Go Back

Last Updated :

Last Updated :

Jan 26, 2026

Jan 26, 2026

Form 3800: How to Claim the General Business Credit in 4 steps

When growing a startup or managing an e-commerce company, minimizing your tax burden is key to preserving cash flow and fueling further innovation. One powerful but sometimes overlooked tax tool in your arsenal is the General Business Credit, claimed via Form 3800.

This credit bundles together dozens of component business credits to help reduce your federal tax liability. As a founder or finance lead, understanding how to properly claim Form 3800 can unlock significant savings and simplify your tax filing process — all while keeping your focus where it matters most: running and scaling your business.

Understanding Form 3800 and the General Business Credit

At its core, Form 3800 is the IRS form businesses use to consolidate and claim the General Business Credit (GBC). The GBC is not a single credit but a composite credit made up of over 30 individual component credits, each targeting specific business activities or investments. These include, but aren’t limited to:

The Research & Development (R&D) Credit

Investment Credit

Work Opportunity Credit

Disabled Access Credit

Employer-Provided Childcare Credit

Each of these credits has its own eligibility rules, separate IRS forms, and calculations. Form 3800 aggregates these so you can claim your total allowed credit in one place, simplifying the filing process.

Why Use Form 3800?

As a founder, the main benefit is business tax efficiency. The General Business Credit can reduce your total tax liability dollar-for-dollar—not just your taxable income—potentially saving you thousands or more annually. It’s especially relevant to startups active in innovation, hiring underrepresented workers, or investing in energy-saving property.

Form 3800 officially communicates your total GBC amount to the IRS. Since these credits are generally non-refundable, the form also helps you track unused credits that can be carried back to prior tax years or forward to future years — essential for startups that might not yet have large tax bills to fully use the credits immediately.

How Does the General Business Credit Work?

Nonrefundable Credit: The GBC can reduce your federal income tax owed down to zero, but it won’t generate a refund beyond your tax liability.

Carrybacks/Carryforwards: If you have unused credits in a tax year, IRS rules allow carrying them back one year or forward 20 years, to maximize credit use.

Both features make it a strategic tax planning tool for startups with fluctuating profits.

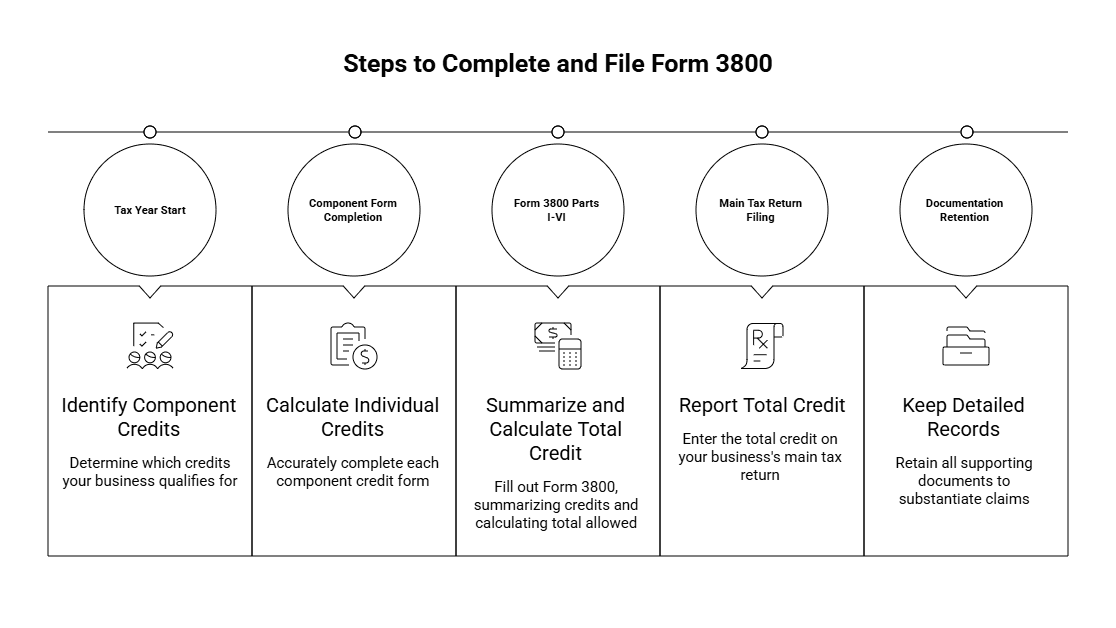

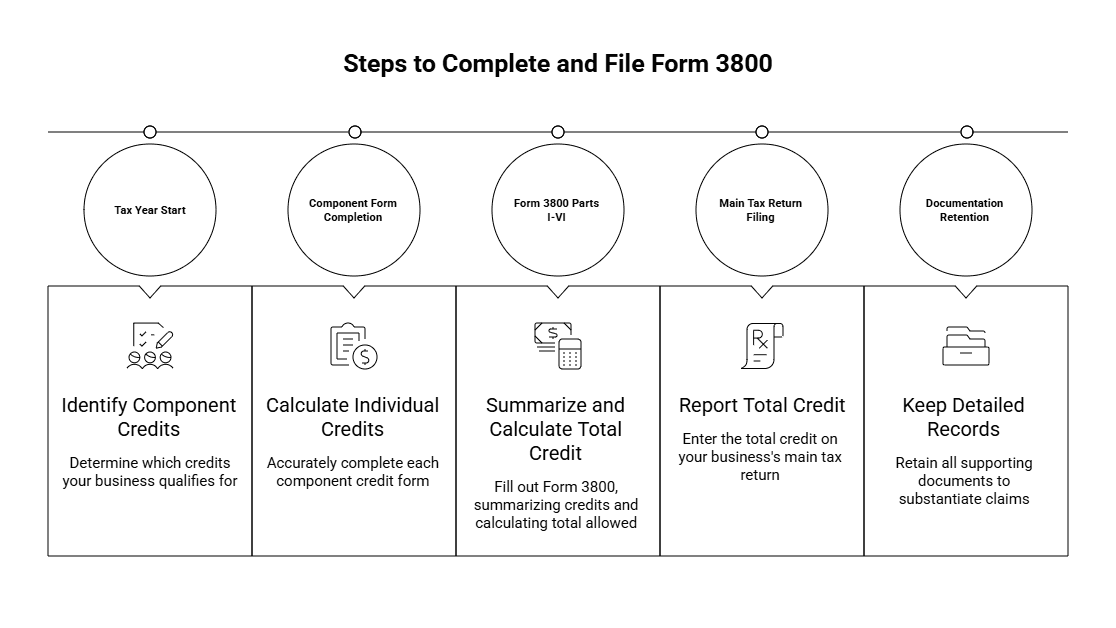

How to Complete and File Form 3800

Properly completing Form 3800 is crucial to ensure you claim the maximum credit without triggering IRS errors or audits. Here’s an operational breakdown tailored for the founder or finance team:

1. Gather Component Credits and Supporting Forms

To start, identify which component credits your business qualifies for in the current tax year. For example, if your tech startup invested heavily in R&D, you should file Form 6765 to calculate the R&D credit portion. Similarly, credits like the Work Opportunity Credit require Form 5884.

Each component has its own form and calculations. Make sure these are accurately completed before moving to Form 3800, where you'll summarize them.

2. Fill Out Form 3800 Parts I to VI

Part | Description |

I | Current Year Credit: Sum all current-year credits from components. |

II | Tentative Credit Limit: Calculates max credit allowed based on your tax liability. |

III | Carryback of Unused Credit: Apply credits to previous tax year(s). |

IV | Carryforward of Unused Credit: Move unused credits forward. |

V | Total Credit: Combines current, carryback, and carryforward credits allowed. |

VI | Consent to Extend Carryback Period (if applicable). |

Ensure each section is reviewed carefully and figures cross-checked with supporting component forms to avoid mistakes.

3. Enter Total Credit on Your Main Tax Return

Once Form 3800 is complete, the total amount allowed will be reported on your business's tax return:

C Corporations: Form 1120

Partnerships: Form 1065 with credits flowing through to partners

S Corporations: Form 1120S with pass-through components

Check IRS rules specific to your business entity to file correctly.

4. Retain Detailed Documentation

Because the GBC encompasses many credits with different supporting documents, keep clear records to substantiate your claims in case of IRS inquiry. This could include payroll records for workforce credits, invoices for equipment investments, or R&D expense logs.

Who Qualifies and What Limitations to Expect

Form 3800 opens access to lucrative tax credits, but several limitations and eligibility nuances impact your claimed amount.

Eligibility

Qualified Activities: Each credit applies only to specific expenses or investments—e.g., qualified R&D for the R&D credit, or hiring certain groups for the Work Opportunity Credit.

No Double-Dipping: You can’t claim the same expense under multiple credits.

Entity Type Matters: C Corps claim directly; partnerships and S Corps pass credits to owners.

Restrictions

Tentative Credit Limit: Part II of Form 3800 ensures you do not claim more than your tax liability allows.

Nonrefundable Nature: These credits reduce tax owed but won’t result in a refund if you're already at zero liability.

AMT Impact: Some credits are limited by the Alternative Minimum Tax (AMT), which may be triggered by certain startup capital structures.

Carryback Consent Rules: Extending carrybacks typically requires Part VI and may need IRS approval.

Tax Planning with Carrybacks and Carryforwards

Startups often experience profit volatility, making carrybacks and carryforwards essential tools to preserve credit value over time.

Term | Description | Startup Benefit |

Carryback | Apply excess credits to reduce prior year taxes | Unlocks retroactive refunds |

Carryforward | Apply excess credits to future taxes (up to 20 years) | Preserves value until profits increase |

Form 3800 Parts III and IV document these adjustments—valuable levers for CFOs and finance teams managing growth-phase tax strategy.

Considerations by Business Type

C Corporations

File Form 3800 directly with Form 1120.

Potential for a large impact if qualifying for credits like R&D.

Review carryover opportunities in loss years.

Partnerships & S Corporations

Credits pass through on K-1 forms to owners.

Individual partners or shareholders claim their share of their personal returns.

Coordinated documentation is required to prevent errors.

Tax-Exempt Organizations

Limited eligibility, usually restricted to certain refundable or unrelated activity credits.

Consult IRS policies before filing credits.

Practical Tips to Maximize Your Business Tax Credits

Start Tracking Early: Segment expenses (e.g., R&D, hiring, energy improvements) throughout the year.

Coordinate Credits & Deductions: Maximize outcomes by aligning GBC claims with other deductions while avoiding overlaps.

Forecast Credit Use: Include expected credits in your quarterly tax planning to improve cash management.

Tap Founder-Focused Tax Services: Work with providers experienced in startup credit strategies, such as Haven’s Business Tax Services.

Stay in Sync: Align your controller or outsourced finance team with tax planning objectives to ensure full credit utilization.

Why Form 3800 Belongs in Your Tax Toolkit

Understanding Form 3800 to claim the General Business Credit is a meaningful way for founders to reduce tax expenses and improve cash flow. Here’s what to remember:

It consolidates over 30 IRS business credits into one process.

It reduces tax liability dollar-for-dollar (but won’t generate refunds).

Carrybacks and carryforwards can extend your tax advantage over multiple years.

Accurate filing depends on knowing your business entity type and gathering solid documentation.

For authoritative IRS guidance on Form 3800 and its component credits, see the IRS page on General Business Credit.

When growing a startup or managing an e-commerce company, minimizing your tax burden is key to preserving cash flow and fueling further innovation. One powerful but sometimes overlooked tax tool in your arsenal is the General Business Credit, claimed via Form 3800.

This credit bundles together dozens of component business credits to help reduce your federal tax liability. As a founder or finance lead, understanding how to properly claim Form 3800 can unlock significant savings and simplify your tax filing process — all while keeping your focus where it matters most: running and scaling your business.

Understanding Form 3800 and the General Business Credit

At its core, Form 3800 is the IRS form businesses use to consolidate and claim the General Business Credit (GBC). The GBC is not a single credit but a composite credit made up of over 30 individual component credits, each targeting specific business activities or investments. These include, but aren’t limited to:

The Research & Development (R&D) Credit

Investment Credit

Work Opportunity Credit

Disabled Access Credit

Employer-Provided Childcare Credit

Each of these credits has its own eligibility rules, separate IRS forms, and calculations. Form 3800 aggregates these so you can claim your total allowed credit in one place, simplifying the filing process.

Why Use Form 3800?

As a founder, the main benefit is business tax efficiency. The General Business Credit can reduce your total tax liability dollar-for-dollar—not just your taxable income—potentially saving you thousands or more annually. It’s especially relevant to startups active in innovation, hiring underrepresented workers, or investing in energy-saving property.

Form 3800 officially communicates your total GBC amount to the IRS. Since these credits are generally non-refundable, the form also helps you track unused credits that can be carried back to prior tax years or forward to future years — essential for startups that might not yet have large tax bills to fully use the credits immediately.

How Does the General Business Credit Work?

Nonrefundable Credit: The GBC can reduce your federal income tax owed down to zero, but it won’t generate a refund beyond your tax liability.

Carrybacks/Carryforwards: If you have unused credits in a tax year, IRS rules allow carrying them back one year or forward 20 years, to maximize credit use.

Both features make it a strategic tax planning tool for startups with fluctuating profits.

How to Complete and File Form 3800

Properly completing Form 3800 is crucial to ensure you claim the maximum credit without triggering IRS errors or audits. Here’s an operational breakdown tailored for the founder or finance team:

1. Gather Component Credits and Supporting Forms

To start, identify which component credits your business qualifies for in the current tax year. For example, if your tech startup invested heavily in R&D, you should file Form 6765 to calculate the R&D credit portion. Similarly, credits like the Work Opportunity Credit require Form 5884.

Each component has its own form and calculations. Make sure these are accurately completed before moving to Form 3800, where you'll summarize them.

2. Fill Out Form 3800 Parts I to VI

Part | Description |

I | Current Year Credit: Sum all current-year credits from components. |

II | Tentative Credit Limit: Calculates max credit allowed based on your tax liability. |

III | Carryback of Unused Credit: Apply credits to previous tax year(s). |

IV | Carryforward of Unused Credit: Move unused credits forward. |

V | Total Credit: Combines current, carryback, and carryforward credits allowed. |

VI | Consent to Extend Carryback Period (if applicable). |

Ensure each section is reviewed carefully and figures cross-checked with supporting component forms to avoid mistakes.

3. Enter Total Credit on Your Main Tax Return

Once Form 3800 is complete, the total amount allowed will be reported on your business's tax return:

C Corporations: Form 1120

Partnerships: Form 1065 with credits flowing through to partners

S Corporations: Form 1120S with pass-through components

Check IRS rules specific to your business entity to file correctly.

4. Retain Detailed Documentation

Because the GBC encompasses many credits with different supporting documents, keep clear records to substantiate your claims in case of IRS inquiry. This could include payroll records for workforce credits, invoices for equipment investments, or R&D expense logs.

Who Qualifies and What Limitations to Expect

Form 3800 opens access to lucrative tax credits, but several limitations and eligibility nuances impact your claimed amount.

Eligibility

Qualified Activities: Each credit applies only to specific expenses or investments—e.g., qualified R&D for the R&D credit, or hiring certain groups for the Work Opportunity Credit.

No Double-Dipping: You can’t claim the same expense under multiple credits.

Entity Type Matters: C Corps claim directly; partnerships and S Corps pass credits to owners.

Restrictions

Tentative Credit Limit: Part II of Form 3800 ensures you do not claim more than your tax liability allows.

Nonrefundable Nature: These credits reduce tax owed but won’t result in a refund if you're already at zero liability.

AMT Impact: Some credits are limited by the Alternative Minimum Tax (AMT), which may be triggered by certain startup capital structures.

Carryback Consent Rules: Extending carrybacks typically requires Part VI and may need IRS approval.

Tax Planning with Carrybacks and Carryforwards

Startups often experience profit volatility, making carrybacks and carryforwards essential tools to preserve credit value over time.

Term | Description | Startup Benefit |

Carryback | Apply excess credits to reduce prior year taxes | Unlocks retroactive refunds |

Carryforward | Apply excess credits to future taxes (up to 20 years) | Preserves value until profits increase |

Form 3800 Parts III and IV document these adjustments—valuable levers for CFOs and finance teams managing growth-phase tax strategy.

Considerations by Business Type

C Corporations

File Form 3800 directly with Form 1120.

Potential for a large impact if qualifying for credits like R&D.

Review carryover opportunities in loss years.

Partnerships & S Corporations

Credits pass through on K-1 forms to owners.

Individual partners or shareholders claim their share of their personal returns.

Coordinated documentation is required to prevent errors.

Tax-Exempt Organizations

Limited eligibility, usually restricted to certain refundable or unrelated activity credits.

Consult IRS policies before filing credits.

Practical Tips to Maximize Your Business Tax Credits

Start Tracking Early: Segment expenses (e.g., R&D, hiring, energy improvements) throughout the year.

Coordinate Credits & Deductions: Maximize outcomes by aligning GBC claims with other deductions while avoiding overlaps.

Forecast Credit Use: Include expected credits in your quarterly tax planning to improve cash management.

Tap Founder-Focused Tax Services: Work with providers experienced in startup credit strategies, such as Haven’s Business Tax Services.

Stay in Sync: Align your controller or outsourced finance team with tax planning objectives to ensure full credit utilization.

Why Form 3800 Belongs in Your Tax Toolkit

Understanding Form 3800 to claim the General Business Credit is a meaningful way for founders to reduce tax expenses and improve cash flow. Here’s what to remember:

It consolidates over 30 IRS business credits into one process.

It reduces tax liability dollar-for-dollar (but won’t generate refunds).

Carrybacks and carryforwards can extend your tax advantage over multiple years.

Accurate filing depends on knowing your business entity type and gathering solid documentation.

For authoritative IRS guidance on Form 3800 and its component credits, see the IRS page on General Business Credit.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026