Go Back

Last Updated :

Last Updated :

Jan 19, 2026

Jan 19, 2026

Net Investment Income Tax (NIIT) Explained for Founders: Form 8960 Overview

For founders steering the financial course of startups, agencies, or e-commerce ventures, understanding specialized tax forms like Form 8960 is essential for optimizing tax outcomes. This guide provides a founder-friendly breakdown of the Net Investment Income Tax (NIIT), explaining how to calculate it using Form 8960 and why it matters for your business and personal finances.

What is Form 8960 and Why Should Founders Care?

Form 8960 is the IRS form used to calculate the Net Investment Income Tax (NIIT), a 3.8% surtax applied to certain investment income for individuals, estates, and trusts that exceed specified income thresholds.

Why does this affect founders?

Many founders' personal incomes include dividends, interest, capital gains, rental income, or other passive incomes derived from investments and business activities. If your modified adjusted gross income (MAGI) surpasses the threshold, you may owe NIIT on your net investment income — impacting your after-tax wealth and reinvestment capacity.

Understanding Form 8960 enables founders to:

Accurately determine NIIT liability

Strategically manage investments to minimize tax burden

Align accounting and tax filings for compliance

Understanding Net Investment Income Tax on Form 8960

Form 8960 calculates NIIT based on two key concepts — your net investment income and whether your MAGI exceeds the applicable threshold.

Term | Definition | Implication for Founders |

Net Investment Income (NII) | Includes interest, dividends, capital gains, rental and royalty income, non-qualified annuities, passive business income, and other investment income. | Founders often receive these from stock sales, dividends, or rentals. |

Modified Adjusted Gross Income (MAGI) | AGI plus excluded foreign income. | NIIT applies when MAGI exceeds $200k (single) or $250k (married filing jointly). |

Calculating Net Investment Income Tax: Step-by-Step

Step 1: Calculate Your Net Investment Income

Add:

Taxable interest and dividends

Net capital gains (see our guide on capital gains recorded via Form 8949)

Rental and royalty income

Passive business income

Step 2: Determine If MAGI Exceeds the Threshold

$250,000 — Married Filing Jointly

$125,000 — Married Filing Separately

$200,000 — Single or Head of Household

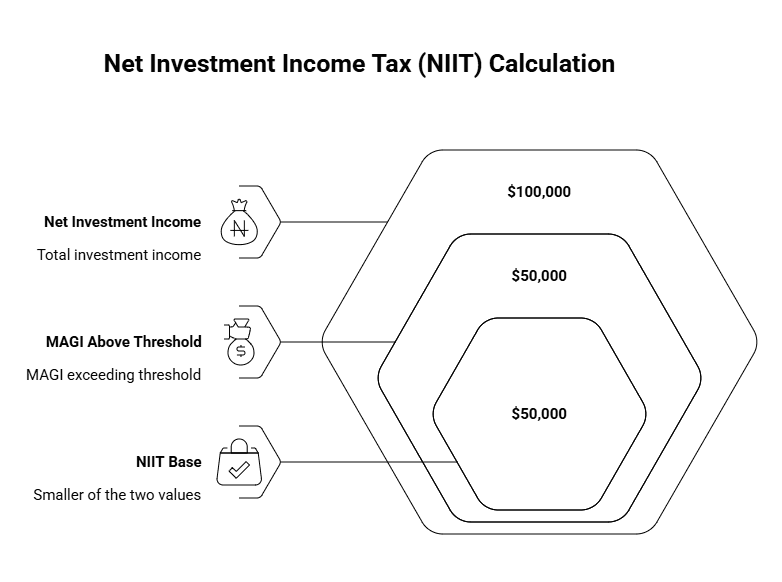

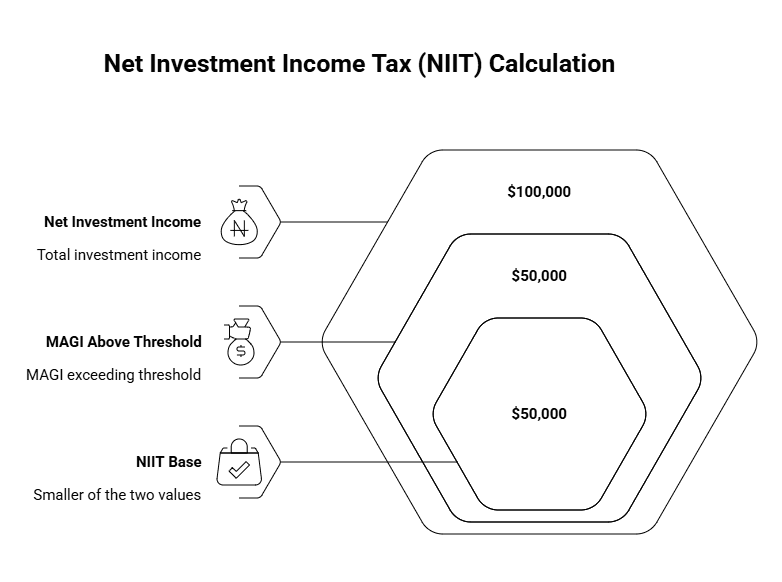

Step 3: Compute the NIIT Base

Calculate both:

Excess MAGI above threshold

Net investment income

NIIT applies to the smaller value × 3.8%.

Real-World Examples for Founders Using Form 8960

The Net Investment Income Tax is calculated on the lesser of net investment income or excess modified adjusted gross income (MAGI) above the applicable threshold. The examples below show how that limitation works in practice.

Example 1: Startup Founder with Capital Gains

Filing status: Married filing jointly

MAGI: $300,000

Net investment income: $80,000

NIIT threshold (MFJ): $250,000

Excess MAGI:

$300,000 − $250,000 = $50,000

Because NIIT applies to the lesser of net investment income ($80,000) or excess MAGI ($50,000), the taxable amount is $50,000.

NIIT owed:

$50,000 × 3.8% = $1,900

Example 2: E-Commerce Founder with Rental Income

Filing status: Single

MAGI: $210,000

Net investment income: $40,000

NIIT threshold (Single): $200,000

Excess MAGI:

$210,000 − $200,000 = $10,000

Here, excess MAGI ($10,000) is lower than net investment income ($40,000), so NIIT applies only to $10,000.

NIIT owed:

$10,000 × 3.8% = $380

Form 8960 Walkthrough: Key Lines Founders Should Know

Line(s) | What It Covers | Founder Tip |

1–6 | Types of investment income | Separate passive vs. active business income. |

7–8 | Deductions | Track investment-related expenses. |

9–10 | Net investment income | Determines NIIT base. |

13–17 | MAGI and thresholds | Forecast income before equity sales. |

18 | Final NIIT owed | Plan tax payments accordingly. |

Minimizing NIIT Exposure: Founder Strategies

Time equity events (e.g., stock sales) during lower-income years

Reclassify rental income by participating materially

Use investment deductions such as interest expense

Optimize business structure

Lower total tax burden with credits (e.g., see Haven’s Form 1120 guide)

Embedding Form 8960 Into Your Tax Workflow

Maintain clear bookkeeping, separating investment income

Forecast MAGI for timing financial events

Use startup-savvy advisors for compliance

Leverage tax automation tools

For a broader tax infrastructure, review Haven’s business tax services.

Why Founders Should Prioritize Form 8960 Understanding

As a founder, your tax strategy directly influences capital allocation, long-term planning, and liquidity. Understanding Form 8960 and its NIIT implications ensures you avoid costly surprises and maintain financial clarity.

To optimize your tax position and confidently navigate forms like Form 8960, consider partnering with Haven’s founder-focused bookkeeping and tax filing teams.

For founders steering the financial course of startups, agencies, or e-commerce ventures, understanding specialized tax forms like Form 8960 is essential for optimizing tax outcomes. This guide provides a founder-friendly breakdown of the Net Investment Income Tax (NIIT), explaining how to calculate it using Form 8960 and why it matters for your business and personal finances.

What is Form 8960 and Why Should Founders Care?

Form 8960 is the IRS form used to calculate the Net Investment Income Tax (NIIT), a 3.8% surtax applied to certain investment income for individuals, estates, and trusts that exceed specified income thresholds.

Why does this affect founders?

Many founders' personal incomes include dividends, interest, capital gains, rental income, or other passive incomes derived from investments and business activities. If your modified adjusted gross income (MAGI) surpasses the threshold, you may owe NIIT on your net investment income — impacting your after-tax wealth and reinvestment capacity.

Understanding Form 8960 enables founders to:

Accurately determine NIIT liability

Strategically manage investments to minimize tax burden

Align accounting and tax filings for compliance

Understanding Net Investment Income Tax on Form 8960

Form 8960 calculates NIIT based on two key concepts — your net investment income and whether your MAGI exceeds the applicable threshold.

Term | Definition | Implication for Founders |

Net Investment Income (NII) | Includes interest, dividends, capital gains, rental and royalty income, non-qualified annuities, passive business income, and other investment income. | Founders often receive these from stock sales, dividends, or rentals. |

Modified Adjusted Gross Income (MAGI) | AGI plus excluded foreign income. | NIIT applies when MAGI exceeds $200k (single) or $250k (married filing jointly). |

Calculating Net Investment Income Tax: Step-by-Step

Step 1: Calculate Your Net Investment Income

Add:

Taxable interest and dividends

Net capital gains (see our guide on capital gains recorded via Form 8949)

Rental and royalty income

Passive business income

Step 2: Determine If MAGI Exceeds the Threshold

$250,000 — Married Filing Jointly

$125,000 — Married Filing Separately

$200,000 — Single or Head of Household

Step 3: Compute the NIIT Base

Calculate both:

Excess MAGI above threshold

Net investment income

NIIT applies to the smaller value × 3.8%.

Real-World Examples for Founders Using Form 8960

The Net Investment Income Tax is calculated on the lesser of net investment income or excess modified adjusted gross income (MAGI) above the applicable threshold. The examples below show how that limitation works in practice.

Example 1: Startup Founder with Capital Gains

Filing status: Married filing jointly

MAGI: $300,000

Net investment income: $80,000

NIIT threshold (MFJ): $250,000

Excess MAGI:

$300,000 − $250,000 = $50,000

Because NIIT applies to the lesser of net investment income ($80,000) or excess MAGI ($50,000), the taxable amount is $50,000.

NIIT owed:

$50,000 × 3.8% = $1,900

Example 2: E-Commerce Founder with Rental Income

Filing status: Single

MAGI: $210,000

Net investment income: $40,000

NIIT threshold (Single): $200,000

Excess MAGI:

$210,000 − $200,000 = $10,000

Here, excess MAGI ($10,000) is lower than net investment income ($40,000), so NIIT applies only to $10,000.

NIIT owed:

$10,000 × 3.8% = $380

Form 8960 Walkthrough: Key Lines Founders Should Know

Line(s) | What It Covers | Founder Tip |

1–6 | Types of investment income | Separate passive vs. active business income. |

7–8 | Deductions | Track investment-related expenses. |

9–10 | Net investment income | Determines NIIT base. |

13–17 | MAGI and thresholds | Forecast income before equity sales. |

18 | Final NIIT owed | Plan tax payments accordingly. |

Minimizing NIIT Exposure: Founder Strategies

Time equity events (e.g., stock sales) during lower-income years

Reclassify rental income by participating materially

Use investment deductions such as interest expense

Optimize business structure

Lower total tax burden with credits (e.g., see Haven’s Form 1120 guide)

Embedding Form 8960 Into Your Tax Workflow

Maintain clear bookkeeping, separating investment income

Forecast MAGI for timing financial events

Use startup-savvy advisors for compliance

Leverage tax automation tools

For a broader tax infrastructure, review Haven’s business tax services.

Why Founders Should Prioritize Form 8960 Understanding

As a founder, your tax strategy directly influences capital allocation, long-term planning, and liquidity. Understanding Form 8960 and its NIIT implications ensures you avoid costly surprises and maintain financial clarity.

To optimize your tax position and confidently navigate forms like Form 8960, consider partnering with Haven’s founder-focused bookkeeping and tax filing teams.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026