Go Back

Last Updated :

Last Updated :

Dec 19, 2025

Dec 19, 2025

Form 1098 Explained: How to Report Mortgage Interest for Your Tax Return

As a founder or CEO managing a startup, agency, or e-commerce business, every dollar counts, especially when it comes to tax planning and deductions. One tax document that often confuses is Form 1098, which reports mortgage interest paid during the tax year. Understanding how to read and accurately report the information from Form 1098 can help you maximize deductions, reduce your tax burden, and maintain cleaner books.

This article walks through Form 1098 clearly and provides actionable steps for utilizing it on your tax return. Taking control of these details helps you focus on growing your business without surprises during tax season.

What Is Form 1098 and Why Does It Matter to Founders?

Form 1098, officially called the “Mortgage Interest Statement,” is issued by financial institutions to individuals who have paid $600 or more in mortgage interest during the year.

Although many startup founders are primarily concerned with business expenses, mortgage interest may be relevant if you claim itemized deductions on your personal tax return — especially if you operate your business partially from a home office or have financed real estate tied to your business.

Key Points about Form 1098

Reports total mortgage interest paid during the year.

Includes data on mortgage insurance premiums, origination fees, and points.

Used when itemizing deductions on Schedule A of IRS Form 1040.

Helps lower taxable income and overall tax liability.

Even if your business finances are separate, personally managing mortgage interest deductions can free up more capital for reinvestment or R&D tax credits. For a deep dive into tax-saving strategies, see Haven’s comprehensive 10-Step Guide to Saving Money on Taxes for Small Businesses.

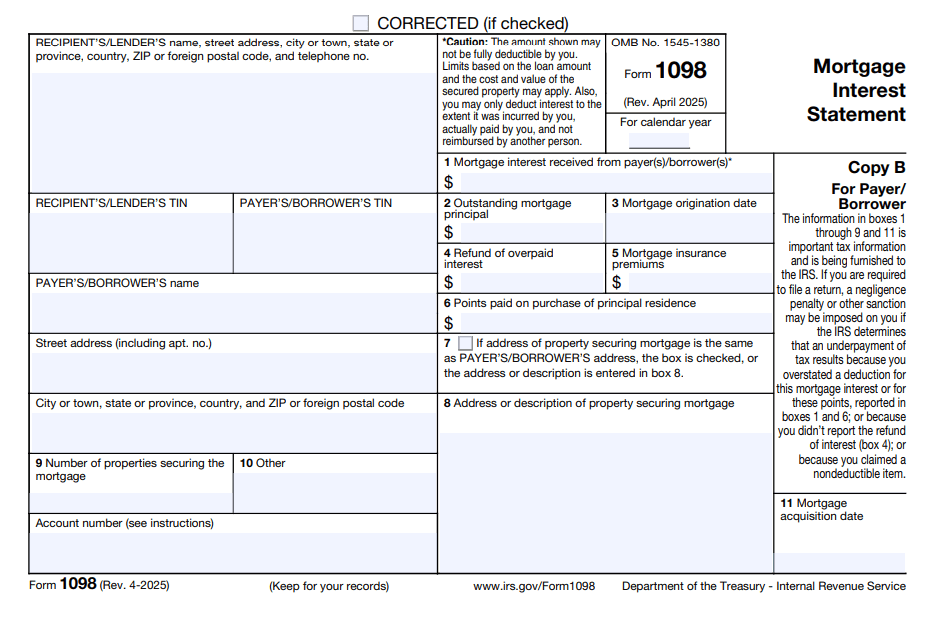

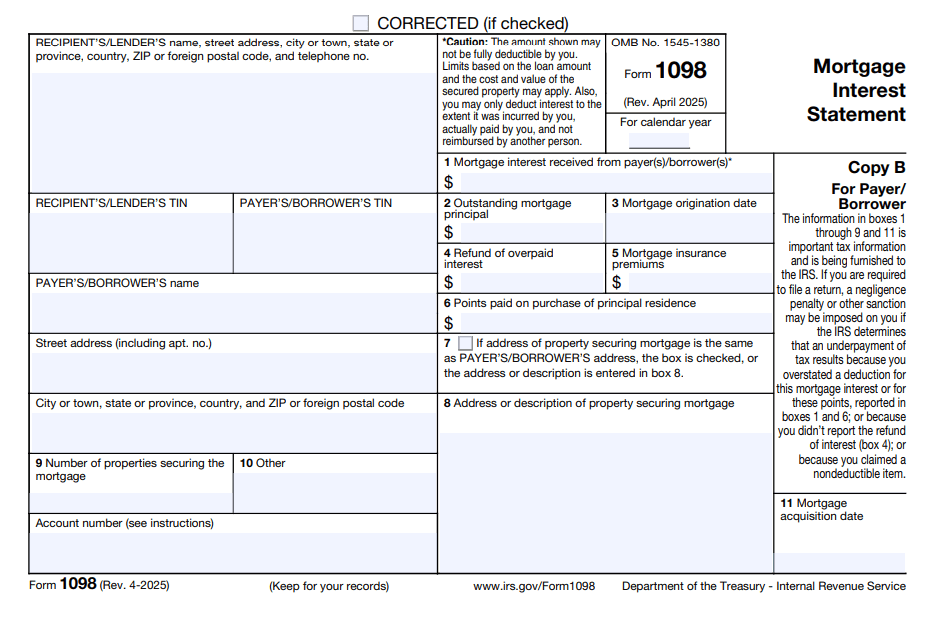

Breaking Down Each Section of Form 1098

To effectively apply Form 1098, it’s critical to understand what each component means:

Box # | Description | Relevance to Founders |

1 | Mortgage interest received by lender | Main deductible amount if itemizing |

2 | Outstanding mortgage principal | Helpful for tracking loan progress |

3 | Mortgage origination date | Date loan was secured; key for refinance reporting |

4 | Refund of overpaid interest | May need adjustment to deductible interest |

5 | Mortgage insurance premiums | Potentially deductible subject to IRS rules |

6 | Points paid | May be deductible all at once or over time |

7 | Property securing the mortgage | Confirms it ties to your home or investment |

8 | Mortgage identification number | Used for tracking or reporting purposes |

For full documentation on how Form 1098 fits into personal taxes, consult the IRS Mortgage Interest Deduction page.

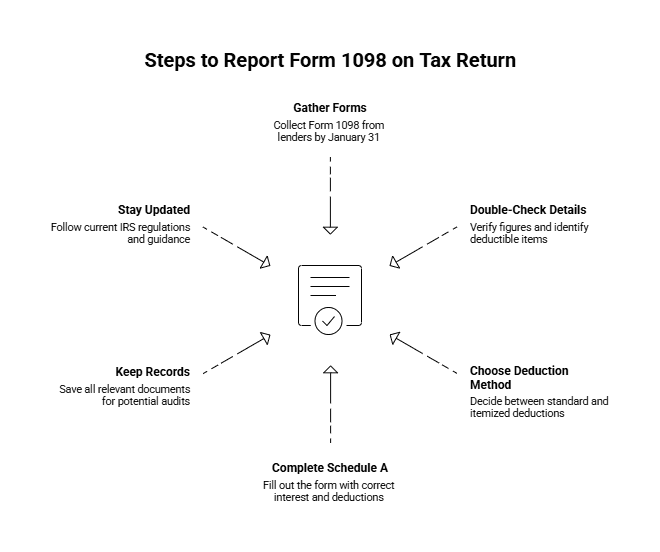

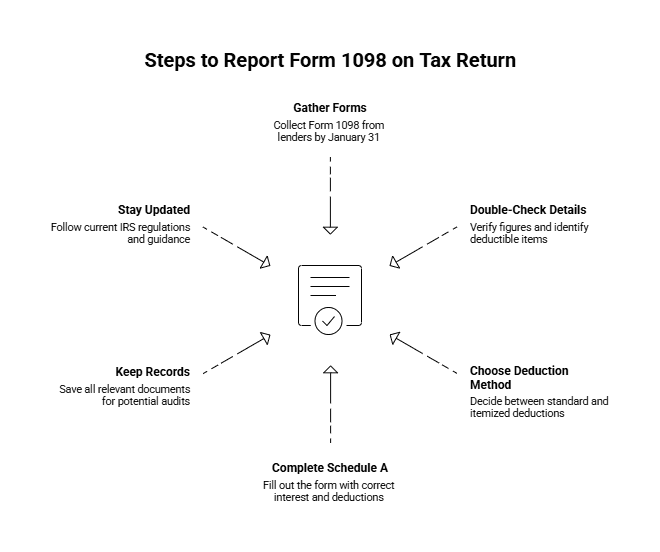

How to Report Form 1098 on Your Tax Return (Step-by-Step for Founders)

1. Gather Your Forms Early

Lenders are required to mail Form 1098 by January 31. Keep an eye out and follow up if it doesn’t arrive promptly.

2. Double-Check the Details

Confirm Box 1 figure matches your own mortgage interest payment records.

Identify any mortgage insurance (Box 5) that you may be able to deduct.

Take particular care with reporting points (Box 6) depending on use: home purchase or refinance.

3. Choose Between Standard vs. Itemized Deduction

Mortgage interest is deductible only with itemization using Schedule A.

Many founders may benefit more from the standard deduction, depending on income level and other deductions.

Want help maximizing your situation? Haven’s Business Tax Services can walk you through it.

4. Complete Schedule A (Form 1040)

Input Box 1 interest on Line 8a of Schedule A.

Place deductible mortgage insurance and points on their respective lines following IRS guidance.

Adjust for any interest refunds (Box 4).

5. Keep Strong Records

Save the entire Form 1098, mortgage documents, payment confirmations, and any refi paperwork.

Keep them with current-year tax files in case of an audit.

6. Stay in Sync with IRS Regulations

Your reporting should align with current IRS guidance. Stay updated via trusted sources like the IRS Forms and Publications page.

Mortgage Interest Scenarios Founders Should Understand

Understanding everyday mortgage tax situations can help founders structure their decisions proactively.

Home Office and Mortgage Interest

If your home is partially used exclusively for business, a portion of the mortgage interest may be deductible under the home office deduction. Portioning must be based on square footage or an allowable method. Maintain documentation showing exclusive use.

Refinanced Mortgages

For refinanced property, the deductible portion of points typically needs to be amortized over the life of the loan, unlike the full deduction often allowed for original purchase points.

Investment or Rental Properties

Mortgage interest on investment real estate doesn’t go on Schedule A—it belongs on Schedule E. This includes short-term rentals or property used to generate income.

Loan Amount Limits

Under the Tax Cuts and Jobs Act, the deductib mortgage interest applies only to loans up to $750,000 (post–Dec 15, 2017). Older loans mleay still fall under the previous $1M limit.

By staying informed, you’ll better plan your personal and business tax strategy. For more examples, see Haven’s full Tax Guide for Founders.

How Haven Simplifies Mortgage and Tax Reporting for Founders

Running your company leaves little time to decipher tax forms. Haven provides:

Expert tax filing that includes accurate Form 1098 handling

Guidance on home office deductions and mortgage allocation

Bookkeeping tools that sync personal and business records where appropriate

R&D tax credit expertise for innovation-focused startups

We help founders stay compliant while keeping their focus on growth.

Form 1098: Reduce Your Tax Burden

Understanding and properly utilizing Form 1098 is more than compliance—it’s a way to reduce personal tax liability and recapture capital for your growing business. Founders who own homes, invest in real estate, or work from a dedicated home office space should explore how mortgage interest can strategically shape tax outcomes.

With Haven’s founder-first financial services, you don’t have to go it alone. Navigating deductions, IRS forms, and tax planning becomes intuitive, structured, and stress-free.

As a founder or CEO managing a startup, agency, or e-commerce business, every dollar counts, especially when it comes to tax planning and deductions. One tax document that often confuses is Form 1098, which reports mortgage interest paid during the tax year. Understanding how to read and accurately report the information from Form 1098 can help you maximize deductions, reduce your tax burden, and maintain cleaner books.

This article walks through Form 1098 clearly and provides actionable steps for utilizing it on your tax return. Taking control of these details helps you focus on growing your business without surprises during tax season.

What Is Form 1098 and Why Does It Matter to Founders?

Form 1098, officially called the “Mortgage Interest Statement,” is issued by financial institutions to individuals who have paid $600 or more in mortgage interest during the year.

Although many startup founders are primarily concerned with business expenses, mortgage interest may be relevant if you claim itemized deductions on your personal tax return — especially if you operate your business partially from a home office or have financed real estate tied to your business.

Key Points about Form 1098

Reports total mortgage interest paid during the year.

Includes data on mortgage insurance premiums, origination fees, and points.

Used when itemizing deductions on Schedule A of IRS Form 1040.

Helps lower taxable income and overall tax liability.

Even if your business finances are separate, personally managing mortgage interest deductions can free up more capital for reinvestment or R&D tax credits. For a deep dive into tax-saving strategies, see Haven’s comprehensive 10-Step Guide to Saving Money on Taxes for Small Businesses.

Breaking Down Each Section of Form 1098

To effectively apply Form 1098, it’s critical to understand what each component means:

Box # | Description | Relevance to Founders |

1 | Mortgage interest received by lender | Main deductible amount if itemizing |

2 | Outstanding mortgage principal | Helpful for tracking loan progress |

3 | Mortgage origination date | Date loan was secured; key for refinance reporting |

4 | Refund of overpaid interest | May need adjustment to deductible interest |

5 | Mortgage insurance premiums | Potentially deductible subject to IRS rules |

6 | Points paid | May be deductible all at once or over time |

7 | Property securing the mortgage | Confirms it ties to your home or investment |

8 | Mortgage identification number | Used for tracking or reporting purposes |

For full documentation on how Form 1098 fits into personal taxes, consult the IRS Mortgage Interest Deduction page.

How to Report Form 1098 on Your Tax Return (Step-by-Step for Founders)

1. Gather Your Forms Early

Lenders are required to mail Form 1098 by January 31. Keep an eye out and follow up if it doesn’t arrive promptly.

2. Double-Check the Details

Confirm Box 1 figure matches your own mortgage interest payment records.

Identify any mortgage insurance (Box 5) that you may be able to deduct.

Take particular care with reporting points (Box 6) depending on use: home purchase or refinance.

3. Choose Between Standard vs. Itemized Deduction

Mortgage interest is deductible only with itemization using Schedule A.

Many founders may benefit more from the standard deduction, depending on income level and other deductions.

Want help maximizing your situation? Haven’s Business Tax Services can walk you through it.

4. Complete Schedule A (Form 1040)

Input Box 1 interest on Line 8a of Schedule A.

Place deductible mortgage insurance and points on their respective lines following IRS guidance.

Adjust for any interest refunds (Box 4).

5. Keep Strong Records

Save the entire Form 1098, mortgage documents, payment confirmations, and any refi paperwork.

Keep them with current-year tax files in case of an audit.

6. Stay in Sync with IRS Regulations

Your reporting should align with current IRS guidance. Stay updated via trusted sources like the IRS Forms and Publications page.

Mortgage Interest Scenarios Founders Should Understand

Understanding everyday mortgage tax situations can help founders structure their decisions proactively.

Home Office and Mortgage Interest

If your home is partially used exclusively for business, a portion of the mortgage interest may be deductible under the home office deduction. Portioning must be based on square footage or an allowable method. Maintain documentation showing exclusive use.

Refinanced Mortgages

For refinanced property, the deductible portion of points typically needs to be amortized over the life of the loan, unlike the full deduction often allowed for original purchase points.

Investment or Rental Properties

Mortgage interest on investment real estate doesn’t go on Schedule A—it belongs on Schedule E. This includes short-term rentals or property used to generate income.

Loan Amount Limits

Under the Tax Cuts and Jobs Act, the deductib mortgage interest applies only to loans up to $750,000 (post–Dec 15, 2017). Older loans mleay still fall under the previous $1M limit.

By staying informed, you’ll better plan your personal and business tax strategy. For more examples, see Haven’s full Tax Guide for Founders.

How Haven Simplifies Mortgage and Tax Reporting for Founders

Running your company leaves little time to decipher tax forms. Haven provides:

Expert tax filing that includes accurate Form 1098 handling

Guidance on home office deductions and mortgage allocation

Bookkeeping tools that sync personal and business records where appropriate

R&D tax credit expertise for innovation-focused startups

We help founders stay compliant while keeping their focus on growth.

Form 1098: Reduce Your Tax Burden

Understanding and properly utilizing Form 1098 is more than compliance—it’s a way to reduce personal tax liability and recapture capital for your growing business. Founders who own homes, invest in real estate, or work from a dedicated home office space should explore how mortgage interest can strategically shape tax outcomes.

With Haven’s founder-first financial services, you don’t have to go it alone. Navigating deductions, IRS forms, and tax planning becomes intuitive, structured, and stress-free.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026