Go Back

Last Updated :

Last Updated :

Jan 20, 2026

Jan 20, 2026

Form 1040 Schedule C: Profit and Loss Reporting for Single-Member LLCs

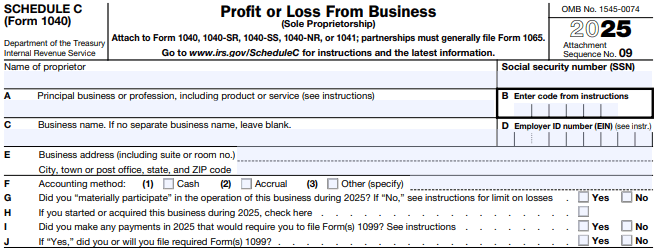

For founders and operators of single-member LLCs, mastering the intricacies of Form 1040 Schedule C is crucial to maximizing tax deductions and accurately reporting your profit and loss. This IRS form is the primary vehicle for sole proprietors and single-member LLCs to report business income and expenses on their individual tax returns.

This guide dives deep into how single-member LLC founders can leverage Schedule C to their advantage — highlighting key sections, best practices for profit and loss reporting, deductible expenses, and the nuances of filing. You’ll also find practical tips tailored to startup-native companies that want fast, modern, and founder-friendly financial workflows.

What is Form 1040 Schedule C and Who Must File It?

Form 1040 Schedule C, also called “Profit or Loss from Business,” is the IRS attachment that sole proprietors and single-member LLCs use to report all business income and eligible expenses. When you operate as a single-member LLC treated as a disregarded entity for tax purposes, your business profits and losses flow through directly to your personal Form 1040.

Who Is Required to File Schedule C?

Single-member LLCs taxed as sole proprietors: If your company isn’t electing corporate taxation, you report your income and expenses on Schedule C.

Sole proprietors with no LLC: Individuals operating a business without formal incorporation use Schedule C.

Side businesses and freelancers: Even if you have a W-2 job, side business income still goes on Schedule C.

An essential criterion is ordinary and necessary expenses — these are costs that are common and accepted in your industry and directly related to operating your business.

Note: If you have multiple separate businesses, you’ll file a Schedule C for each distinct revenue stream.

The Structure of Schedule C: Key Sections Every Founder Should Know

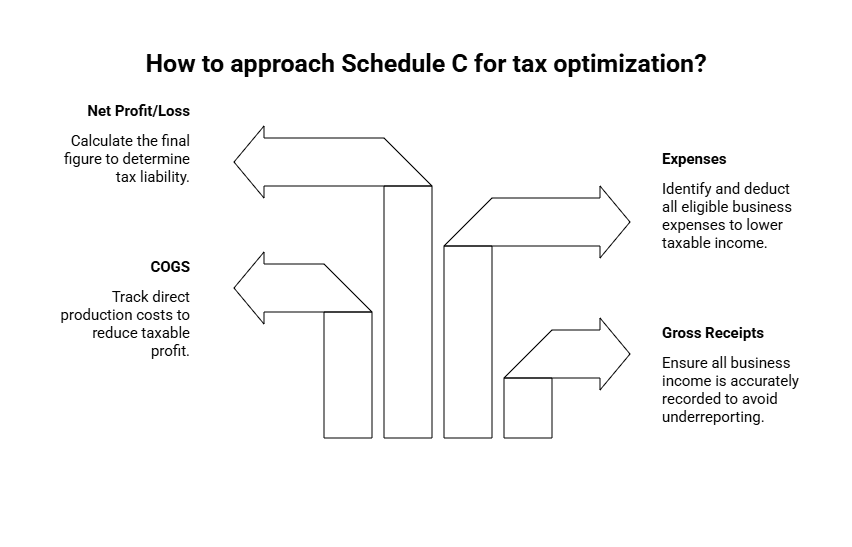

Schedule C is organized into areas where you report your revenue, expenses, and calculate your net profit or loss. Here's how to approach each section with a founder’s eye toward maximizing deductions and clarity:

Gross Receipts or Sales

This is your total business income, including all payments received during the tax year before any expenses. Make sure this includes all client payments, online sales, and other business revenue recorded in your bookkeeping system.

Cost of Goods Sold (COGS)

Applicable if you sell products, this section captures direct costs such as materials, supplies, and labor tied to production. Accurately tracking COGS reduces your gross income and thus your taxable profit.

Expenses – The Heart of Tax Deductions

This is where many founders can optimize. Deductible expenses categories include:

Advertising

Car and truck expenses (choose between actual expenses or standard mileage)

Contract labor (payments to freelancers or independent contractors)

Depreciation and Section 179 expenses (for equipment purchases)

Home office deduction (must meet IRS criteria of exclusive use)

Insurance (business-related)

Office expenses and supplies

Travel and meals (subject to IRS limitations)

Utilities, rent, and repairs

Accurate categorization here means you aren’t missing out on legitimate deductions, which directly lower your taxable income.

Net Profit or Loss

The final calculation subtracts your total expenses (including COGS) from your gross income, arriving at your net profit or loss. This figure flows to your Form 1040 and impacts your overall tax bill.

How Single-Member LLC Founders Can Maximize Schedule C Deductions

Maximizing available deductions means more than just listing expenses — founders need to proactively structure spending, maintain meticulous records, and understand IRS rules. Here's a practical checklist:

Document Everything

Keep receipts, invoices, bank statements, and mileage logs to substantiate every expense. The IRS requires proof during audits, especially for big-ticket deductions like home office or vehicle use.

Choose Vehicle Expense Method Wisely

Actual Expense Method: Total up gas, maintenance, depreciation, insurance, and repairs related solely to business use.

Standard Mileage Rate: Multiply business miles driven by the IRS mileage rate for the tax year.

Consider which yields greater deductions given your travel frequency and car costs.

Home Office Deduction

If you use part of your home exclusively and regularly for business, you can deduct a portion of rent, mortgage interest, utilities, and insurance. Opt between:

Simplified method: $5 per square foot up to 300 sq ft.

Regular method: Allocate actual expenses based on your office’s proportion of home space.

Leverage Start-Up and Organizational Costs

Expenses related to creating your business entity or developing business plans are deductible or amortizable over several years — don't overlook these in your Schedule C.

Separate Business and Personal Expenses

Avoid commingling personal and business transactions, as this complicates expense tracking and increases audit risk. Use dedicated bank accounts and credit cards for business.

Consider the Impact of R&D Tax Credits

If your startup invests in product development or engineering, pairing Schedule C deductions with available R&D credits can multiply tax savings. While the credit itself isn’t reported on Schedule C, understanding how your reported expenses support credits can influence your budgeting and tax strategy. (Learn more about saving money on tax credits with this 10-step guide for small businesses).

Special Scenarios and Key Considerations for Single-Member LLCs

Single-member LLCs are typically reported on Schedule C, which means classification and documentation decisions flow directly into personal tax liability. The scenarios below frequently affect compliance and audit risk.

Distinguishing Business vs. Hobby

Expenses are deductible only if the activity is conducted with a profit motive. The IRS evaluates this based on facts and circumstances, not intent alone.

Key indicators include:

A history of profits or a credible path to profitability

Time and effort devoted to the activity

Businesslike operations (separate bank account, records, marketing)

Occasional losses are common in early years, but consistent losses over multiple years increase scrutiny. Founders should retain documentation that supports commercial intent, especially during growth or experimentation phases.

Multiple Business Activities

If a single-member LLC operates distinctly different lines of business, each activity may require a separate Schedule C. Activities are considered separate if they differ materially in function, customers, or operations (e.g., e-commerce storefront and consulting arm). Combining unrelated activities can distort profit reporting and complicate loss analysis.

Dealing with Estimated Taxes and Self-Employment Tax

Net profit reported on Schedule C is subject to self-employment tax, which covers both the employer and employee portions of Social Security and Medicare.

As a result:

Federal income tax and self-employment tax are typically paid through quarterly estimated tax payments

Underpayment can trigger penalties, even if the annual return is accurate

Using Modern Bookkeeping Tools for Schedule C Preparation

Startups and small businesses benefit greatly from cloud-based bookkeeping that tracks income and expenses in real time, tags deductible items correctly, and makes Schedule C tax filing straightforward. Features to look for:

Seamless integration with banking and payment platforms

Automated categorization aligned with Schedule C categories

Easy mileage tracking on mobile devices

Ready-to-export tax reports

Responsive support tuned to startup schedules

Implementing such tools reduces the risk of missed deductions or errors that inflate tax liability.

Remember, your Schedule C profit and loss figures directly influence your taxes and your business decisions. Use it as a management tool as much as a tax form.

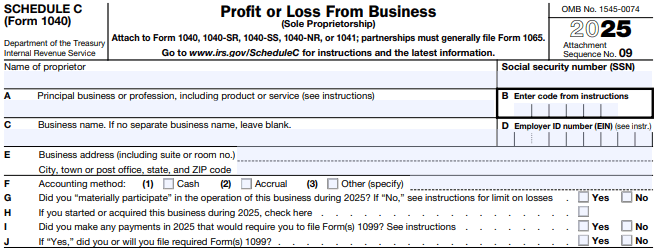

For founders and operators of single-member LLCs, mastering the intricacies of Form 1040 Schedule C is crucial to maximizing tax deductions and accurately reporting your profit and loss. This IRS form is the primary vehicle for sole proprietors and single-member LLCs to report business income and expenses on their individual tax returns.

This guide dives deep into how single-member LLC founders can leverage Schedule C to their advantage — highlighting key sections, best practices for profit and loss reporting, deductible expenses, and the nuances of filing. You’ll also find practical tips tailored to startup-native companies that want fast, modern, and founder-friendly financial workflows.

What is Form 1040 Schedule C and Who Must File It?

Form 1040 Schedule C, also called “Profit or Loss from Business,” is the IRS attachment that sole proprietors and single-member LLCs use to report all business income and eligible expenses. When you operate as a single-member LLC treated as a disregarded entity for tax purposes, your business profits and losses flow through directly to your personal Form 1040.

Who Is Required to File Schedule C?

Single-member LLCs taxed as sole proprietors: If your company isn’t electing corporate taxation, you report your income and expenses on Schedule C.

Sole proprietors with no LLC: Individuals operating a business without formal incorporation use Schedule C.

Side businesses and freelancers: Even if you have a W-2 job, side business income still goes on Schedule C.

An essential criterion is ordinary and necessary expenses — these are costs that are common and accepted in your industry and directly related to operating your business.

Note: If you have multiple separate businesses, you’ll file a Schedule C for each distinct revenue stream.

The Structure of Schedule C: Key Sections Every Founder Should Know

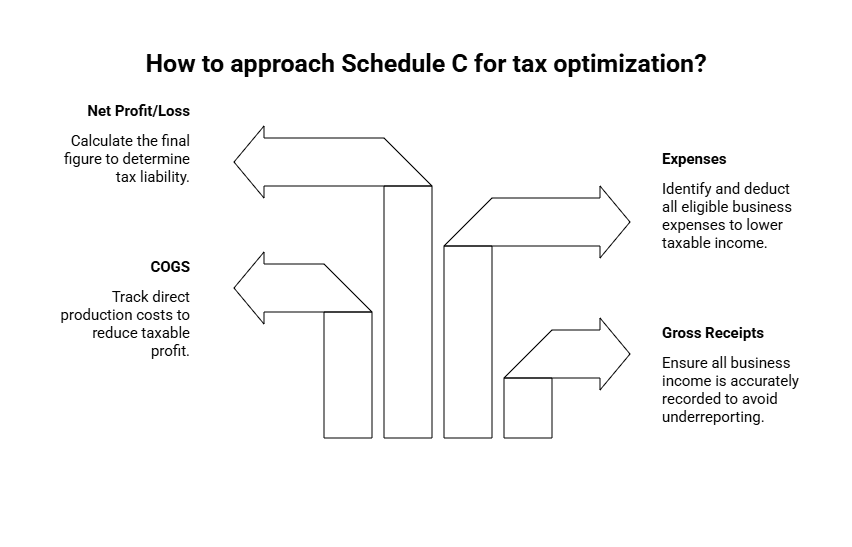

Schedule C is organized into areas where you report your revenue, expenses, and calculate your net profit or loss. Here's how to approach each section with a founder’s eye toward maximizing deductions and clarity:

Gross Receipts or Sales

This is your total business income, including all payments received during the tax year before any expenses. Make sure this includes all client payments, online sales, and other business revenue recorded in your bookkeeping system.

Cost of Goods Sold (COGS)

Applicable if you sell products, this section captures direct costs such as materials, supplies, and labor tied to production. Accurately tracking COGS reduces your gross income and thus your taxable profit.

Expenses – The Heart of Tax Deductions

This is where many founders can optimize. Deductible expenses categories include:

Advertising

Car and truck expenses (choose between actual expenses or standard mileage)

Contract labor (payments to freelancers or independent contractors)

Depreciation and Section 179 expenses (for equipment purchases)

Home office deduction (must meet IRS criteria of exclusive use)

Insurance (business-related)

Office expenses and supplies

Travel and meals (subject to IRS limitations)

Utilities, rent, and repairs

Accurate categorization here means you aren’t missing out on legitimate deductions, which directly lower your taxable income.

Net Profit or Loss

The final calculation subtracts your total expenses (including COGS) from your gross income, arriving at your net profit or loss. This figure flows to your Form 1040 and impacts your overall tax bill.

How Single-Member LLC Founders Can Maximize Schedule C Deductions

Maximizing available deductions means more than just listing expenses — founders need to proactively structure spending, maintain meticulous records, and understand IRS rules. Here's a practical checklist:

Document Everything

Keep receipts, invoices, bank statements, and mileage logs to substantiate every expense. The IRS requires proof during audits, especially for big-ticket deductions like home office or vehicle use.

Choose Vehicle Expense Method Wisely

Actual Expense Method: Total up gas, maintenance, depreciation, insurance, and repairs related solely to business use.

Standard Mileage Rate: Multiply business miles driven by the IRS mileage rate for the tax year.

Consider which yields greater deductions given your travel frequency and car costs.

Home Office Deduction

If you use part of your home exclusively and regularly for business, you can deduct a portion of rent, mortgage interest, utilities, and insurance. Opt between:

Simplified method: $5 per square foot up to 300 sq ft.

Regular method: Allocate actual expenses based on your office’s proportion of home space.

Leverage Start-Up and Organizational Costs

Expenses related to creating your business entity or developing business plans are deductible or amortizable over several years — don't overlook these in your Schedule C.

Separate Business and Personal Expenses

Avoid commingling personal and business transactions, as this complicates expense tracking and increases audit risk. Use dedicated bank accounts and credit cards for business.

Consider the Impact of R&D Tax Credits

If your startup invests in product development or engineering, pairing Schedule C deductions with available R&D credits can multiply tax savings. While the credit itself isn’t reported on Schedule C, understanding how your reported expenses support credits can influence your budgeting and tax strategy. (Learn more about saving money on tax credits with this 10-step guide for small businesses).

Special Scenarios and Key Considerations for Single-Member LLCs

Single-member LLCs are typically reported on Schedule C, which means classification and documentation decisions flow directly into personal tax liability. The scenarios below frequently affect compliance and audit risk.

Distinguishing Business vs. Hobby

Expenses are deductible only if the activity is conducted with a profit motive. The IRS evaluates this based on facts and circumstances, not intent alone.

Key indicators include:

A history of profits or a credible path to profitability

Time and effort devoted to the activity

Businesslike operations (separate bank account, records, marketing)

Occasional losses are common in early years, but consistent losses over multiple years increase scrutiny. Founders should retain documentation that supports commercial intent, especially during growth or experimentation phases.

Multiple Business Activities

If a single-member LLC operates distinctly different lines of business, each activity may require a separate Schedule C. Activities are considered separate if they differ materially in function, customers, or operations (e.g., e-commerce storefront and consulting arm). Combining unrelated activities can distort profit reporting and complicate loss analysis.

Dealing with Estimated Taxes and Self-Employment Tax

Net profit reported on Schedule C is subject to self-employment tax, which covers both the employer and employee portions of Social Security and Medicare.

As a result:

Federal income tax and self-employment tax are typically paid through quarterly estimated tax payments

Underpayment can trigger penalties, even if the annual return is accurate

Using Modern Bookkeeping Tools for Schedule C Preparation

Startups and small businesses benefit greatly from cloud-based bookkeeping that tracks income and expenses in real time, tags deductible items correctly, and makes Schedule C tax filing straightforward. Features to look for:

Seamless integration with banking and payment platforms

Automated categorization aligned with Schedule C categories

Easy mileage tracking on mobile devices

Ready-to-export tax reports

Responsive support tuned to startup schedules

Implementing such tools reduces the risk of missed deductions or errors that inflate tax liability.

Remember, your Schedule C profit and loss figures directly influence your taxes and your business decisions. Use it as a management tool as much as a tax form.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026