Go Back

Last Updated :

Last Updated :

Dec 22, 2025

Dec 22, 2025

Form 56 Filing Guide: Notice of Fiduciary Relationship for Founders (Enhanced)

Form 56 Filing Guide: Notice of Fiduciary Relationship for Founders (Enhanced)

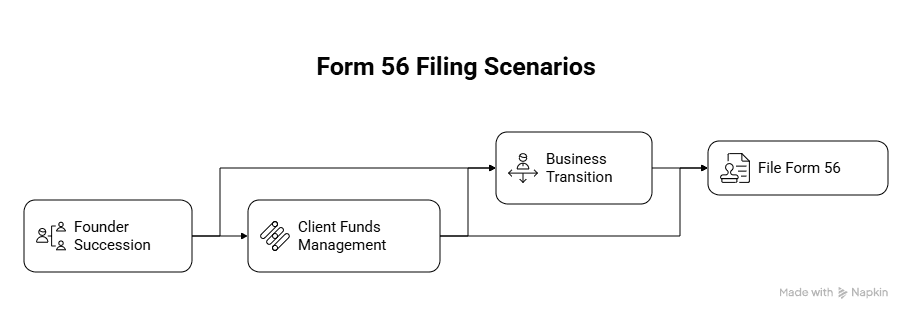

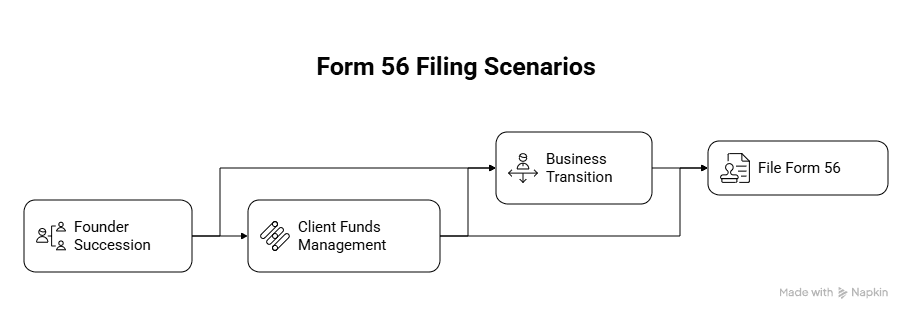

Navigating the complexities of business tax compliance can be daunting for startup founders and finance leads. One form that often flies under the radar—but is essential in certain fiduciary scenarios—is Form 56. This document helps you properly notify the IRS of a fiduciary relationship when a fiduciary is appointed to act on behalf of an individual or entity, which can affect tax responsibilities and reporting.

For founders, understanding when and how to file Form 56 can save your business from costly penalties and ensure smooth tax operations, especially if your company is managing assets or estates, or acting as a trustee.

In this guide, we’ll break down the key aspects of Form 56, explain practical scenarios where it applies to startups and agencies, and provide actionable, step-by-step guidance to file correctly.

What is Form 56?

Form 56, officially titled "Notice Concerning Fiduciary Relationship", is an IRS document used to formally inform the Internal Revenue Service when a fiduciary has been appointed to manage the affairs of a taxpayer.

A fiduciary is any person or entity designated to act on behalf of another individual or entity, such as an:

Executor or Administrator of an estate

Guardian or Conservator

Trustee of a trust

Receiver or Assignee in a bankruptcy

Why Should Founders Care About Form 56?

Legally Designates Authority: It tells the IRS who is authorized to receive confidential tax information and legally represent the taxpayer (the estate, the trust, or the individual).

Redirects Correspondence: It ensures all official IRS notices, communications, and liability statements are sent directly to the appointed fiduciary.

Prevents Compliance Risks: Late or missed filings can lead to IRS correspondence being sent to the wrong, unauthorized party, causing miscommunication, delayed filings, and compliance risks.

Who Needs to File Form 56?

You must file Form 56 if you are the person assuming the fiduciary role (the executor, trustee, etc.) and you are acting for any of the following entities or persons for tax purposes:

A Decedent (e.g., managing the taxes after a founder’s passing)

A Trust (e.g., a business trust, or a founder’s estate planning trust)

A Corporation or Partnership (rare, but possible during liquidation or dissolution)

An Estate (Testate or Intestate)

A person or entity involved in Bankruptcy or Assignment for the Benefit of Creditors

Filing Requirements and Deadlines

Form 56 does not have a set due date like a tax return, but it must be filed as soon as possible after the fiduciary relationship is created.

For Estates: File immediately upon appointment as executor or administrator.

For Trusts/Other: File within 30 days of taking office, being appointed, or receiving the transfer of assets.

💡 Guidance Tip: File Early! The sooner you file, the sooner the IRS sends notices to the correct person. Delays can lead to the IRS sending important tax notices (like a Notice of Deficiency) to the previous address or representative, which can result in missed deadlines and financial penalties.

How to File Form 56

Form 56 must be mailed to the Internal Revenue Service—it cannot be filed electronically. The correct mailing address depends on the address of the person for whom you are acting. Always check the latest IRS instructions for Form 56 for the most current mailing location.

Step-by-Step Guidance for Completing Form 56

Step 1: Complete Part I - Identification

This section is divided into two roles: the Taxpayer and the Fiduciary.

Section | Required Information | Guidance for Founders/Fiduciaries |

Taxpayer's Info | Name, Address, and Identifying Number (TIN/EIN) of the person/entity you are acting for. | This is the Estate, Trust, or Founder who passed away. Use the name exactly as it appears on their tax returns. Include the Decedent's SSN if you are an executor of an estate. |

Fiduciary's Info | Fiduciary’s Name, Address, and TIN. | This is your name (or your company's name if the company is the fiduciary), address, and your personal SSN/ITIN or the company's EIN. |

Step 2: Select Your Authority (Part I, Section A)

You must check only one box on Line 1 that describes the source of your fiduciary authority.

1a/1b: Check these if you were Court-appointed as an executor or administrator of an estate (testate/intestate).

1c: Check this for a Court-appointed guardian or conservator.

1d: Check this if your authority comes from a Valid Trust Instrument and Amendments (most common for business trusts or estate planning trusts).

1e/1f/1g: Cover other, less common scenarios (receiver, bankruptcy, or Other).

Important Dates (Line 2):

If you checked 1a, 1b, or 1d (Estate/Trust), enter the Decedent's date of death.

For all others, enter the date you were appointed, took office, or received the assignment of assets.

Step 3: Define Tax Liabilities (Part I, Section B)

On Line 3, you must check all boxes for the types of taxes the fiduciary relationship covers (e.g., Income, Estate, Gift, etc.).

Crucial: For each type of tax checked, you must also provide the specific Year(s) or Period(s) covered by your notice (e.g., "2023," "2024," or "Dec. 31, 2023," etc.).

Step 4: Attach Supporting Documentation

You must attach proof of your authority. This is critical for the IRS to process the form quickly.

For Court Appointments (1a, 1b, 1c): Attach a certified copy of the court order.

For Trusts (1d): Attach a copy of the valid trust instrument (and any amendments). Note: You may be able to attach an affidavit or certification of trust instead; see the current IRS instructions for details.

For "Other" (1g): Attach a copy of the legal document creating the fiduciary relationship.

Step 5: Sign and Submit

Sign and Date: The fiduciary must personally sign and date the form in Part IV. You must also enter your official title (e.g., "Executor," "Trustee," "President").

Mail: Mail the completed Form 56 and all attachments to the correct IRS address.

Record Keeping: Keep copies of the signed form, all attachments, and proof of mailing (e.g., Certified Mail receipt) for your company's records.

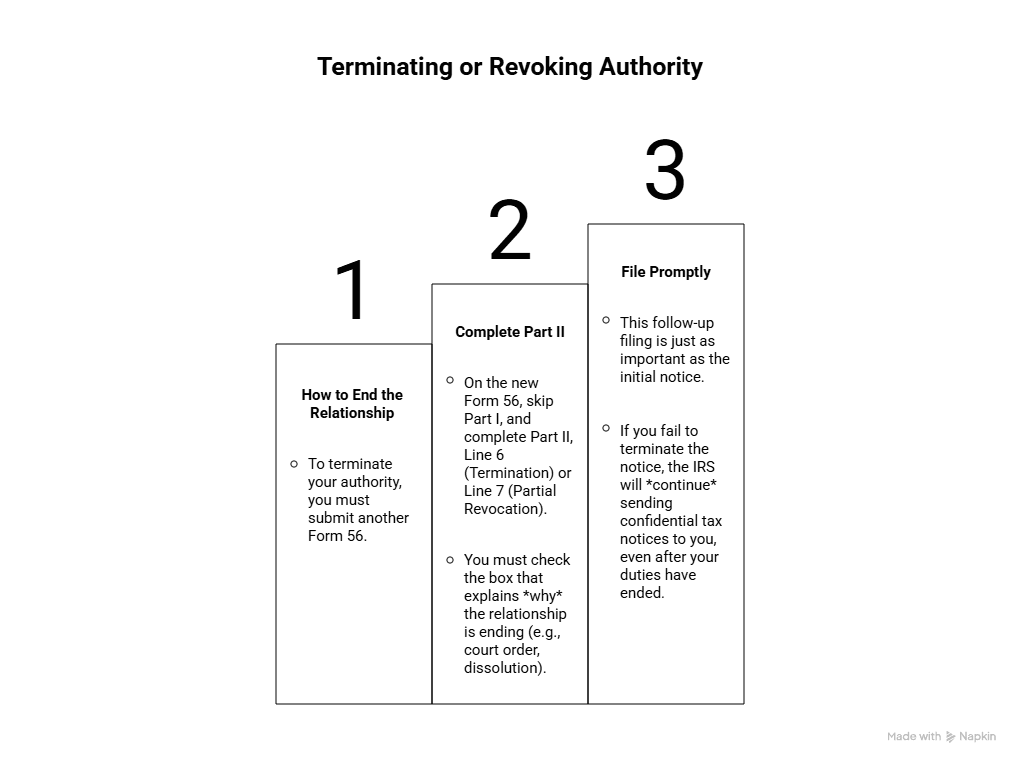

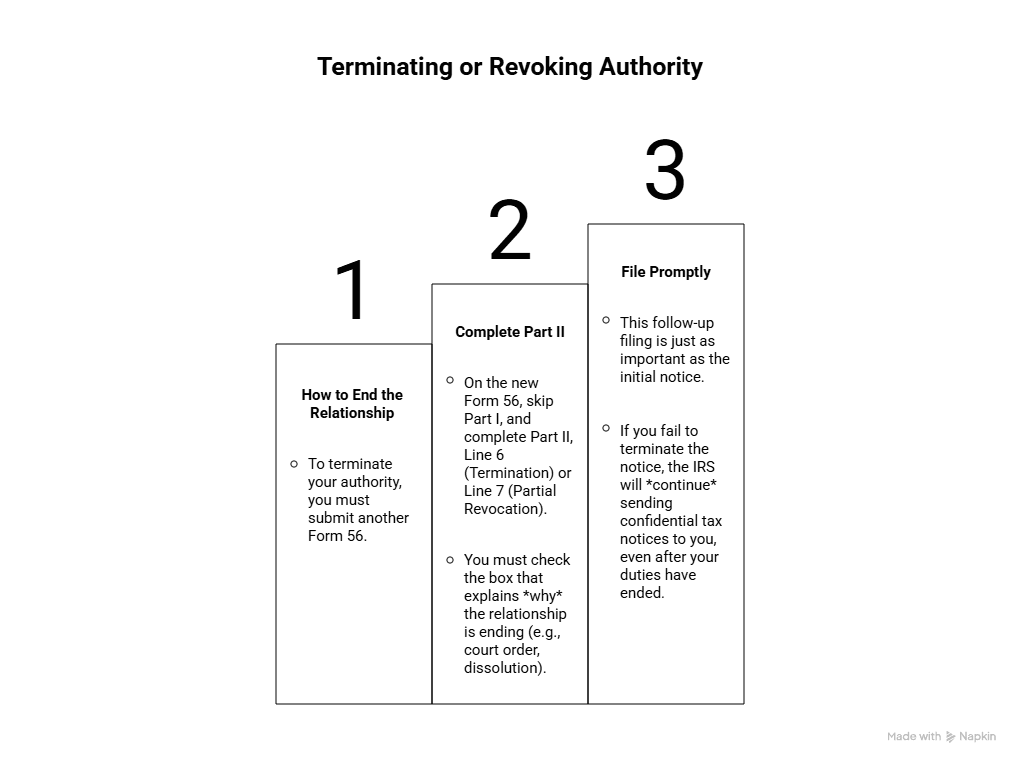

Terminating or Revoking Authority

A fiduciary relationship is ongoing until you formally notify the IRS that your duties have ended.

How to End the Relationship: To terminate your authority, you must submit another Form 56.

Complete Part II: On the new Form 56, skip Part I, and complete Part II, Line 6 (Termination) or Line 7 (Partial Revocation). You must check the box that explains why the relationship is ending (e.g., court order, dissolution).

File Promptly: This follow-up filing is just as important as the initial notice. If you fail to terminate the notice, the IRS will continue sending confidential tax notices to you, even after your duties have ended.

Common Mistakes Founders Make on Form 56

Avoiding these common errors will ensure your filing is processed without delay:

Mistake 1: Confusing Roles: Filing Form 56 as an agent (e.g., a CPA or attorney using a Power of Attorney, Form 2848/8821) instead of a fiduciary (e.g., a Trustee). Form 56 is only for fiduciaries.

Mistake 2: Missing Documentation: Failing to attach the required legal documents (court order, trust instrument, etc.) to prove your authority. The IRS will reject the filing or request follow-up.

Mistake 3: Incorrect Tax Years: Not clearly specifying the tax forms and the exact year(s) or period(s) your notice covers in Line 3.

Mistake 4: Not Terminating the Notice: Forgetting to file a second Form 56 (completing Part II) when the fiduciary duties are over. This leaves the IRS sending confidential notices to an unauthorized or outdated representative.

Frequently Asked Questions (FAQs)

Q: Can I use Form 56 to authorize my CPA or attorney to talk to the IRS?

A: No. Form 56 is only for fiduciaries (those legally responsible for the taxpayer's property or assets). For authorizing a tax professional to inspect or receive your tax information, you must use Form 8821, Tax Information Authorization. For authorizing them to represent you before the IRS, you must use Form 2848, Power of Attorney and Declaration of Representative.

Q: What happens if I forget to file Form 56?

A: The IRS will continue to send important tax-related correspondence to the last known address or representative of the taxpayer. If you are the new fiduciary, you may miss critical deadlines (like responding to an audit notice or paying a tax liability), which could lead to penalties, interest, or missed opportunities.

Q: Where should I mail Form 56?

A: The mailing address depends on the state where the taxpayer (the person for whom you are acting) is located. You must consult the latest IRS instructions for Form 56 to find the correct Service Center address for your specific case.

Form 56 Filing Guide: Notice of Fiduciary Relationship for Founders (Enhanced)

Navigating the complexities of business tax compliance can be daunting for startup founders and finance leads. One form that often flies under the radar—but is essential in certain fiduciary scenarios—is Form 56. This document helps you properly notify the IRS of a fiduciary relationship when a fiduciary is appointed to act on behalf of an individual or entity, which can affect tax responsibilities and reporting.

For founders, understanding when and how to file Form 56 can save your business from costly penalties and ensure smooth tax operations, especially if your company is managing assets or estates, or acting as a trustee.

In this guide, we’ll break down the key aspects of Form 56, explain practical scenarios where it applies to startups and agencies, and provide actionable, step-by-step guidance to file correctly.

What is Form 56?

Form 56, officially titled "Notice Concerning Fiduciary Relationship", is an IRS document used to formally inform the Internal Revenue Service when a fiduciary has been appointed to manage the affairs of a taxpayer.

A fiduciary is any person or entity designated to act on behalf of another individual or entity, such as an:

Executor or Administrator of an estate

Guardian or Conservator

Trustee of a trust

Receiver or Assignee in a bankruptcy

Why Should Founders Care About Form 56?

Legally Designates Authority: It tells the IRS who is authorized to receive confidential tax information and legally represent the taxpayer (the estate, the trust, or the individual).

Redirects Correspondence: It ensures all official IRS notices, communications, and liability statements are sent directly to the appointed fiduciary.

Prevents Compliance Risks: Late or missed filings can lead to IRS correspondence being sent to the wrong, unauthorized party, causing miscommunication, delayed filings, and compliance risks.

Who Needs to File Form 56?

You must file Form 56 if you are the person assuming the fiduciary role (the executor, trustee, etc.) and you are acting for any of the following entities or persons for tax purposes:

A Decedent (e.g., managing the taxes after a founder’s passing)

A Trust (e.g., a business trust, or a founder’s estate planning trust)

A Corporation or Partnership (rare, but possible during liquidation or dissolution)

An Estate (Testate or Intestate)

A person or entity involved in Bankruptcy or Assignment for the Benefit of Creditors

Filing Requirements and Deadlines

Form 56 does not have a set due date like a tax return, but it must be filed as soon as possible after the fiduciary relationship is created.

For Estates: File immediately upon appointment as executor or administrator.

For Trusts/Other: File within 30 days of taking office, being appointed, or receiving the transfer of assets.

💡 Guidance Tip: File Early! The sooner you file, the sooner the IRS sends notices to the correct person. Delays can lead to the IRS sending important tax notices (like a Notice of Deficiency) to the previous address or representative, which can result in missed deadlines and financial penalties.

How to File Form 56

Form 56 must be mailed to the Internal Revenue Service—it cannot be filed electronically. The correct mailing address depends on the address of the person for whom you are acting. Always check the latest IRS instructions for Form 56 for the most current mailing location.

Step-by-Step Guidance for Completing Form 56

Step 1: Complete Part I - Identification

This section is divided into two roles: the Taxpayer and the Fiduciary.

Section | Required Information | Guidance for Founders/Fiduciaries |

Taxpayer's Info | Name, Address, and Identifying Number (TIN/EIN) of the person/entity you are acting for. | This is the Estate, Trust, or Founder who passed away. Use the name exactly as it appears on their tax returns. Include the Decedent's SSN if you are an executor of an estate. |

Fiduciary's Info | Fiduciary’s Name, Address, and TIN. | This is your name (or your company's name if the company is the fiduciary), address, and your personal SSN/ITIN or the company's EIN. |

Step 2: Select Your Authority (Part I, Section A)

You must check only one box on Line 1 that describes the source of your fiduciary authority.

1a/1b: Check these if you were Court-appointed as an executor or administrator of an estate (testate/intestate).

1c: Check this for a Court-appointed guardian or conservator.

1d: Check this if your authority comes from a Valid Trust Instrument and Amendments (most common for business trusts or estate planning trusts).

1e/1f/1g: Cover other, less common scenarios (receiver, bankruptcy, or Other).

Important Dates (Line 2):

If you checked 1a, 1b, or 1d (Estate/Trust), enter the Decedent's date of death.

For all others, enter the date you were appointed, took office, or received the assignment of assets.

Step 3: Define Tax Liabilities (Part I, Section B)

On Line 3, you must check all boxes for the types of taxes the fiduciary relationship covers (e.g., Income, Estate, Gift, etc.).

Crucial: For each type of tax checked, you must also provide the specific Year(s) or Period(s) covered by your notice (e.g., "2023," "2024," or "Dec. 31, 2023," etc.).

Step 4: Attach Supporting Documentation

You must attach proof of your authority. This is critical for the IRS to process the form quickly.

For Court Appointments (1a, 1b, 1c): Attach a certified copy of the court order.

For Trusts (1d): Attach a copy of the valid trust instrument (and any amendments). Note: You may be able to attach an affidavit or certification of trust instead; see the current IRS instructions for details.

For "Other" (1g): Attach a copy of the legal document creating the fiduciary relationship.

Step 5: Sign and Submit

Sign and Date: The fiduciary must personally sign and date the form in Part IV. You must also enter your official title (e.g., "Executor," "Trustee," "President").

Mail: Mail the completed Form 56 and all attachments to the correct IRS address.

Record Keeping: Keep copies of the signed form, all attachments, and proof of mailing (e.g., Certified Mail receipt) for your company's records.

Terminating or Revoking Authority

A fiduciary relationship is ongoing until you formally notify the IRS that your duties have ended.

How to End the Relationship: To terminate your authority, you must submit another Form 56.

Complete Part II: On the new Form 56, skip Part I, and complete Part II, Line 6 (Termination) or Line 7 (Partial Revocation). You must check the box that explains why the relationship is ending (e.g., court order, dissolution).

File Promptly: This follow-up filing is just as important as the initial notice. If you fail to terminate the notice, the IRS will continue sending confidential tax notices to you, even after your duties have ended.

Common Mistakes Founders Make on Form 56

Avoiding these common errors will ensure your filing is processed without delay:

Mistake 1: Confusing Roles: Filing Form 56 as an agent (e.g., a CPA or attorney using a Power of Attorney, Form 2848/8821) instead of a fiduciary (e.g., a Trustee). Form 56 is only for fiduciaries.

Mistake 2: Missing Documentation: Failing to attach the required legal documents (court order, trust instrument, etc.) to prove your authority. The IRS will reject the filing or request follow-up.

Mistake 3: Incorrect Tax Years: Not clearly specifying the tax forms and the exact year(s) or period(s) your notice covers in Line 3.

Mistake 4: Not Terminating the Notice: Forgetting to file a second Form 56 (completing Part II) when the fiduciary duties are over. This leaves the IRS sending confidential notices to an unauthorized or outdated representative.

Frequently Asked Questions (FAQs)

Q: Can I use Form 56 to authorize my CPA or attorney to talk to the IRS?

A: No. Form 56 is only for fiduciaries (those legally responsible for the taxpayer's property or assets). For authorizing a tax professional to inspect or receive your tax information, you must use Form 8821, Tax Information Authorization. For authorizing them to represent you before the IRS, you must use Form 2848, Power of Attorney and Declaration of Representative.

Q: What happens if I forget to file Form 56?

A: The IRS will continue to send important tax-related correspondence to the last known address or representative of the taxpayer. If you are the new fiduciary, you may miss critical deadlines (like responding to an audit notice or paying a tax liability), which could lead to penalties, interest, or missed opportunities.

Q: Where should I mail Form 56?

A: The mailing address depends on the state where the taxpayer (the person for whom you are acting) is located. You must consult the latest IRS instructions for Form 56 to find the correct Service Center address for your specific case.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026