Go Back

Last Updated :

Last Updated :

Feb 2, 2026

Feb 2, 2026

Form 8824: Reporting Like-Kind Exchanges Made Simple

Like-kind exchanges provide a powerful tax deferral opportunity for founders and startup leaders holding business or investment property. Yet navigating the IRS paperwork involved — specifically Form 8824 — can feel daunting without clear, founder-focused guidance.

In this article, we’ll demystify Form 8824 and the related like-kind exchange process with actionable insights and practical tips aligned to your fast-moving startup or agency. We’ll cover eligibility criteria, deadlines, step-by-step filing guidance, and key pitfalls to avoid — empowering you to leverage this tax tool effectively and confidently.

What Is Form 8824 and Why Does It Matter?

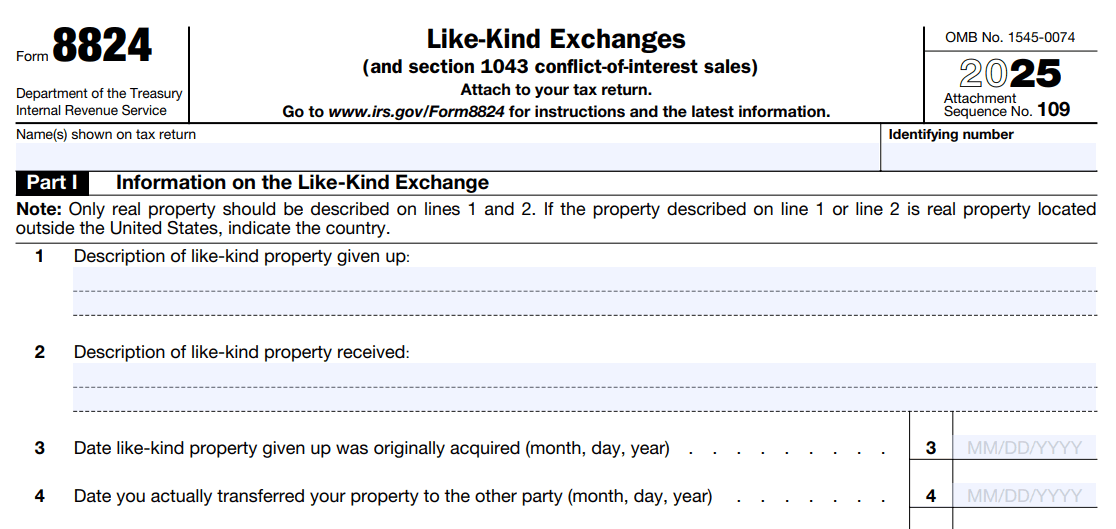

Form 8824, Like-Kind Exchanges, is an IRS form used to report specific property exchanges where you defer recognition of capital gains taxes by swapping one qualifying property for another “like-kind” property.

For founders and finance leaders, this matters because deferring tax payments means more cash flow to reinvest in growth, rather than fronting a large tax bill when replacing business or investment assets. It’s essential to get the reporting right to maintain these benefits.

Like-kind exchanges are commonly used for real estate, but some business assets may also qualify under certain circumstances. The exchange must follow IRS rules closely, or a transaction meant to defer tax could instead trigger an immediate gain recognition.

Founder insight: Think of Form 8824 as a vital piece of the tax puzzle that unlocks favorable tax treatment when you’re upgrading or changing your business assets without cashing out.

Which Properties Qualify for a Like-Kind Exchange?

Understanding what counts as “like-kind” is critical. The IRS generally considers real property held for business or investment use as eligible, including:

Commercial real estate buildings

Office spaces

Warehouses

Land (undeveloped or developed)

However, personal use property, inventory, stocks, bonds, and partnership interests are excluded. Also, property held primarily for resale (think flipping property/speculation) does not qualify.

For startups or e-commerce companies with physical assets, machinery and equipment may qualify if held for business use, but this is complex and less common than real estate exchanges.

Important Eligibility Points for Founders:

Property Type | Eligibility for Like-Kind Exchange |

Real estate for business/investment | Usually qualifies |

Machinery and business equipment | Sometimes; consult a tax professional |

Inventory and stock | Does NOT qualify |

Personal residences | Does NOT qualify |

Make sure to review the IRS guidelines carefully or work with your financial controller to confirm eligibility.

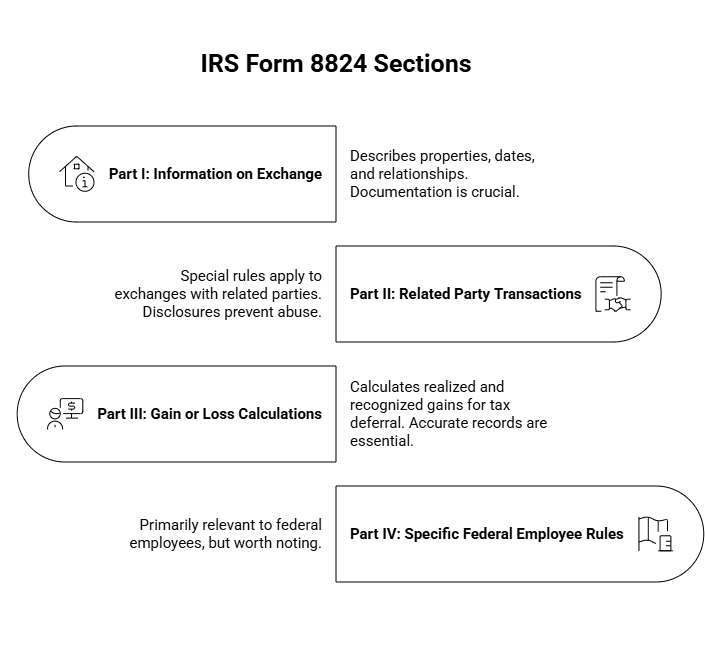

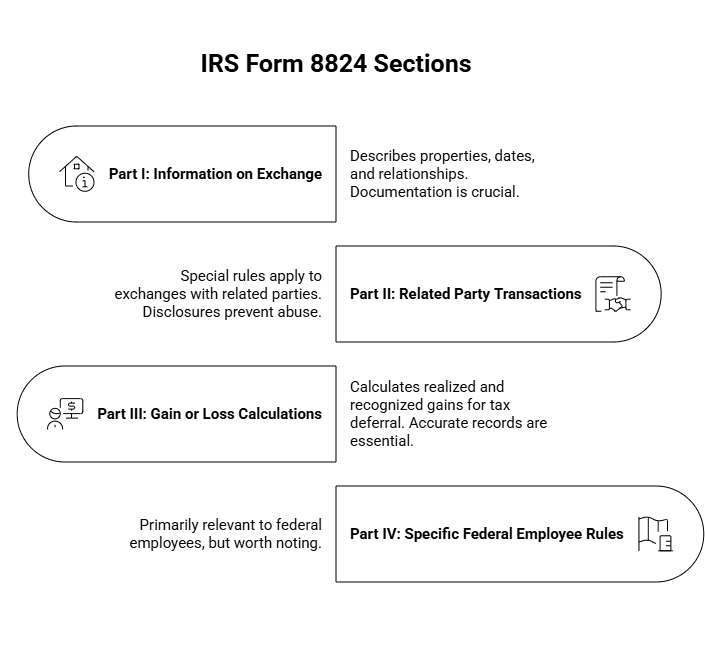

Key Sections of IRS Form 8824: What You Need to Know

Form 8824 contains multiple sections designed to capture details about the exchange. Here's a breakdown targeted for startup finance teams:

Part I: Information on Exchange

This includes the description of the properties given and received, dates of transfer, and the relationship of the parties involved. Make sure to keep thorough documentation here — dates and values must be exact.

Part II: Related Party Transactions

Special rules apply if you’re exchanging property with a related party (e.g., a business owned by a family member or a controlled entity). Disclosures here prevent abuse of the deferral benefits. Founders should be vigilant if the exchange involves related business entities.

Part III: Gain or Loss Calculations

This section is where you calculate realized and recognized gains — key to understanding the tax deferral impact. A common founder challenge is reconciling adjusted basis and fair market values, so having accurate cost and valuation records in your bookkeeping system is crucial.

Part IV: Specific Federal Employee Rules

Primarily relevant to federal employees, but worth noting if any executives or key staff fit that category.

Critical Deadlines and Timelines for Like-Kind Exchanges

Like-kind exchanges come with strict timelines. Missing these deadlines generally means the IRS will not honor the tax deferral, triggering immediate gain recognition and a major tax bill.

45-Day Identification Period: You must identify your replacement property within 45 calendar days of transferring the original property.

180-Day Exchange Period: The replacement property must be received (closed on) within 180 days of the original transfer.

Track these dates carefully. Many founders underestimate the importance of calendar management here, especially when juggling operational priorities. Consider setting automated reminders or using calendaring apps shared with your CFO or Head of Finance.

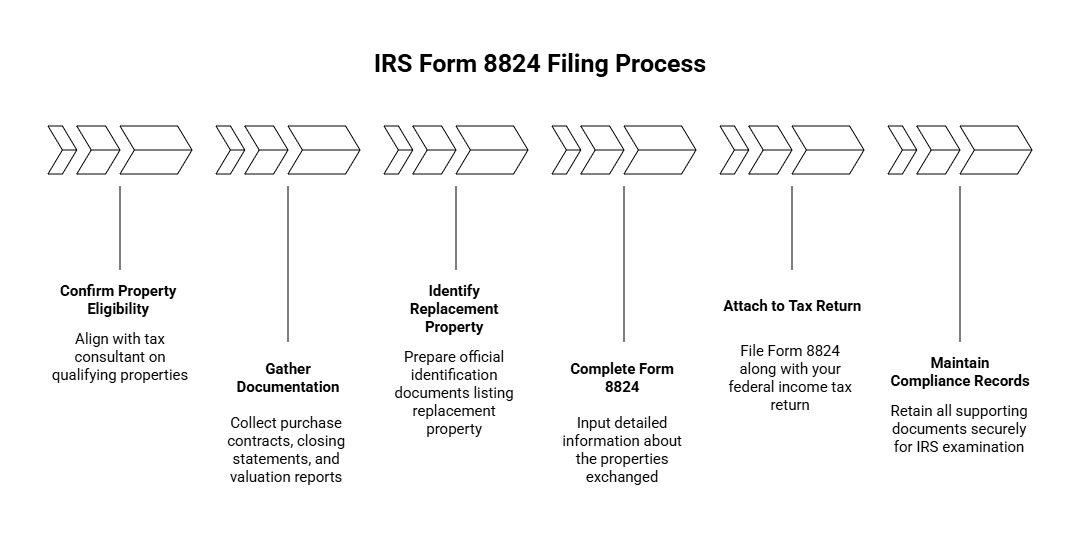

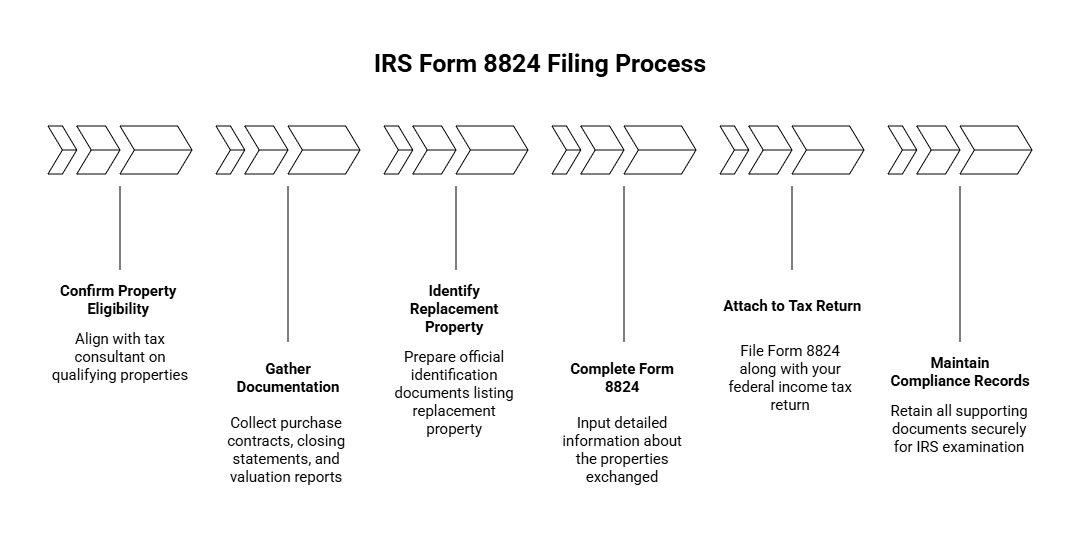

Step-by-Step: How to File IRS Form 8824

For startup finance teams managing taxes in-house or working with an external tax advisor, here’s a practical workflow for handling Form 8824:

Confirm Property Eligibility: Align with your tax consultant or controller on which properties qualify for like-kind exchange treatment.

Gather Documentation: Collect purchase contracts, closing statements, and valuation reports for old and new properties.

Identify Replacement Property: Within 45 days, prepare official identification documents listing replacement property.

Complete Form 8824 (Parts I-III): Input detailed info about the properties exchanged, values, gains, and any related party information.

Attach to Tax Return: File Form 8824 along with your federal income tax return — for example, Form 1120 for corporations or 1040 Schedule D for individuals.

Maintain Compliance Records: Retain all supporting documents securely in case of IRS examination.

Leveraging modern bookkeeping platforms or tax prep partners can streamline the integration of forms like this into your annual reporting workflows. It reduces your margin for error and ensures you're audit-ready.

For more on capital gains reporting, you must file Form 8949.

Founder-Focused Scenarios for Like-Kind Exchanges

To clarify, here are simple examples of startups or agencies that might use Form 8824:

Example 1: Startup Office Expansion

Your agency owns office space downtown but needs larger premises. You sell the old property and within 45 days identify and close on a new commercial office building. Using Form 8824, you report the exchange and defer capital gains tax, freeing up cash to invest in hiring or equipment.

Example 2: Upgrading an E-Commerce Warehouse

An e-commerce company upgrades from a small, leased warehouse to a larger owned facility. The swap meets like-kind criteria as both are business-use real estate. Reporting on Form 8824 means deferring capital gains while scaling logistics.

Pitfalls Startups Should Avoid When Filing Form 8824

Missing Cutoff Dates: Maintain a shared calendar for tax deadlines, especially the 45- and 180-day milestones.

Incomplete Paperwork: Audit-ready records like contracts, appraisals, and closing statements are a must.

Improper Asset Classification: Don’t assume machinery or digital assets are eligible. Confirm with your tax team.

Overlooking Related Party Rules: Transactions between related entities need extra scrutiny and documentation.

Inaccurate Filing: Errors or omissions in Form 8824 could delay your return or lead to penalties.

Working with tools and advisors that know startup finance inside-out — like business tax services — reduces risk and keeps your tax strategy aligned with your growth plans.

Why Proper Use of Form 8824 Pays Off for Founders

Executing and reporting like-kind exchanges properly is more than an IRS requirement — it’s a strategic way to strengthen cash flow and increase reinvestment potential.

Smart reporting of Form 8824 helps you avoid costly penalties and positions your startup to capitalize on physical asset upgrades without triggering immediate tax burdens.

Modern systems and expert support go a long way in ensuring your reporting accuracy and deadline compliance. Whether you're scaling offices or expanding warehouses, integrating tax compliance seamlessly can support your larger business strategy.

Like-kind exchanges provide a powerful tax deferral opportunity for founders and startup leaders holding business or investment property. Yet navigating the IRS paperwork involved — specifically Form 8824 — can feel daunting without clear, founder-focused guidance.

In this article, we’ll demystify Form 8824 and the related like-kind exchange process with actionable insights and practical tips aligned to your fast-moving startup or agency. We’ll cover eligibility criteria, deadlines, step-by-step filing guidance, and key pitfalls to avoid — empowering you to leverage this tax tool effectively and confidently.

What Is Form 8824 and Why Does It Matter?

Form 8824, Like-Kind Exchanges, is an IRS form used to report specific property exchanges where you defer recognition of capital gains taxes by swapping one qualifying property for another “like-kind” property.

For founders and finance leaders, this matters because deferring tax payments means more cash flow to reinvest in growth, rather than fronting a large tax bill when replacing business or investment assets. It’s essential to get the reporting right to maintain these benefits.

Like-kind exchanges are commonly used for real estate, but some business assets may also qualify under certain circumstances. The exchange must follow IRS rules closely, or a transaction meant to defer tax could instead trigger an immediate gain recognition.

Founder insight: Think of Form 8824 as a vital piece of the tax puzzle that unlocks favorable tax treatment when you’re upgrading or changing your business assets without cashing out.

Which Properties Qualify for a Like-Kind Exchange?

Understanding what counts as “like-kind” is critical. The IRS generally considers real property held for business or investment use as eligible, including:

Commercial real estate buildings

Office spaces

Warehouses

Land (undeveloped or developed)

However, personal use property, inventory, stocks, bonds, and partnership interests are excluded. Also, property held primarily for resale (think flipping property/speculation) does not qualify.

For startups or e-commerce companies with physical assets, machinery and equipment may qualify if held for business use, but this is complex and less common than real estate exchanges.

Important Eligibility Points for Founders:

Property Type | Eligibility for Like-Kind Exchange |

Real estate for business/investment | Usually qualifies |

Machinery and business equipment | Sometimes; consult a tax professional |

Inventory and stock | Does NOT qualify |

Personal residences | Does NOT qualify |

Make sure to review the IRS guidelines carefully or work with your financial controller to confirm eligibility.

Key Sections of IRS Form 8824: What You Need to Know

Form 8824 contains multiple sections designed to capture details about the exchange. Here's a breakdown targeted for startup finance teams:

Part I: Information on Exchange

This includes the description of the properties given and received, dates of transfer, and the relationship of the parties involved. Make sure to keep thorough documentation here — dates and values must be exact.

Part II: Related Party Transactions

Special rules apply if you’re exchanging property with a related party (e.g., a business owned by a family member or a controlled entity). Disclosures here prevent abuse of the deferral benefits. Founders should be vigilant if the exchange involves related business entities.

Part III: Gain or Loss Calculations

This section is where you calculate realized and recognized gains — key to understanding the tax deferral impact. A common founder challenge is reconciling adjusted basis and fair market values, so having accurate cost and valuation records in your bookkeeping system is crucial.

Part IV: Specific Federal Employee Rules

Primarily relevant to federal employees, but worth noting if any executives or key staff fit that category.

Critical Deadlines and Timelines for Like-Kind Exchanges

Like-kind exchanges come with strict timelines. Missing these deadlines generally means the IRS will not honor the tax deferral, triggering immediate gain recognition and a major tax bill.

45-Day Identification Period: You must identify your replacement property within 45 calendar days of transferring the original property.

180-Day Exchange Period: The replacement property must be received (closed on) within 180 days of the original transfer.

Track these dates carefully. Many founders underestimate the importance of calendar management here, especially when juggling operational priorities. Consider setting automated reminders or using calendaring apps shared with your CFO or Head of Finance.

Step-by-Step: How to File IRS Form 8824

For startup finance teams managing taxes in-house or working with an external tax advisor, here’s a practical workflow for handling Form 8824:

Confirm Property Eligibility: Align with your tax consultant or controller on which properties qualify for like-kind exchange treatment.

Gather Documentation: Collect purchase contracts, closing statements, and valuation reports for old and new properties.

Identify Replacement Property: Within 45 days, prepare official identification documents listing replacement property.

Complete Form 8824 (Parts I-III): Input detailed info about the properties exchanged, values, gains, and any related party information.

Attach to Tax Return: File Form 8824 along with your federal income tax return — for example, Form 1120 for corporations or 1040 Schedule D for individuals.

Maintain Compliance Records: Retain all supporting documents securely in case of IRS examination.

Leveraging modern bookkeeping platforms or tax prep partners can streamline the integration of forms like this into your annual reporting workflows. It reduces your margin for error and ensures you're audit-ready.

For more on capital gains reporting, you must file Form 8949.

Founder-Focused Scenarios for Like-Kind Exchanges

To clarify, here are simple examples of startups or agencies that might use Form 8824:

Example 1: Startup Office Expansion

Your agency owns office space downtown but needs larger premises. You sell the old property and within 45 days identify and close on a new commercial office building. Using Form 8824, you report the exchange and defer capital gains tax, freeing up cash to invest in hiring or equipment.

Example 2: Upgrading an E-Commerce Warehouse

An e-commerce company upgrades from a small, leased warehouse to a larger owned facility. The swap meets like-kind criteria as both are business-use real estate. Reporting on Form 8824 means deferring capital gains while scaling logistics.

Pitfalls Startups Should Avoid When Filing Form 8824

Missing Cutoff Dates: Maintain a shared calendar for tax deadlines, especially the 45- and 180-day milestones.

Incomplete Paperwork: Audit-ready records like contracts, appraisals, and closing statements are a must.

Improper Asset Classification: Don’t assume machinery or digital assets are eligible. Confirm with your tax team.

Overlooking Related Party Rules: Transactions between related entities need extra scrutiny and documentation.

Inaccurate Filing: Errors or omissions in Form 8824 could delay your return or lead to penalties.

Working with tools and advisors that know startup finance inside-out — like business tax services — reduces risk and keeps your tax strategy aligned with your growth plans.

Why Proper Use of Form 8824 Pays Off for Founders

Executing and reporting like-kind exchanges properly is more than an IRS requirement — it’s a strategic way to strengthen cash flow and increase reinvestment potential.

Smart reporting of Form 8824 helps you avoid costly penalties and positions your startup to capitalize on physical asset upgrades without triggering immediate tax burdens.

Modern systems and expert support go a long way in ensuring your reporting accuracy and deadline compliance. Whether you're scaling offices or expanding warehouses, integrating tax compliance seamlessly can support your larger business strategy.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026