Go Back

Last Updated :

Last Updated :

Dec 6, 2025

Dec 6, 2025

Bookkeeping for Tradies: A Guide to Staying on Top of Your Finances

Running a trades business comes with a unique set of challenges — tight deadlines, managing multiple jobs, and handling a range of materials and suppliers. Yet, one area that deserves equal attention and vigilance is bookkeeping for tradies. Keeping your financial records organized and up to date is crucial to the health and growth of your business, but it’s often overlooked amid the daily hustle.

This guide is designed specifically for founders and operators of trades businesses.. We’ll walk through practical tips, common pitfalls, and how the right tools and professional support can keep your finances in order — freeing you to focus on what you do best.

Why Accurate Bookkeeping Matters for Tradies

Accurate bookkeeping matters for tradies because day-to-day operations move quickly and every dollar counts. Most trade businesses deal with variable cash flow, multiple suppliers, and a mix of employees and subcontractors. Without solid bookkeeping, issues show up fast:

Cash flow becomes unclear. It’s harder to see when money is coming in versus when bills are due, which can lead to late payments or last-minute fixes.

Profitability gets harder to track. A job might look successful, but missing receipts or inaccurate costing can hide margin pressure.

Tax deductions are missed. Legitimate business expenses and credits become harder to claim without clear records.

Compliance risk increases. Gaps in payroll or sales tax documentation can lead to penalties or audits.

Good bookkeeping systems built for trade businesses make it easier to understand job costs, set pricing, and prepare for tax season with less friction.

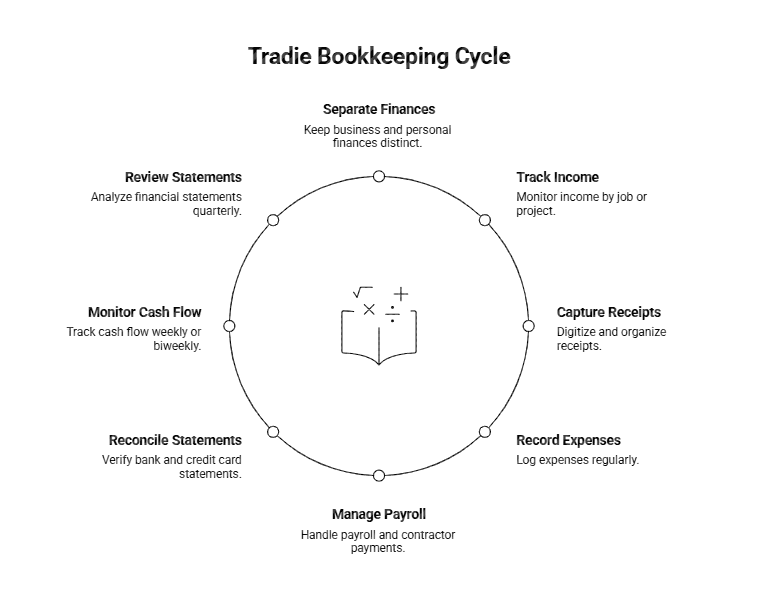

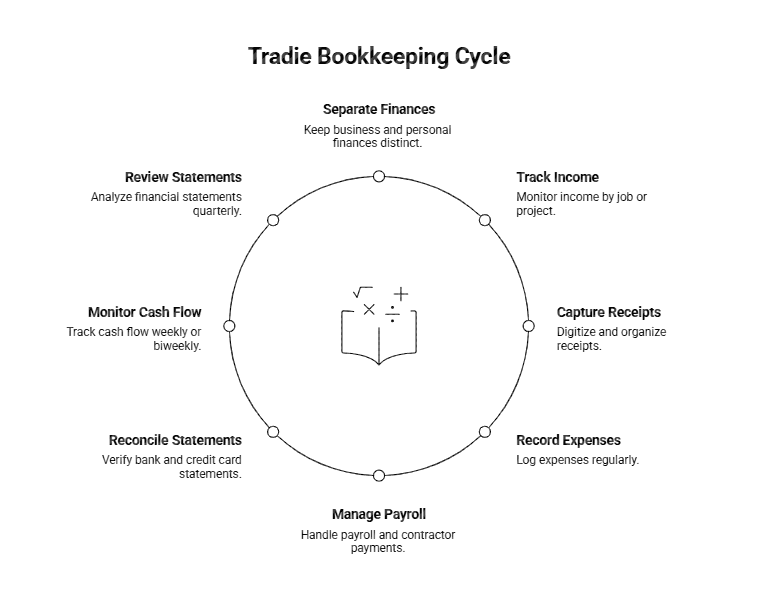

Key Bookkeeping Best Practices Every Tradie Should Adopt

Having a hands-on, founder-friendly approach to your bookkeeping sets your business up for long-term stability and growth. Here are practical steps tailored to trades that can simplify and enhance your financial management:

1. Separate Business and Personal Finances

Open a dedicated business bank account and credit card. This keeps records clean and provides a clearer view of business expenditure and income. It also simplifies tax preparation and audit defense.

2. Track Income by Job or Project

Use bookkeeping software or spreadsheets to tag income and expenses by individual jobs. This helps identify which types of jobs or clients are most profitable and where you might be losing money.

3. Capture and Organize Receipts Routinely

Rather than keeping piles of paper, use mobile apps or digital camera shots to save receipts immediately. Cloud-based storage linked to your accounting software makes retrieval seamless when compiling expenses or tax documents.

4. Record Expenses Consistently

Materials, labor, subcontractors, vehicle costs — log these regularly. Over time, this data will inform your pricing models and project estimates. Documenting everything supports claiming valid tax deductions without hassle.

5. Keep on Top of Payroll and Contractor Payments

If you have employees or subcontractors, managing payroll taxes, superannuation, and 1099s properly is critical. Set calendar reminders or automate payments to avoid late fees and penalties.

6. Regularly Reconcile Bank and Credit Card Statements

Mistakes or fraudulent charges can slip through if unchecked. Monthly reconciliation ensures your books reflect reality and any errors or discrepancies are caught early.

7. Monitor Cash Flow Weekly or Biweekly

Timely cash flow visibility lets you anticipate shortfalls or investment opportunities. Build simple cash flow forecasts with key inputs like upcoming expenses, payment schedules, and seasonal fluctuations.

8. Review Financial Statements Quarterly

Set time aside each quarter to review your profit & loss and balance sheet statements, ideally with your accountant or bookkeeper. This strategic check-in helps spot trends, adjust budgets, and plan ahead.

Incorporating these steps may sound overwhelming initially, but the right tools and support make them manageable. Haven’s bookkeeping services specialize in helping startups and tradie businesses implement modern systems that save time while increasing financial clarity.

Leveraging Technology and Expert Support to Streamline Tradie Bookkeeping

Today’s bookkeeping landscape offers powerful cloud-based software tailored for small business needs. For tradies juggling site work and admin, mobile-friendly platforms with automation features mean:

Automatic bank feeds and transaction categorization reduce manual data entry.

Mobile receipt capture lets you log expenses on the go.

Job costing dashboards provide real-time profitability insights per project.

Integration with payroll and tax software simplifies compliance.

Besides technology, partnering with a responsive bookkeeping provider focused on startup and tradie clients brings considerable benefits:

Tailored advice on managing expenses, payroll, and tax credits — including the Research & Development (R&D) tax credit that may apply to trades innovating tools or methods.

Ongoing financial coaching and forecasting support to aid decision-making.

Quick responses to urgent queries or audits, minimizing disruptions.

Haven combines these elements — modern software, founder-focused accounting expertise, and proactive communication — to elevate trades business owners beyond bookkeeping basics. Learn more about Haven’s full service offerings designed for businesses like yours.

For detailed compliance guidance and definitions surrounding bookkeeping and tax treatment, authoritative resources like the IRS Small Business Center offer dependable reference material.

Mastering Bookkeeping for Tradies With Practical Systems and Support

Effective bookkeeping for tradies isn’t just about staying compliant — it’s about creating operational visibility. When job costs, margins, and cash-flow signals are tracked consistently across sites and projects, founders can make decisions earlier, avoid underbilling, and stay ahead of seasonal dips. Partners like Haven help sharpen this visibility by organizing financial data around real business patterns, giving trades operators a clearer view of which jobs, crews, or service lines actually drive profit.

Running a trades business comes with a unique set of challenges — tight deadlines, managing multiple jobs, and handling a range of materials and suppliers. Yet, one area that deserves equal attention and vigilance is bookkeeping for tradies. Keeping your financial records organized and up to date is crucial to the health and growth of your business, but it’s often overlooked amid the daily hustle.

This guide is designed specifically for founders and operators of trades businesses.. We’ll walk through practical tips, common pitfalls, and how the right tools and professional support can keep your finances in order — freeing you to focus on what you do best.

Why Accurate Bookkeeping Matters for Tradies

Accurate bookkeeping matters for tradies because day-to-day operations move quickly and every dollar counts. Most trade businesses deal with variable cash flow, multiple suppliers, and a mix of employees and subcontractors. Without solid bookkeeping, issues show up fast:

Cash flow becomes unclear. It’s harder to see when money is coming in versus when bills are due, which can lead to late payments or last-minute fixes.

Profitability gets harder to track. A job might look successful, but missing receipts or inaccurate costing can hide margin pressure.

Tax deductions are missed. Legitimate business expenses and credits become harder to claim without clear records.

Compliance risk increases. Gaps in payroll or sales tax documentation can lead to penalties or audits.

Good bookkeeping systems built for trade businesses make it easier to understand job costs, set pricing, and prepare for tax season with less friction.

Key Bookkeeping Best Practices Every Tradie Should Adopt

Having a hands-on, founder-friendly approach to your bookkeeping sets your business up for long-term stability and growth. Here are practical steps tailored to trades that can simplify and enhance your financial management:

1. Separate Business and Personal Finances

Open a dedicated business bank account and credit card. This keeps records clean and provides a clearer view of business expenditure and income. It also simplifies tax preparation and audit defense.

2. Track Income by Job or Project

Use bookkeeping software or spreadsheets to tag income and expenses by individual jobs. This helps identify which types of jobs or clients are most profitable and where you might be losing money.

3. Capture and Organize Receipts Routinely

Rather than keeping piles of paper, use mobile apps or digital camera shots to save receipts immediately. Cloud-based storage linked to your accounting software makes retrieval seamless when compiling expenses or tax documents.

4. Record Expenses Consistently

Materials, labor, subcontractors, vehicle costs — log these regularly. Over time, this data will inform your pricing models and project estimates. Documenting everything supports claiming valid tax deductions without hassle.

5. Keep on Top of Payroll and Contractor Payments

If you have employees or subcontractors, managing payroll taxes, superannuation, and 1099s properly is critical. Set calendar reminders or automate payments to avoid late fees and penalties.

6. Regularly Reconcile Bank and Credit Card Statements

Mistakes or fraudulent charges can slip through if unchecked. Monthly reconciliation ensures your books reflect reality and any errors or discrepancies are caught early.

7. Monitor Cash Flow Weekly or Biweekly

Timely cash flow visibility lets you anticipate shortfalls or investment opportunities. Build simple cash flow forecasts with key inputs like upcoming expenses, payment schedules, and seasonal fluctuations.

8. Review Financial Statements Quarterly

Set time aside each quarter to review your profit & loss and balance sheet statements, ideally with your accountant or bookkeeper. This strategic check-in helps spot trends, adjust budgets, and plan ahead.

Incorporating these steps may sound overwhelming initially, but the right tools and support make them manageable. Haven’s bookkeeping services specialize in helping startups and tradie businesses implement modern systems that save time while increasing financial clarity.

Leveraging Technology and Expert Support to Streamline Tradie Bookkeeping

Today’s bookkeeping landscape offers powerful cloud-based software tailored for small business needs. For tradies juggling site work and admin, mobile-friendly platforms with automation features mean:

Automatic bank feeds and transaction categorization reduce manual data entry.

Mobile receipt capture lets you log expenses on the go.

Job costing dashboards provide real-time profitability insights per project.

Integration with payroll and tax software simplifies compliance.

Besides technology, partnering with a responsive bookkeeping provider focused on startup and tradie clients brings considerable benefits:

Tailored advice on managing expenses, payroll, and tax credits — including the Research & Development (R&D) tax credit that may apply to trades innovating tools or methods.

Ongoing financial coaching and forecasting support to aid decision-making.

Quick responses to urgent queries or audits, minimizing disruptions.

Haven combines these elements — modern software, founder-focused accounting expertise, and proactive communication — to elevate trades business owners beyond bookkeeping basics. Learn more about Haven’s full service offerings designed for businesses like yours.

For detailed compliance guidance and definitions surrounding bookkeeping and tax treatment, authoritative resources like the IRS Small Business Center offer dependable reference material.

Mastering Bookkeeping for Tradies With Practical Systems and Support

Effective bookkeeping for tradies isn’t just about staying compliant — it’s about creating operational visibility. When job costs, margins, and cash-flow signals are tracked consistently across sites and projects, founders can make decisions earlier, avoid underbilling, and stay ahead of seasonal dips. Partners like Haven help sharpen this visibility by organizing financial data around real business patterns, giving trades operators a clearer view of which jobs, crews, or service lines actually drive profit.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026