Go Back

Last Updated :

Last Updated :

Feb 2, 2026

Feb 2, 2026

Form 8915-F: Reporting Qualified Disaster Retirement Distributions

Navigating the financial aftermath of a disaster adds layers of stress and complexity for any business founder. For startups, agencies, and e-commerce companies, understanding how to handle retirement plan distributions when disaster strikes is critical—not only for immediate cash flow needs but for long-term tax planning and financial health.

Form 8915-F serves as the IRS's dedicated tool to report qualified disaster retirement distributions and their repayments for disasters from 2020 onwards.

This article provides a founder-friendly guide, helping you grasp what Form 8915-F entails, who qualifies, how to avoid common pitfalls, and how it can integrate with your company’s broader tax strategy.

What is Form 8915-F and Who Should Be Concerned?

Form 8915-F replaced the earlier version, Form 8915-E, starting with the 2021 tax year. It specifically covers qualified disaster distributions and repayment provisions related to Presidentially declared disasters beginning in 2020, incorporating updates from legislation like the SECURE 2.0 Act. This form is essential for founders and finance leads overseeing startup finances who must manage qualified disaster distributions from retirement plans such as IRAs or 401(k)s.

Why Founders Should Care About Form 8915-F

Cash Flow Relief: Disaster distributions allow fund withdrawal up to $100,000 without the typical 10% early withdrawal penalty.

Tax Timing Flexibility: Taxes on these distributions can be spread over three years or repaid within a three-year window to avoid tax entirely.

Compliance: Properly reporting with Form 8915-F avoids IRS penalties and ensures the company’s financial records reflect IRS expectations accurately.

Strategic Tax Planning: When integrated into broader tax planning—like R&D tax credit claims or business tax filings—correct use of this form helps optimize cash management and tax outcomes.

Eligibility Criteria: Who Can Use Form 8915-F?

Not everyone who withdraws money from a retirement account during a disaster qualifies for the special tax treatment offered by Form 8915-F. Here is what makes a distribution “qualified”:

Disaster Declaration: The withdrawal must be linked to a disaster declared by the President of the United States occurring in 2020 or later.

Eligible Retirement Plans: The distribution must come from accounts like IRAs, SEP IRAs, SIMPLE IRAs, or employer-sponsored retirement plans such as 401(k)s.

Economic Loss: The taxpayer took the distribution due to “economic loss” from the disaster. This can mean physical damage to property, financial hardship, or loss of income relating to the disaster.

Maximum Distribution Limit: Up to $100,000 of distributions per taxpayer can qualify.

Distribution Timing: Distributions must have occurred in the year associated with the disaster.

For founders managing finance teams or CFOs overseeing multiple retirement accounts, verifying eligibility is a vital step before proceeding with tax reporting or repayment strategies.

Tax Treatment and Special Provisions of Qualified Disaster Distributions

Understanding the tax implications is key to managing the financial impact efficiently. Here are the crucial provisions about the tax treatment of qualified disaster distributions.

Avoidance of Early Withdrawal Penalties

Typically, withdrawing from retirement accounts before age 59½ incurs a 10% early withdrawal penalty. However, qualified disaster distributions reported on Form 8915-F are exempt from this penalty, providing founders with an emergency financial cushion without additional tax costs.

Spreading the Tax Burden

Instead of paying the full tax on the distribution amount in the year of withdrawal, recipients can elect to spread the taxable income over three years. This deferral eases the tax burden during already challenging times.

Option to Repay and Avoid Taxation

Taxpayers can repay all or part of their qualified disaster distributions back into the same or another eligible retirement plan within three years from the distribution date. These repayments are treated as rollover contributions, effectively eliminating the tax liability on the distribution.

Interaction with the SECURE 2.0 Act

The SECURE 2.0 Act, enacted recently, extends and expands the repayment window and modifies some eligibility conditions, further enhancing the options available to founders experiencing disaster-related financial interruptions.

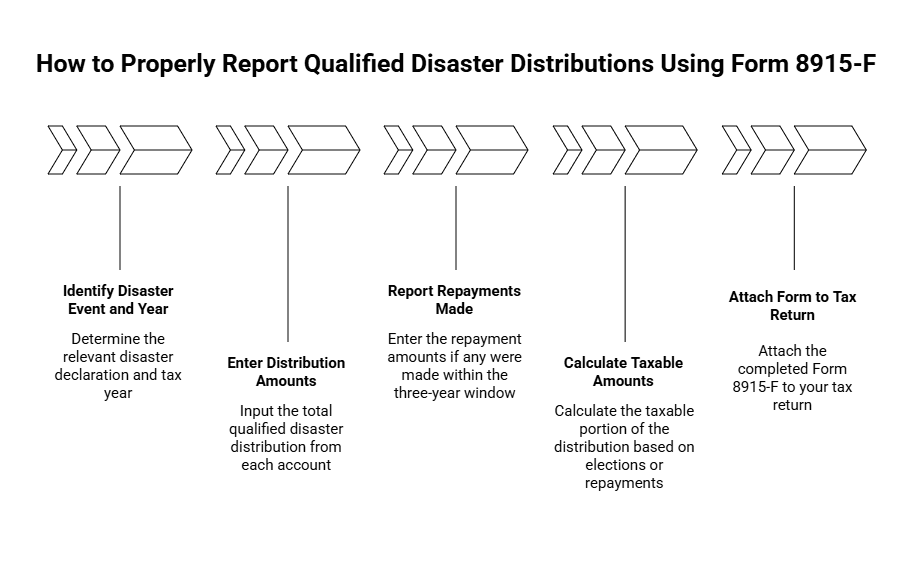

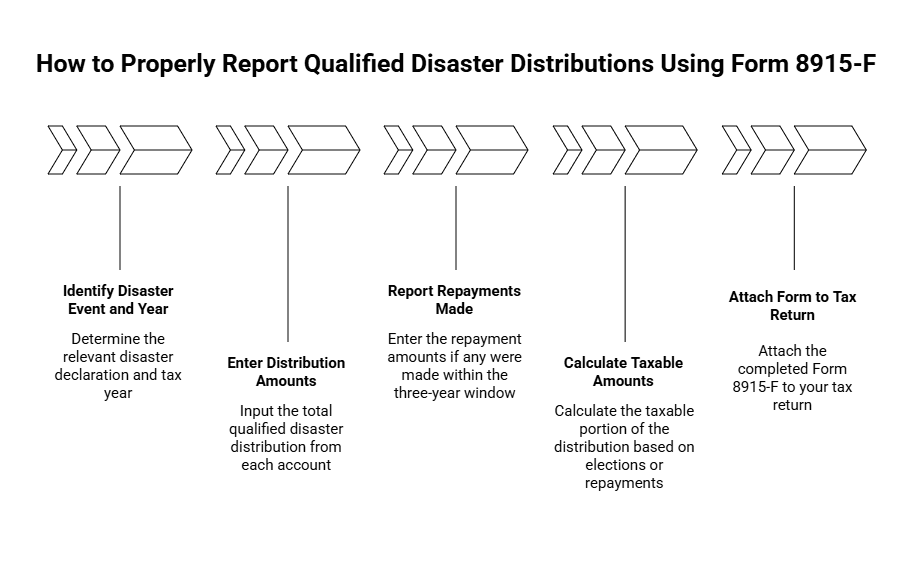

How to Properly Report Qualified Disaster Distributions Using Form 8915-F

Mastering the correct usage of Form 8915-F is essential for compliant tax filing and capturing the full benefits available.

Step 1: Identify the Applicable Disaster Event and Year

Form 8915-F is segmented by different disaster events by tax year. Begin by determining which disaster declaration your distribution relates to. The form provides separate sections for each disaster, so attention to this detail is critical.

Step 2: Enter the Distribution Amounts

Input the total qualified disaster distribution amount from each eligible retirement account during the specified disaster year.

Step 3: Report Any Repayments Made

If you have repaid part or all of the distribution during the three-year window, enter the repayment amounts in the corresponding section.

Step 4: Calculate Taxable Amounts

The form guides you through calculating how much of the distribution is taxable in the current tax year based on deferral elections or repayments.

Step 5: Attach Form 8915-F to Your Tax Return

After completion, attach the form to your tax return to inform the IRS officially about your qualified disaster distribution and any repayment activity.

Common Mistakes to Avoid on Form 8915-F

From our experience with founder-led companies, these errors frequently cause headaches and delays:

Common Errors | How to Avoid Them |

Misidentifying the disaster year | Cross-reference with IRS disaster declarations before entering data. |

Leaving out repayments | Track repayments diligently to avoid underreporting. |

Failing to attach Form 8915-F | Always double-check tax return attachments. |

Overreporting distribution limits | Remember the $100,000 cap per individual. |

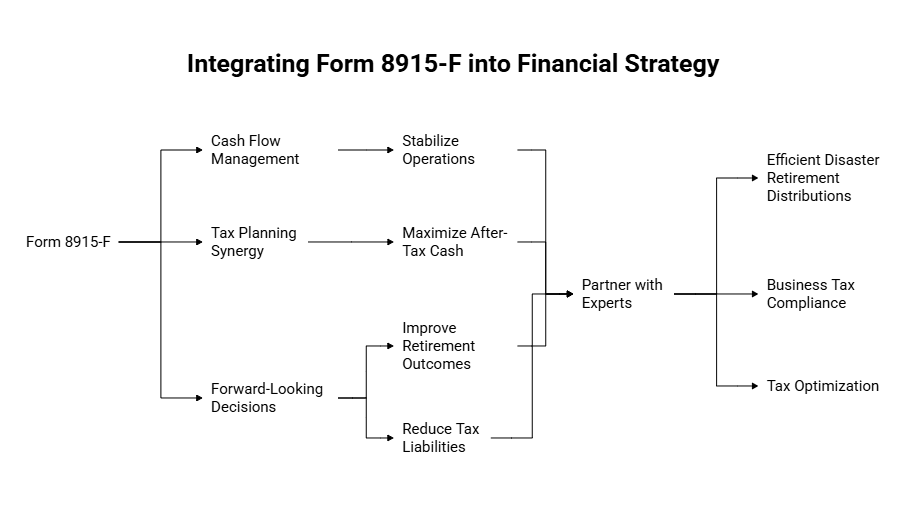

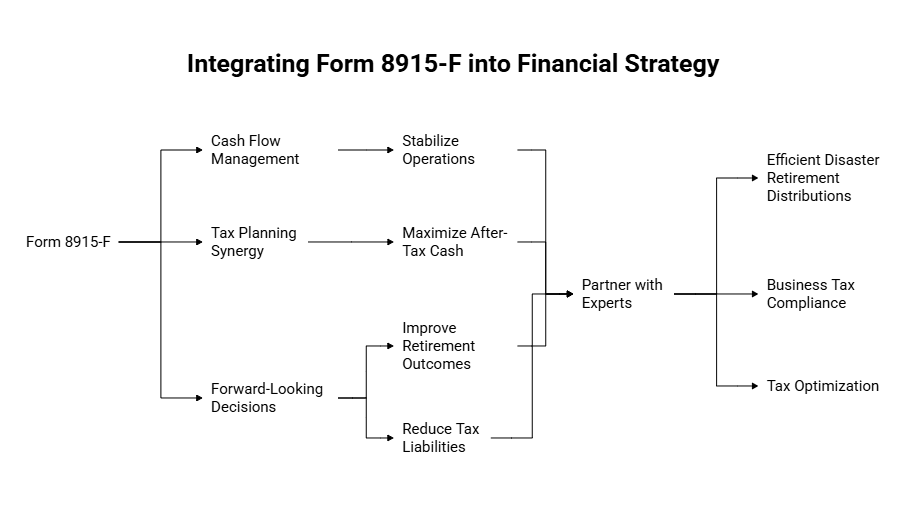

Integrating Form 8915-F Into Your Broader Tax and Financial Strategy

For startup founders and finance leaders, correctly handling Form 8915-F isn’t just about compliance—it’s a part of comprehensive financial resilience planning. Disasters can disrupt cash flow, business continuity, and R&D activities.

Cash Flow Management: Qualified disaster distributions provide immediate access to funds. Strategic use can stabilize operations until normal revenue streams return.

Tax Planning Synergy: Aligning disaster distribution reporting with other tax credits and deductions, such as the R&D tax credit, maximizes after-tax cash.

Forward-Looking Decisions: Early repayments of distributions might improve future retirement outcomes and reduce tax liabilities.

Additional Resources for Form 8915-F Filers

Understanding IRS expectations is critical. For definitive guidance, consult the official IRS source on Form 8915-F at IRS.gov. This ensures your interpretation aligns with the most current rules and updates.

Form 8915-F Matters for Founders

As a CEO, COO, or head of finance juggling the complexities of startup operations, mastering Form 8915-F unlocks a vital lever in your disaster response toolkit. It allows you to tap into retirement savings for crucial liquidity without penalties, spread tax liabilities over time, and choose repayments to optimize long-term tax outcomes.

Properly integrating Form 8915-F reporting with your modern bookkeeping and tax filing processes protects not just your current cash flow but your company’s financial future.

Navigating the financial aftermath of a disaster adds layers of stress and complexity for any business founder. For startups, agencies, and e-commerce companies, understanding how to handle retirement plan distributions when disaster strikes is critical—not only for immediate cash flow needs but for long-term tax planning and financial health.

Form 8915-F serves as the IRS's dedicated tool to report qualified disaster retirement distributions and their repayments for disasters from 2020 onwards.

This article provides a founder-friendly guide, helping you grasp what Form 8915-F entails, who qualifies, how to avoid common pitfalls, and how it can integrate with your company’s broader tax strategy.

What is Form 8915-F and Who Should Be Concerned?

Form 8915-F replaced the earlier version, Form 8915-E, starting with the 2021 tax year. It specifically covers qualified disaster distributions and repayment provisions related to Presidentially declared disasters beginning in 2020, incorporating updates from legislation like the SECURE 2.0 Act. This form is essential for founders and finance leads overseeing startup finances who must manage qualified disaster distributions from retirement plans such as IRAs or 401(k)s.

Why Founders Should Care About Form 8915-F

Cash Flow Relief: Disaster distributions allow fund withdrawal up to $100,000 without the typical 10% early withdrawal penalty.

Tax Timing Flexibility: Taxes on these distributions can be spread over three years or repaid within a three-year window to avoid tax entirely.

Compliance: Properly reporting with Form 8915-F avoids IRS penalties and ensures the company’s financial records reflect IRS expectations accurately.

Strategic Tax Planning: When integrated into broader tax planning—like R&D tax credit claims or business tax filings—correct use of this form helps optimize cash management and tax outcomes.

Eligibility Criteria: Who Can Use Form 8915-F?

Not everyone who withdraws money from a retirement account during a disaster qualifies for the special tax treatment offered by Form 8915-F. Here is what makes a distribution “qualified”:

Disaster Declaration: The withdrawal must be linked to a disaster declared by the President of the United States occurring in 2020 or later.

Eligible Retirement Plans: The distribution must come from accounts like IRAs, SEP IRAs, SIMPLE IRAs, or employer-sponsored retirement plans such as 401(k)s.

Economic Loss: The taxpayer took the distribution due to “economic loss” from the disaster. This can mean physical damage to property, financial hardship, or loss of income relating to the disaster.

Maximum Distribution Limit: Up to $100,000 of distributions per taxpayer can qualify.

Distribution Timing: Distributions must have occurred in the year associated with the disaster.

For founders managing finance teams or CFOs overseeing multiple retirement accounts, verifying eligibility is a vital step before proceeding with tax reporting or repayment strategies.

Tax Treatment and Special Provisions of Qualified Disaster Distributions

Understanding the tax implications is key to managing the financial impact efficiently. Here are the crucial provisions about the tax treatment of qualified disaster distributions.

Avoidance of Early Withdrawal Penalties

Typically, withdrawing from retirement accounts before age 59½ incurs a 10% early withdrawal penalty. However, qualified disaster distributions reported on Form 8915-F are exempt from this penalty, providing founders with an emergency financial cushion without additional tax costs.

Spreading the Tax Burden

Instead of paying the full tax on the distribution amount in the year of withdrawal, recipients can elect to spread the taxable income over three years. This deferral eases the tax burden during already challenging times.

Option to Repay and Avoid Taxation

Taxpayers can repay all or part of their qualified disaster distributions back into the same or another eligible retirement plan within three years from the distribution date. These repayments are treated as rollover contributions, effectively eliminating the tax liability on the distribution.

Interaction with the SECURE 2.0 Act

The SECURE 2.0 Act, enacted recently, extends and expands the repayment window and modifies some eligibility conditions, further enhancing the options available to founders experiencing disaster-related financial interruptions.

How to Properly Report Qualified Disaster Distributions Using Form 8915-F

Mastering the correct usage of Form 8915-F is essential for compliant tax filing and capturing the full benefits available.

Step 1: Identify the Applicable Disaster Event and Year

Form 8915-F is segmented by different disaster events by tax year. Begin by determining which disaster declaration your distribution relates to. The form provides separate sections for each disaster, so attention to this detail is critical.

Step 2: Enter the Distribution Amounts

Input the total qualified disaster distribution amount from each eligible retirement account during the specified disaster year.

Step 3: Report Any Repayments Made

If you have repaid part or all of the distribution during the three-year window, enter the repayment amounts in the corresponding section.

Step 4: Calculate Taxable Amounts

The form guides you through calculating how much of the distribution is taxable in the current tax year based on deferral elections or repayments.

Step 5: Attach Form 8915-F to Your Tax Return

After completion, attach the form to your tax return to inform the IRS officially about your qualified disaster distribution and any repayment activity.

Common Mistakes to Avoid on Form 8915-F

From our experience with founder-led companies, these errors frequently cause headaches and delays:

Common Errors | How to Avoid Them |

Misidentifying the disaster year | Cross-reference with IRS disaster declarations before entering data. |

Leaving out repayments | Track repayments diligently to avoid underreporting. |

Failing to attach Form 8915-F | Always double-check tax return attachments. |

Overreporting distribution limits | Remember the $100,000 cap per individual. |

Integrating Form 8915-F Into Your Broader Tax and Financial Strategy

For startup founders and finance leaders, correctly handling Form 8915-F isn’t just about compliance—it’s a part of comprehensive financial resilience planning. Disasters can disrupt cash flow, business continuity, and R&D activities.

Cash Flow Management: Qualified disaster distributions provide immediate access to funds. Strategic use can stabilize operations until normal revenue streams return.

Tax Planning Synergy: Aligning disaster distribution reporting with other tax credits and deductions, such as the R&D tax credit, maximizes after-tax cash.

Forward-Looking Decisions: Early repayments of distributions might improve future retirement outcomes and reduce tax liabilities.

Additional Resources for Form 8915-F Filers

Understanding IRS expectations is critical. For definitive guidance, consult the official IRS source on Form 8915-F at IRS.gov. This ensures your interpretation aligns with the most current rules and updates.

Form 8915-F Matters for Founders

As a CEO, COO, or head of finance juggling the complexities of startup operations, mastering Form 8915-F unlocks a vital lever in your disaster response toolkit. It allows you to tap into retirement savings for crucial liquidity without penalties, spread tax liabilities over time, and choose repayments to optimize long-term tax outcomes.

Properly integrating Form 8915-F reporting with your modern bookkeeping and tax filing processes protects not just your current cash flow but your company’s financial future.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026