Go Back

Last Updated :

Last Updated :

Dec 11, 2025

Dec 11, 2025

Form 1095-A: How to Use Your Health Insurance Marketplace Statement

As a founder, managing your startup's finances means staying on top of complex tax documents—and that includes personal ones tied to healthcare, like Form 1095-A. If your company’s owners or employees purchase health insurance through the Health Insurance Marketplace, understanding how to use Form 1095-A is essential. This form plays a critical role when filing your personal taxes and can help you avoid costly errors, especially if you or your team claim the Premium Tax Credit or reconcile advanced credits received.

In this comprehensive guide, we’ll explain what Form 1095-A is, why it matters to startup founders and their teams, and how to use it correctly with concrete examples and practical tips. Properly handling this document helps ensure tax compliance while optimizing potential savings—freeing you to focus on growing your business.

What Is Form 1095-A and Why Does It Matter to Founders?

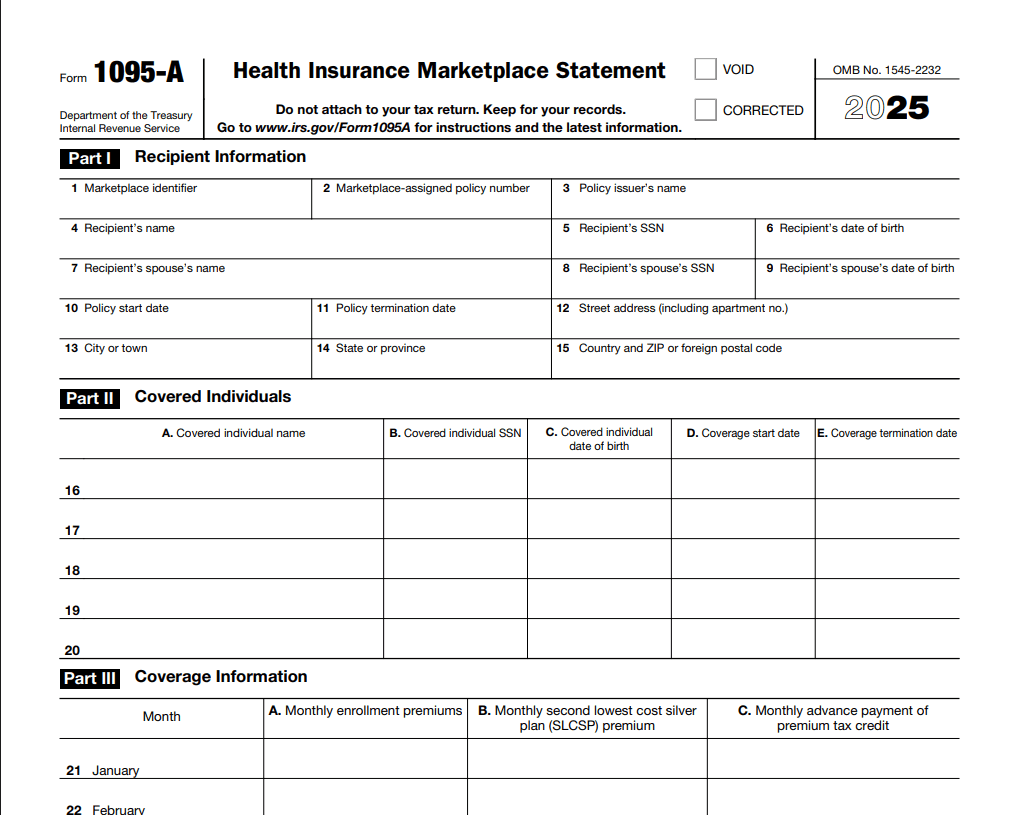

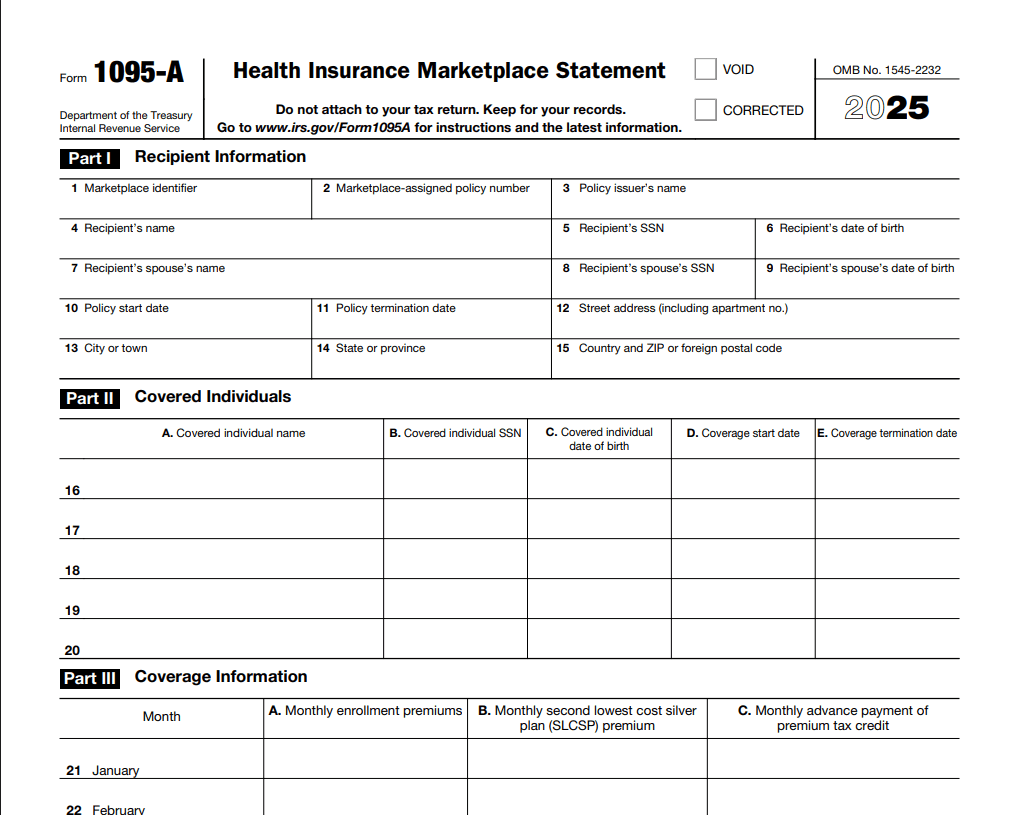

Form 1095-A, officially titled the Health Insurance Marketplace Statement, is issued to individuals who buy health insurance through the Health Insurance Marketplace established under the Affordable Care Act (ACA). It documents monthly insurance coverage and includes crucial information like:

The amount of premiums paid

The premium amount of the benchmark plan is used to calculate the Premium Tax Credit

Any advanced premium tax credits (APTC) paid on your behalf

For founders navigating personal or employee health insurance purchased through the Marketplace, understanding this form matters because:

It informs your personal tax return. Form 1095-A is critical for reconciling any premium tax credits using IRS Form 8962. It directly impacts your refund or taxes owed.

Incorrect reconciliation can lead to penalties or repayment obligations. If your income differs from what was reported when applying for health insurance, misreporting advanced credits on your return may result in having to repay them.

It affects startup benefit planning. Understanding this form helps founders assess whether offering health insurance via the exchange or providing group benefits is financially smarter in the long run.

By paying keen attention to your Form 1095-A, you avoid surprises during tax season and keep your company’s financial foundation steady.

How to Read and Use Your Form 1095-A Correctly

The exact numbers reported on Form 1095-A will determine the Premium Tax Credit you or your employees can claim. Here’s how to properly decode and apply the data from your form when filing your taxes:

Section on Form 1095-A | What It Means | Why It’s Important for Founders |

Part I: Recipient Information | Basic info: name, SSN, policy number, coverage dates | Must match your tax return to avoid delays |

Part II: Covered Individuals | Names of everyone covered under the policy | Ensures correct dependent claims |

Part III: Coverage Information | Monthly premiums, benchmark premium, APTC | These numbers go into IRS Form 8962 |

Step-by-Step Guide to Using Form 1095-A

Download your form from HealthCare.gov or your state Marketplace by mid-February.

Verify information against your Marketplace account and payments.

Fill out IRS Form 8962 (Premium Tax Credit) using the numbers reported in Part III.

File your return with Form 8962 attached. Missing it will delay your refund.

For official IRS instructions, see the IRS page on Premium Tax Credit and Form 8962.

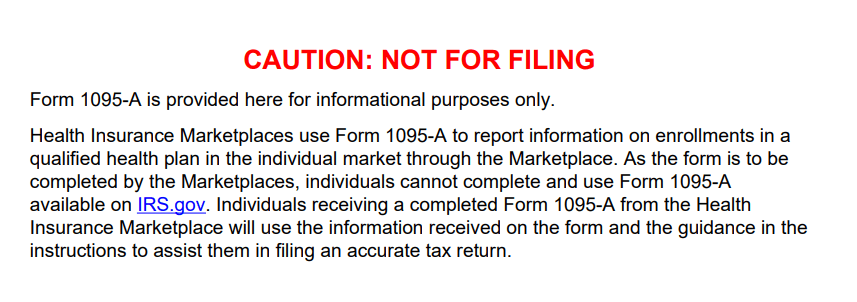

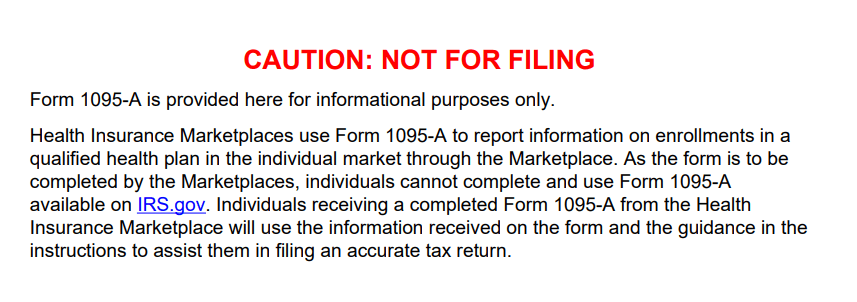

Understanding the “CAUTION: NOT FOR FILING” Notice on Form 1095-A

When you download a sample or preview of Form 1095-A online, you’ll often see a red “CAUTION: NOT FOR FILING” message. This simply means the PDF you’re viewing is not your official tax form — it’s an informational version provided by the IRS.

Actual Form 1095-A documents are issued only by the Health Insurance Marketplace, not by the IRS. You’ll receive your official version directly through HealthCare.gov or your state Marketplace, and that is the one you must use when completing your tax return and reconciling the Premium Tax Credit.

The IRS provides the blank version so taxpayers and professionals can understand the structure of the form, but you cannot file using the sample copy. Only the Marketplace-generated Form 1095-A contains your real coverage months, premiums, and advance tax credit amounts.

Practical Implications for Startup Founders and Their Teams

Variable Income Means Fluctuating Premium Tax Credits

Founders often experience income swings. Marketplace subsidies depend on projected income—your tax filing uses actual income. Accurate reconciliation via Form 8962 prevents penalties.

Part-Time Team Members or Contractors

Team members without group-plan access often rely on Marketplace plans. Helping them understand Form 1095-A can prevent tax errors and improve financial wellness across your team.

Decision-Making: Group Plan vs. Marketplace

Form 1095-A data can inform whether your company should move to a group plan or increase compensation to support Marketplace options.

Founders’ Checklist for Handling Form 1095-A and Marketplace Coverage

Task | Why It Matters | Recommended Action |

Collect Form 1095-A early | Prevents last-minute issues | Download from Marketplace portal |

Cross-check all entries | Ensures accurate Form 8962 reconciliation | Compare with actual payment records |

File IRS Form 8962 | Required when APTC is received | Use qualified software or advisor |

Educate your team | Reduces tax errors | Provide internal guidance or IRS resources |

Integrate benefits with bookkeeping | Supports long-term planning | Use modern finance platforms |

Where to Learn More and Get Help with Taxes and Health Coverage

Understanding Form 1095-A and related filings ensures you and your team stay compliant and financially prepared.

Helpful resources:

Mastering Form 1095-A for Startup Financial Health

Handling Form 1095-A correctly is more than a tax requirement—it’s a strategic advantage. From reconciling premium credits to making smarter benefits decisions, this form impacts both personal and business finances.

At Haven, we help founders turn tax complexity into clarity. Whether you're decoding Form 1095-A, optimizing credits, or planning long-term financial strategy, we’ve built our services with the startup founder in mind.

As a founder, managing your startup's finances means staying on top of complex tax documents—and that includes personal ones tied to healthcare, like Form 1095-A. If your company’s owners or employees purchase health insurance through the Health Insurance Marketplace, understanding how to use Form 1095-A is essential. This form plays a critical role when filing your personal taxes and can help you avoid costly errors, especially if you or your team claim the Premium Tax Credit or reconcile advanced credits received.

In this comprehensive guide, we’ll explain what Form 1095-A is, why it matters to startup founders and their teams, and how to use it correctly with concrete examples and practical tips. Properly handling this document helps ensure tax compliance while optimizing potential savings—freeing you to focus on growing your business.

What Is Form 1095-A and Why Does It Matter to Founders?

Form 1095-A, officially titled the Health Insurance Marketplace Statement, is issued to individuals who buy health insurance through the Health Insurance Marketplace established under the Affordable Care Act (ACA). It documents monthly insurance coverage and includes crucial information like:

The amount of premiums paid

The premium amount of the benchmark plan is used to calculate the Premium Tax Credit

Any advanced premium tax credits (APTC) paid on your behalf

For founders navigating personal or employee health insurance purchased through the Marketplace, understanding this form matters because:

It informs your personal tax return. Form 1095-A is critical for reconciling any premium tax credits using IRS Form 8962. It directly impacts your refund or taxes owed.

Incorrect reconciliation can lead to penalties or repayment obligations. If your income differs from what was reported when applying for health insurance, misreporting advanced credits on your return may result in having to repay them.

It affects startup benefit planning. Understanding this form helps founders assess whether offering health insurance via the exchange or providing group benefits is financially smarter in the long run.

By paying keen attention to your Form 1095-A, you avoid surprises during tax season and keep your company’s financial foundation steady.

How to Read and Use Your Form 1095-A Correctly

The exact numbers reported on Form 1095-A will determine the Premium Tax Credit you or your employees can claim. Here’s how to properly decode and apply the data from your form when filing your taxes:

Section on Form 1095-A | What It Means | Why It’s Important for Founders |

Part I: Recipient Information | Basic info: name, SSN, policy number, coverage dates | Must match your tax return to avoid delays |

Part II: Covered Individuals | Names of everyone covered under the policy | Ensures correct dependent claims |

Part III: Coverage Information | Monthly premiums, benchmark premium, APTC | These numbers go into IRS Form 8962 |

Step-by-Step Guide to Using Form 1095-A

Download your form from HealthCare.gov or your state Marketplace by mid-February.

Verify information against your Marketplace account and payments.

Fill out IRS Form 8962 (Premium Tax Credit) using the numbers reported in Part III.

File your return with Form 8962 attached. Missing it will delay your refund.

For official IRS instructions, see the IRS page on Premium Tax Credit and Form 8962.

Understanding the “CAUTION: NOT FOR FILING” Notice on Form 1095-A

When you download a sample or preview of Form 1095-A online, you’ll often see a red “CAUTION: NOT FOR FILING” message. This simply means the PDF you’re viewing is not your official tax form — it’s an informational version provided by the IRS.

Actual Form 1095-A documents are issued only by the Health Insurance Marketplace, not by the IRS. You’ll receive your official version directly through HealthCare.gov or your state Marketplace, and that is the one you must use when completing your tax return and reconciling the Premium Tax Credit.

The IRS provides the blank version so taxpayers and professionals can understand the structure of the form, but you cannot file using the sample copy. Only the Marketplace-generated Form 1095-A contains your real coverage months, premiums, and advance tax credit amounts.

Practical Implications for Startup Founders and Their Teams

Variable Income Means Fluctuating Premium Tax Credits

Founders often experience income swings. Marketplace subsidies depend on projected income—your tax filing uses actual income. Accurate reconciliation via Form 8962 prevents penalties.

Part-Time Team Members or Contractors

Team members without group-plan access often rely on Marketplace plans. Helping them understand Form 1095-A can prevent tax errors and improve financial wellness across your team.

Decision-Making: Group Plan vs. Marketplace

Form 1095-A data can inform whether your company should move to a group plan or increase compensation to support Marketplace options.

Founders’ Checklist for Handling Form 1095-A and Marketplace Coverage

Task | Why It Matters | Recommended Action |

Collect Form 1095-A early | Prevents last-minute issues | Download from Marketplace portal |

Cross-check all entries | Ensures accurate Form 8962 reconciliation | Compare with actual payment records |

File IRS Form 8962 | Required when APTC is received | Use qualified software or advisor |

Educate your team | Reduces tax errors | Provide internal guidance or IRS resources |

Integrate benefits with bookkeeping | Supports long-term planning | Use modern finance platforms |

Where to Learn More and Get Help with Taxes and Health Coverage

Understanding Form 1095-A and related filings ensures you and your team stay compliant and financially prepared.

Helpful resources:

Mastering Form 1095-A for Startup Financial Health

Handling Form 1095-A correctly is more than a tax requirement—it’s a strategic advantage. From reconciling premium credits to making smarter benefits decisions, this form impacts both personal and business finances.

At Haven, we help founders turn tax complexity into clarity. Whether you're decoding Form 1095-A, optimizing credits, or planning long-term financial strategy, we’ve built our services with the startup founder in mind.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026