Go Back

Last Updated :

Last Updated :

Jan 20, 2026

Jan 20, 2026

R&D Tax Credit with Form 6765: A Guide to Increasing Research Activities

For founders and CEOs steering startups, agencies, and e-commerce businesses, capturing every available financial advantage is essential. One of the most powerful yet often underleveraged benefits is the Research & Development (R&D) Tax Credit.

A key component to unlocking this credit is correctly filing Form 6765, which claims eligible research activities and expenses. This guide will provide a practical roadmap — helping you understand Form 6765, maximize your credits, and strategically grow your innovation-focused spend.

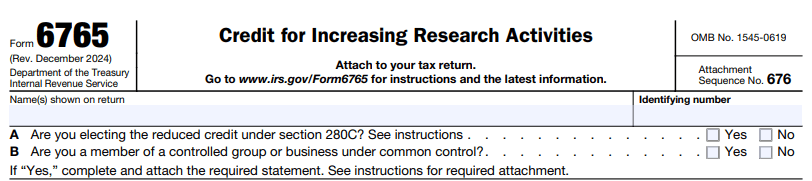

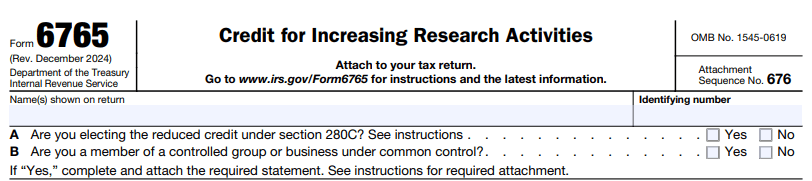

What Is Form 6765 and Why It Matters

Form 6765, officially titled Credit for Increasing Research Activities, is the IRS form businesses use to claim the federal R&D tax credit. This credit rewards companies investing in qualified research aimed at discovering or improving products, processes, techniques, formulas, or software.

For founders, mastering Form 6765 means more than just checking a box during tax season — it opens the door to substantial tax savings, freeing up capital to reinvest in further innovation or scale operations.

Why Filing Form 6765 Is Critical:

It formalizes your request for the credit and calculates your eligible amount.

It identifies your chosen method for quantifying research expenditures.

It ensures regulatory alignment, reducing IRS audit risk.

By integrating Form 6765 into your annual tax planning, your business can access a proven incentive aimed at reducing the real cost of innovation.

Qualified Research Activities and Expenses: Who Benefits and How

Who Should Consider Filing Form 6765?

Any company that engages in ongoing product or process innovation should explore eligibility. Commonly qualifying companies operate in:

Technology and software development

E-commerce platforms with custom engineering

Product testing and prototyping

Manufacturing and automation upgrades

Internal process improvement initiatives

Whether you're developing internal tools to streamline operations or designing customer-facing solutions, your business might qualify.

Meeting the IRS Four-Part Test

The IRS requires activities to satisfy all four of the following tests:

Permitted Purpose: Activities should aim to develop or improve business components (products, software, techniques).

Technological in Nature: The work relies on principles of science, math, engineering, or computer science.

Elimination of Uncertainty: You’re attempting to resolve unknowns related to capability, method, or design.

Process of Experimentation: Involves hypothesis testing, trial and error, simulation, or modeling.

Real-world examples include:

Engineering a logistics algorithm to optimize delivery times.

Experimenting with recyclable packaging for a subscription box service.

Building proprietary APIs to integrate multiple sales channels.

Eligible R&D Expenses

Expense Type | Qualified? | Notes |

Wages for employees conducting research | Yes | Proportional to time spent on qualifying activities |

Supplies consumed during R&D | Yes | Includes items used in prototyping or iteration |

Contract research expenses | Yes | Up to 65% of eligible subcontractor costs |

Cloud computing/server rentals for R&D | Yes | Costs must support qualified R&D activities only |

Overhead costs or indirect expenses | Possibly | Requires careful allocation and documentation |

Note: Marketing, quality assurance, and post-production reviews generally do not qualify.

A Walkthrough of Form 6765 Sections for Founders

Although Form 6765 may appear daunting, understanding its structure makes filing much more approachable.

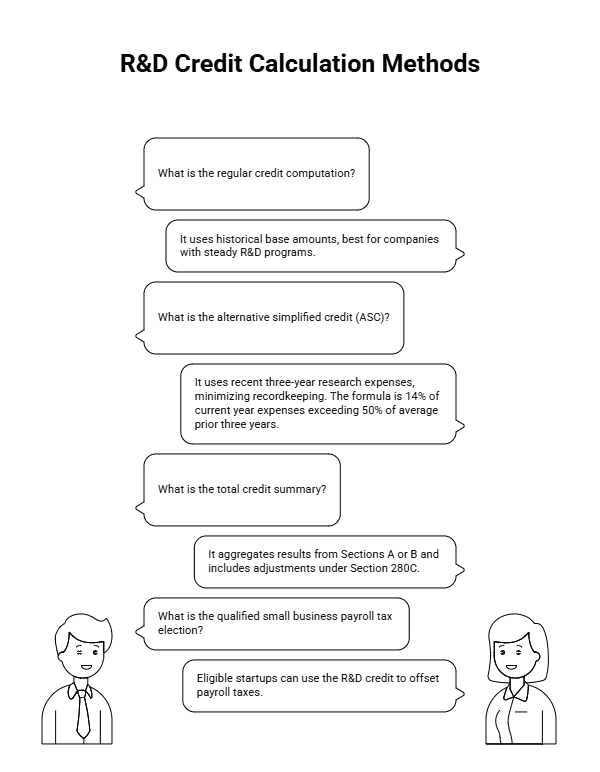

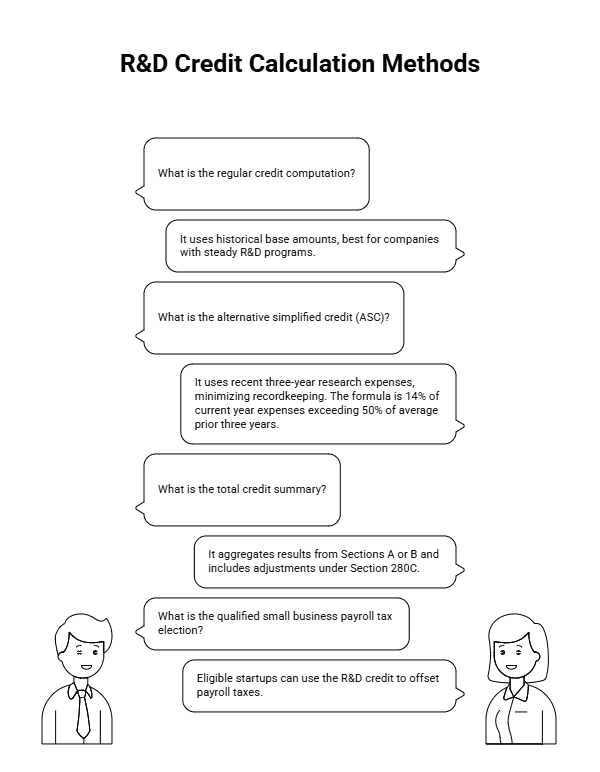

Section A: Regular Credit Computation

For companies opting to calculate their credit using historical base amounts (usually best for longer-standing companies with steady R&D programs).

Section B: Alternative Simplified Credit (ASC)

The more popular option for many startups. ASC offers a straightforward calculation using recent three-year research expenses, minimizing recordkeeping requirements.

Formula: 14% of current year expenses exceeding 50% of average prior three years.

If you had no qualified research in prior years, you may still use the ASC approach.

Section C: Total Credit Summary

This aggregates the results from Sections A or B and includes adjustments under Section 280C (see below).

Section D: Qualified Small Business Payroll Tax Election

Eligible startups (less than five years old with under $5M in revenue) can use the R&D credit to offset payroll taxes — a direct cash flow booster.

Section G: Disclosure and Reporting (Recent Addition)

The IRS added this section requiring detailed substantiation of research activities:

Written descriptions of each project

Business purpose and uncertainty

R&D methods and principles

Ensuring this portion is clear and well-documented protects your business in the event of an audit.

How Section 174 and Section 280C Affect Form 6765 Filings

Impact of Section 174 Amendments

As of 2022, companies can no longer immediately deduct R&D expenses. Instead, qualified expenditures must be capitalized and amortized:

Domestic R&D: Amortized over 5 years.

Foreign R&D: Amortized over 15 years.

This changes how R&D expenses are reported and interacts directly with your Form 6765 calculations.

Navigating Section 280C Limitations

Section 280C prevents “double dipping” — claiming both a deduction and a credit for the same expenses:

You must reduce your deductible R&D expense by the amount claimed as credit, or

Elect a reduced credit on Form 6765 to maintain your full deduction elsewhere on the return.

Founders should work closely with an expert tax advisor to model these trade-offs before filing.

Proactive R&D Credit Strategy: Best Practices for Founders

1. Keep Diligent Project Documentation

Capture detailed notes during development.

Track time logs connected to experimental activities.

Build a tax trail supported by calendars, JIRA tickets, Git commits, and invoices.

2. Plan R&D Investments With Tax in Mind

Time your innovation sprints to match fiscal goals.

Delay or accelerate initiatives based on projected eligibility.

3. Choose the Right Credit Method

For higher R&D spend in the current year: consider ASC.

For established, historically consistent spend: evaluate Regular Credit.

4. Leverage Trusted Experts Who Understand Startups

Partner with advisors fluent in fast-moving product teams and lean operations.

Avoid generic tax firms that overlook nuanced activities that qualify.ax

Real-Life Case Study: Maximizing Credits with Form 6765

An AI-based software startup working on personalized customer journeys invested heavily in proprietary model training and backend development:

Developers and data engineers spent ~50% of their time refining underlying architecture.

Cloud costs, labeled data procurement, and prototyping expenses were tracked diligently.

By choosing the ASC method and completing Form 6765 correctly, the startup claimed over $70,000 in credits.

Using the Qualified Small Business Payroll Tax Election, they applied credits against quarterly payroll taxes, freeing cash to accelerate hiring.

A focused approach to R&D documentation and proactive strategy ensured they stayed audit-ready while maximizing the short-term cash benefit.

Own Your R&D Advantage with Form 6765

For startups and innovation-first companies, understanding and leveraging Form 6765 is a tactical move — not just a compliance step.

By embracing the R&D tax credit as part of your broader operating strategy, you put money back into the areas of your business that need it most: engineering, product, and experimentation.

Whether you’re building software, testing materials, or optimizing processes, the IRS rewards what innovation-driven founders already do naturally.

Form 6765 unlocks this reward — but only if used correctly.

For founders and CEOs steering startups, agencies, and e-commerce businesses, capturing every available financial advantage is essential. One of the most powerful yet often underleveraged benefits is the Research & Development (R&D) Tax Credit.

A key component to unlocking this credit is correctly filing Form 6765, which claims eligible research activities and expenses. This guide will provide a practical roadmap — helping you understand Form 6765, maximize your credits, and strategically grow your innovation-focused spend.

What Is Form 6765 and Why It Matters

Form 6765, officially titled Credit for Increasing Research Activities, is the IRS form businesses use to claim the federal R&D tax credit. This credit rewards companies investing in qualified research aimed at discovering or improving products, processes, techniques, formulas, or software.

For founders, mastering Form 6765 means more than just checking a box during tax season — it opens the door to substantial tax savings, freeing up capital to reinvest in further innovation or scale operations.

Why Filing Form 6765 Is Critical:

It formalizes your request for the credit and calculates your eligible amount.

It identifies your chosen method for quantifying research expenditures.

It ensures regulatory alignment, reducing IRS audit risk.

By integrating Form 6765 into your annual tax planning, your business can access a proven incentive aimed at reducing the real cost of innovation.

Qualified Research Activities and Expenses: Who Benefits and How

Who Should Consider Filing Form 6765?

Any company that engages in ongoing product or process innovation should explore eligibility. Commonly qualifying companies operate in:

Technology and software development

E-commerce platforms with custom engineering

Product testing and prototyping

Manufacturing and automation upgrades

Internal process improvement initiatives

Whether you're developing internal tools to streamline operations or designing customer-facing solutions, your business might qualify.

Meeting the IRS Four-Part Test

The IRS requires activities to satisfy all four of the following tests:

Permitted Purpose: Activities should aim to develop or improve business components (products, software, techniques).

Technological in Nature: The work relies on principles of science, math, engineering, or computer science.

Elimination of Uncertainty: You’re attempting to resolve unknowns related to capability, method, or design.

Process of Experimentation: Involves hypothesis testing, trial and error, simulation, or modeling.

Real-world examples include:

Engineering a logistics algorithm to optimize delivery times.

Experimenting with recyclable packaging for a subscription box service.

Building proprietary APIs to integrate multiple sales channels.

Eligible R&D Expenses

Expense Type | Qualified? | Notes |

Wages for employees conducting research | Yes | Proportional to time spent on qualifying activities |

Supplies consumed during R&D | Yes | Includes items used in prototyping or iteration |

Contract research expenses | Yes | Up to 65% of eligible subcontractor costs |

Cloud computing/server rentals for R&D | Yes | Costs must support qualified R&D activities only |

Overhead costs or indirect expenses | Possibly | Requires careful allocation and documentation |

Note: Marketing, quality assurance, and post-production reviews generally do not qualify.

A Walkthrough of Form 6765 Sections for Founders

Although Form 6765 may appear daunting, understanding its structure makes filing much more approachable.

Section A: Regular Credit Computation

For companies opting to calculate their credit using historical base amounts (usually best for longer-standing companies with steady R&D programs).

Section B: Alternative Simplified Credit (ASC)

The more popular option for many startups. ASC offers a straightforward calculation using recent three-year research expenses, minimizing recordkeeping requirements.

Formula: 14% of current year expenses exceeding 50% of average prior three years.

If you had no qualified research in prior years, you may still use the ASC approach.

Section C: Total Credit Summary

This aggregates the results from Sections A or B and includes adjustments under Section 280C (see below).

Section D: Qualified Small Business Payroll Tax Election

Eligible startups (less than five years old with under $5M in revenue) can use the R&D credit to offset payroll taxes — a direct cash flow booster.

Section G: Disclosure and Reporting (Recent Addition)

The IRS added this section requiring detailed substantiation of research activities:

Written descriptions of each project

Business purpose and uncertainty

R&D methods and principles

Ensuring this portion is clear and well-documented protects your business in the event of an audit.

How Section 174 and Section 280C Affect Form 6765 Filings

Impact of Section 174 Amendments

As of 2022, companies can no longer immediately deduct R&D expenses. Instead, qualified expenditures must be capitalized and amortized:

Domestic R&D: Amortized over 5 years.

Foreign R&D: Amortized over 15 years.

This changes how R&D expenses are reported and interacts directly with your Form 6765 calculations.

Navigating Section 280C Limitations

Section 280C prevents “double dipping” — claiming both a deduction and a credit for the same expenses:

You must reduce your deductible R&D expense by the amount claimed as credit, or

Elect a reduced credit on Form 6765 to maintain your full deduction elsewhere on the return.

Founders should work closely with an expert tax advisor to model these trade-offs before filing.

Proactive R&D Credit Strategy: Best Practices for Founders

1. Keep Diligent Project Documentation

Capture detailed notes during development.

Track time logs connected to experimental activities.

Build a tax trail supported by calendars, JIRA tickets, Git commits, and invoices.

2. Plan R&D Investments With Tax in Mind

Time your innovation sprints to match fiscal goals.

Delay or accelerate initiatives based on projected eligibility.

3. Choose the Right Credit Method

For higher R&D spend in the current year: consider ASC.

For established, historically consistent spend: evaluate Regular Credit.

4. Leverage Trusted Experts Who Understand Startups

Partner with advisors fluent in fast-moving product teams and lean operations.

Avoid generic tax firms that overlook nuanced activities that qualify.ax

Real-Life Case Study: Maximizing Credits with Form 6765

An AI-based software startup working on personalized customer journeys invested heavily in proprietary model training and backend development:

Developers and data engineers spent ~50% of their time refining underlying architecture.

Cloud costs, labeled data procurement, and prototyping expenses were tracked diligently.

By choosing the ASC method and completing Form 6765 correctly, the startup claimed over $70,000 in credits.

Using the Qualified Small Business Payroll Tax Election, they applied credits against quarterly payroll taxes, freeing cash to accelerate hiring.

A focused approach to R&D documentation and proactive strategy ensured they stayed audit-ready while maximizing the short-term cash benefit.

Own Your R&D Advantage with Form 6765

For startups and innovation-first companies, understanding and leveraging Form 6765 is a tactical move — not just a compliance step.

By embracing the R&D tax credit as part of your broader operating strategy, you put money back into the areas of your business that need it most: engineering, product, and experimentation.

Whether you’re building software, testing materials, or optimizing processes, the IRS rewards what innovation-driven founders already do naturally.

Form 6765 unlocks this reward — but only if used correctly.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026