Go Back

Last Updated :

Last Updated :

Dec 11, 2025

Dec 11, 2025

Form 2210 Guide: How to Calculate and Avoid Underpayment Penalties

For founders steering startups, agencies, or e-commerce ventures, managing business finances involves more than just tracking revenue and expenses. Understanding tax obligations and preemptively addressing penalties is crucial to preserve cash flow and focus on growth. One tax form founders should be familiar with is Form 2210, which helps you calculate and potentially avoid penalties related to underpayment of estimated taxes.

This comprehensive guide unpacks Form 2210 in practical terms—what it is, when it applies, how to calculate your penalty, and strategies to avoid or reduce it. We’ll also share pathways where founders can optimize tax planning effectively without disrupting your core business activities.

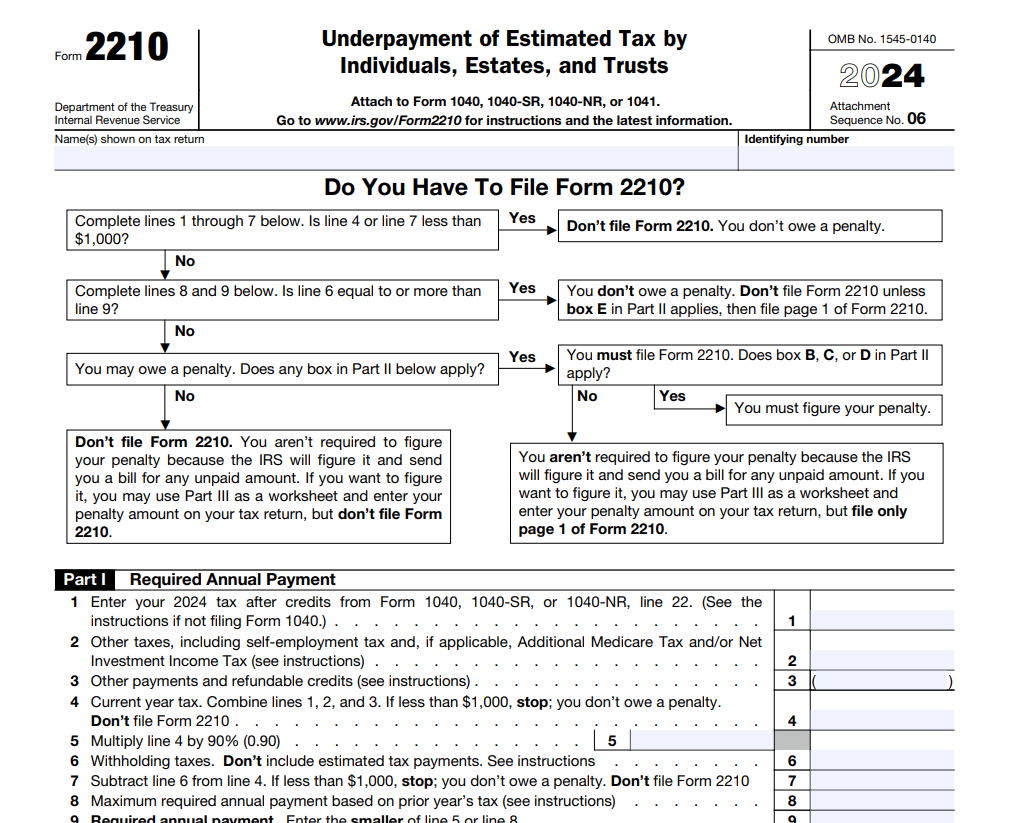

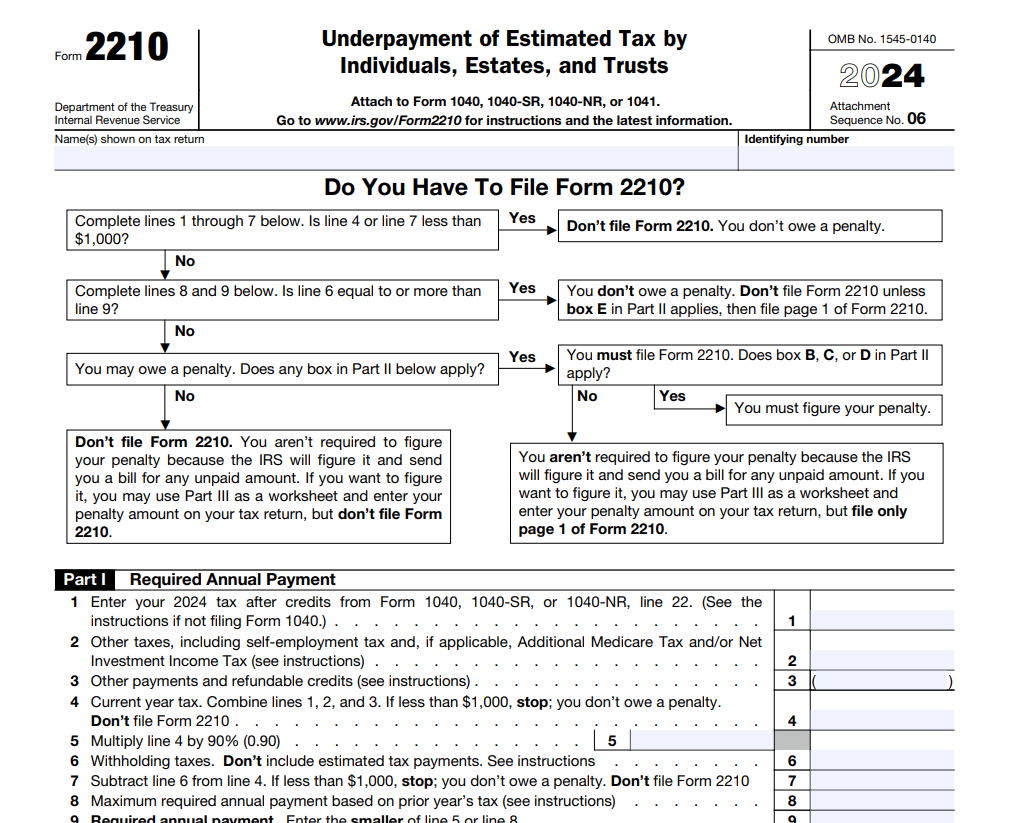

What is Form 2210 and Why It Matters for Founders

Form 2210, underpayment of estimated tax penalty, is an IRS form used to determine whether you owe a penalty for not paying enough taxes during the tax year via estimated payments or withholding. Many small and growing businesses, especially startups and e-commerce companies, operate on unpredictable cash flows. This can lead to underestimating tax payments and facing penalties down the line.

Form 2210 allows you to:

Calculate any penalties for underpayment of estimated taxes.

Request a waiver of the penalty if certain exceptions apply.

Show the IRS your accurate payment history and potentially reduce charges.

Founders need to grasp this because tax penalties aren't just an extra charge—they impact the business's cash reserves at critical moments. Timely management of these penalties ensures your company maintains liquidity and avoids surprises during tax season.

For a broader understanding of tax essentials for startups, consider reviewing our Tax Guide for Startups, which prepares founders to meet tax compliance confidently.

When Do Underpayment Penalties Apply?

Understanding the timing and thresholds can help you preempt costly mistakes.

Estimated tax payments are quarterly prepayments to the IRS based on your predicted annual tax liability, commonly required if you expect to owe more than $1,000 in taxes after withholding.

You might face underpayment penalties if:

You did not pay enough tax through withholding and estimated payments.

Your payments were late or insufficient compared to your actual tax liability.

Your income fluctuated, making estimated payments too low.

To avoid penalties, the IRS requires paying either:

90% of the current year’s tax, or

100% of the previous year’s tax (110% for higher earners).

These safe harbor thresholds are especially relevant for founders with variable income.

How to Calculate the Underpayment Penalty Using Form 2210

Calculating the penalty involves several steps, but understanding them empowers you to take control over your payments.

Step 1: Determine Your Required Installment Amounts

The IRS divides estimated taxes into four payment periods, due:

April 15

June 15

September 15

January 15 (next year)

Your required payment is based on:

The safe harbor amount, or

90% of the current year’s estimated tax.

Step 2: Calculate the Amount Paid Each Period

Record your withholding and estimated payments made by each deadline.

Step 3: Identify the Underpayment for Each Period

Subtract actual payments from required payments.

Step 4: Compute the Penalty

Form 2210 applies an interest-based penalty for each underpaid period.

Payment Period | Due Date | Required Payment | Actual Payment | Underpayment | Penalty Accrued |

1st Quarter | April 15 | $X | $Y | $X - $Y | Interest × Underpayment |

2nd Quarter | June 15 | $X | $Y | $X - $Y | Interest × Underpayment |

3rd Quarter | Sept 15 | $X | $Y | $X - $Y | Interest × Underpayment |

4th Quarter | Jan 15 | $X | $Y | $X - $Y | Interest × Underpayment |

Strategies Founders Can Use to Avoid Underpayment Penalties

1. Use Last Year’s Tax Liability as a Baseline

Paying 100% (or 110% for higher earners) of the prior year’s tax generally shields you from penalties even if current-year income spikes.

2. Track Cash Flow and Adjust Quarterly

Update estimated payments as income shifts—critical for seasonal or project-based revenue.

3. Leverage Withholding for Salaried Income

Increasing withholding late in the year can help catch up, since IRS treats all withholding as evenly paid throughout the year.

4. Consider Filing for a Penalty Waiver

Waivers apply in cases such as:

Natural disasters

Disability or retirement

Small underpayment under $1,000

When to Talk to a Tax Professional

Tax professionals can:

Monitor estimated tax needs

Forecast cash flow impacts

Prepare Form 2210

Help apply credits like the R&D credit

Explore Haven’s expert support through business tax services.

Best Practices for Staying Ahead on Estimated Taxes

For founders—especially those with fluctuating income or rapidly changing business needs—managing estimated taxes is an ongoing discipline rather than a once-a-year task.

Following a few core best practices can help you avoid penalties, reduce cash-flow stress, and keep your financial planning predictable throughout the year. The table below summarizes the most effective strategies and why they matter for startup operators.

Best Practice | Why It Matters |

Pay 100–110% of prior year’s tax | Safest route for variable income |

Adjust quarterly based on revenue | Keeps payments accurate |

Increase withholding if needed | Helps avoid separate estimated payments |

File for waivers when eligible | Can remove penalties entirely |

Work with startup-focused tax pros | Prevents costly compliance errors |

Useful IRS Resources

For detailed guidance, review the IRS overview of estimated taxes.

Mastering Form 2210 for Your Startup’s Financial Health

Understanding Form 2210 empowers founders to proactively manage estimated tax payments and safeguard cash flow. By leveraging safe harbor rules, tracking revenue changes, and optimizing withholding, you minimize unexpected penalties and gain clarity over your financial obligations.

At Haven, we combine modern bookkeeping and tax expertise to help founders stay ahead—so you can focus on scaling.

Taking control of Form 2210 penalties brings confidence and stability to your financial planning—exactly what founders need as they grow.

For founders steering startups, agencies, or e-commerce ventures, managing business finances involves more than just tracking revenue and expenses. Understanding tax obligations and preemptively addressing penalties is crucial to preserve cash flow and focus on growth. One tax form founders should be familiar with is Form 2210, which helps you calculate and potentially avoid penalties related to underpayment of estimated taxes.

This comprehensive guide unpacks Form 2210 in practical terms—what it is, when it applies, how to calculate your penalty, and strategies to avoid or reduce it. We’ll also share pathways where founders can optimize tax planning effectively without disrupting your core business activities.

What is Form 2210 and Why It Matters for Founders

Form 2210, underpayment of estimated tax penalty, is an IRS form used to determine whether you owe a penalty for not paying enough taxes during the tax year via estimated payments or withholding. Many small and growing businesses, especially startups and e-commerce companies, operate on unpredictable cash flows. This can lead to underestimating tax payments and facing penalties down the line.

Form 2210 allows you to:

Calculate any penalties for underpayment of estimated taxes.

Request a waiver of the penalty if certain exceptions apply.

Show the IRS your accurate payment history and potentially reduce charges.

Founders need to grasp this because tax penalties aren't just an extra charge—they impact the business's cash reserves at critical moments. Timely management of these penalties ensures your company maintains liquidity and avoids surprises during tax season.

For a broader understanding of tax essentials for startups, consider reviewing our Tax Guide for Startups, which prepares founders to meet tax compliance confidently.

When Do Underpayment Penalties Apply?

Understanding the timing and thresholds can help you preempt costly mistakes.

Estimated tax payments are quarterly prepayments to the IRS based on your predicted annual tax liability, commonly required if you expect to owe more than $1,000 in taxes after withholding.

You might face underpayment penalties if:

You did not pay enough tax through withholding and estimated payments.

Your payments were late or insufficient compared to your actual tax liability.

Your income fluctuated, making estimated payments too low.

To avoid penalties, the IRS requires paying either:

90% of the current year’s tax, or

100% of the previous year’s tax (110% for higher earners).

These safe harbor thresholds are especially relevant for founders with variable income.

How to Calculate the Underpayment Penalty Using Form 2210

Calculating the penalty involves several steps, but understanding them empowers you to take control over your payments.

Step 1: Determine Your Required Installment Amounts

The IRS divides estimated taxes into four payment periods, due:

April 15

June 15

September 15

January 15 (next year)

Your required payment is based on:

The safe harbor amount, or

90% of the current year’s estimated tax.

Step 2: Calculate the Amount Paid Each Period

Record your withholding and estimated payments made by each deadline.

Step 3: Identify the Underpayment for Each Period

Subtract actual payments from required payments.

Step 4: Compute the Penalty

Form 2210 applies an interest-based penalty for each underpaid period.

Payment Period | Due Date | Required Payment | Actual Payment | Underpayment | Penalty Accrued |

1st Quarter | April 15 | $X | $Y | $X - $Y | Interest × Underpayment |

2nd Quarter | June 15 | $X | $Y | $X - $Y | Interest × Underpayment |

3rd Quarter | Sept 15 | $X | $Y | $X - $Y | Interest × Underpayment |

4th Quarter | Jan 15 | $X | $Y | $X - $Y | Interest × Underpayment |

Strategies Founders Can Use to Avoid Underpayment Penalties

1. Use Last Year’s Tax Liability as a Baseline

Paying 100% (or 110% for higher earners) of the prior year’s tax generally shields you from penalties even if current-year income spikes.

2. Track Cash Flow and Adjust Quarterly

Update estimated payments as income shifts—critical for seasonal or project-based revenue.

3. Leverage Withholding for Salaried Income

Increasing withholding late in the year can help catch up, since IRS treats all withholding as evenly paid throughout the year.

4. Consider Filing for a Penalty Waiver

Waivers apply in cases such as:

Natural disasters

Disability or retirement

Small underpayment under $1,000

When to Talk to a Tax Professional

Tax professionals can:

Monitor estimated tax needs

Forecast cash flow impacts

Prepare Form 2210

Help apply credits like the R&D credit

Explore Haven’s expert support through business tax services.

Best Practices for Staying Ahead on Estimated Taxes

For founders—especially those with fluctuating income or rapidly changing business needs—managing estimated taxes is an ongoing discipline rather than a once-a-year task.

Following a few core best practices can help you avoid penalties, reduce cash-flow stress, and keep your financial planning predictable throughout the year. The table below summarizes the most effective strategies and why they matter for startup operators.

Best Practice | Why It Matters |

Pay 100–110% of prior year’s tax | Safest route for variable income |

Adjust quarterly based on revenue | Keeps payments accurate |

Increase withholding if needed | Helps avoid separate estimated payments |

File for waivers when eligible | Can remove penalties entirely |

Work with startup-focused tax pros | Prevents costly compliance errors |

Useful IRS Resources

For detailed guidance, review the IRS overview of estimated taxes.

Mastering Form 2210 for Your Startup’s Financial Health

Understanding Form 2210 empowers founders to proactively manage estimated tax payments and safeguard cash flow. By leveraging safe harbor rules, tracking revenue changes, and optimizing withholding, you minimize unexpected penalties and gain clarity over your financial obligations.

At Haven, we combine modern bookkeeping and tax expertise to help founders stay ahead—so you can focus on scaling.

Taking control of Form 2210 penalties brings confidence and stability to your financial planning—exactly what founders need as they grow.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026