Go Back

Last Updated :

Last Updated :

Jan 26, 2026

Jan 26, 2026

Form 6251: Understanding the Alternative Minimum Tax (AMT)

For many founders steering startups, agencies, or e-commerce ventures, navigating the complexities of federal taxes can feel like a maze. One particularly challenging area is the Alternative Minimum Tax, or AMT, calculated using Form 6251, which many entrepreneurs encounter but few fully understand.

This guide breaks down everything a founder needs to know about Form 6251, how it impacts your tax planning, and practical steps to minimize surprises when tax season arrives.

What Is Form 6251 and Why Should Founders Care?

Form 6251 is the IRS form used to calculate the Alternative Minimum Tax (AMT). The AMT is a parallel tax system designed to ensure that taxpayers with certain income levels and deductions pay a minimum level of tax. While the regular tax system allows many deductions and credits, the AMT limits some of these to prevent excessive tax avoidance.

Why Was AMT Implemented?

Historically, AMT was created to make sure high-income individuals and corporations didn't use loopholes to legally reduce their tax responsibility to near zero. It does this by adjusting your taxable income, disallowing some deductions, and applying specific tax rates.

For founders, this is crucial because many startup tax benefits—like certain deductions, credits, or losses—may trigger AMT adjustments. For example:

Exercising incentive stock options (ISOs)

Large depreciation deductions on equipment

Certain business-related deductions and losses

Without careful planning, AMT can lead to an unexpected tax bill, undermining cash flow or reinvestment plans.

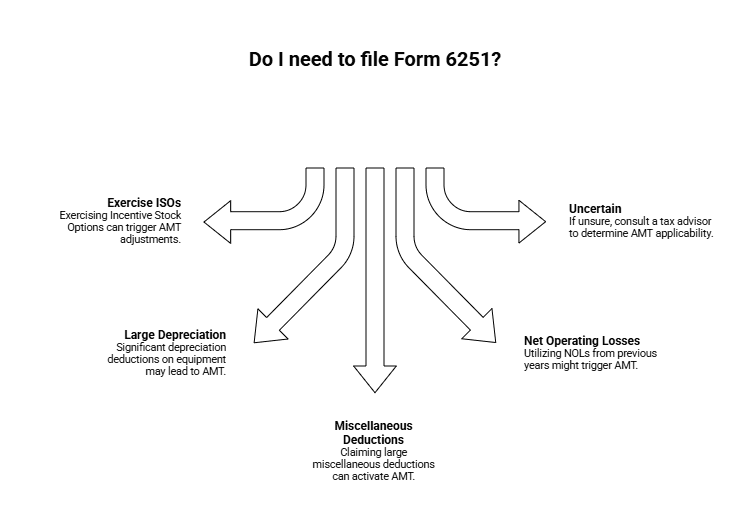

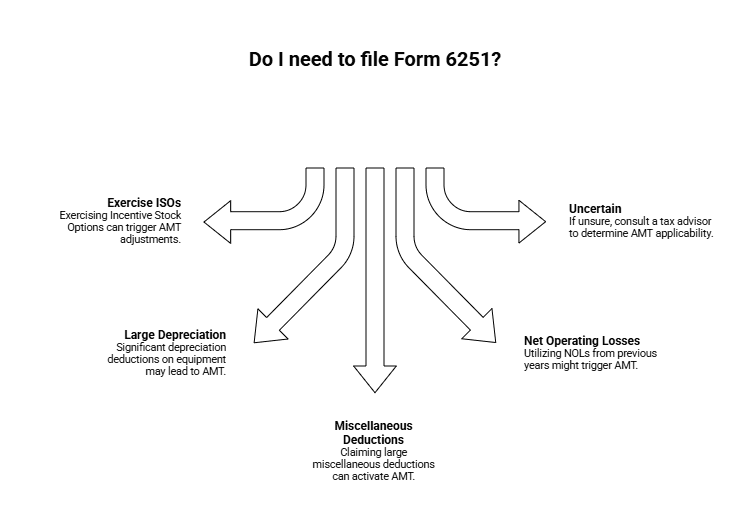

Who Needs to File Form 6251?

Not every filer submits Form 6251. It’s triggered for taxpayers who claim income or deductions that potentially activate the AMT. Common situations for startups and founders include:

Exercising ISOs in your startup

Reporting large tax-exempt interest income

Claiming significant miscellaneous deductions, such as unreimbursed business expenses

Utilizing net operating losses from previous years

If you’re uncertain whether AMT applies to you, it’s essential to go through the calculation using the data from Form 6251—either manually or with a tax advisor. Many founders find professionals specializing in startup tax helpful here, especially when R&D tax credits and complex equity plans are involved.

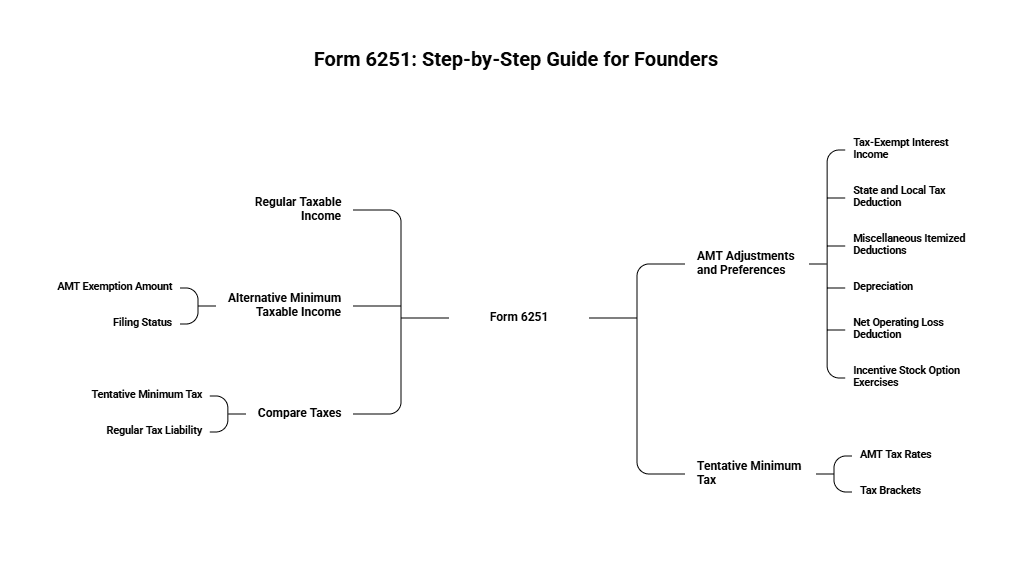

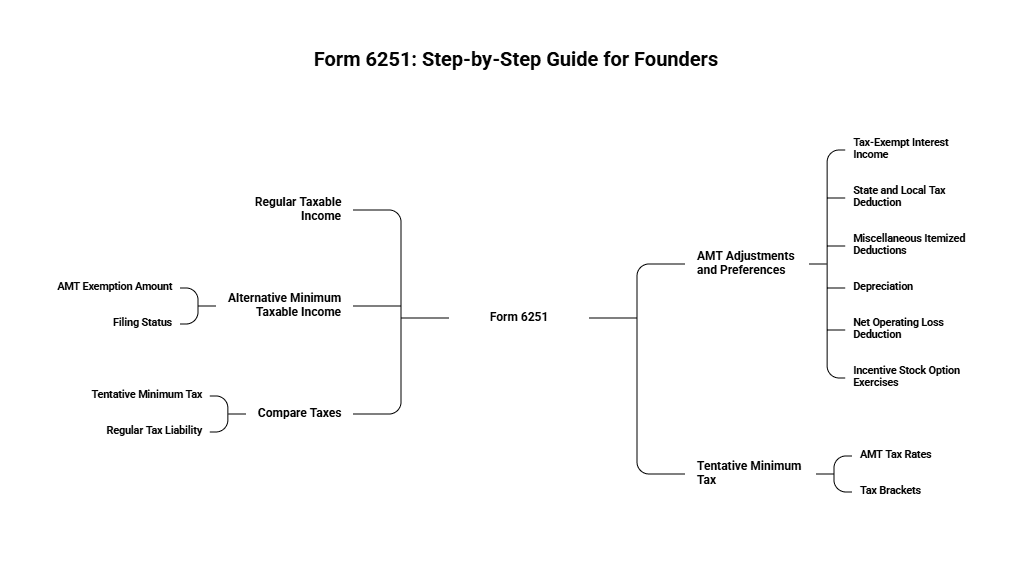

Breaking Down Form 6251: Step-by-Step Guide for Founders

Understanding the structure and key components of Form 6251 is one way to demystify the AMT process. Here’s a simplified walk-through tailored for a startup founder’s perspective.

1. Start with Your Regular Taxable Income

Form 6251 begins with your taxable income as reported on Form 1040, Line 15. This figure includes all income after applying regular tax deductions.

2. Apply AMT Adjustments and Preferences

The AMT system requires you to add back or adjust certain deductions and losses that are treated differently. Key examples include:

Adjustment Type | Examples Relevant to Founders |

Tax-Exempt Interest Income | Interest from private activity bonds |

State and Local Tax Deduction | Limited under AMT |

Miscellaneous Itemized Deductions | Often disallowed or adjusted |

Depreciation | Different rules for equipment assets |

Net Operating Loss Deduction | May need recalculating under AMT rules |

Incentive Stock Option (ISO) Exercises | Difference between exercise price and market price included as income |

3. Calculate Alternative Minimum Taxable Income (AMTI)

Subtract the AMT exemption amount (which varies by filing status) from the adjusted income. This is your AMTI—the income subject to AMT.

For example, in 2024, the AMT exemption for single filers is $81,300 and begins phasing out at $578,150.

For married filing jointly, it’s $126,500 with phase-outs starting at $1,156,300.

4. Compute Tentative Minimum Tax

Apply the AMT tax rates to your AMTI:

Tax Bracket | AMT Rate |

AMTI up to $220,300 | 26% |

Above $220,300 | 28% |

Note that these thresholds adjust annually and differ by filing status.

5. Compare the Tentative Minimum Tax to the Regular Tax

If the tentative minimum tax is higher than your regular tax liability, you’ll owe the difference as AMT.

Key AMT Exemptions and Phase-Outs: What Founders Should Know

Understanding AMT exemptions and how they phase out is essential, especially as your income and company grow.

Filing Status | 2024 AMT Exemption | Phase-Out Begins At |

Single/Head of Household | $81,300 | $578,150 |

Married Filing Jointly | $126,500 | $1,156,300 |

Married Filing Separately | $63,250 | $578,150 |

The AMT exemption is reduced by $0.25 for every $1 over the phase-out threshold. This means your AMTI and tax liability could increase sharply if you're in a growth phase.

AMT-Triggering Adjustments Founders Should Watch For

Understanding which deductions and income types trigger AMT is foundational. Below are common causes:

Trigger | Impact for Founders |

Incentive Stock Options (ISOs) | ISO exercise “bargain element” counts as AMT income |

Depreciation Deductions | Modified under AMT, reducing tax benefit |

State and Local Taxes | Cannot be deducted under AMT |

Miscellaneous Deductions | Often disallowed |

Net Operating Losses | Must be recalculated per AMT rules |

Bonus tip: If your company claims R&D tax credits, they may interact with AMT liabilities in complex ways. For extra clarity, understand how to handle taxes as a startup.

Strategic AMT Planning Tips for Founders

Forward-thinking founders build AMT considerations into their broader tax and compensation strategies:

Monitor ISO Exercises: Spread large option exercises across tax years.

Optimize Compensation Structure: Balance cash salary and equity to manage AMT exposure.

Track State and Local Tax Outflows: These may not benefit your AMT calculation.

Time Major Deductions Thoughtfully: When possible, time expenses or deductions to offload AMT impact.

Use Pro Tools or Advisors: Specialized tax software and startup-savvy CPAs can model your AMT exposure.

Understanding these strategies early reduces surprises and improves year-round financial decision-making. Founders also benefit from tax-saving strategies.

How Tax Law Changes Affect Form 6251 and AMT Exposure

The tax code—and therefore AMT rules—continues to evolve. Recent adjustments every founder should keep in mind include:

The Tax Cuts and Jobs Act (TCJA) raised AMT exemptions and widened phase-out thresholds, benefiting many filers.

Specific credits—like the R&D tax credit—may be claimed against AMT in some cases.

Annual IRS updates require checking official limits during tax prep.

For the most recent AMT and tax details, consult the IRS official About Form 6251 page.

Why Founders Need to Understand Form 6251 and AMT

In the startup world, unexpected tax liabilities can disrupt growth plans—making Form 6251 a critical piece of the tax puzzle. The Alternative Minimum Tax ensures a base tax owed after accounting for special deductions and income types that many startups have. Awareness of your AMT exposure early enables smarter tax decisions throughout the year:

Recognize if and when you must file Form 6251

Track and understand AMT-specific income adjustments

Use exemptions and phase-outs knowledge to better predict tax bills

Factor AMT into stock option and deduction strategies

Partnering with advisors who specialize in startup and agency tax needs, especially regarding AMT, can save you time, financial headaches, and help harness available tax benefits without triggering costly AMT liabilities.

For many founders steering startups, agencies, or e-commerce ventures, navigating the complexities of federal taxes can feel like a maze. One particularly challenging area is the Alternative Minimum Tax, or AMT, calculated using Form 6251, which many entrepreneurs encounter but few fully understand.

This guide breaks down everything a founder needs to know about Form 6251, how it impacts your tax planning, and practical steps to minimize surprises when tax season arrives.

What Is Form 6251 and Why Should Founders Care?

Form 6251 is the IRS form used to calculate the Alternative Minimum Tax (AMT). The AMT is a parallel tax system designed to ensure that taxpayers with certain income levels and deductions pay a minimum level of tax. While the regular tax system allows many deductions and credits, the AMT limits some of these to prevent excessive tax avoidance.

Why Was AMT Implemented?

Historically, AMT was created to make sure high-income individuals and corporations didn't use loopholes to legally reduce their tax responsibility to near zero. It does this by adjusting your taxable income, disallowing some deductions, and applying specific tax rates.

For founders, this is crucial because many startup tax benefits—like certain deductions, credits, or losses—may trigger AMT adjustments. For example:

Exercising incentive stock options (ISOs)

Large depreciation deductions on equipment

Certain business-related deductions and losses

Without careful planning, AMT can lead to an unexpected tax bill, undermining cash flow or reinvestment plans.

Who Needs to File Form 6251?

Not every filer submits Form 6251. It’s triggered for taxpayers who claim income or deductions that potentially activate the AMT. Common situations for startups and founders include:

Exercising ISOs in your startup

Reporting large tax-exempt interest income

Claiming significant miscellaneous deductions, such as unreimbursed business expenses

Utilizing net operating losses from previous years

If you’re uncertain whether AMT applies to you, it’s essential to go through the calculation using the data from Form 6251—either manually or with a tax advisor. Many founders find professionals specializing in startup tax helpful here, especially when R&D tax credits and complex equity plans are involved.

Breaking Down Form 6251: Step-by-Step Guide for Founders

Understanding the structure and key components of Form 6251 is one way to demystify the AMT process. Here’s a simplified walk-through tailored for a startup founder’s perspective.

1. Start with Your Regular Taxable Income

Form 6251 begins with your taxable income as reported on Form 1040, Line 15. This figure includes all income after applying regular tax deductions.

2. Apply AMT Adjustments and Preferences

The AMT system requires you to add back or adjust certain deductions and losses that are treated differently. Key examples include:

Adjustment Type | Examples Relevant to Founders |

Tax-Exempt Interest Income | Interest from private activity bonds |

State and Local Tax Deduction | Limited under AMT |

Miscellaneous Itemized Deductions | Often disallowed or adjusted |

Depreciation | Different rules for equipment assets |

Net Operating Loss Deduction | May need recalculating under AMT rules |

Incentive Stock Option (ISO) Exercises | Difference between exercise price and market price included as income |

3. Calculate Alternative Minimum Taxable Income (AMTI)

Subtract the AMT exemption amount (which varies by filing status) from the adjusted income. This is your AMTI—the income subject to AMT.

For example, in 2024, the AMT exemption for single filers is $81,300 and begins phasing out at $578,150.

For married filing jointly, it’s $126,500 with phase-outs starting at $1,156,300.

4. Compute Tentative Minimum Tax

Apply the AMT tax rates to your AMTI:

Tax Bracket | AMT Rate |

AMTI up to $220,300 | 26% |

Above $220,300 | 28% |

Note that these thresholds adjust annually and differ by filing status.

5. Compare the Tentative Minimum Tax to the Regular Tax

If the tentative minimum tax is higher than your regular tax liability, you’ll owe the difference as AMT.

Key AMT Exemptions and Phase-Outs: What Founders Should Know

Understanding AMT exemptions and how they phase out is essential, especially as your income and company grow.

Filing Status | 2024 AMT Exemption | Phase-Out Begins At |

Single/Head of Household | $81,300 | $578,150 |

Married Filing Jointly | $126,500 | $1,156,300 |

Married Filing Separately | $63,250 | $578,150 |

The AMT exemption is reduced by $0.25 for every $1 over the phase-out threshold. This means your AMTI and tax liability could increase sharply if you're in a growth phase.

AMT-Triggering Adjustments Founders Should Watch For

Understanding which deductions and income types trigger AMT is foundational. Below are common causes:

Trigger | Impact for Founders |

Incentive Stock Options (ISOs) | ISO exercise “bargain element” counts as AMT income |

Depreciation Deductions | Modified under AMT, reducing tax benefit |

State and Local Taxes | Cannot be deducted under AMT |

Miscellaneous Deductions | Often disallowed |

Net Operating Losses | Must be recalculated per AMT rules |

Bonus tip: If your company claims R&D tax credits, they may interact with AMT liabilities in complex ways. For extra clarity, understand how to handle taxes as a startup.

Strategic AMT Planning Tips for Founders

Forward-thinking founders build AMT considerations into their broader tax and compensation strategies:

Monitor ISO Exercises: Spread large option exercises across tax years.

Optimize Compensation Structure: Balance cash salary and equity to manage AMT exposure.

Track State and Local Tax Outflows: These may not benefit your AMT calculation.

Time Major Deductions Thoughtfully: When possible, time expenses or deductions to offload AMT impact.

Use Pro Tools or Advisors: Specialized tax software and startup-savvy CPAs can model your AMT exposure.

Understanding these strategies early reduces surprises and improves year-round financial decision-making. Founders also benefit from tax-saving strategies.

How Tax Law Changes Affect Form 6251 and AMT Exposure

The tax code—and therefore AMT rules—continues to evolve. Recent adjustments every founder should keep in mind include:

The Tax Cuts and Jobs Act (TCJA) raised AMT exemptions and widened phase-out thresholds, benefiting many filers.

Specific credits—like the R&D tax credit—may be claimed against AMT in some cases.

Annual IRS updates require checking official limits during tax prep.

For the most recent AMT and tax details, consult the IRS official About Form 6251 page.

Why Founders Need to Understand Form 6251 and AMT

In the startup world, unexpected tax liabilities can disrupt growth plans—making Form 6251 a critical piece of the tax puzzle. The Alternative Minimum Tax ensures a base tax owed after accounting for special deductions and income types that many startups have. Awareness of your AMT exposure early enables smarter tax decisions throughout the year:

Recognize if and when you must file Form 6251

Track and understand AMT-specific income adjustments

Use exemptions and phase-outs knowledge to better predict tax bills

Factor AMT into stock option and deduction strategies

Partnering with advisors who specialize in startup and agency tax needs, especially regarding AMT, can save you time, financial headaches, and help harness available tax benefits without triggering costly AMT liabilities.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026