Go Back

Last Updated :

Last Updated :

Feb 2, 2026

Feb 2, 2026

Form 4684: How to Deduct Business Casualties and Thefts

For CEOs, COOs, and heads of finance at startups and growing companies, navigating complex tax forms can feel like a distraction from scaling your business. Yet, understanding the nuances of IRS regulations related to unexpected losses is crucial to optimizing your tax position. One tax form that often comes up but remains underutilized is Form 4684, the IRS’s tool for reporting casualty and theft losses — losses that can significantly impact your business’s bottom line if properly accounted for.

In this comprehensive guide, you will learn exactly when and how to use Form 4684 to deduct business casualties and thefts. We’ll go beyond definitions to focus on practical steps, examples, and considerations tailored for startup founders and finance leaders who want to confidently claim losses while keeping IRS compliance tight and efficient.

What Is Form 4684 and When Should You Use It?

Form 4684, Casualties and Thefts, is the IRS form used to report gains and losses arising from damage, destruction, or theft of property. For businesses, these losses typically involve damage to business assets like inventory, equipment, real estate, or improvements caused by events like fires, storms, vandalism, robberies, or employee theft.

This form becomes relevant when the loss is not fully reimbursed by insurance or any other form of compensation. If you suffer a loss during your business operations, it’s essential to know:

When you are eligible to deduct the loss on your business tax return

How to properly calculate the deductible amount

Which sections of the form to complete and how to report accurately

Use Form 4684 when you have business casualty losses or theft losses that affect your tax liability. These losses can reduce your taxable income — vital for startup cashflow management.

Heads up: Personal casualty losses (on your home or personal property) are restricted by recent tax law changes and usually offer fewer deduction benefits. For your business, however, most qualified losses retain their deductibility.

Eligibility Criteria: What Qualifies as a Business Casualty or Theft Loss?

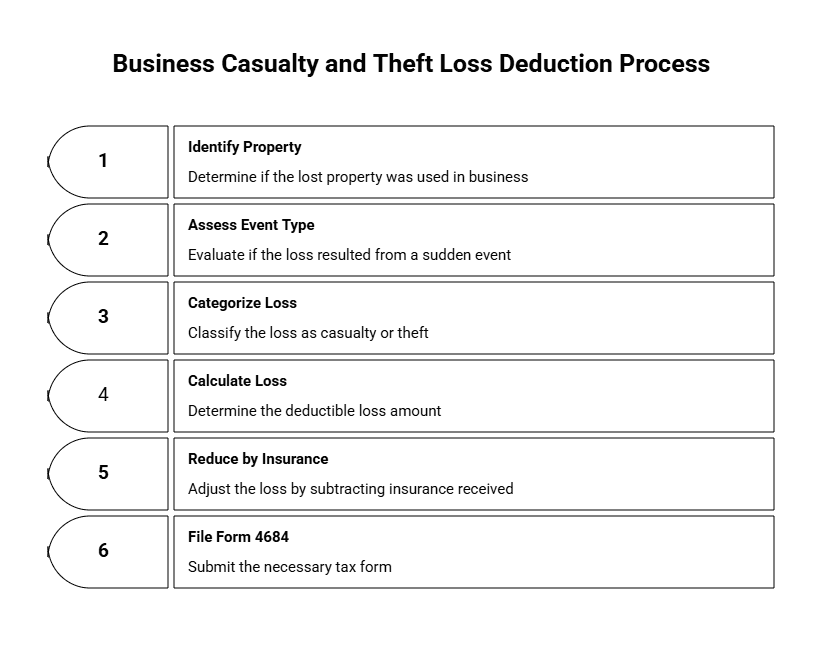

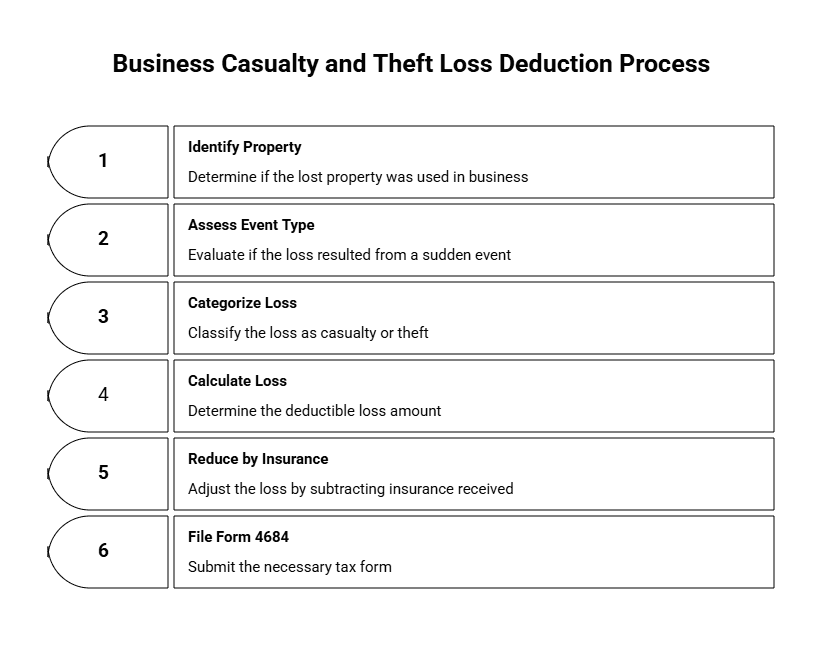

To deduct a casualty or theft loss using Form 4684, the IRS requires that:

The property lost must be used in your business or income-producing activity.

The loss results directly from a sudden, unexpected, or unusual event.

What qualifies as a casualty loss?

Events that can cause deductible casualty losses include:

Natural disasters (fires, floods, hurricanes, tornadoes)

Accidents (vehicle crashes involving business property)

Vandalism or deliberate destruction

Sudden equipment failures triggered by external events

What constitutes a theft loss?

You may deduct theft losses involving:

Robbery, burglary, or break-ins

Employee theft and embezzlement

Fraudulent transfers of company assets

Losses from gradual wear and tear, market losses, or obsolescence are not deductible.

Insurance and Deductible Losses

If your insurance reimburses a portion of your loss, your deduction must be reduced accordingly.

Formula:

Loss = Lesser of (Adjusted Basis, FMV Decline) − Insurance Received

Only the remainder is deductible using Form 4684.

How to Complete Form 4684: A Section-by-Section Guide

Form 4684 includes:

Section A — Personal Use Property (not usually applicable for businesses)

Section B — Business and Income-Producing Property (your focus)

Section C — Special Ponzi scheme-related losses

Step 1: Use Section B

This section is for losses tied to business or income-producing property. Applicable property includes:

Machinery, computers, and office equipment

Business vehicles and delivery vans

Inventory and raw materials

Intellectual property under specific theft circumstances

Step 2: Gather Required Documentation

Organize:

Proof of the event (e.g., police report, photos)

Pre- and post-event valuations of the property

Insurance claims/payout info

Cost basis (original price or adjusted)

Repair and replacement costs

Step 3: Determine the Deductible Loss

Adjusted Basis: Original price less depreciation

FMV Decline: FMV before minus FMV after the casualty

Deduct the lesser of the basis or FMV drop, then subtract insurance recoveries.

Step 4: Fill Out Key Lines

Line 18: Describe the property

Lines 19–22: Provide basis, FMV (before/after), and reimbursement received

Line 23: Compute the tentative loss amount

Line 24–25: Finalize loss after subtracting insurance

Step 5: Report on Business Tax Return

Depending on your structure:

Form 1120 Schedule M for corporations

Form 1065 K-1 for partnerships

Schedule C for sole proprietors

Always double-check that losses are excluded from other schedules to avoid duplication.

For official references, see the IRS’s Casualty, Disaster, and Theft Losses page.

Real-World Examples of Casualty & Theft Loss Claims

Example 1: Fire Damaged Equipment in a Startup Office

Original purchase value: $50,000

FMV before fire: $45,000

FMV after fire: $5,000

Insurance reimbursement: $30,000

Calculation:

FMV loss = $45,000 − $5,000 = $40,000

Deductible loss = Lesser of $50,000 or $40,000 = $40,000 − $30,000 = $10,000

Example 2: Stolen E-commerce Inventory

Inventory cost basis: $15,000

Insurance reimbursement: $8,000

Deductible theft loss = $15,000 − $8,000 = $7,000

Special Rules for Startups and Small Businesses

Qualify for Safe Harbor Elections

The IRS allows certain businesses to apply safe harbor accounting rules:

Small businesses can deduct certain repairs/replacements immediately

Avoids multi-year depreciation treatment

Increases potential short-term tax savings

Disaster Area Relief Options

If your business lies in a federally declared disaster area, additional benefits may apply:

Deduct loss on prior year taxes (carryback) to get a refund

Extended IRS filing timelines

Stay updated by checking announcements directly on IRS.gov.

Frequently Asked Questions about Form 4684

Question | Quick Answer |

Do I need to itemize deductions to claim business casualty losses? | No. These go on your business return, not Schedule A. |

Can I deduct a loss if I don’t carry insurance? | Yes, for the portion you were not reimbursed. |

What if insurance exceeds my asset basis? | Excess insurance may create a gain; report on your return. |

How are multiple losses handled in the same year? | Complete a separate worksheet for each, then consolidate. |

Can I deduct stolen intellectual property? | Often no, unless tangible value loss can be proven. |

Best Practices for Maximizing Casualty and Theft Deductions

Act quickly after a loss: Document everything — reports, images, asset records.

Engage tax professionals early: Don’t wait until tax season.

Integrate with strategic planning: Casualty losses can improve tax posture when paired with loss carryovers.

Audit your insurance annually: Know your coverage gaps and business interruption risks.

Leverage tech integrations: Use asset tracking software and accounting tools to stay ahead of documentation.

Maximize Business Resilience with Form 4684

Using Form 4684 effectively allows startup to turn business casualties into deductible tax savings that protect working capital and drive strategic advantage. With the right documentation, planning, and guidance, your startup can recover faster — and smarter — from losses.

Whether you’re facing theft, fire, or other setbacks, don’t miss the tax opportunity this form provides. To further reduce your company’s tax burden, understand how to save money on taxes for small businesses.

For official instructions and policy updates, visit the IRS’s Casualty, Disaster, and Theft Losses Information.

For CEOs, COOs, and heads of finance at startups and growing companies, navigating complex tax forms can feel like a distraction from scaling your business. Yet, understanding the nuances of IRS regulations related to unexpected losses is crucial to optimizing your tax position. One tax form that often comes up but remains underutilized is Form 4684, the IRS’s tool for reporting casualty and theft losses — losses that can significantly impact your business’s bottom line if properly accounted for.

In this comprehensive guide, you will learn exactly when and how to use Form 4684 to deduct business casualties and thefts. We’ll go beyond definitions to focus on practical steps, examples, and considerations tailored for startup founders and finance leaders who want to confidently claim losses while keeping IRS compliance tight and efficient.

What Is Form 4684 and When Should You Use It?

Form 4684, Casualties and Thefts, is the IRS form used to report gains and losses arising from damage, destruction, or theft of property. For businesses, these losses typically involve damage to business assets like inventory, equipment, real estate, or improvements caused by events like fires, storms, vandalism, robberies, or employee theft.

This form becomes relevant when the loss is not fully reimbursed by insurance or any other form of compensation. If you suffer a loss during your business operations, it’s essential to know:

When you are eligible to deduct the loss on your business tax return

How to properly calculate the deductible amount

Which sections of the form to complete and how to report accurately

Use Form 4684 when you have business casualty losses or theft losses that affect your tax liability. These losses can reduce your taxable income — vital for startup cashflow management.

Heads up: Personal casualty losses (on your home or personal property) are restricted by recent tax law changes and usually offer fewer deduction benefits. For your business, however, most qualified losses retain their deductibility.

Eligibility Criteria: What Qualifies as a Business Casualty or Theft Loss?

To deduct a casualty or theft loss using Form 4684, the IRS requires that:

The property lost must be used in your business or income-producing activity.

The loss results directly from a sudden, unexpected, or unusual event.

What qualifies as a casualty loss?

Events that can cause deductible casualty losses include:

Natural disasters (fires, floods, hurricanes, tornadoes)

Accidents (vehicle crashes involving business property)

Vandalism or deliberate destruction

Sudden equipment failures triggered by external events

What constitutes a theft loss?

You may deduct theft losses involving:

Robbery, burglary, or break-ins

Employee theft and embezzlement

Fraudulent transfers of company assets

Losses from gradual wear and tear, market losses, or obsolescence are not deductible.

Insurance and Deductible Losses

If your insurance reimburses a portion of your loss, your deduction must be reduced accordingly.

Formula:

Loss = Lesser of (Adjusted Basis, FMV Decline) − Insurance Received

Only the remainder is deductible using Form 4684.

How to Complete Form 4684: A Section-by-Section Guide

Form 4684 includes:

Section A — Personal Use Property (not usually applicable for businesses)

Section B — Business and Income-Producing Property (your focus)

Section C — Special Ponzi scheme-related losses

Step 1: Use Section B

This section is for losses tied to business or income-producing property. Applicable property includes:

Machinery, computers, and office equipment

Business vehicles and delivery vans

Inventory and raw materials

Intellectual property under specific theft circumstances

Step 2: Gather Required Documentation

Organize:

Proof of the event (e.g., police report, photos)

Pre- and post-event valuations of the property

Insurance claims/payout info

Cost basis (original price or adjusted)

Repair and replacement costs

Step 3: Determine the Deductible Loss

Adjusted Basis: Original price less depreciation

FMV Decline: FMV before minus FMV after the casualty

Deduct the lesser of the basis or FMV drop, then subtract insurance recoveries.

Step 4: Fill Out Key Lines

Line 18: Describe the property

Lines 19–22: Provide basis, FMV (before/after), and reimbursement received

Line 23: Compute the tentative loss amount

Line 24–25: Finalize loss after subtracting insurance

Step 5: Report on Business Tax Return

Depending on your structure:

Form 1120 Schedule M for corporations

Form 1065 K-1 for partnerships

Schedule C for sole proprietors

Always double-check that losses are excluded from other schedules to avoid duplication.

For official references, see the IRS’s Casualty, Disaster, and Theft Losses page.

Real-World Examples of Casualty & Theft Loss Claims

Example 1: Fire Damaged Equipment in a Startup Office

Original purchase value: $50,000

FMV before fire: $45,000

FMV after fire: $5,000

Insurance reimbursement: $30,000

Calculation:

FMV loss = $45,000 − $5,000 = $40,000

Deductible loss = Lesser of $50,000 or $40,000 = $40,000 − $30,000 = $10,000

Example 2: Stolen E-commerce Inventory

Inventory cost basis: $15,000

Insurance reimbursement: $8,000

Deductible theft loss = $15,000 − $8,000 = $7,000

Special Rules for Startups and Small Businesses

Qualify for Safe Harbor Elections

The IRS allows certain businesses to apply safe harbor accounting rules:

Small businesses can deduct certain repairs/replacements immediately

Avoids multi-year depreciation treatment

Increases potential short-term tax savings

Disaster Area Relief Options

If your business lies in a federally declared disaster area, additional benefits may apply:

Deduct loss on prior year taxes (carryback) to get a refund

Extended IRS filing timelines

Stay updated by checking announcements directly on IRS.gov.

Frequently Asked Questions about Form 4684

Question | Quick Answer |

Do I need to itemize deductions to claim business casualty losses? | No. These go on your business return, not Schedule A. |

Can I deduct a loss if I don’t carry insurance? | Yes, for the portion you were not reimbursed. |

What if insurance exceeds my asset basis? | Excess insurance may create a gain; report on your return. |

How are multiple losses handled in the same year? | Complete a separate worksheet for each, then consolidate. |

Can I deduct stolen intellectual property? | Often no, unless tangible value loss can be proven. |

Best Practices for Maximizing Casualty and Theft Deductions

Act quickly after a loss: Document everything — reports, images, asset records.

Engage tax professionals early: Don’t wait until tax season.

Integrate with strategic planning: Casualty losses can improve tax posture when paired with loss carryovers.

Audit your insurance annually: Know your coverage gaps and business interruption risks.

Leverage tech integrations: Use asset tracking software and accounting tools to stay ahead of documentation.

Maximize Business Resilience with Form 4684

Using Form 4684 effectively allows startup to turn business casualties into deductible tax savings that protect working capital and drive strategic advantage. With the right documentation, planning, and guidance, your startup can recover faster — and smarter — from losses.

Whether you’re facing theft, fire, or other setbacks, don’t miss the tax opportunity this form provides. To further reduce your company’s tax burden, understand how to save money on taxes for small businesses.

For official instructions and policy updates, visit the IRS’s Casualty, Disaster, and Theft Losses Information.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026