Go Back

Last Updated :

Last Updated :

Dec 19, 2025

Dec 19, 2025

Form 2441 Guide: Learn How to Claim the Child and Dependent Care Tax Credit

As a founder running a startup or e-commerce business, every dollar counts, especially when it comes to taxes. One tax provision many founders overlook is the Form 2441, which helps you claim the Child and Dependent Care Tax Credit. This credit can directly reduce your tax bill by offsetting expenses associated with child or dependent care, a relevant consideration if you juggle running a company while caring for children or dependents.

This guide demystifies Form 2441, from eligibility criteria to step-by-step, explaining how you can leverage it to ease your tax burden and optimize cash flow.

What Is Form 2441 and Why It Matters for Founders

Form 2441 is the IRS form used to claim the Child and Dependent Care Tax Credit. This credit helps reduce your tax bill if you paid someone to care for a qualifying child under age 13 or an incapacitated dependent, allowing you to work or look for work. For founders managing tight schedules and budgets, leveraging this credit can be a strategic move:

Reduce your income tax liability through a dollar-for-dollar credit

Offset care expenses that enable you to operate or scale your business

Preserve cash flow for hiring, runway, or product development

Many founders miss this opportunity because they don’t understand what expenses qualify or how to properly file Form 2441. This guide walks you through the process, highlighting key considerations so you can make informed tax decisions. For broader context on where this fits in your financial stack, check out our Tax Guide for Founders.

Who Qualifies for the Child and Dependent Care Tax Credit?

Qualifying Expenses

Expenses must be work-related to qualify. Eligible payments include:

Daycare centers

Nannies, babysitters, or in-home caregivers

After-school programs

Summer day camps (overnight camps do not qualify)

Care for a spouse or dependent unable to self-care

Qualifying Dependents

Dependent Type | Eligibility |

Child under 13 | Must live with you for more than half the year |

Spouse or adult dependent | Must be physically/mentally incapable of self-care and live with you more than half the year |

Earned Income Requirement

You (and your spouse, if filing jointly) must have earned income — wages or self-employment. Exceptions apply for full-time students or individuals incapable of self-care.

Credit Amount

The credit equals 20%–35% of qualified expenses, depending on income, up to:

$3,000 for one dependent

$6,000 for two or more

How to Fill Out Form 2441: Step-By-Step

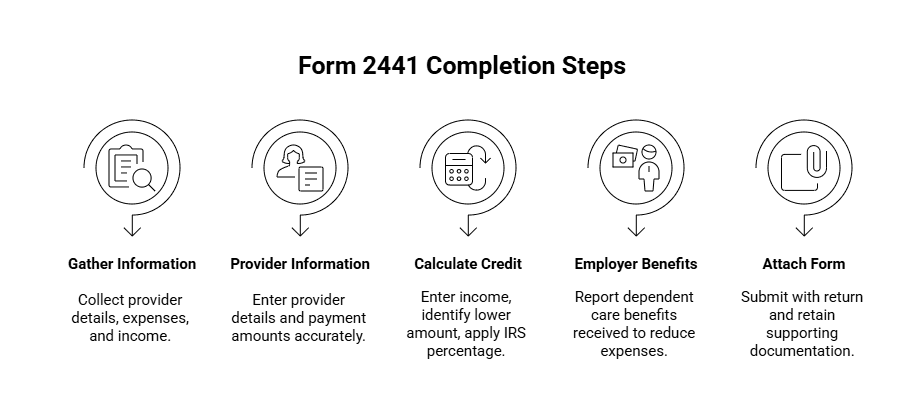

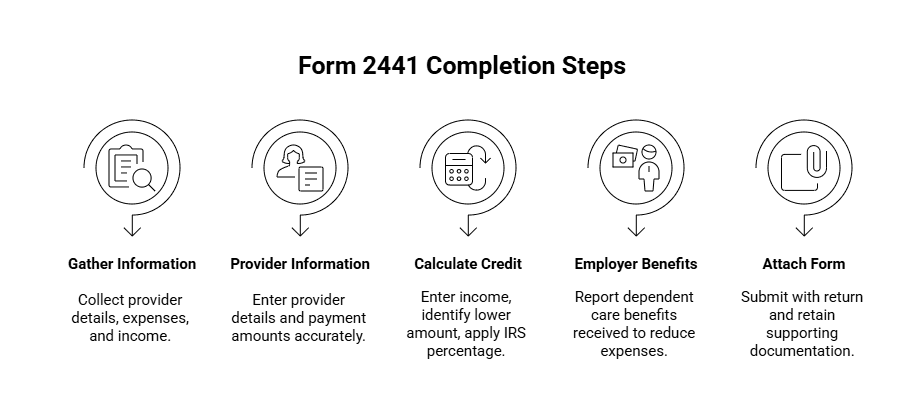

Step 1: Gather Required Information

Care provider name, address, and TIN/SSN

Total paid expenses

Earned income amounts (you and spouse, if MFJ)

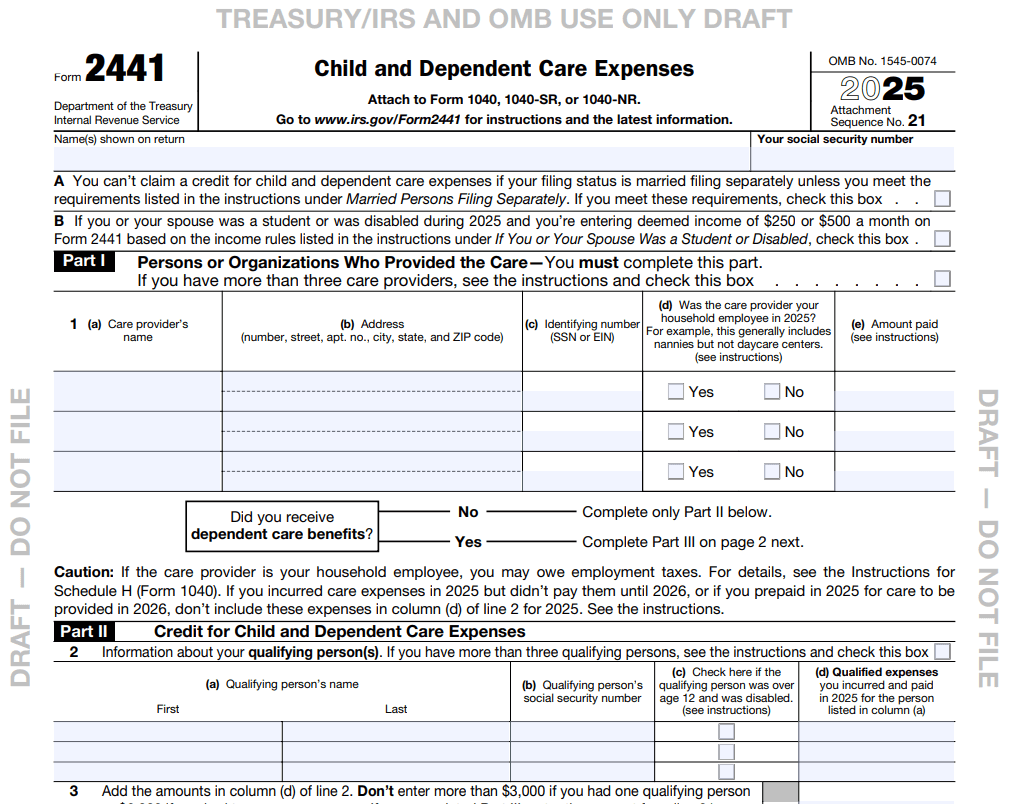

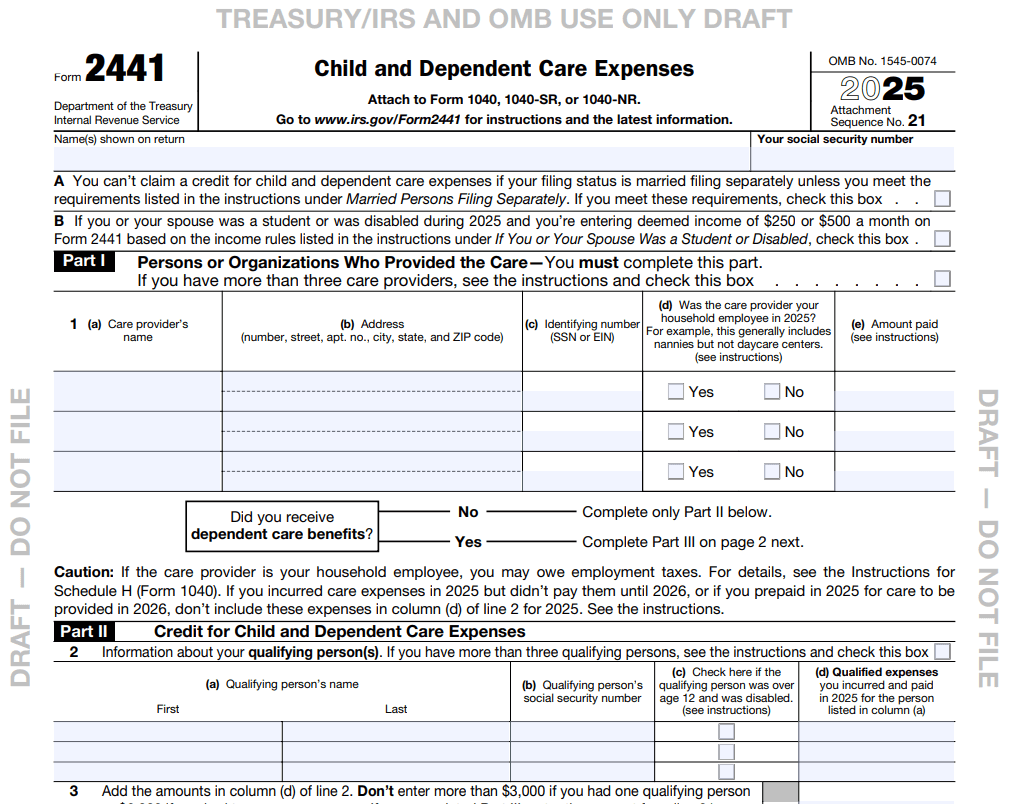

Step 2: Complete Part I – Care Provider Information

Enter each provider’s details and the amount paid. Double-check the TIN — this is one of the most common audit triggers.

Step 3: Complete Part II – Calculating the Credit

Enter your earned income (and spouse’s, if applicable)

Identify the lower earned income amount

Apply the IRS percentage from the income table

Multiply by your qualified care expenses

Step 4: Complete Part III – Employer-Provided Benefits

If you received dependent care benefits (like a dependent care FSA), report them. These reduce the expenses eligible for the credit.

Step 5: Attach Form 2441 to Your Form 1040

Submit with your personal return and retain receipts, invoices, and documentation.

Need help navigating complex founder-specific scenarios? Explore our Business Tax Services.

Key Considerations & Common Mistakes for Founders

1. Interactions With R&D Credits and Other Incentives

Yes — you can claim both the Child and Dependent Care Credit and the R&D credit. Coordinated tax planning ensures you leverage both fully.

2. Documentation Is Everything

Keep:

Provider receipts

Cancelled checks

Written agreements

Proof of dependence or disability where applicable

3. Don’t Double Count Expenses

If you use a dependent care FSA, those expenses are already tax-advantaged. You can’t claim the same costs again for another tax benefit.

4. Ineligible Payments

Many filings get rejected due to confusion around these rules:

Payments to your spouse

Payments to your own child under 19

Overnight camps

General household services (cleaning, cooking, etc.)

5. Spouse Income Rule

If married filing jointly and your spouse has no earned income — and is not a student or incapacitated — you cannot claim the credit.

Resources to Support Your Filing

Resource | How it Helps |

IRS Instructions | Official worksheets + examples: IRS Child and Dependent Care Credit |

Tax Software | Step-by-step guidance minimizes errors |

Professional Support | Startup-focused tax advisors help maximize credits and cash flow |

Why Form 2441 Matters for Founders

The Child and Dependent Care Tax Credit is a powerful tool for founders balancing the realities of building a company and caring for a family. Completing Form 2441 correctly helps you:

Reduce your tax bill

Improve annual cash flow

Reinvest savings where they matter most — your business

At Haven, we help founders navigate these decisions with clarity, accuracy, and speed.

As a founder running a startup or e-commerce business, every dollar counts, especially when it comes to taxes. One tax provision many founders overlook is the Form 2441, which helps you claim the Child and Dependent Care Tax Credit. This credit can directly reduce your tax bill by offsetting expenses associated with child or dependent care, a relevant consideration if you juggle running a company while caring for children or dependents.

This guide demystifies Form 2441, from eligibility criteria to step-by-step, explaining how you can leverage it to ease your tax burden and optimize cash flow.

What Is Form 2441 and Why It Matters for Founders

Form 2441 is the IRS form used to claim the Child and Dependent Care Tax Credit. This credit helps reduce your tax bill if you paid someone to care for a qualifying child under age 13 or an incapacitated dependent, allowing you to work or look for work. For founders managing tight schedules and budgets, leveraging this credit can be a strategic move:

Reduce your income tax liability through a dollar-for-dollar credit

Offset care expenses that enable you to operate or scale your business

Preserve cash flow for hiring, runway, or product development

Many founders miss this opportunity because they don’t understand what expenses qualify or how to properly file Form 2441. This guide walks you through the process, highlighting key considerations so you can make informed tax decisions. For broader context on where this fits in your financial stack, check out our Tax Guide for Founders.

Who Qualifies for the Child and Dependent Care Tax Credit?

Qualifying Expenses

Expenses must be work-related to qualify. Eligible payments include:

Daycare centers

Nannies, babysitters, or in-home caregivers

After-school programs

Summer day camps (overnight camps do not qualify)

Care for a spouse or dependent unable to self-care

Qualifying Dependents

Dependent Type | Eligibility |

Child under 13 | Must live with you for more than half the year |

Spouse or adult dependent | Must be physically/mentally incapable of self-care and live with you more than half the year |

Earned Income Requirement

You (and your spouse, if filing jointly) must have earned income — wages or self-employment. Exceptions apply for full-time students or individuals incapable of self-care.

Credit Amount

The credit equals 20%–35% of qualified expenses, depending on income, up to:

$3,000 for one dependent

$6,000 for two or more

How to Fill Out Form 2441: Step-By-Step

Step 1: Gather Required Information

Care provider name, address, and TIN/SSN

Total paid expenses

Earned income amounts (you and spouse, if MFJ)

Step 2: Complete Part I – Care Provider Information

Enter each provider’s details and the amount paid. Double-check the TIN — this is one of the most common audit triggers.

Step 3: Complete Part II – Calculating the Credit

Enter your earned income (and spouse’s, if applicable)

Identify the lower earned income amount

Apply the IRS percentage from the income table

Multiply by your qualified care expenses

Step 4: Complete Part III – Employer-Provided Benefits

If you received dependent care benefits (like a dependent care FSA), report them. These reduce the expenses eligible for the credit.

Step 5: Attach Form 2441 to Your Form 1040

Submit with your personal return and retain receipts, invoices, and documentation.

Need help navigating complex founder-specific scenarios? Explore our Business Tax Services.

Key Considerations & Common Mistakes for Founders

1. Interactions With R&D Credits and Other Incentives

Yes — you can claim both the Child and Dependent Care Credit and the R&D credit. Coordinated tax planning ensures you leverage both fully.

2. Documentation Is Everything

Keep:

Provider receipts

Cancelled checks

Written agreements

Proof of dependence or disability where applicable

3. Don’t Double Count Expenses

If you use a dependent care FSA, those expenses are already tax-advantaged. You can’t claim the same costs again for another tax benefit.

4. Ineligible Payments

Many filings get rejected due to confusion around these rules:

Payments to your spouse

Payments to your own child under 19

Overnight camps

General household services (cleaning, cooking, etc.)

5. Spouse Income Rule

If married filing jointly and your spouse has no earned income — and is not a student or incapacitated — you cannot claim the credit.

Resources to Support Your Filing

Resource | How it Helps |

IRS Instructions | Official worksheets + examples: IRS Child and Dependent Care Credit |

Tax Software | Step-by-step guidance minimizes errors |

Professional Support | Startup-focused tax advisors help maximize credits and cash flow |

Why Form 2441 Matters for Founders

The Child and Dependent Care Tax Credit is a powerful tool for founders balancing the realities of building a company and caring for a family. Completing Form 2441 correctly helps you:

Reduce your tax bill

Improve annual cash flow

Reinvest savings where they matter most — your business

At Haven, we help founders navigate these decisions with clarity, accuracy, and speed.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026