Go Back

Last Updated :

Last Updated :

Dec 19, 2025

Dec 19, 2025

Form 1041: How to File Income Tax Returns for Estates and Trusts

When a loved one passes away, managing their financial legacy can quickly become complex—especially when it comes to taxes. For founders and business leaders handling estates or trusts, understanding how to properly file Form 1041 is key to minimizing tax liabilities and avoiding IRS complications.

This practical guide breaks down what Form 1041 entails, why it matters to estates and trusts, and how you can efficiently manage and file these returns with confidence.

What Is Form 1041?

Form 1041, U.S. Income Tax Return for Estates and Trusts, reports income, deductions, gains, losses, and distributions for an estate or trust.

Think of it as the estate’s or trust’s version of a business tax return. The fiduciary—effectively the “CEO” of the estate — files it on behalf of beneficiaries.

Key Takeaways for Founders

Form 1041 is required when an estate or trust earns income during the tax year. This includes dividends, interest, business income, rental income, and capital gains.

The executor or fiduciary is responsible for filing and ensuring compliance—think of this person as the “CEO” of the estate or trust.

Filing Form 1041 properly helps avoid penalties and ensures beneficiaries receive their rightful income distributions with correct tax treatment.

Understanding these fundamentals can save you time and preserve your business continuity while managing estate matters.

Who Must File Form 1041 and When?

You must file Form 1041 if either applies:

Estates

The estate earns more than $600 in gross income during administration.

The estate sells assets (property, investments, equity) and records gains.

The estate operates a business that continues generating income.

Trusts

The trust earns any taxable income, regardless of the amount.

The trust makes distributions to beneficiaries that must be reported on Schedule K-1.

Scenario | Must File Form 1041? | Notes |

Estate generating gross income over $600 | Yes | Applies for income earned after death and before distribution. |

Trust earning any taxable income | Yes | Trusts must report all taxable income, irrespective of amount. |

Estate selling property or final year returns | Yes | Even if no income, certain estates must file. |

When Form 1041 Is Due

Form 1041 is due on the 15th day of the 4th month after the entity’s tax year ends.

Calendar-year entities: April 15

Fiscal-year estates: 4 months after year-end

Extensions: File Form 7004 for a 5-month extension

Missing the deadline triggers penalties, which add avoidable friction when you’re already managing operations and estate logistics.

Step-by-Step Filing Process for Form 1041

Filing Form 1041 becomes manageable when treated systematically.

Step 1: Enter Entity Information

Provide:

Name of the estate or trust

Fiduciary name and address

Employer Identification Number (EIN)

Tax year

Type of entity (estate, simple trust, complex trust)

Step 2: Report All Income

Include income earned after the decedent’s date of death (for estates) or during the tax year (for trusts):

Interest and dividends

Rental income

Business income

Capital gains

Investment or portfolio income

If the estate sold property, this typically flows through Schedule D before landing in the income section.

Step 3: Deduct Administrative Expenses

Common deductible expenses include:

Legal and accounting fees

Fiduciary fees

Costs necessary to administer the estate or trust

If the estate still operates a business, business-related expenses may also qualify.

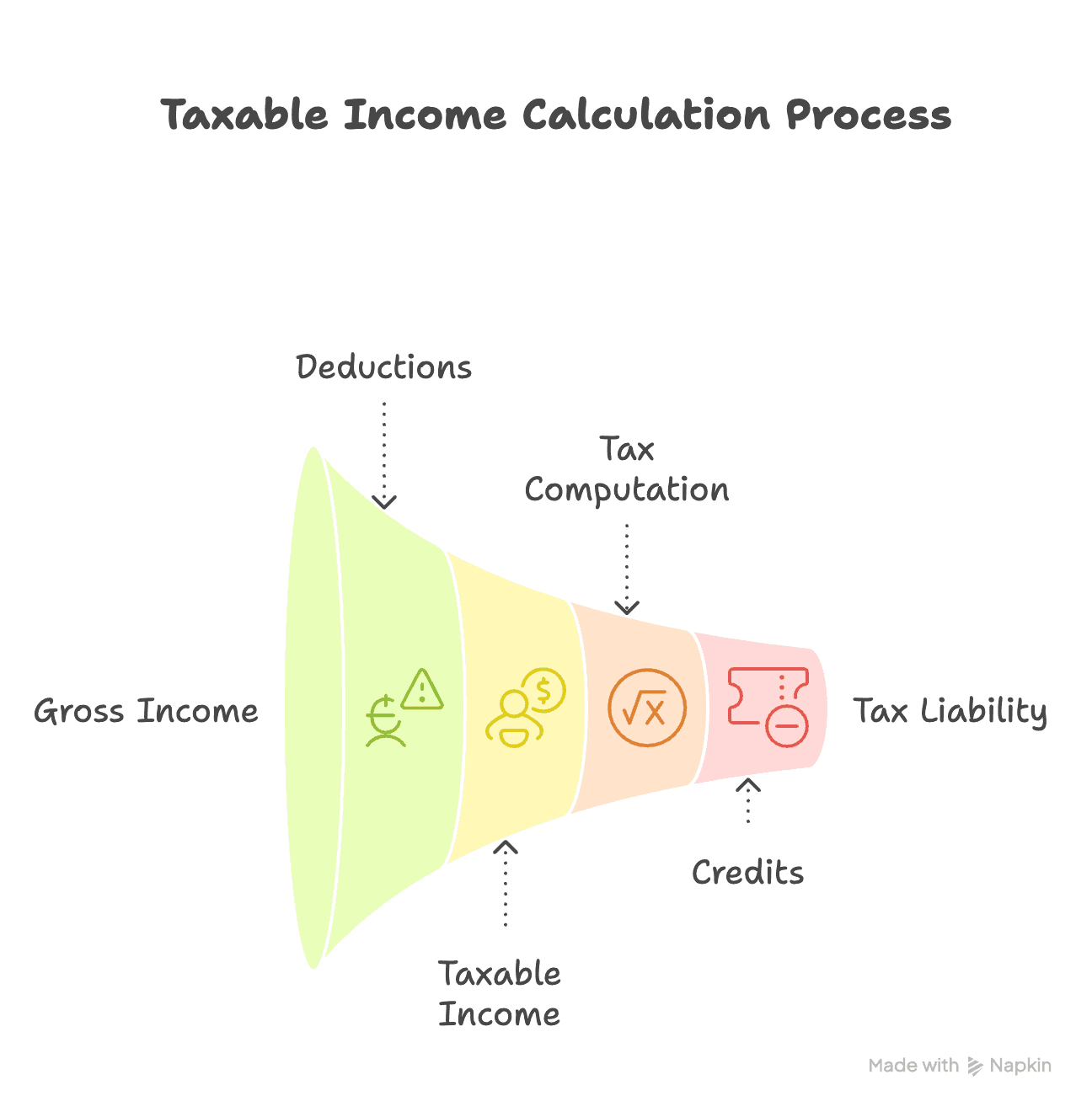

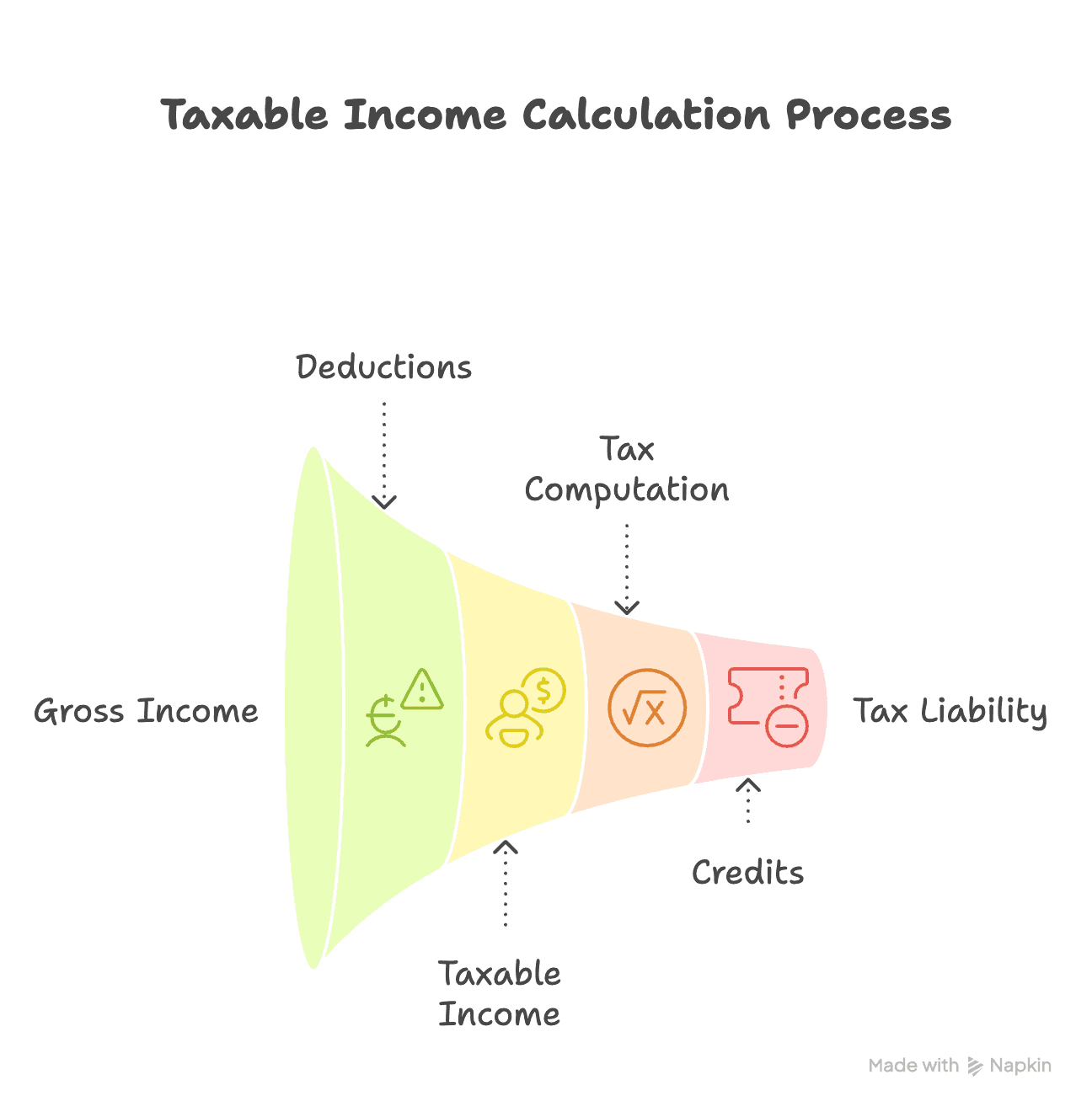

Step 4: Calculate Adjusted Total Income and Tax

This is where Form 1041 converts gross income minus deductions into taxable income.

You’ll complete:

Tax computation

Credits

Alternative minimum tax (if applicable)

Most founders delegate this step to a tax professional because the calculations map across multiple schedules.

Step 5: Prepare Schedule K-1s for Beneficiaries

If the estate or trust distributes income, you must issue a Schedule K-1 to each beneficiary.

The K-1 shifts tax liability from the estate to the recipients.

What you’ll need:

Beneficiary name, address, TIN

Distribution amounts

Classification of income (interest, dividends, capital gains, etc.)

Step 6: Review, File, and Store Records

Before filing:

Confirm beneficiary distributions match accounting records

Double-check tax year and EIN

File electronically or mail to the correct IRS address

Store copies for at least 7 years

Avoiding Common Pitfalls When Managing Estate and Trust Taxes

Founders may face unfamiliar challenges in fiduciary accounting:

Keep estate/trust finances separate from business or personal accounts

Use professional bookkeeping to track income and expenses clearly

Don’t overlook business-related deductions if the estate owns an operating business

Strategically plan distributions to minimize the overall tax burden

Our business tax services help founders navigate these complexities smoothly.

How Modern Bookkeeping Tools Support Form 1041 Preparation

Technology can dramatically streamline fiduciary tax work:

Feature | Benefit for Estates/Trusts |

Automated Income Categorization | Quickly identify taxable income streams |

Custom Expense Tracking | Capture deductible administrative expenses accurately |

Beneficiary Reporting Tools | Simplify Schedule K-1 preparation and coordination |

Real-Time Dashboards | Provide holistic visibility into estate/trust finances |

Tools like those used at Haven reduce manual errors and increase filing efficiency.

Key Forms and Schedules to Know Besides Form 1041

Depending on the estate/trust’s activities, additional forms may be required:

Schedule K-1 — Beneficiary income reporting

Schedule D — Capital gains and losses

Schedule G — Fiduciary information

Form 56 — Notice of fiduciary relationship

Form 1310 — Refunds due to deceased individuals

Full guidance is available on the IRS Form 1041 instructions page.

Checklist: Filing Form 1041 Without Stress

Collect income statements and receipts

Confirm deductions

Prepare all K-1s

Review deadlines or file extension

Use professional tax review

Submit Form 1041 + all schedules

Store copies for future reference

Why Partner with Haven for Your Estate and Trust Tax Needs?

Haven supports founders facing complex estate and trust responsibilities with:

Founder-friendly tax guidance

Integrated personal + business + fiduciary support

Strategic tax minimization

Fast, modern bookkeeping that scales

Filing Form 1041 doesn’t need to be overwhelming. With the right steps, tools, and expert support, you can manage fiduciary tax duties with clarity and confidence.

When a loved one passes away, managing their financial legacy can quickly become complex—especially when it comes to taxes. For founders and business leaders handling estates or trusts, understanding how to properly file Form 1041 is key to minimizing tax liabilities and avoiding IRS complications.

This practical guide breaks down what Form 1041 entails, why it matters to estates and trusts, and how you can efficiently manage and file these returns with confidence.

What Is Form 1041?

Form 1041, U.S. Income Tax Return for Estates and Trusts, reports income, deductions, gains, losses, and distributions for an estate or trust.

Think of it as the estate’s or trust’s version of a business tax return. The fiduciary—effectively the “CEO” of the estate — files it on behalf of beneficiaries.

Key Takeaways for Founders

Form 1041 is required when an estate or trust earns income during the tax year. This includes dividends, interest, business income, rental income, and capital gains.

The executor or fiduciary is responsible for filing and ensuring compliance—think of this person as the “CEO” of the estate or trust.

Filing Form 1041 properly helps avoid penalties and ensures beneficiaries receive their rightful income distributions with correct tax treatment.

Understanding these fundamentals can save you time and preserve your business continuity while managing estate matters.

Who Must File Form 1041 and When?

You must file Form 1041 if either applies:

Estates

The estate earns more than $600 in gross income during administration.

The estate sells assets (property, investments, equity) and records gains.

The estate operates a business that continues generating income.

Trusts

The trust earns any taxable income, regardless of the amount.

The trust makes distributions to beneficiaries that must be reported on Schedule K-1.

Scenario | Must File Form 1041? | Notes |

Estate generating gross income over $600 | Yes | Applies for income earned after death and before distribution. |

Trust earning any taxable income | Yes | Trusts must report all taxable income, irrespective of amount. |

Estate selling property or final year returns | Yes | Even if no income, certain estates must file. |

When Form 1041 Is Due

Form 1041 is due on the 15th day of the 4th month after the entity’s tax year ends.

Calendar-year entities: April 15

Fiscal-year estates: 4 months after year-end

Extensions: File Form 7004 for a 5-month extension

Missing the deadline triggers penalties, which add avoidable friction when you’re already managing operations and estate logistics.

Step-by-Step Filing Process for Form 1041

Filing Form 1041 becomes manageable when treated systematically.

Step 1: Enter Entity Information

Provide:

Name of the estate or trust

Fiduciary name and address

Employer Identification Number (EIN)

Tax year

Type of entity (estate, simple trust, complex trust)

Step 2: Report All Income

Include income earned after the decedent’s date of death (for estates) or during the tax year (for trusts):

Interest and dividends

Rental income

Business income

Capital gains

Investment or portfolio income

If the estate sold property, this typically flows through Schedule D before landing in the income section.

Step 3: Deduct Administrative Expenses

Common deductible expenses include:

Legal and accounting fees

Fiduciary fees

Costs necessary to administer the estate or trust

If the estate still operates a business, business-related expenses may also qualify.

Step 4: Calculate Adjusted Total Income and Tax

This is where Form 1041 converts gross income minus deductions into taxable income.

You’ll complete:

Tax computation

Credits

Alternative minimum tax (if applicable)

Most founders delegate this step to a tax professional because the calculations map across multiple schedules.

Step 5: Prepare Schedule K-1s for Beneficiaries

If the estate or trust distributes income, you must issue a Schedule K-1 to each beneficiary.

The K-1 shifts tax liability from the estate to the recipients.

What you’ll need:

Beneficiary name, address, TIN

Distribution amounts

Classification of income (interest, dividends, capital gains, etc.)

Step 6: Review, File, and Store Records

Before filing:

Confirm beneficiary distributions match accounting records

Double-check tax year and EIN

File electronically or mail to the correct IRS address

Store copies for at least 7 years

Avoiding Common Pitfalls When Managing Estate and Trust Taxes

Founders may face unfamiliar challenges in fiduciary accounting:

Keep estate/trust finances separate from business or personal accounts

Use professional bookkeeping to track income and expenses clearly

Don’t overlook business-related deductions if the estate owns an operating business

Strategically plan distributions to minimize the overall tax burden

Our business tax services help founders navigate these complexities smoothly.

How Modern Bookkeeping Tools Support Form 1041 Preparation

Technology can dramatically streamline fiduciary tax work:

Feature | Benefit for Estates/Trusts |

Automated Income Categorization | Quickly identify taxable income streams |

Custom Expense Tracking | Capture deductible administrative expenses accurately |

Beneficiary Reporting Tools | Simplify Schedule K-1 preparation and coordination |

Real-Time Dashboards | Provide holistic visibility into estate/trust finances |

Tools like those used at Haven reduce manual errors and increase filing efficiency.

Key Forms and Schedules to Know Besides Form 1041

Depending on the estate/trust’s activities, additional forms may be required:

Schedule K-1 — Beneficiary income reporting

Schedule D — Capital gains and losses

Schedule G — Fiduciary information

Form 56 — Notice of fiduciary relationship

Form 1310 — Refunds due to deceased individuals

Full guidance is available on the IRS Form 1041 instructions page.

Checklist: Filing Form 1041 Without Stress

Collect income statements and receipts

Confirm deductions

Prepare all K-1s

Review deadlines or file extension

Use professional tax review

Submit Form 1041 + all schedules

Store copies for future reference

Why Partner with Haven for Your Estate and Trust Tax Needs?

Haven supports founders facing complex estate and trust responsibilities with:

Founder-friendly tax guidance

Integrated personal + business + fiduciary support

Strategic tax minimization

Fast, modern bookkeeping that scales

Filing Form 1041 doesn’t need to be overwhelming. With the right steps, tools, and expert support, you can manage fiduciary tax duties with clarity and confidence.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026