Go Back

Last Updated :

Last Updated :

Feb 2, 2026

Feb 2, 2026

Form 8379: How to File an Injured Spouse Allocation

For founders navigating the complexities of joint tax filings, unexpected IRS refund offsets can be a jarring setback—especially when those offsets are due to your spouse's debts. The IRS Form 8379, or Injured Spouse Allocation, is designed specifically to protect your rightful portion of a joint tax refund. Understanding Form 8379, when and how to file it, and its nuances can save you money and avoid lengthy processing delays.

This guide unpacks everything founders and finance leaders need to know about Form 8379, empowering you to secure your business and personal finances with clarity and confidence.

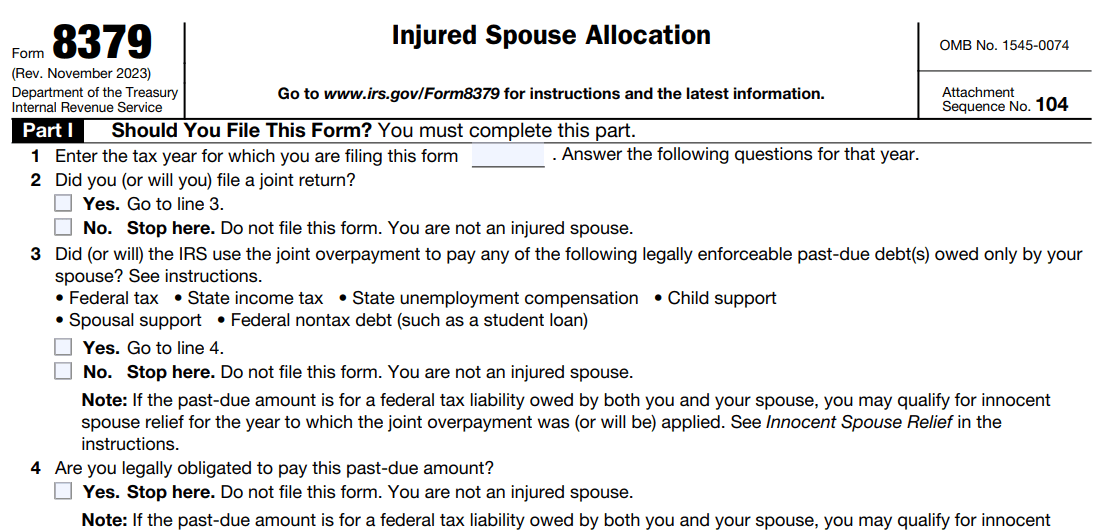

What Is Form 8379 and Who Should Consider Filing?

Form 8379 is an IRS tax form that helps spouses recover their share of a joint tax refund when the refund is offset to pay a past-due debt owed solely by the other spouse. These debts typically include unpaid federal tax, state income tax, child support, or federal nontax debts such as student loans or unemployment compensation.

Who Qualifies as an Injured Spouse?

You are considered an injured spouse if you meet the following criteria:

You filed a joint tax return with your spouse.

You are not legally responsible for the debt that caused the offset.

You want to claim your portion of the joint refund that the IRS applied to your spouse's debt.

For example, if your spouse has unpaid federal student loans, and the IRS offsets your joint refund, you can file Form 8379 to claim your share of that refund.

This form provides important protection for founders and business owners who co-file taxes but maintain separate financial liabilities or debts.

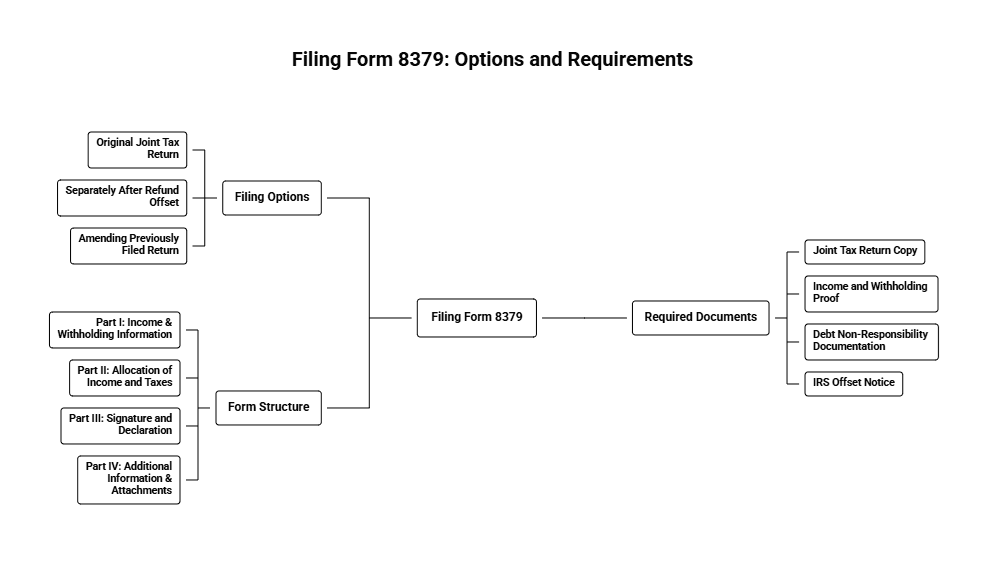

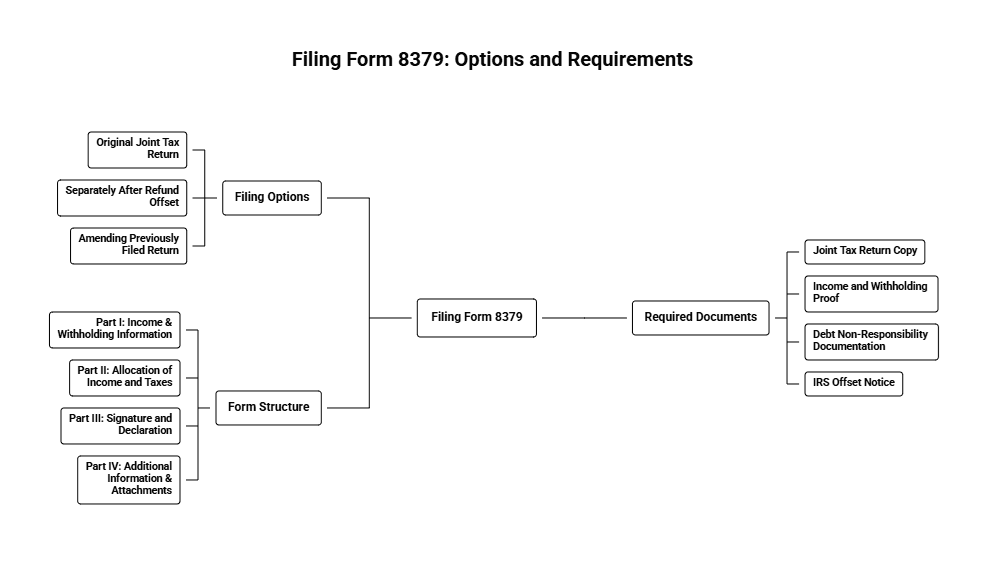

How and When to File Form 8379

Founders and finance-savvy couples have a few options when it comes to filing:

Filing With Your Original Joint Tax Return

To avoid delays, the most efficient approach is to submit Form 8379 alongside your original joint tax return. If you know there might be an offset risk, attaching the form proactively ensures the IRS allocates the refund properly without extra back-and-forth.

Filing Separately After a Refund Offset

If the IRS has already seized your joint refund to cover your spouse’s debt, you can still file Form 8379 separately. This must be done as soon as possible after receiving your IRS notice—the quicker you respond, the earlier you can reclaim your portion.

Amending a Previously Filed Return

If you didn’t file the injured spouse form with the original return and haven’t received the refund, you may be able to submit an amended return attaching Form 8379. However, this takes longer to process and may delay your refund further.

What Documents Should You Attach?

Including all relevant supporting documents with your Form 8379 submission speeds up processing and reduces chances of back-and-forth with the IRS.

A copy of your joint tax return.

Proof of income and withholding (Form W-2, 1099s).

Documentation proving your non-responsibility for the debt, if applicable.

The IRS offset notice you received, if filing after an offset.

For startups and founders, keeping your withholding forms and financial records organized goes a long way toward smooth tax interactions. You must always keep detailed records and use tax organization tools as a small business.

Understanding the Parts of Form 8379

Form 8379 is structured to clearly separate income and withholding between spouses to calculate the injured spouse’s portion accurately.

Part | Purpose | What It Asks |

Part I | Income & Withholding Information | Details individual wages, taxable income, and withholding amounts. |

Part II | Allocation of Income and Taxes | Divides income and withholding between both spouses. |

Part III | Signature and Declaration | Both spouses must sign if filing jointly; confirms accuracy of data. |

Part IV | Additional Information & Attachments | Provides space for further context or to include supplementary documents. |

Filing this correctly demands precision. If you’re unsure, consulting with a modern tax service familiar with startup financials can help prevent errors that lead to processing delays.

How Long Does the IRS Take to Process Form 8379?

The IRS typically takes 8 to 11 weeks to process Form 8379 when filed separately after an offset. Filing it alongside your original return often results in quicker integration and less delay.

You can track the progress using the IRS “Where’s My Refund?” tool or by contacting the IRS. Keep your refund notice or case number handy to help with status checks.

Common Issues and Tips for a Smooth Filing

Avoid Missing Attachments: Forgetting to include your W-2 or IRS offset notice can delay processing.

Watch Out for Signature Requirements: A joint filing demands both signatures—don’t overlook it.

Be Clear About Debt Responsibility: Form 8379 won’t apply if the debt is jointly owed.

Use the Correct Mailing Address: Refer to the IRS site for the designated submission address by state.

Respond Quickly: If the IRS requests more information, reply promptly to keep your claim on track.

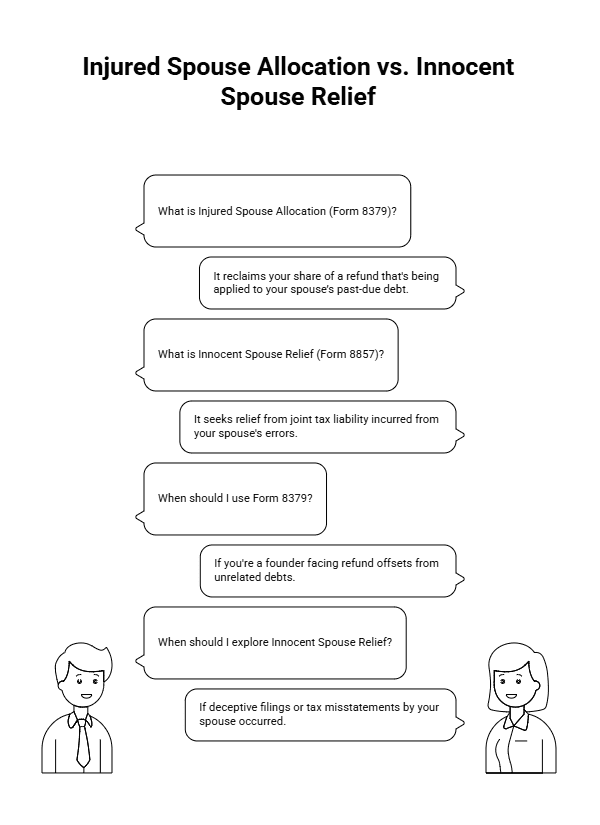

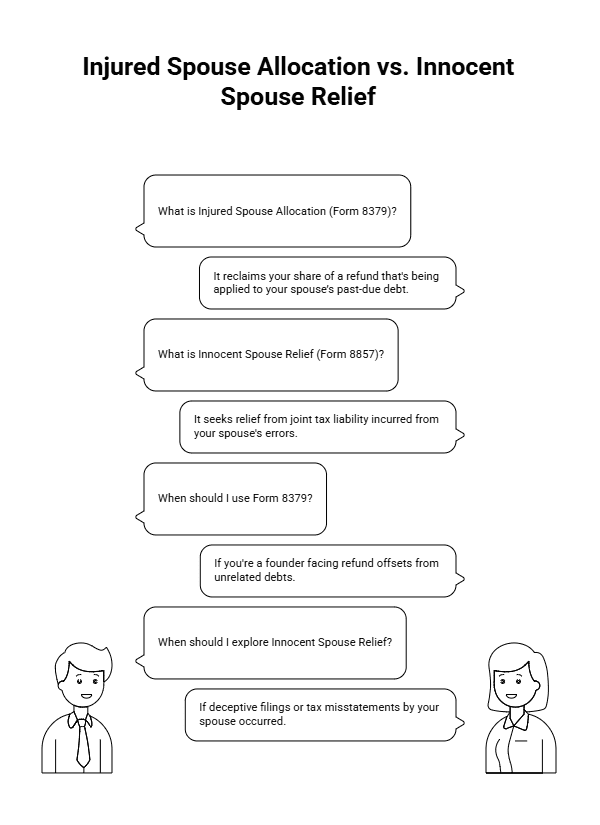

Injured Spouse Allocation vs. Innocent Spouse Relief

While Form 8379 protects your refund share from being applied to your spouse’s past-due debt, Innocent Spouse Relief is different—it seeks relief from joint tax liability incurred from your spouse's errors.

Key Differences:

Injured Spouse Allocation (Form 8379): Reclaims your share of a refund.

Innocent Spouse Relief (Form 8857): Requests exemption from responsibility for joint tax debt.

Founders facing refund offsets from unrelated debts should use Form 8379. But if deceptive filings or tax misstatements by a spouse occurred, you must understand Innocent Spouse Relief for broader protection.

Why Founders Should Pay Attention to Form 8379

In fast-paced startup life, refund offsets due to shared filings can seriously impact personal and business liquidity. Securing your share through Form 8379 lets you maintain cash flow without unnecessary complexity or legal hassle.

Additionally, founders leveraging credits like R&D or startup tax incentives benefit greatly from well-managed individual tax positions. The smoother your personal refund process, the easier it is to invest energy in growing your business, not fixing tax errors.

Next Steps for Filing IRS Form 8379

Review Past Joint Returns: Look for risks of offset or previously lost refunds.

Keep Documents Organized: Maintain W-2s, 1099s, and debt communications in startup financial folders.

File Form 8379 Early: If there's any risk of offset, file it with your return immediately.

Partner With Modern Tax Providers: For startup-specific guidance, use tailored business tax solutions and other Business Tax Services.

Bookmark the IRS Site: Get the latest instructions and mailing addresses from the Form 8379 IRS page.

For founders committed to maintaining agile control over their finances, Form 8379 is a crucial instrument for protecting your share of a joint tax refund from being offset due to your spouse's separate debts. Knowing when and how to file Form 8379, the required documentation, and how to navigate IRS processes will empower you to secure valuable cash flow and keep your startup’s finances resilient.

If you anticipate needing to file or have already been impacted by an offset, act promptly by preparing and submitting Form 8379 to reclaim what is rightfully yours.

For founders navigating the complexities of joint tax filings, unexpected IRS refund offsets can be a jarring setback—especially when those offsets are due to your spouse's debts. The IRS Form 8379, or Injured Spouse Allocation, is designed specifically to protect your rightful portion of a joint tax refund. Understanding Form 8379, when and how to file it, and its nuances can save you money and avoid lengthy processing delays.

This guide unpacks everything founders and finance leaders need to know about Form 8379, empowering you to secure your business and personal finances with clarity and confidence.

What Is Form 8379 and Who Should Consider Filing?

Form 8379 is an IRS tax form that helps spouses recover their share of a joint tax refund when the refund is offset to pay a past-due debt owed solely by the other spouse. These debts typically include unpaid federal tax, state income tax, child support, or federal nontax debts such as student loans or unemployment compensation.

Who Qualifies as an Injured Spouse?

You are considered an injured spouse if you meet the following criteria:

You filed a joint tax return with your spouse.

You are not legally responsible for the debt that caused the offset.

You want to claim your portion of the joint refund that the IRS applied to your spouse's debt.

For example, if your spouse has unpaid federal student loans, and the IRS offsets your joint refund, you can file Form 8379 to claim your share of that refund.

This form provides important protection for founders and business owners who co-file taxes but maintain separate financial liabilities or debts.

How and When to File Form 8379

Founders and finance-savvy couples have a few options when it comes to filing:

Filing With Your Original Joint Tax Return

To avoid delays, the most efficient approach is to submit Form 8379 alongside your original joint tax return. If you know there might be an offset risk, attaching the form proactively ensures the IRS allocates the refund properly without extra back-and-forth.

Filing Separately After a Refund Offset

If the IRS has already seized your joint refund to cover your spouse’s debt, you can still file Form 8379 separately. This must be done as soon as possible after receiving your IRS notice—the quicker you respond, the earlier you can reclaim your portion.

Amending a Previously Filed Return

If you didn’t file the injured spouse form with the original return and haven’t received the refund, you may be able to submit an amended return attaching Form 8379. However, this takes longer to process and may delay your refund further.

What Documents Should You Attach?

Including all relevant supporting documents with your Form 8379 submission speeds up processing and reduces chances of back-and-forth with the IRS.

A copy of your joint tax return.

Proof of income and withholding (Form W-2, 1099s).

Documentation proving your non-responsibility for the debt, if applicable.

The IRS offset notice you received, if filing after an offset.

For startups and founders, keeping your withholding forms and financial records organized goes a long way toward smooth tax interactions. You must always keep detailed records and use tax organization tools as a small business.

Understanding the Parts of Form 8379

Form 8379 is structured to clearly separate income and withholding between spouses to calculate the injured spouse’s portion accurately.

Part | Purpose | What It Asks |

Part I | Income & Withholding Information | Details individual wages, taxable income, and withholding amounts. |

Part II | Allocation of Income and Taxes | Divides income and withholding between both spouses. |

Part III | Signature and Declaration | Both spouses must sign if filing jointly; confirms accuracy of data. |

Part IV | Additional Information & Attachments | Provides space for further context or to include supplementary documents. |

Filing this correctly demands precision. If you’re unsure, consulting with a modern tax service familiar with startup financials can help prevent errors that lead to processing delays.

How Long Does the IRS Take to Process Form 8379?

The IRS typically takes 8 to 11 weeks to process Form 8379 when filed separately after an offset. Filing it alongside your original return often results in quicker integration and less delay.

You can track the progress using the IRS “Where’s My Refund?” tool or by contacting the IRS. Keep your refund notice or case number handy to help with status checks.

Common Issues and Tips for a Smooth Filing

Avoid Missing Attachments: Forgetting to include your W-2 or IRS offset notice can delay processing.

Watch Out for Signature Requirements: A joint filing demands both signatures—don’t overlook it.

Be Clear About Debt Responsibility: Form 8379 won’t apply if the debt is jointly owed.

Use the Correct Mailing Address: Refer to the IRS site for the designated submission address by state.

Respond Quickly: If the IRS requests more information, reply promptly to keep your claim on track.

Injured Spouse Allocation vs. Innocent Spouse Relief

While Form 8379 protects your refund share from being applied to your spouse’s past-due debt, Innocent Spouse Relief is different—it seeks relief from joint tax liability incurred from your spouse's errors.

Key Differences:

Injured Spouse Allocation (Form 8379): Reclaims your share of a refund.

Innocent Spouse Relief (Form 8857): Requests exemption from responsibility for joint tax debt.

Founders facing refund offsets from unrelated debts should use Form 8379. But if deceptive filings or tax misstatements by a spouse occurred, you must understand Innocent Spouse Relief for broader protection.

Why Founders Should Pay Attention to Form 8379

In fast-paced startup life, refund offsets due to shared filings can seriously impact personal and business liquidity. Securing your share through Form 8379 lets you maintain cash flow without unnecessary complexity or legal hassle.

Additionally, founders leveraging credits like R&D or startup tax incentives benefit greatly from well-managed individual tax positions. The smoother your personal refund process, the easier it is to invest energy in growing your business, not fixing tax errors.

Next Steps for Filing IRS Form 8379

Review Past Joint Returns: Look for risks of offset or previously lost refunds.

Keep Documents Organized: Maintain W-2s, 1099s, and debt communications in startup financial folders.

File Form 8379 Early: If there's any risk of offset, file it with your return immediately.

Partner With Modern Tax Providers: For startup-specific guidance, use tailored business tax solutions and other Business Tax Services.

Bookmark the IRS Site: Get the latest instructions and mailing addresses from the Form 8379 IRS page.

For founders committed to maintaining agile control over their finances, Form 8379 is a crucial instrument for protecting your share of a joint tax refund from being offset due to your spouse's separate debts. Knowing when and how to file Form 8379, the required documentation, and how to navigate IRS processes will empower you to secure valuable cash flow and keep your startup’s finances resilient.

If you anticipate needing to file or have already been impacted by an offset, act promptly by preparing and submitting Form 8379 to reclaim what is rightfully yours.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026