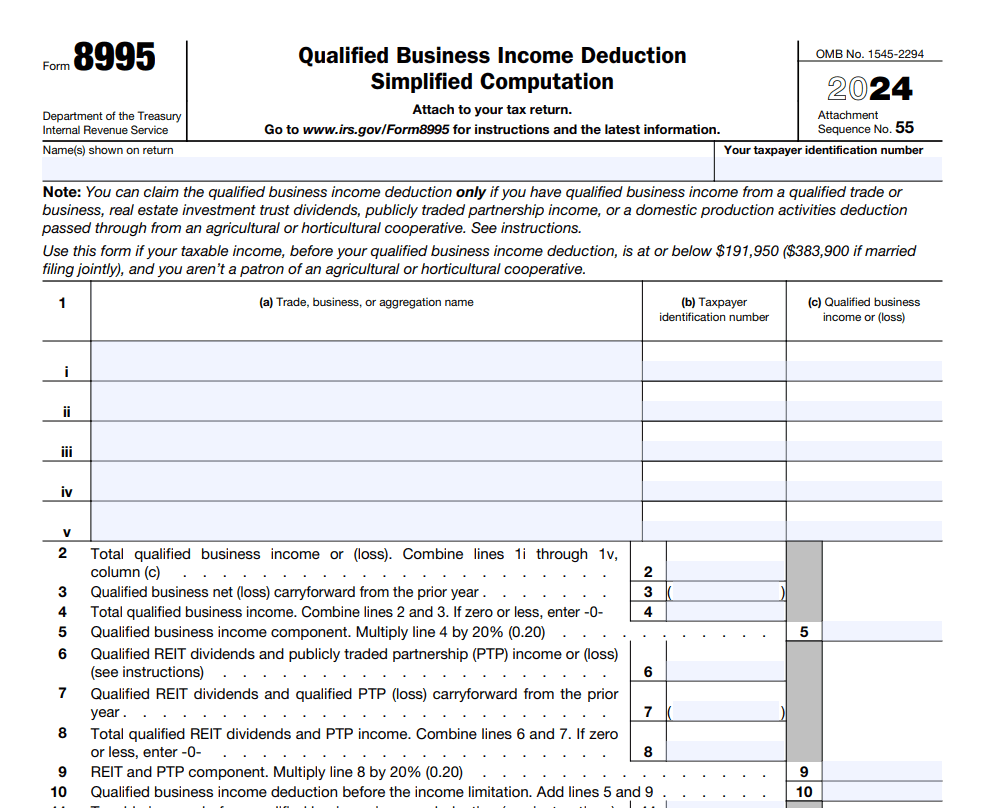

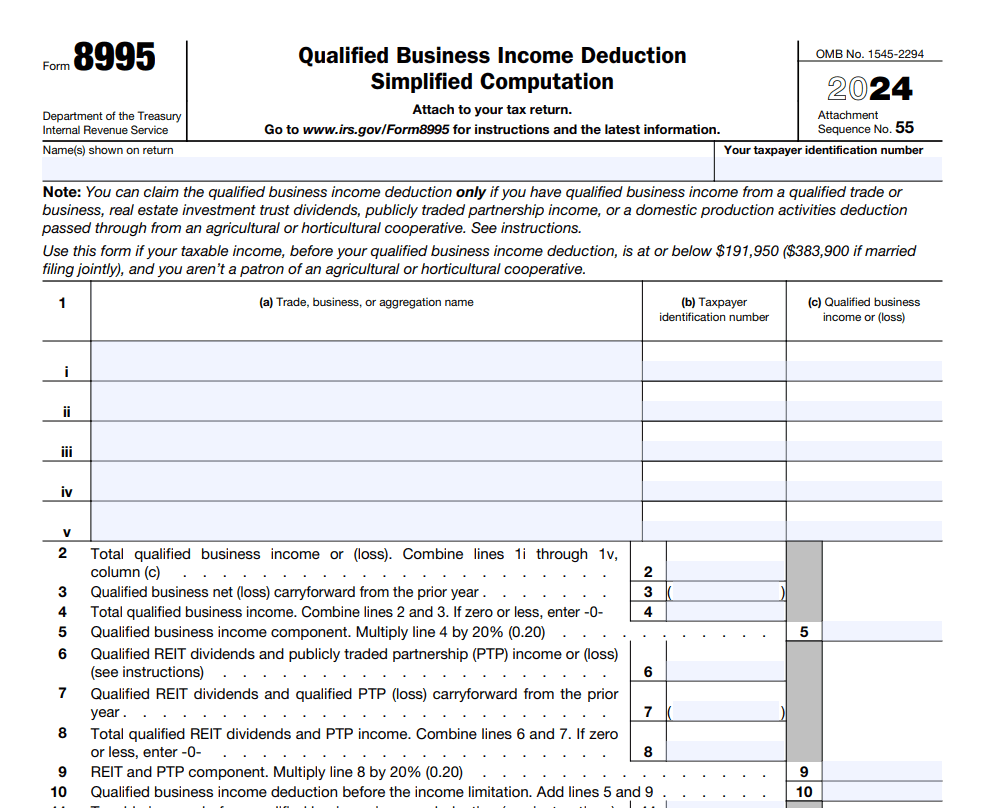

Form 8995 Instructions: How to Calculate and Claim the QBI Deduction

For founders steering startups, agencies, or e-commerce companies, maximizing tax benefits can often feel like navigating a maze. One vital yet frequently misunderstood tax provision is the Qualified Business Income (QBI) deduction, accessible via Form 8995. Properly claiming this deduction can significantly reduce your taxable income, freeing up capital for growth and innovation.

In this practical guide, we’ll break down the essential steps to complete Form 8995, clarify critical calculations, and show how to maximize this deduction’s value as a modern founder. Whether you're managing your books internally or partnering with a service like Haven’s business tax services, understanding these instructions helps you make smarter financial choices that support your startup’s trajectory.

What Is the QBI Deduction and Why Founders Should Care

The Qualified Business Income (QBI) deduction, introduced by the Tax Cuts and Jobs Act, allows eligible pass-through entities—sole proprietorships, partnerships, S corporations, and certain trusts or estates—to deduct up to 20% of their qualified business income. This deduction directly lowers your taxable income, which can translate into substantial tax savings.

For founders, this means:

Retaining more capital for R&D, hiring, or expansion

Reducing tax liability without complex shelters or restructuring

Continued eligibility even as taxable income grows—within thresholds

However, the deduction involves nuanced eligibility criteria and calculations. Errors in applying it can lead to missed savings or IRS scrutiny. You’ll use Form 8995 for simpler tax scenarios, while Form 8995-A is reserved for more complex circumstances. Most startups and small businesses qualify to use Form 8995 if they meet income thresholds.

Step-by-Step Guide to Completing Form 8995

Step 1: Gather Your Business Income Details and Tax Documents

Before starting the form, gather the following:

Total qualified business income from all pass-through sources

W-2 wages paid (for employees and active founders)

Unadjusted Basis Immediately After Acquisition (UBIA) of any qualified property

Personal taxable income from Form 1040

These figures underpin all deductions. Ensuring accuracy here avoids revision delays or potential IRS audits.

Step 2: Confirm Income Thresholds for Eligibility

Form 8995's application depends in part on whether your taxable income falls below IRS thresholds. For 2023:

Filing Status | Threshold Income |

Single or Married Filing Separately | $182,100 |

Married Filing Jointly | $364,200 |

These benchmarks impact whether you qualify for the full, simplified deduction or must apply wage/property limitations.

Tax thresholds update yearly. Always confirm with the IRS official instructions.

Step 3: Complete Part I – Qualified Business Income (QBI) Details

Input your QBI across all your eligible trades or businesses. Combine figures where applicable.

Guidelines:

Include only U.S.-sourced income

Exclude investment income (capital gains, dividends, etc.)

Adjust for business losses or deductions

Accurate bookkeeping—like the founder-focused systems Haven offers—ensures you reflect QBI precisely.

Step 4: Determine Tentative QBI Deduction

Multiply your total QBI by 20%.

Record this in Part I, Line 4 of Form 8995.

Step 5: Apply Wage and Property Limitations (If Needed)

If your income exceeds the thresholds, your deduction may be limited based on:

50% of W-2 wages paid

OR25% of W-2 wages + 2.5% of UBIA of qualified property

The lowest applicable limit becomes your allowable deduction.

Founders with lean teams and limited assets may see a reduced deduction at this stage.

Step 6: Finalize and Transfer Deduction

Complete Part II to arrive at your final deduction.

Transfer the number to Form 1040, Line 13, for the applicable tax year.

Tips to Maximize QBI Deduction for Startups and Small Agencies

Segment Income and Expenses Clearly

Maintain detailed separation of income by entity. Tag wage payments and asset purchases cleanly to satisfy IRS reporting.

Pair with R&D Tax Credits

Consider layering the QBI deduction with R&D credits. Many startups building tech or optimizing workflows qualify.

Haven’s R&D credit specialists can support the full process.

Monitor Income Relative to Thresholds

If your income approaches IRS limits, strategic planning may help preserve eligibility.

This can include timing revenue, adjusting payroll, or investing in qualified property.

Invest in Qualified Assets Early

Purchasing equipment used in the business boosts UBIA and can help maintain your deduction.

Use a Founder-Focused Bookkeeping System

Accurate financials are the foundation of a strong QBI claim. Haven’s systems keep everything categorized and audit-ready.

Key Form 8995 Sections & Steps for Founders

This section breaks down the core components of Form 8995 so founders can quickly understand what each part does and how to navigate it confidently. From calculating Qualified Business Income (QBI) to applying wage and property limits, each step highlights what matters for maximizing the deduction and avoiding common filing mistakes.

Use this table as a practical guide to stay organized, ensure accuracy, and streamline the process before transferring the final amount to your Form 1040.

Section | Purpose | Action Steps |

Part I – QBI Reporting | Calculate qualified business income | Ensure clean records and separate each business |

Tentative Deduction | Determine 20% of QBI | Apply correct percentage and confirm accuracy |

Wage / Property Limit | Reduce deduction if above thresholds | Aggregate W-2 wages and UBIA correctly |

Final Deduction (Part II) | Transfer amount to Form 1040 | Review for accuracy before filing |

Staying Compliant: IRS Resources and Updates

The IRS Form 8995 portal includes official instructions and yearly updates. Since thresholds and interpretations shift, founders should review updates annually to avoid missed opportunities or filing errors.

How Haven Helps Founders with Form 8995 and QBI Strategy

At Haven, we support founders with:

Transparent, organized bookkeeping

Expert application of QBI and R&D incentives

Strategic tax planning as your company scales

Continuous monitoring for new opportunities to reduce tax liability

Explore more in Haven’s small business tax savings guide or see details on our business tax services.

Mastering Form 8995 Empowers Smarter Founders

Understanding and efficiently applying Form 8995 to claim the QBI deduction is a strategic advantage for founders aiming to minimize tax burden while maximizing reinvestment potential. With modern bookkeeping, optimized wage and asset tracking, and founder-first tax support from Haven, you can confidently unlock meaningful tax savings.

For founders steering startups, agencies, or e-commerce companies, maximizing tax benefits can often feel like navigating a maze. One vital yet frequently misunderstood tax provision is the Qualified Business Income (QBI) deduction, accessible via Form 8995. Properly claiming this deduction can significantly reduce your taxable income, freeing up capital for growth and innovation.

In this practical guide, we’ll break down the essential steps to complete Form 8995, clarify critical calculations, and show how to maximize this deduction’s value as a modern founder. Whether you're managing your books internally or partnering with a service like Haven’s business tax services, understanding these instructions helps you make smarter financial choices that support your startup’s trajectory.

What Is the QBI Deduction and Why Founders Should Care

The Qualified Business Income (QBI) deduction, introduced by the Tax Cuts and Jobs Act, allows eligible pass-through entities—sole proprietorships, partnerships, S corporations, and certain trusts or estates—to deduct up to 20% of their qualified business income. This deduction directly lowers your taxable income, which can translate into substantial tax savings.

For founders, this means:

Retaining more capital for R&D, hiring, or expansion

Reducing tax liability without complex shelters or restructuring

Continued eligibility even as taxable income grows—within thresholds

However, the deduction involves nuanced eligibility criteria and calculations. Errors in applying it can lead to missed savings or IRS scrutiny. You’ll use Form 8995 for simpler tax scenarios, while Form 8995-A is reserved for more complex circumstances. Most startups and small businesses qualify to use Form 8995 if they meet income thresholds.

Step-by-Step Guide to Completing Form 8995

Step 1: Gather Your Business Income Details and Tax Documents

Before starting the form, gather the following:

Total qualified business income from all pass-through sources

W-2 wages paid (for employees and active founders)

Unadjusted Basis Immediately After Acquisition (UBIA) of any qualified property

Personal taxable income from Form 1040

These figures underpin all deductions. Ensuring accuracy here avoids revision delays or potential IRS audits.

Step 2: Confirm Income Thresholds for Eligibility

Form 8995's application depends in part on whether your taxable income falls below IRS thresholds. For 2023:

Filing Status | Threshold Income |

Single or Married Filing Separately | $182,100 |

Married Filing Jointly | $364,200 |

These benchmarks impact whether you qualify for the full, simplified deduction or must apply wage/property limitations.

Tax thresholds update yearly. Always confirm with the IRS official instructions.

Step 3: Complete Part I – Qualified Business Income (QBI) Details

Input your QBI across all your eligible trades or businesses. Combine figures where applicable.

Guidelines:

Include only U.S.-sourced income

Exclude investment income (capital gains, dividends, etc.)

Adjust for business losses or deductions

Accurate bookkeeping—like the founder-focused systems Haven offers—ensures you reflect QBI precisely.

Step 4: Determine Tentative QBI Deduction

Multiply your total QBI by 20%.

Record this in Part I, Line 4 of Form 8995.

Step 5: Apply Wage and Property Limitations (If Needed)

If your income exceeds the thresholds, your deduction may be limited based on:

50% of W-2 wages paid

OR25% of W-2 wages + 2.5% of UBIA of qualified property

The lowest applicable limit becomes your allowable deduction.

Founders with lean teams and limited assets may see a reduced deduction at this stage.

Step 6: Finalize and Transfer Deduction

Complete Part II to arrive at your final deduction.

Transfer the number to Form 1040, Line 13, for the applicable tax year.

Tips to Maximize QBI Deduction for Startups and Small Agencies

Segment Income and Expenses Clearly

Maintain detailed separation of income by entity. Tag wage payments and asset purchases cleanly to satisfy IRS reporting.

Pair with R&D Tax Credits

Consider layering the QBI deduction with R&D credits. Many startups building tech or optimizing workflows qualify.

Haven’s R&D credit specialists can support the full process.

Monitor Income Relative to Thresholds

If your income approaches IRS limits, strategic planning may help preserve eligibility.

This can include timing revenue, adjusting payroll, or investing in qualified property.

Invest in Qualified Assets Early

Purchasing equipment used in the business boosts UBIA and can help maintain your deduction.

Use a Founder-Focused Bookkeeping System

Accurate financials are the foundation of a strong QBI claim. Haven’s systems keep everything categorized and audit-ready.

Key Form 8995 Sections & Steps for Founders

This section breaks down the core components of Form 8995 so founders can quickly understand what each part does and how to navigate it confidently. From calculating Qualified Business Income (QBI) to applying wage and property limits, each step highlights what matters for maximizing the deduction and avoiding common filing mistakes.

Use this table as a practical guide to stay organized, ensure accuracy, and streamline the process before transferring the final amount to your Form 1040.

Section | Purpose | Action Steps |

Part I – QBI Reporting | Calculate qualified business income | Ensure clean records and separate each business |

Tentative Deduction | Determine 20% of QBI | Apply correct percentage and confirm accuracy |

Wage / Property Limit | Reduce deduction if above thresholds | Aggregate W-2 wages and UBIA correctly |

Final Deduction (Part II) | Transfer amount to Form 1040 | Review for accuracy before filing |

Staying Compliant: IRS Resources and Updates

The IRS Form 8995 portal includes official instructions and yearly updates. Since thresholds and interpretations shift, founders should review updates annually to avoid missed opportunities or filing errors.

How Haven Helps Founders with Form 8995 and QBI Strategy

At Haven, we support founders with:

Transparent, organized bookkeeping

Expert application of QBI and R&D incentives

Strategic tax planning as your company scales

Continuous monitoring for new opportunities to reduce tax liability

Explore more in Haven’s small business tax savings guide or see details on our business tax services.

Mastering Form 8995 Empowers Smarter Founders

Understanding and efficiently applying Form 8995 to claim the QBI deduction is a strategic advantage for founders aiming to minimize tax burden while maximizing reinvestment potential. With modern bookkeeping, optimized wage and asset tracking, and founder-first tax support from Haven, you can confidently unlock meaningful tax savings.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026