Go Back

Last Updated :

Last Updated :

Jan 26, 2026

Jan 26, 2026

Form 8959: A Guide to the Additional Medicare Tax

For founders and executives steering startups, agencies, or e-commerce companies, managing taxes is never just about compliance—it’s about optimizing cash flow and forecasting expenses accurately. Understanding specific taxes like the Additional Medicare Tax and how Form 8959 fits into your annual filing can help you avoid surprises come tax season and better plan your financial runway.

This guide demystifies Form 8959, providing you with actionable insights and a clear path to compliance tailored for modern founders.

What Is Form 8959 and Why Does the Additional Medicare Tax Matter to Your Business?

The Additional Medicare Tax emerged from the Affordable Care Act (ACA) as a mechanism to bolster funding for Medicare by targeting higher earners. It’s a 0.9% tax on wages, self-employment income, and railroad retirement compensation that exceed certain income thresholds based on filing status. This tax is separate from the standard Medicare tax of 1.45% that applies to all earnings.

Form 8959 is the IRS form used to calculate and report this tax. Unlike typical tax withholding, the Additional Medicare Tax is withheld only after your wages cross the threshold, and employers may not always withhold enough—or any at all—if they are unaware of your other income streams. For founders juggling multiple income sources or working as officers drawing salaries, understanding Form 8959 is crucial to reconcile any tax owed and avoid penalties.

Key Points About Form 8959 and Additional Medicare Tax |

Applies to individuals with combined earnings above $200,000 (single) or higher filing thresholds |

Tax rate: 0.9% on income exceeding the threshold |

Form 8959 reports additional tax liability not captured on Form W-2 alone |

Self-employed individuals calculate this tax on Schedule SE alongside Form 8959 |

Failure to file or underpayment may lead to IRS penalties |

For other tax responsibilities analogous to Form 8959 and other additional taxes you might encounter, refer to Form 5329.

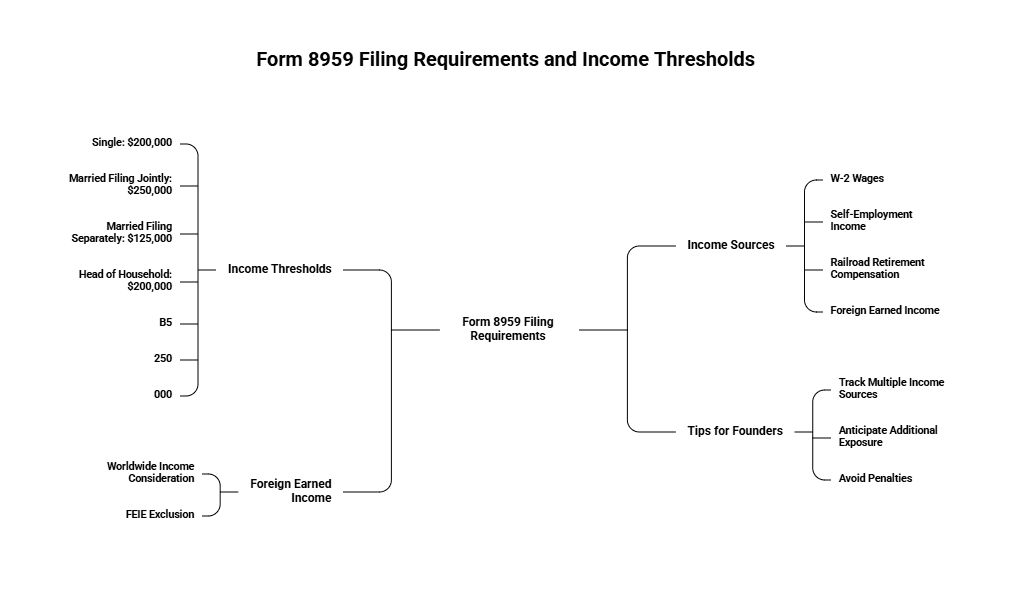

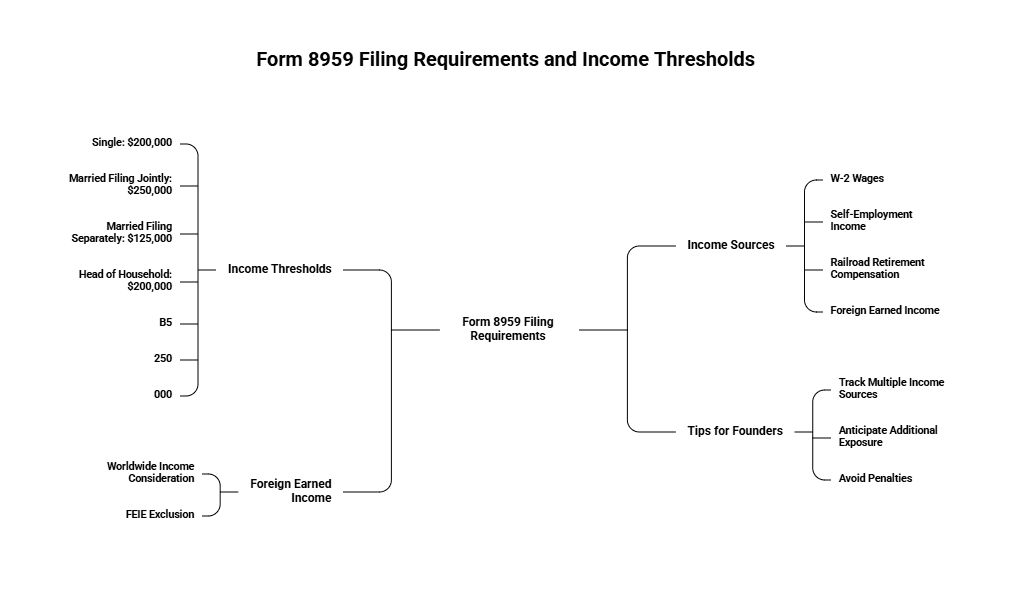

Who Needs to File Form 8959? Understanding Income Thresholds and Filing Requirements

Filing Form 8959 is mandatory if you have wages, compensation, or self-employment income above the threshold amounts. These thresholds vary based on your IRS filing status:

Filing Status | Income Threshold for Additional Medicare Tax |

Single | $200,000 |

Married Filing Jointly | $250,000 |

Married Filing Separately | $125,000 |

Head of Household | $200,000 |

Qualifying Widow(er) | $250,000 |

Income That Counts Towards the Threshold Includes:

W-2 wages

Self-employment income (reported on Schedule SE)

Railroad retirement compensation subject to Medicare taxes

Certain foreign earned income (after adjustments)

Even if your employer withheld Additional Medicare Tax, you must still file Form 8959 if your income from all sources exceeds your filing threshold to reconcile any under- or over-withholding.

Foreign Earned Income Consideration

Yes, if you claim the Foreign Earned Income Exclusion (FEIE) on Form 2555, your income for Additional Medicare Tax purposes may differ. The IRS considers worldwide income for the threshold but excludes FEIE in taxable income calculations, so it’s important to reconcile accordingly.

Tip for Founders: If you receive income from multiple startups, consulting activities, or investments generating self-employment income, track these closely to anticipate any additional exposure to this tax. Failure to file can result in underpayment penalties and interest.

How Is the Additional Medicare Tax Calculated on Form 8959?

The Additional Medicare Tax is levied at 0.9% on earnings exceeding your filing status threshold. Unlike a flat tax on total income, you only pay the tax on the excess amount.

Calculation Steps Simplified:

Determine total earnings subject to Medicare tax, including wages, compensation, and net self-employment income.

Subtract your filing status threshold from your total earnings.

Apply the 0.9% tax rate to the excess amount.

Example:

If you are filing as single with $230,000 in wages and self-employment income combined:

Threshold for single: $200,000

Taxable amount for Additional Medicare Tax = $230,000 - $200,000 = $30,000

Additional Medicare Tax = $30,000 × 0.009 = $270

Employer Withholding Considerations

Employers begin withholding Additional Medicare Tax once an employee’s wages exceed $200,000 in a calendar year, regardless of filing status, which may result in withholding even if your total income threshold for your filing status is higher (e.g., Married Filing Jointly).

Because of this, you may:

Receive a refund if overwithheld

Owe more at tax time if you underpaid due to multiple income sources

Reconciling these amounts on Form 8959 is key.

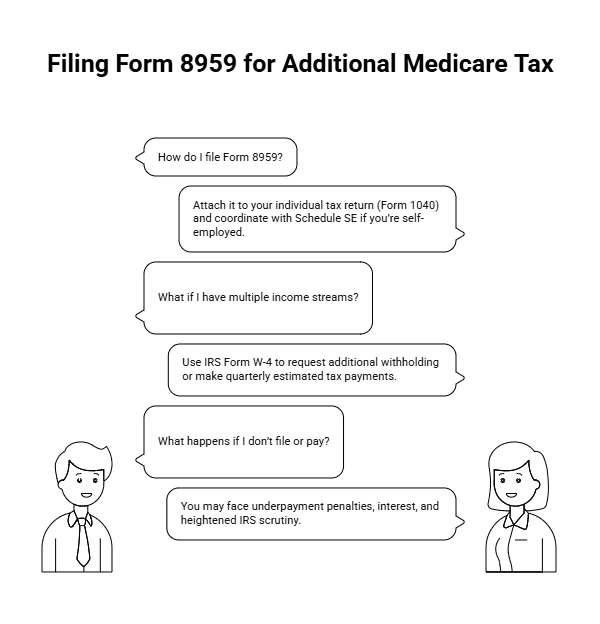

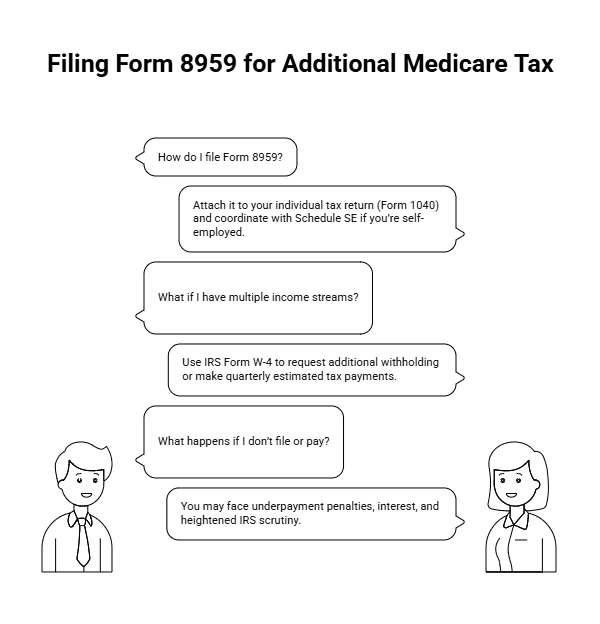

Filing Form 8959 Alongside Your Tax Returns

Form 8959 is attached to your individual tax return (Form 1040) and coordinates with Schedule SE if you’re self-employed.

Scenario | Filing Requirements |

Employed (W-2 income only) | Attach Form 8959 to Form 1040 |

Self-employed | Include Form 8959 and Schedule SE with your 1040 |

Railroad Retirement Income | Consider RRTA credits when completing Form 8959 |

Since additional Medicare tax is reported on your W-2, employers may not calculate withholding across your multiple income streams. This is especially relevant for founders who:

Have more than one employer

Combine W-2 and self-employed income streams

Mitigation Strategies:

Use IRS Form W-4 to request additional withholding

Make quarterly estimated tax payments aligned with overall income

Failing to file or pay the tax can result in:

Underpayment penalties

Interest on unpaid amounts

Heightened IRS scrutiny or audit exposure

Special Situations: Founders with Foreign Income, Multiple Jobs, and Self-Employment

Foreign Earned Income

Even if you exclude income using FEIE on Form 2555, the IRS still considers your total foreign income when assessing whether you cross the Additional Medicare Tax threshold. Keep detailed records.

Multiple Employers or Roles

Founders who wear many hats—such as acting as a W-2 employee for one business while earning freelance income from another—should watch for:

Overpayment from multiple employers withholding after the $200k mark

Underwithholding if income flows under the radar from smaller payers

Proactive coordination avoids surprises.

Self-Employed Founders

Those running solo operations report net profit on Schedule SE. The 0.9% Additional Medicare Tax applies beyond the threshold amount and is calculated on top of standard self-employment taxes. Important details:

Additional Medicare Tax is not deductible

You can deduct 50% of regular self-employment tax but not this surtax

Penalties, Refunds, and IRS Resources

If you fail to accurately calculate or report Additional Medicare Tax:

You may owe underpayment penalties and interest

Ignoring Form 8959 may increase audit risk

What If You've Overpaid?

Overpayment is common when multiple employers withhold separately. Filing Form 8959 lets you claim a refund of excess tax.

Where to Learn More

Visit the IRS’s authoritative guide on Additional Medicare Tax for official guidance and FAQs.

Pro Tips for Founders Filing Form 8959

Recommended Action | Why It Matters |

Track all income streams | Prevent threshold surprises and plan year-end tax strategy |

Estimate aggregate earnings | Combine W-2 + self-employment + foreign income projections |

Adjust withholdings/payments | Avoid penalties via estimated taxes or higher paycheck withholding |

Include Form 8959 with 1040 | Required to reconcile total Additional Medicare Tax owed |

Maintain detailed records | Essential for calculating accurate thresholds and responding to IRS |

Why Form 8959 Should Be on Every Founder’s Radar

Understanding the Form 8959 process and the Additional Medicare Tax is an essential component of founder-led financial management. Beyond compliance, this knowledge equips you to forecast tax liabilities, optimize cash flow, and avoid expensive penalties that distract from scaling your business.

Incorporate this form and its calculations into your annual tax checklist, monitor your income diligently, and leverage tools or expert guidance to get ahead. The 0.9% additional tax may seem small, but for high-earning founders, neglecting it can become a costly oversight.

For founders and executives steering startups, agencies, or e-commerce companies, managing taxes is never just about compliance—it’s about optimizing cash flow and forecasting expenses accurately. Understanding specific taxes like the Additional Medicare Tax and how Form 8959 fits into your annual filing can help you avoid surprises come tax season and better plan your financial runway.

This guide demystifies Form 8959, providing you with actionable insights and a clear path to compliance tailored for modern founders.

What Is Form 8959 and Why Does the Additional Medicare Tax Matter to Your Business?

The Additional Medicare Tax emerged from the Affordable Care Act (ACA) as a mechanism to bolster funding for Medicare by targeting higher earners. It’s a 0.9% tax on wages, self-employment income, and railroad retirement compensation that exceed certain income thresholds based on filing status. This tax is separate from the standard Medicare tax of 1.45% that applies to all earnings.

Form 8959 is the IRS form used to calculate and report this tax. Unlike typical tax withholding, the Additional Medicare Tax is withheld only after your wages cross the threshold, and employers may not always withhold enough—or any at all—if they are unaware of your other income streams. For founders juggling multiple income sources or working as officers drawing salaries, understanding Form 8959 is crucial to reconcile any tax owed and avoid penalties.

Key Points About Form 8959 and Additional Medicare Tax |

Applies to individuals with combined earnings above $200,000 (single) or higher filing thresholds |

Tax rate: 0.9% on income exceeding the threshold |

Form 8959 reports additional tax liability not captured on Form W-2 alone |

Self-employed individuals calculate this tax on Schedule SE alongside Form 8959 |

Failure to file or underpayment may lead to IRS penalties |

For other tax responsibilities analogous to Form 8959 and other additional taxes you might encounter, refer to Form 5329.

Who Needs to File Form 8959? Understanding Income Thresholds and Filing Requirements

Filing Form 8959 is mandatory if you have wages, compensation, or self-employment income above the threshold amounts. These thresholds vary based on your IRS filing status:

Filing Status | Income Threshold for Additional Medicare Tax |

Single | $200,000 |

Married Filing Jointly | $250,000 |

Married Filing Separately | $125,000 |

Head of Household | $200,000 |

Qualifying Widow(er) | $250,000 |

Income That Counts Towards the Threshold Includes:

W-2 wages

Self-employment income (reported on Schedule SE)

Railroad retirement compensation subject to Medicare taxes

Certain foreign earned income (after adjustments)

Even if your employer withheld Additional Medicare Tax, you must still file Form 8959 if your income from all sources exceeds your filing threshold to reconcile any under- or over-withholding.

Foreign Earned Income Consideration

Yes, if you claim the Foreign Earned Income Exclusion (FEIE) on Form 2555, your income for Additional Medicare Tax purposes may differ. The IRS considers worldwide income for the threshold but excludes FEIE in taxable income calculations, so it’s important to reconcile accordingly.

Tip for Founders: If you receive income from multiple startups, consulting activities, or investments generating self-employment income, track these closely to anticipate any additional exposure to this tax. Failure to file can result in underpayment penalties and interest.

How Is the Additional Medicare Tax Calculated on Form 8959?

The Additional Medicare Tax is levied at 0.9% on earnings exceeding your filing status threshold. Unlike a flat tax on total income, you only pay the tax on the excess amount.

Calculation Steps Simplified:

Determine total earnings subject to Medicare tax, including wages, compensation, and net self-employment income.

Subtract your filing status threshold from your total earnings.

Apply the 0.9% tax rate to the excess amount.

Example:

If you are filing as single with $230,000 in wages and self-employment income combined:

Threshold for single: $200,000

Taxable amount for Additional Medicare Tax = $230,000 - $200,000 = $30,000

Additional Medicare Tax = $30,000 × 0.009 = $270

Employer Withholding Considerations

Employers begin withholding Additional Medicare Tax once an employee’s wages exceed $200,000 in a calendar year, regardless of filing status, which may result in withholding even if your total income threshold for your filing status is higher (e.g., Married Filing Jointly).

Because of this, you may:

Receive a refund if overwithheld

Owe more at tax time if you underpaid due to multiple income sources

Reconciling these amounts on Form 8959 is key.

Filing Form 8959 Alongside Your Tax Returns

Form 8959 is attached to your individual tax return (Form 1040) and coordinates with Schedule SE if you’re self-employed.

Scenario | Filing Requirements |

Employed (W-2 income only) | Attach Form 8959 to Form 1040 |

Self-employed | Include Form 8959 and Schedule SE with your 1040 |

Railroad Retirement Income | Consider RRTA credits when completing Form 8959 |

Since additional Medicare tax is reported on your W-2, employers may not calculate withholding across your multiple income streams. This is especially relevant for founders who:

Have more than one employer

Combine W-2 and self-employed income streams

Mitigation Strategies:

Use IRS Form W-4 to request additional withholding

Make quarterly estimated tax payments aligned with overall income

Failing to file or pay the tax can result in:

Underpayment penalties

Interest on unpaid amounts

Heightened IRS scrutiny or audit exposure

Special Situations: Founders with Foreign Income, Multiple Jobs, and Self-Employment

Foreign Earned Income

Even if you exclude income using FEIE on Form 2555, the IRS still considers your total foreign income when assessing whether you cross the Additional Medicare Tax threshold. Keep detailed records.

Multiple Employers or Roles

Founders who wear many hats—such as acting as a W-2 employee for one business while earning freelance income from another—should watch for:

Overpayment from multiple employers withholding after the $200k mark

Underwithholding if income flows under the radar from smaller payers

Proactive coordination avoids surprises.

Self-Employed Founders

Those running solo operations report net profit on Schedule SE. The 0.9% Additional Medicare Tax applies beyond the threshold amount and is calculated on top of standard self-employment taxes. Important details:

Additional Medicare Tax is not deductible

You can deduct 50% of regular self-employment tax but not this surtax

Penalties, Refunds, and IRS Resources

If you fail to accurately calculate or report Additional Medicare Tax:

You may owe underpayment penalties and interest

Ignoring Form 8959 may increase audit risk

What If You've Overpaid?

Overpayment is common when multiple employers withhold separately. Filing Form 8959 lets you claim a refund of excess tax.

Where to Learn More

Visit the IRS’s authoritative guide on Additional Medicare Tax for official guidance and FAQs.

Pro Tips for Founders Filing Form 8959

Recommended Action | Why It Matters |

Track all income streams | Prevent threshold surprises and plan year-end tax strategy |

Estimate aggregate earnings | Combine W-2 + self-employment + foreign income projections |

Adjust withholdings/payments | Avoid penalties via estimated taxes or higher paycheck withholding |

Include Form 8959 with 1040 | Required to reconcile total Additional Medicare Tax owed |

Maintain detailed records | Essential for calculating accurate thresholds and responding to IRS |

Why Form 8959 Should Be on Every Founder’s Radar

Understanding the Form 8959 process and the Additional Medicare Tax is an essential component of founder-led financial management. Beyond compliance, this knowledge equips you to forecast tax liabilities, optimize cash flow, and avoid expensive penalties that distract from scaling your business.

Incorporate this form and its calculations into your annual tax checklist, monitor your income diligently, and leverage tools or expert guidance to get ahead. The 0.9% additional tax may seem small, but for high-earning founders, neglecting it can become a costly oversight.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026